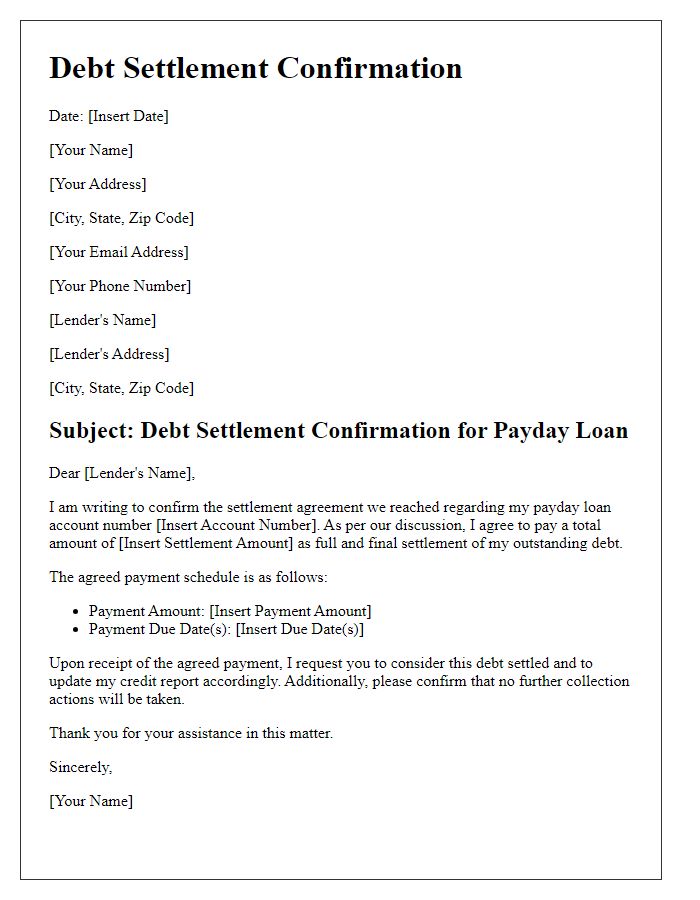

If you've ever found yourself navigating the tricky waters of debt settlement, you know how important clear communication can be. A well-crafted letter confirming your debt settlement agreement is vital to ensure everyone is on the same page and to protect your financial interests. Not only does this letter serve as a formal record of your settlement, but it also sets the stage for a fresh start on your financial journey. Ready to learn more about how to create the perfect debt settlement confirmation letter?

Creditor and debtor information

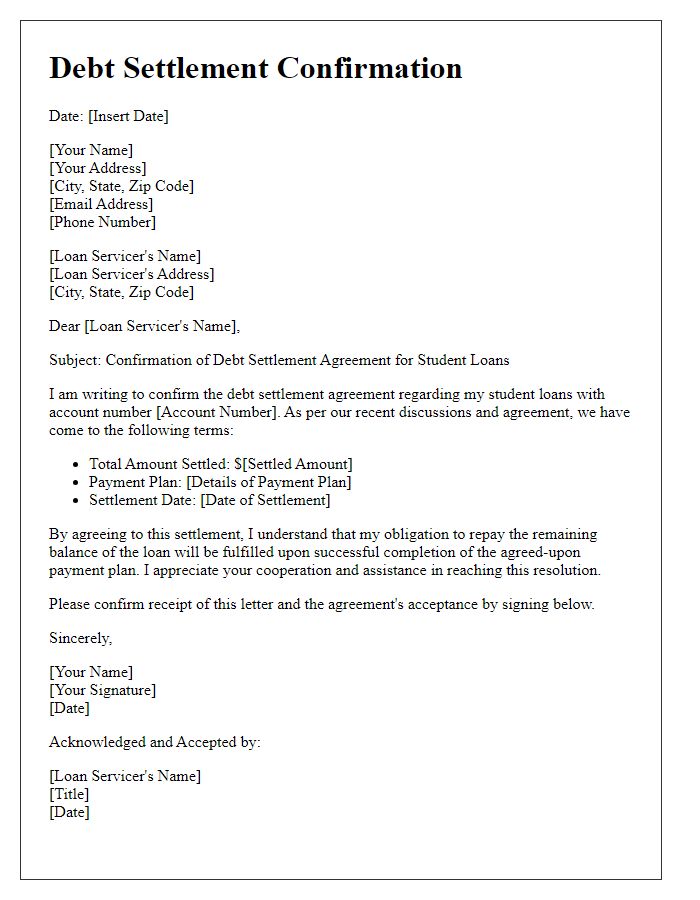

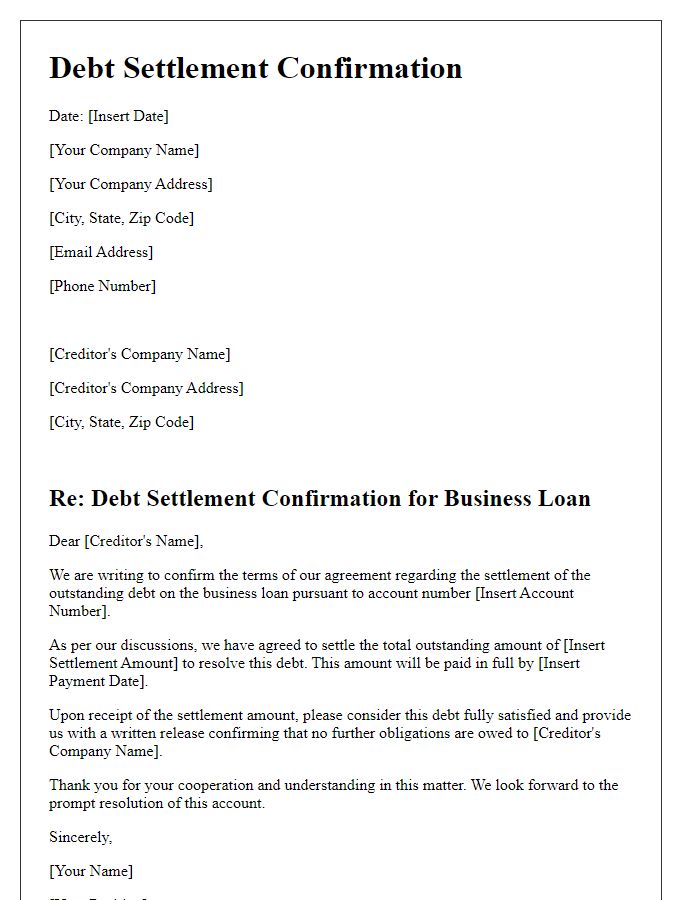

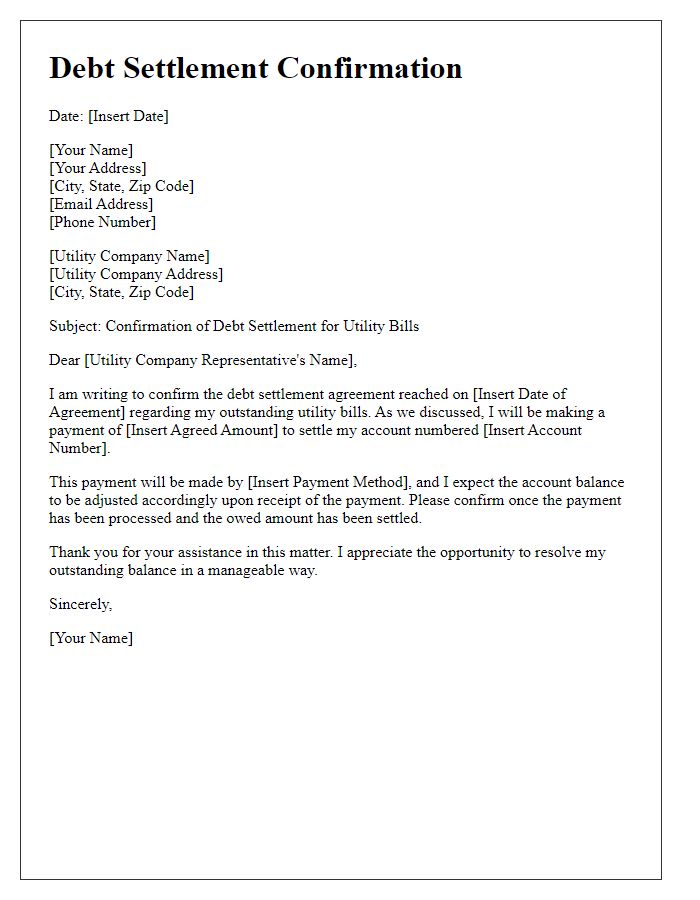

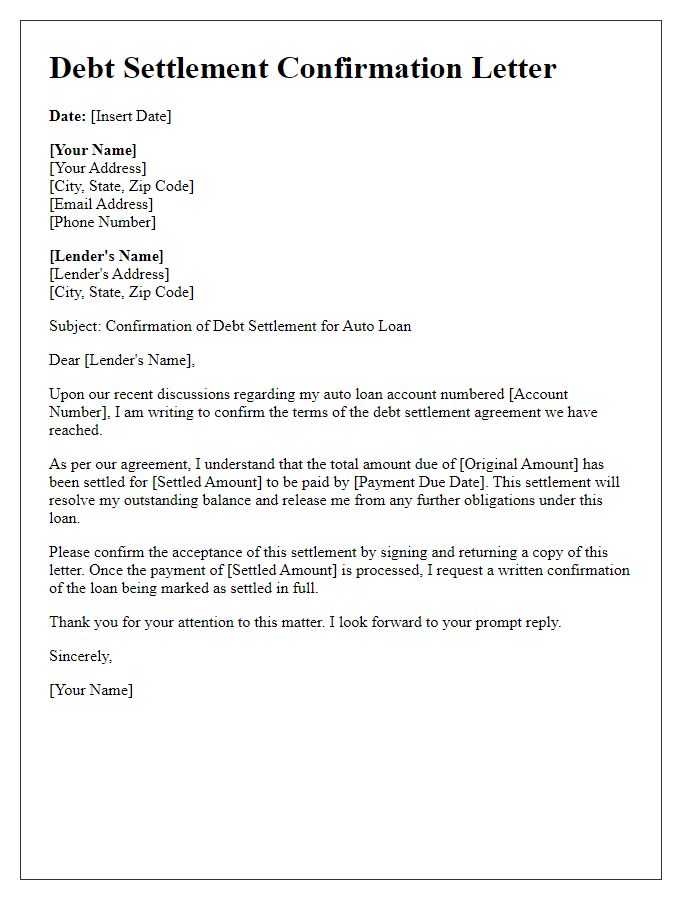

Debt settlement confirmations require precise documentation to ensure both parties are aligned on the agreement. The creditor (the entity owed money, such as a bank or financial institution) must provide its full name, address, and contact information. The debtor (the individual or business responsible for the debt) must include their name, address, and any relevant account numbers. The confirmation should detail the settled amount, the total original debt, and the date of the settlement agreement. Additionally, it is important to note any agreed-upon terms regarding the payment schedule, conditions for the settlement, and any potential implications for the debtor's credit report following the settlement. Clear, unequivocal language ought to be used to prevent misunderstandings.

Settlement amount and terms

Debt settlement confirmations can greatly benefit from clear communication regarding the settlement amount and terms involved in the agreement. Such confirmations should explicitly state the agreed total amount to be paid, which typically is less than the original debt, highlighting any discounts obtained. Terms should include the payment schedule, such as due dates, acceptable payment methods (such as bank transfer or check), and any conditions regarding late payments or defaults. Furthermore, including reference to the original creditor's details, account number, and contact information adds clarity, ensuring that the debtor fully understands the implications of the settlement. This approach helps in establishing a transparent relationship and reduces the risk of confusion or further disputes down the line.

Payment schedule and deadlines

Debt settlement agreements often involve detailed payment schedules and strict deadlines. Clear communication is essential to ensure parties understand their responsibilities. The agreed-upon payment plan typically outlines installment amounts, due dates, and any applicable fees. For instance, a debtor may have a total debt of $5,000, divided into monthly payments of $500, due by the 15th of each month, starting from January 2024. Important deadlines include the final payment date, which is crucial for completing the settlement process, along with specific milestones (e.g., 50% of debt reduction by June 2024). This framework helps both the debtor and creditor track the progress of the settlement, ensuring a structured approach to financial resolution.

Release of liability statement

Debt settlement agreements can significantly impact a debtor's financial landscape, particularly when a release of liability statement is issued. This formal document serves as an official acknowledgment that the debtor (individual or entity) has fulfilled their obligations towards the creditor (such as a financial institution or collection agency) by paying a negotiated amount that is less than the total original debt. The confirmation typically includes the original debt amount, the settled amount, the date of settlement (which could be a critical timeline, like December 1, 2023), and the specific terms agreed upon by both parties. Additionally, the release of liability ensures that the creditor relinquishes any future claims against the debtor regarding this settled debt, effectively restoring the debtor's credit standing. This process is crucial for individuals looking to regain financial stability after challenging economic circumstances.

Signatures and date of agreement

In debt settlement agreements, clear confirmation of the debt resolution is crucial. The document should detail the debtor's name, amount settled, and creditor's information. Important elements include the signatures of both parties, affirming mutual consent to the terms outlined in the settlement. Each signature must include the date of agreement, providing a legal timestamp for when the contract was finalized. Clarity in wording surrounding the debt settlement process fosters trust and accountability essential for successful negotiations. Additionally, the document may include references to any applicable laws, enhancing its legitimacy and enforceability.

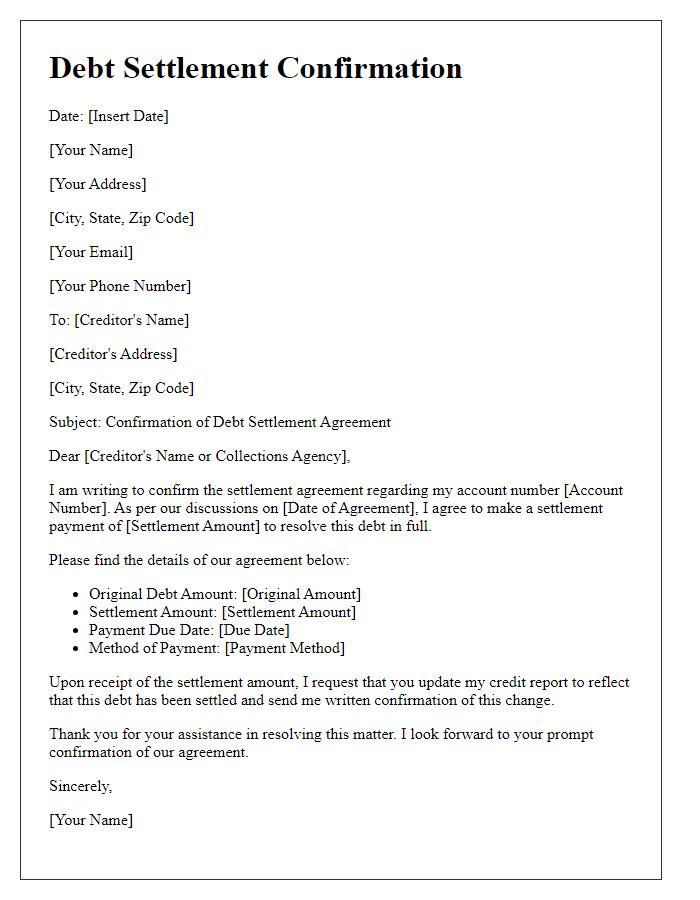

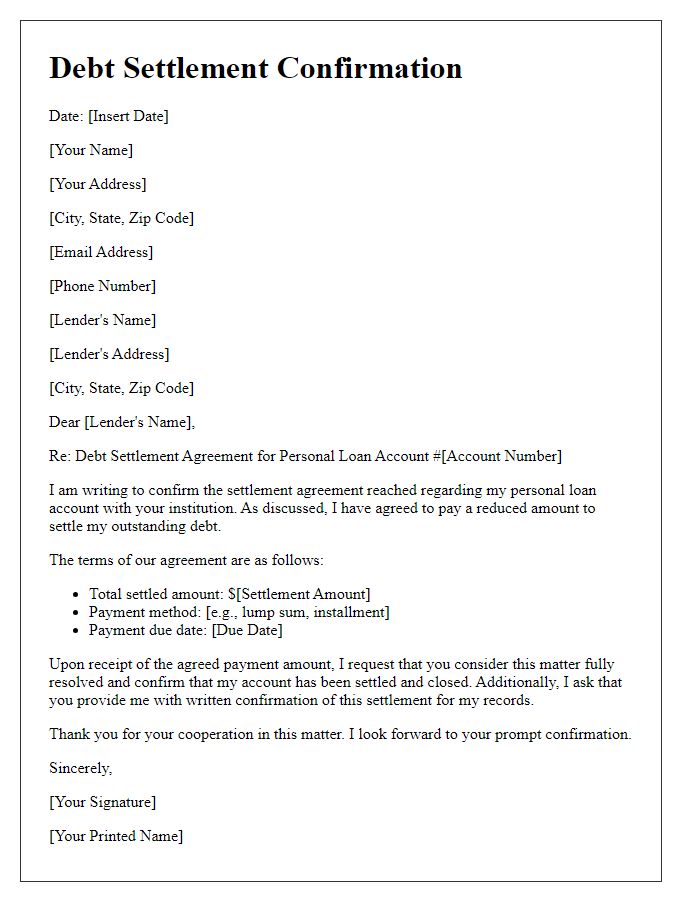

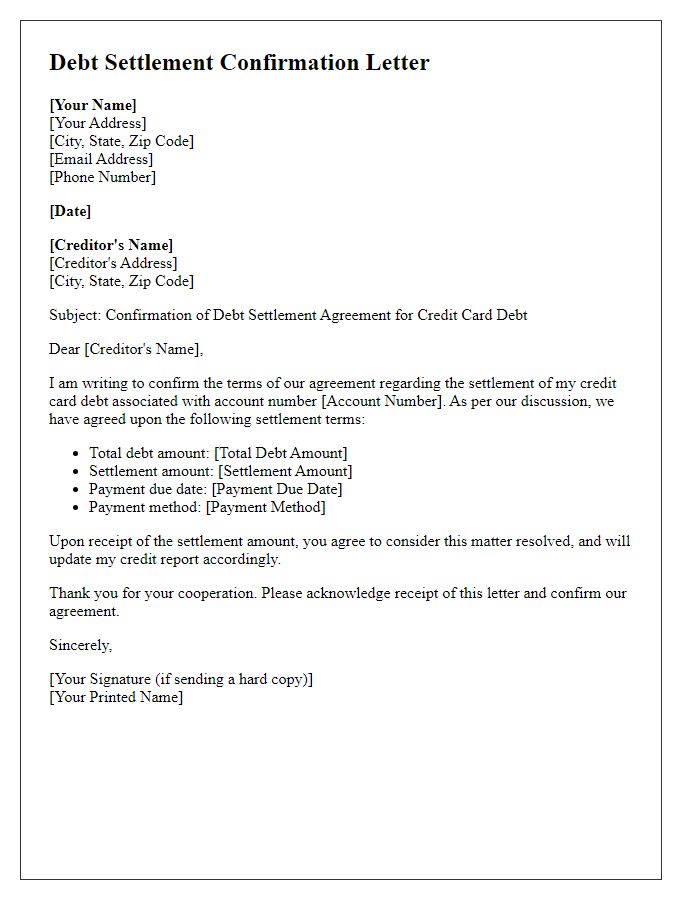

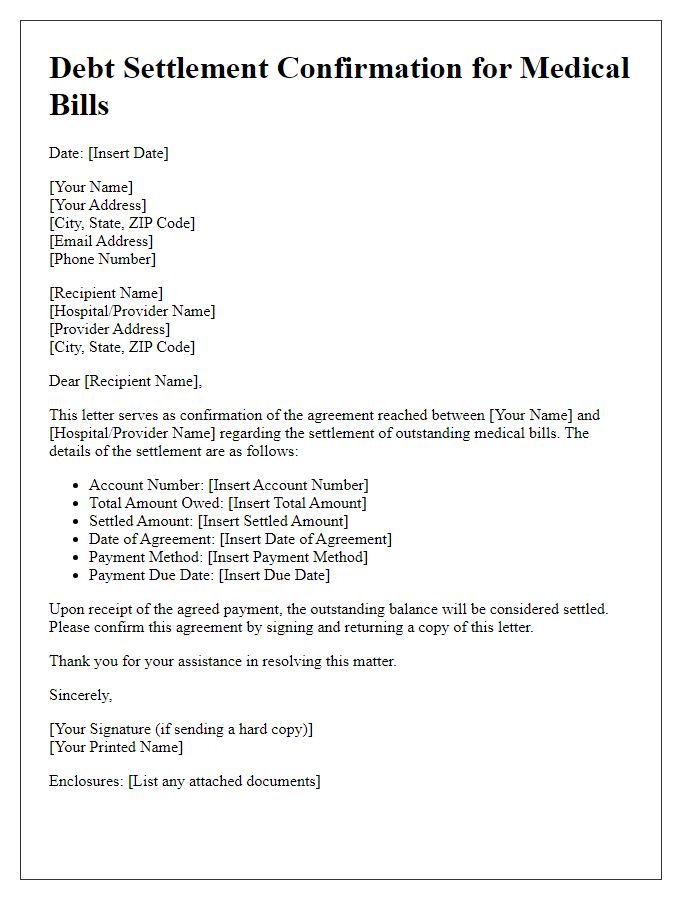

Letter Template For Debt Settlement Confirmation Samples

Letter template of debt settlement confirmation for mortgage short sale.

Letter template of debt settlement confirmation for collection accounts.

Comments