Are you feeling a bit lost after filing your home insurance claim? You're not aloneâmany homeowners find themselves navigating the complex claims process without clear guidance. In this article, we'll break down the essential steps to ensure your claim is processed smoothly and efficiently. So, if you're ready to take control of your home insurance journey, keep reading to discover valuable tips and insights!

Policy Information

Home insurance claims often require detailed policy information for effective follow-up. An insurance policy includes critical details such as the policyholder's name, the unique policy number (usually found on the declaration page), and the effective dates (start and end date of coverage). Property details like the address of the insured property are essential. Coverage limits dictate the maximum amount the insurer will pay for damages, including specific limits for personal property, liability, and additional living expenses. Deductible amounts indicate the upfront costs policyholders must pay before coverage kicks in. Understanding these components is vital for navigating the claim process and ensuring claim inquiries reference accurate policy data.

Claim Reference Number

Follow-up on a home insurance claim can reveal significant details of the evaluation process. A homeowner (typically in an area prone to natural disasters) may reference their claim reference number (unique identifier assigned by the insurance company) to track the status of their recent claim submission. Claims often arise following events such as floods (which can cause extensive water damage) or fires (often resulting from electrical faults or wildfires). In these circumstances, documentation may include photographs of the damage (showing structural impacts) and repair estimates (providing costs for restoration). Timely follow-up ensures the insurance company prioritizes claims, potentially impacting the homeowner's financial recovery and restoration timelines. Regular communication is essential to clarify details and expedite the claims process, preserving the homeowner's peace of mind during stressful recovery periods.

Incident Description Summary

The severe storm that struck Dallas, Texas on April 15, 2023, caused significant damage to residential properties. High winds, exceeding 70 miles per hour, uprooted trees and shattered windows, leading to extensive roof and siding damage. My home, located on Maple Drive, sustained severe water infiltration as a result of the roof breach, resulting in damage to the interior walls and mold growth. Emergency services dispatched to the area reported over 500 similar incidents, highlighting the widespread devastation. This event classified as a natural disaster, necessitated immediate action and assessment for insurance claims to cover repairs and restoration efforts. I have documented the damages and initiated the claims process with my insurance provider.

Contact Information

Home insurance claims often require diligent follow-up to ensure a smooth process. A homeowner might need to contact their insurance provider, such as State Farm or Allstate, through the designated claims department. This department typically provides a direct phone number for inquiries, available during business hours from 8 AM to 8 PM EST. The claim reference number, usually a combination of letters and digits like 123456789, is essential for tracking the status. Homeowners should include their personal information, such as name, policy number, and the address of the insured property, to expedite the follow-up process. Ensuring clear communication during this period can significantly affect claim resolution timeframes and outcomes.

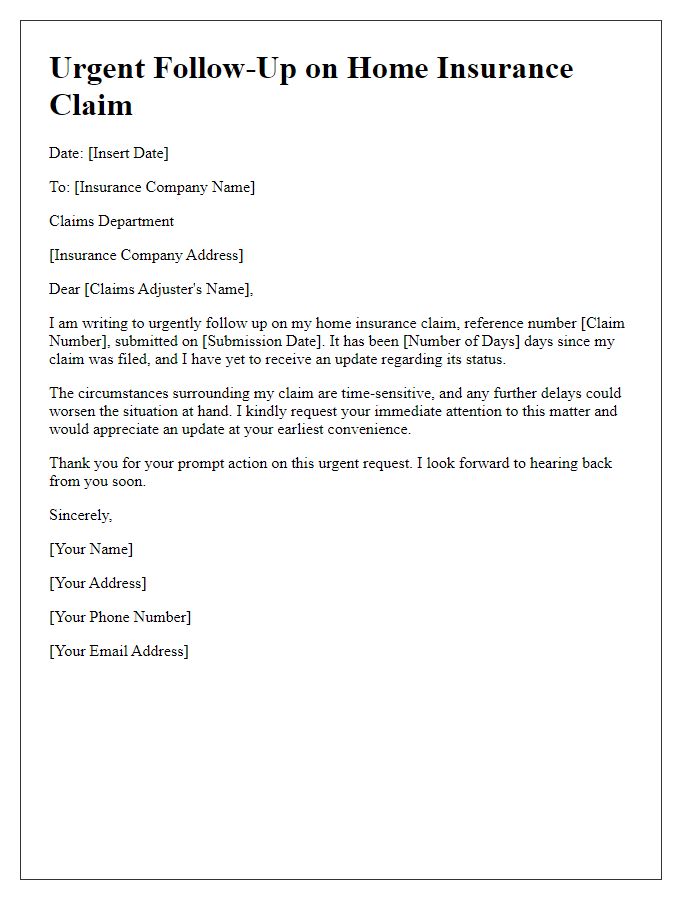

Request for Status Update

Homeowners often seek updates on their insurance claims after incidents such as fires, flooding, or theft. Creating a follow-up document involves addressing specific details of the claim, such as the claim number and the date of the incident, which may have occurred on the property located at 123 Maple Street, Springfield. Home insurance policies, particularly those from companies like Allstate or State Farm, typically cover property damage, personal liability, and loss of use. Key factors include policy limits, deductibles, and the estimated timeline for repairs or reimbursements. Clear communication and understanding of the claims process are crucial for homeowners aiming to resolve their claims efficiently and receive compensation for damages incurred.

Letter Template For Home Insurance Claim Follow-Up Samples

Letter template of home insurance claim follow-up regarding document submission

Letter template of home insurance claim follow-up for claim status inquiry

Letter template of home insurance claim follow-up after initial assessment

Letter template of home insurance claim follow-up for additional information request

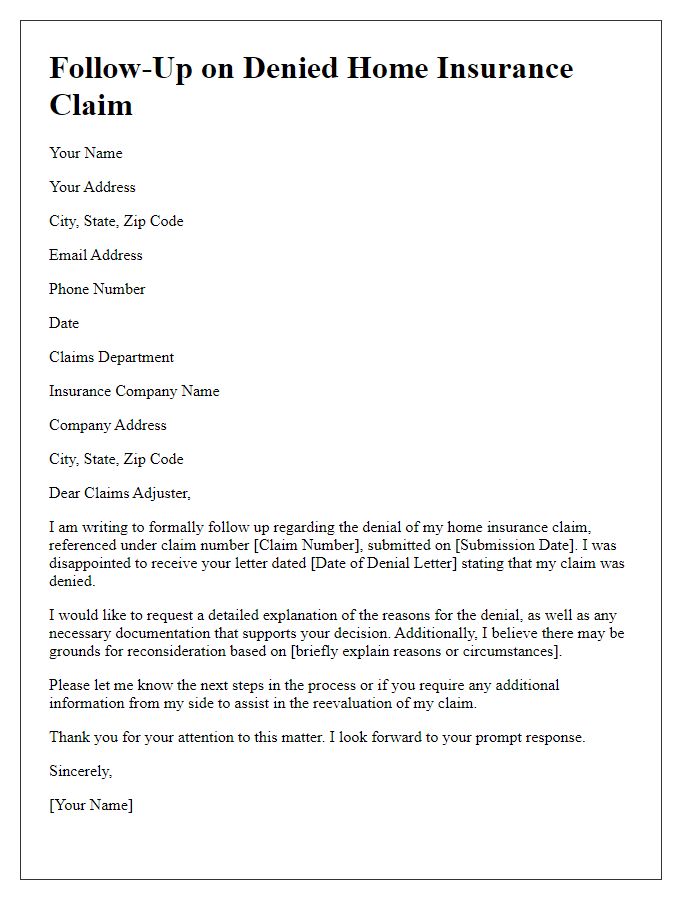

Letter template of home insurance claim follow-up addressing denied claim

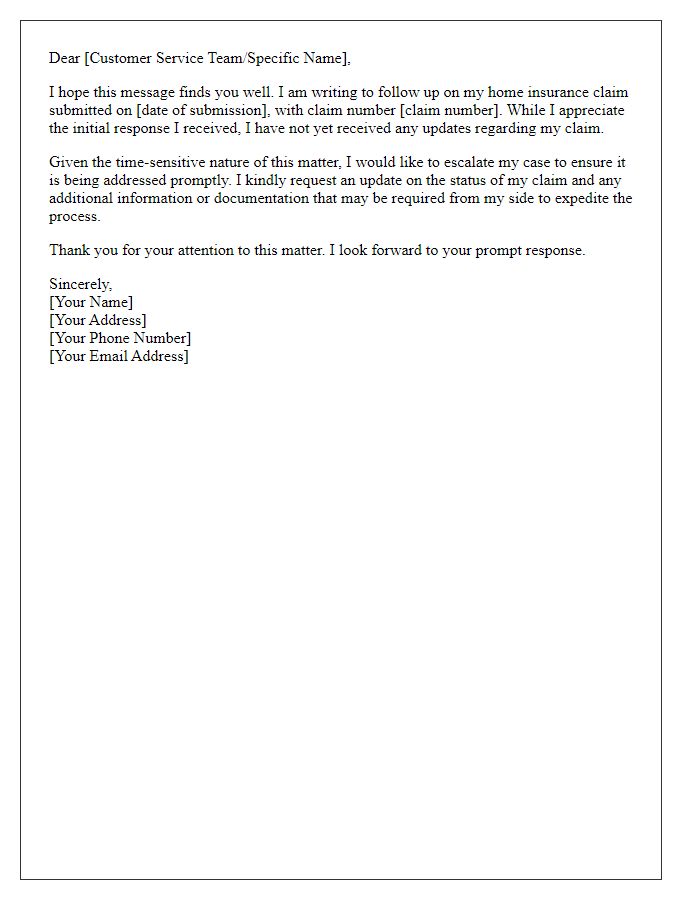

Letter template of home insurance claim follow-up for customer service escalation

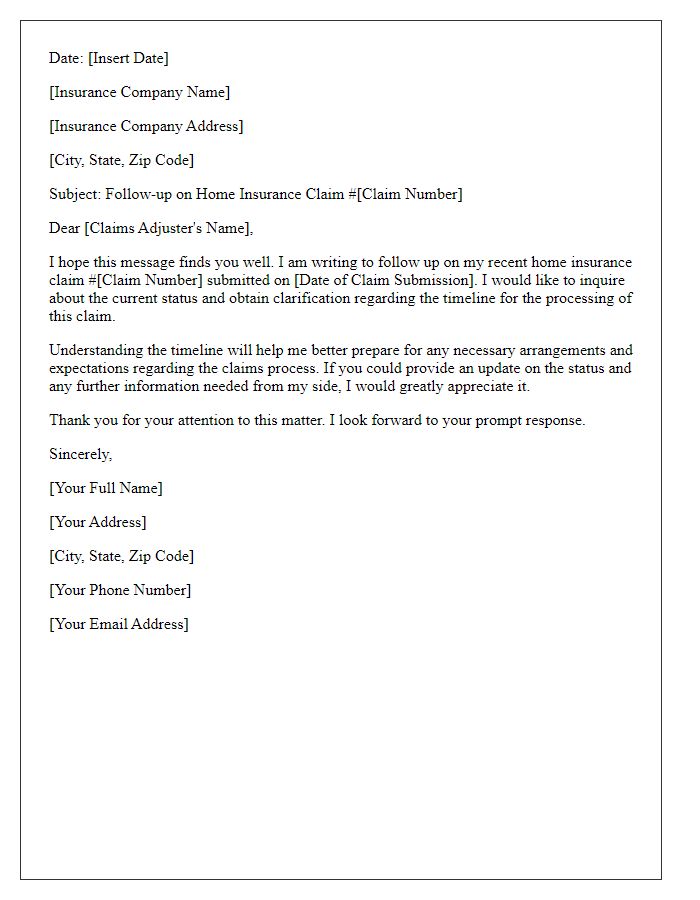

Letter template of home insurance claim follow-up for timeline clarification

Comments