Are you ready to take your spending power to the next level? Upgrading your credit card can open up a world of exciting rewards, benefits, and opportunities tailored just for you! Whether it's cashback on your favorite purchases, travel perks, or exclusive discounts, there's a perfect card waiting to enhance your financial journey. Ready to learn more about how you can enjoy these perks? Let's dive in!

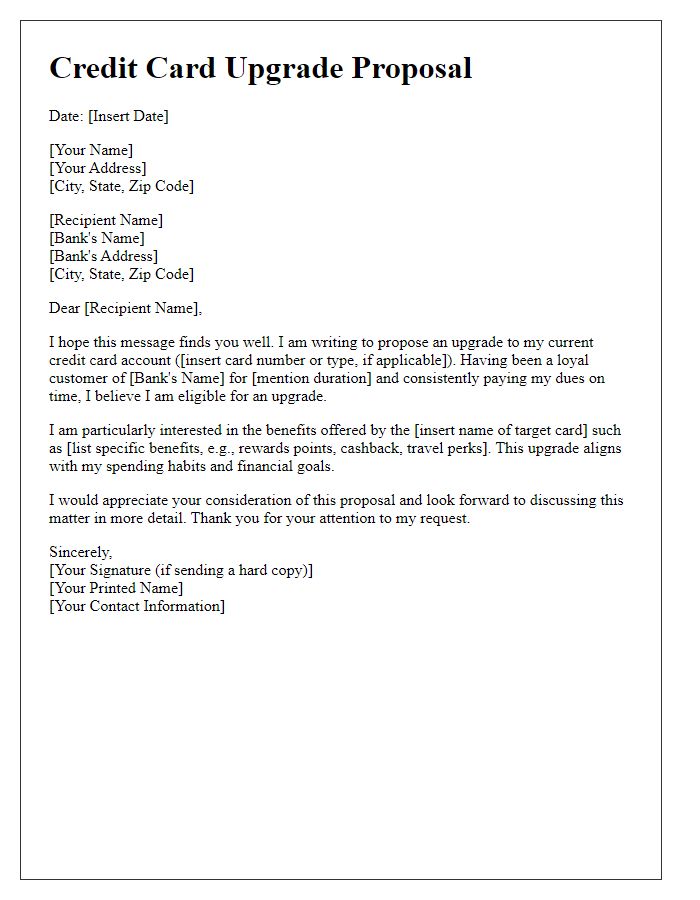

Personalized Greeting

Credit card upgrade offers present users with enhanced benefits and exclusive rewards, often tailored to individual spending habits. Financial institutions, such as Chase or American Express, typically send personalized letters to existing customers, highlighting features like increased credit limits or lower interest rates. Users can enjoy rewards programs with cash back percentages sometimes reaching 5% on certain categories, travel perks including access to airport lounges, or no foreign transaction fees for international purchases. This strategic marketing approach aims to improve customer loyalty and increase card usage, providing a competitive edge in the crowded financial market.

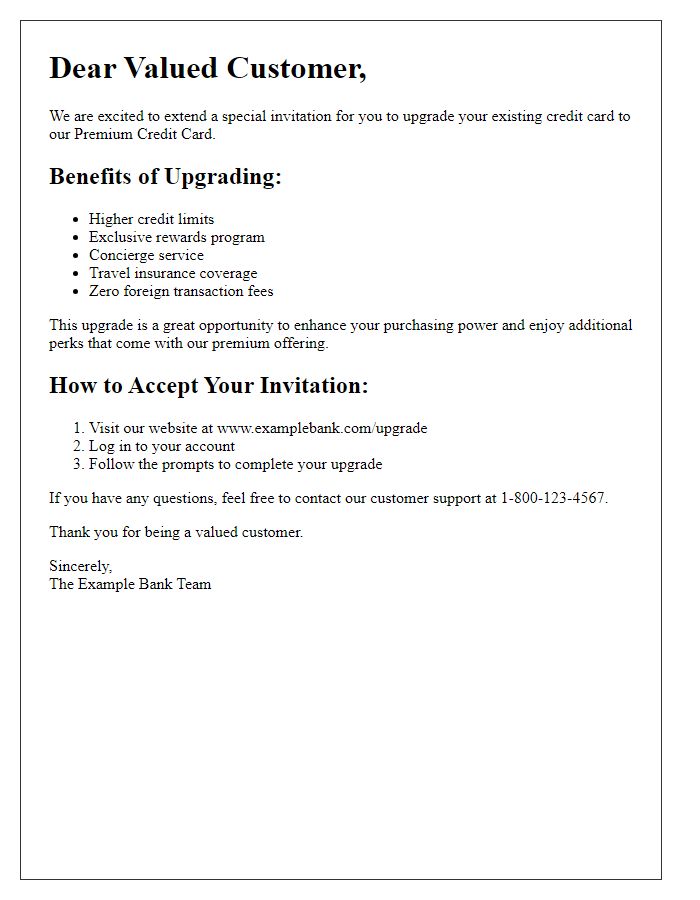

Benefits and Features

Upgrading to a premium credit card offers numerous advantages, enhancing financial flexibility. Enhanced rewards programs, such as cash back (typically between 1.5% to 5% on select categories) and travel points (often redeemable for flights and hotel stays), provide significant savings, especially for frequent travelers. Additional features include zero foreign transaction fees, making international purchases more economical. Premium cards often come with exclusive access to events, concierge services, and travel insurance (covering trip cancellations up to $1,500), adding value to consumers' lifestyles. Furthermore, higher credit limits may improve purchasing power and credit utilization ratios, positively influencing credit scores.

Eligibility Criteria

Eligibility criteria for a credit card upgrade offer typically include factors such as age requirements, credit score thresholds, income level, and existing relationship with the issuing bank. Candidates must often be at least 21 years old to comply with regulations, while those below this age must provide parental consent. A minimum credit score of 700, as considered by FICO, is commonly required to qualify for premium cards. Additionally, an annual income of at least $30,000 may be expected to ensure the applicant can meet financial obligations. Existing customers must have maintained their accounts in good standing for at least six months, showing responsible credit management. Moreover, prior spending patterns, such as spending thresholds of $1,000 within the first three months, could factor into the eligibility assessment for upgraded benefits like increased rewards points.

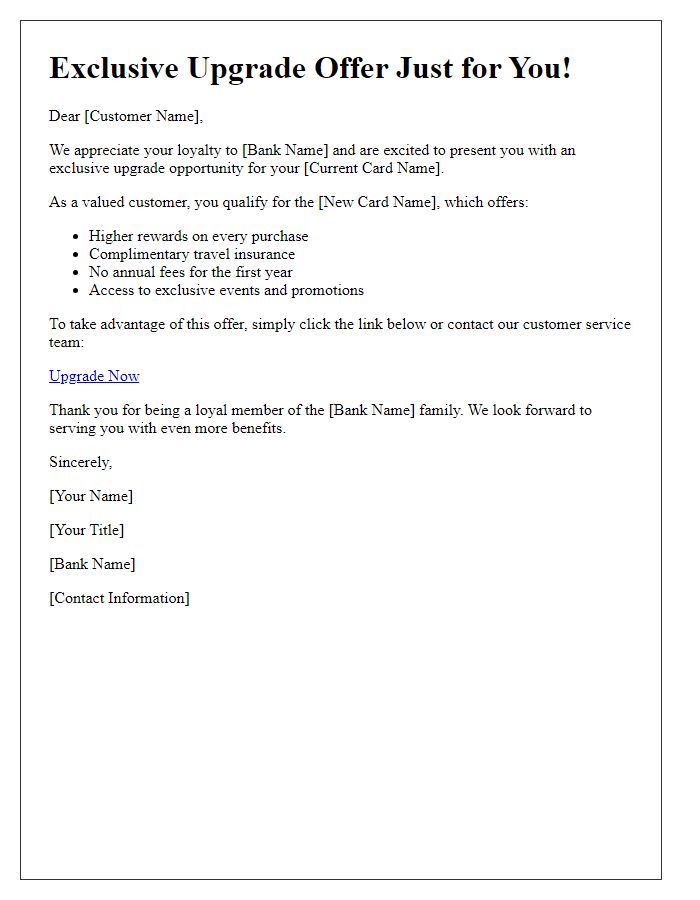

Call to Action

Upgrading credit cards can enhance benefits tailored to individual spending habits, such as increased rewards and lower interest rates. Premium cards often offer perks like travel insurance or cashback programs. Specific upgrades might include transitioning to a card with a higher credit limit, encouraging purchases over $1,000. Research indicates that consumers with upgraded cards participate more actively in loyalty programs, enhancing overall satisfaction with financial institutions. Annual fees for premium cards vary; for instance, some may reach $450, yet the potential rewards or bonuses can significantly outweigh the costs, motivating customers to engage with exclusive offers.

Contact Information

Credit card upgrades often entice customers with enhanced features and rewards. An upgrade offer can include benefits like increased credit limits with numbers reaching up to $10,000 or more. Enhanced rewards programs may offer 2% cash back on purchases or exclusive travel perks such as complimentary airport lounge access at over 1,000 locations worldwide. Contact information plays a crucial role in the communication process. Customers are typically encouraged to reach out via toll-free numbers, often displayed prominently, which can lead to dedicated customer service representatives available 24/7 for assistance. Additionally, official communication channels such as email addresses or online chat options provide convenience and allow for quick inquiries regarding the upgrade process or specific benefits associated with the new card.

Comments