Hey there! We all know that unexpected surprises can pop up in our financial journeys, and one of those surprises might just be a closed account notification. Whether it's due to inactivity, a change in personal circumstances, or even a simple oversight, receiving such a notice can be a bit jarring. Curious about why accounts close and how to prevent it from happening to you? Let's dive into the details!

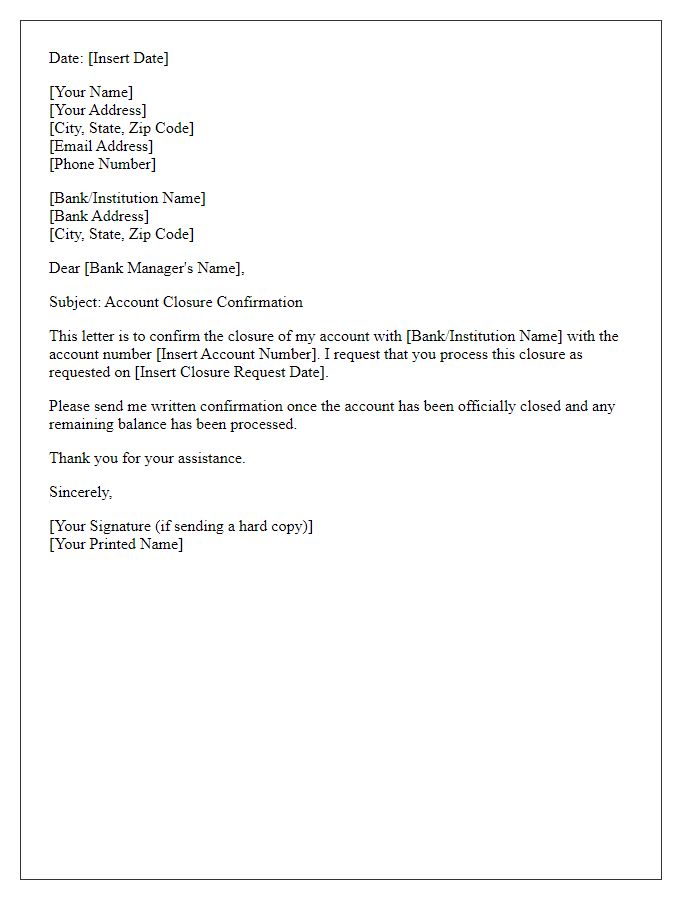

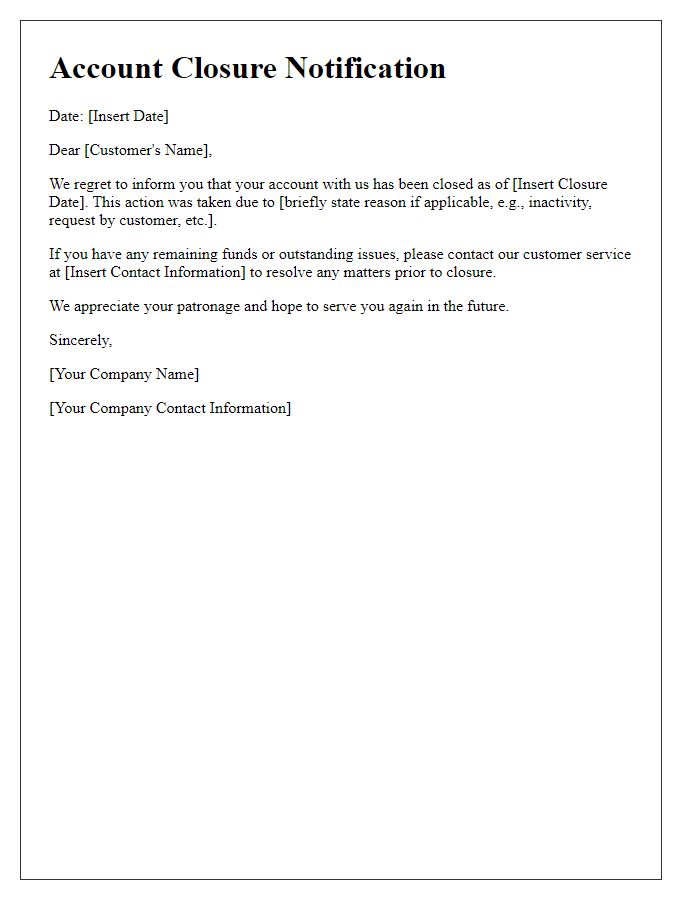

Subject line clarity

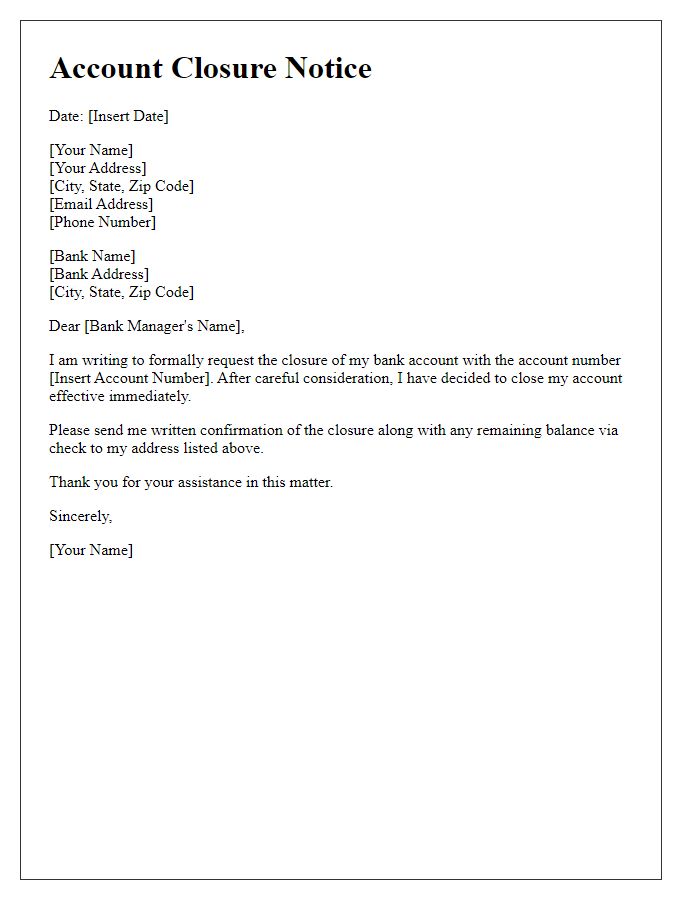

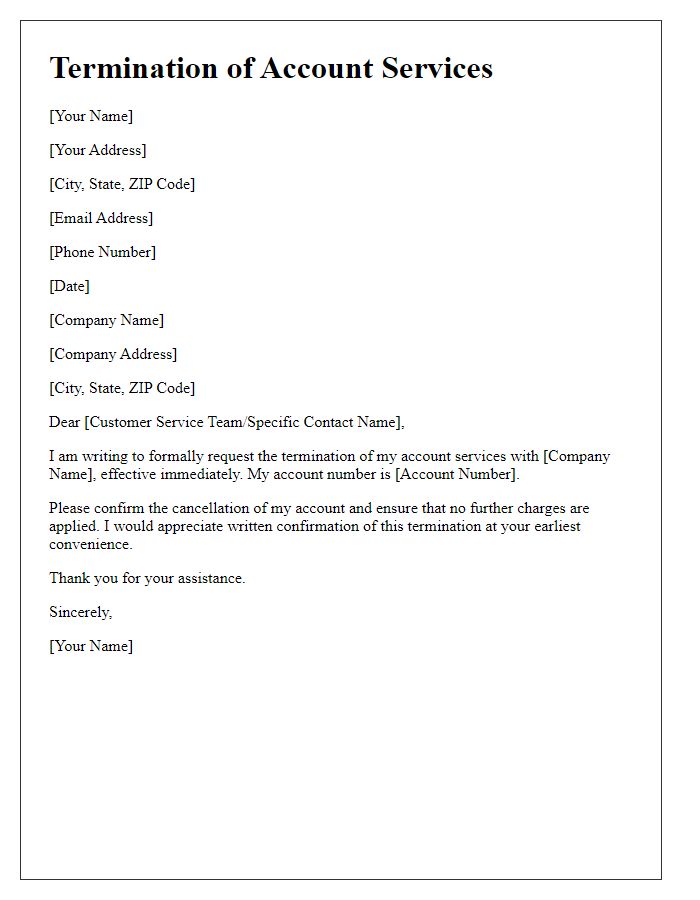

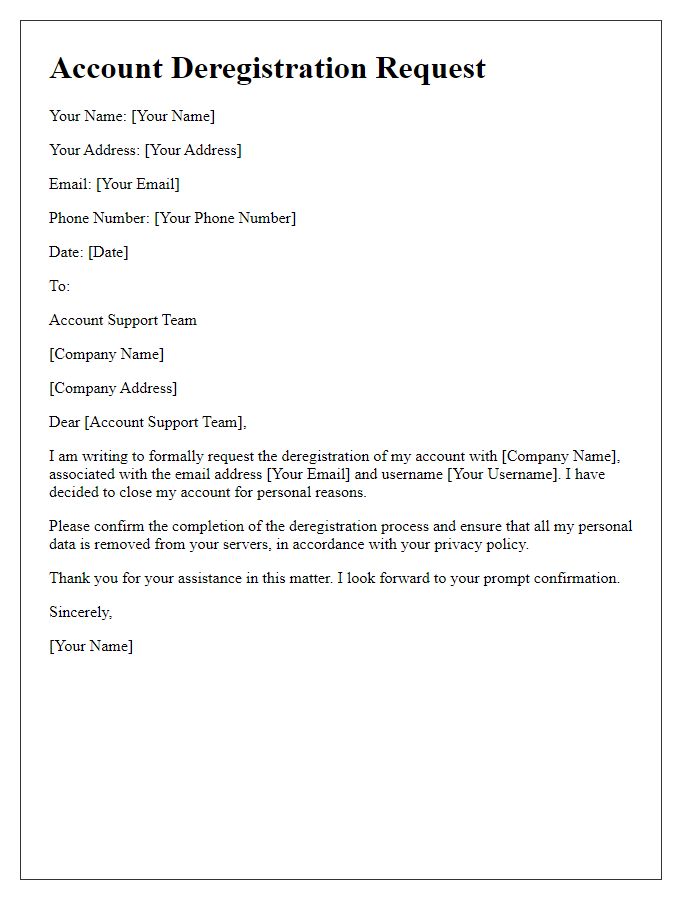

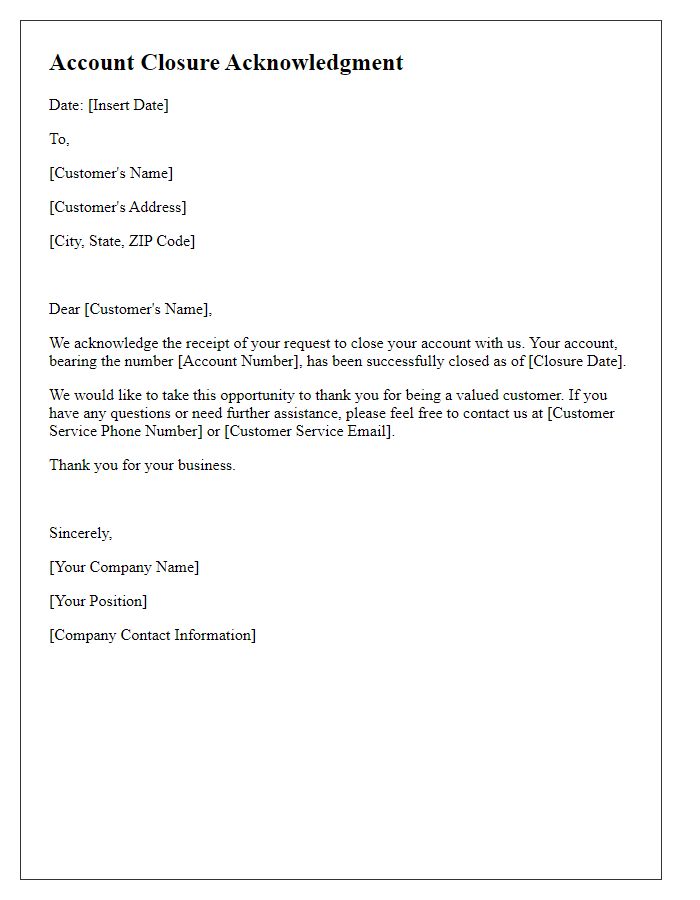

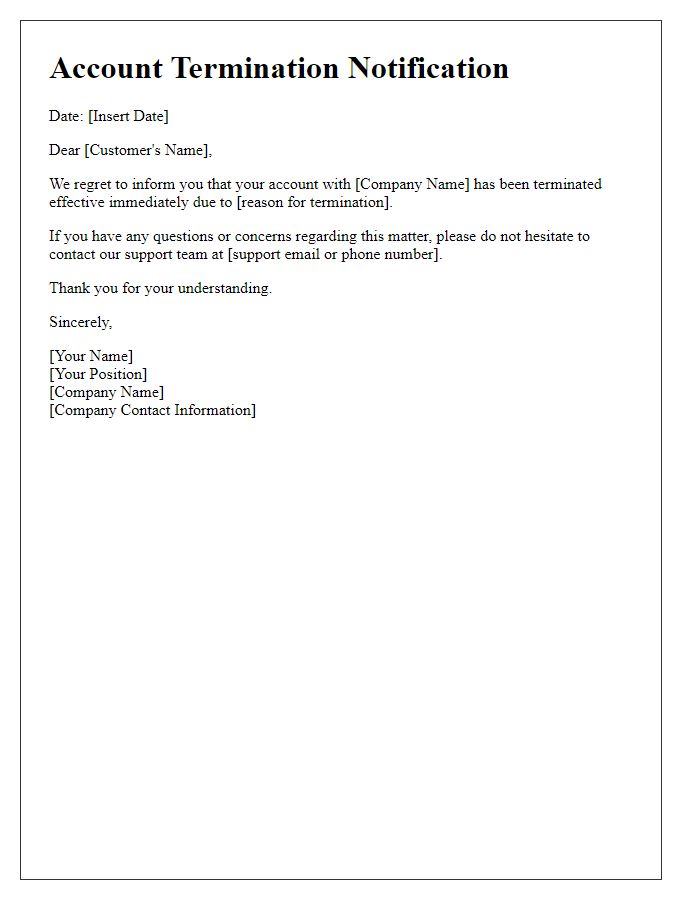

Subject lines that clearly indicate a closed account notification include: "Your Account Has Been Closed - Important Information Inside," "Account Closure Confirmation - [Your Company Name]," and "Notice: Your Account Closure with [Company Name]." Clear and concise language ensures immediate understanding for the recipient. It provides necessary context, reducing confusion about the content. Including the company name and account status reinforces clarity and the urgency of the message. Furthermore, highlighting important details in the subject line enhances response rates and promotes better customer service.

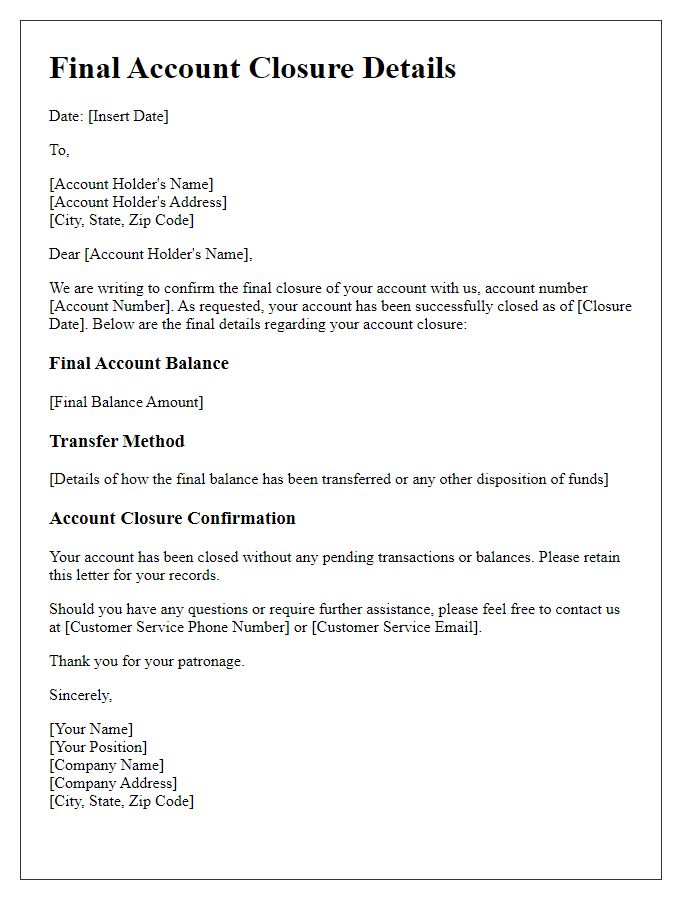

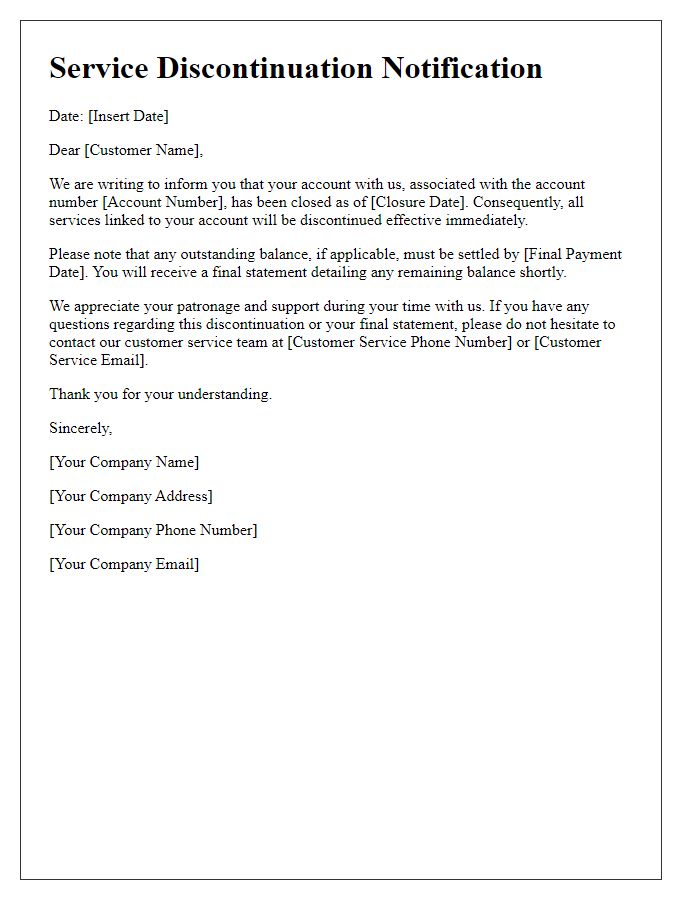

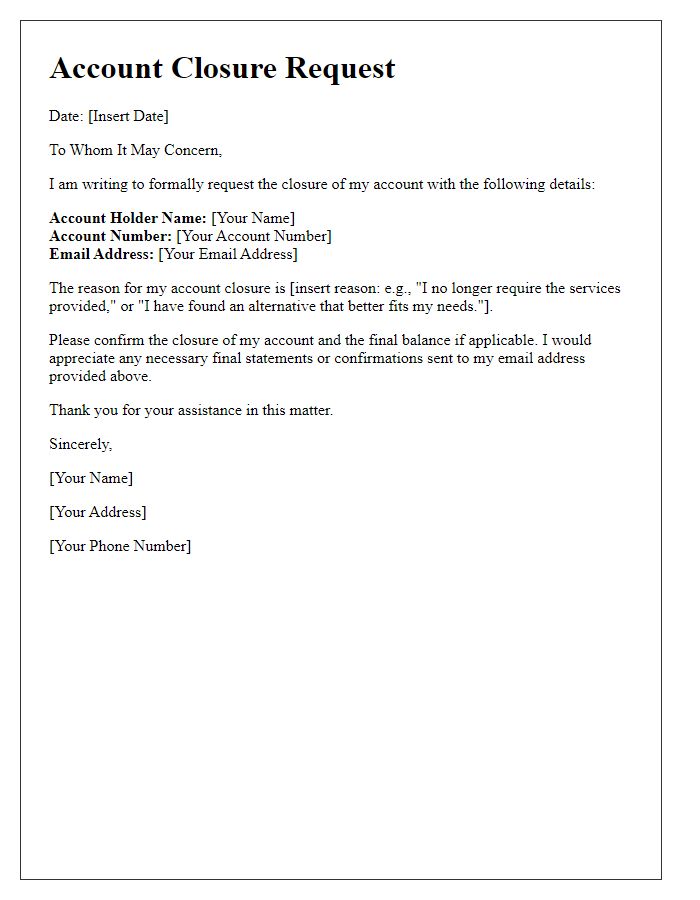

Account information details

Closed accounts on financial platforms can impact users' access to funds and transaction history. Account details typically include unique identifiers such as account number, account type (checking, savings, etc.), and the account holder's name. Notifications should specify the date of closure, which is crucial for record-keeping, while also detailing any pending transactions and remaining balances. Users must be informed about alternative ways to retrieve financial documents and tax-related information, especially when annual reports or statements are needed for income verification. Additionally, essential customer service contact details and instructions for future inquiries should be included to ensure a seamless transition post-closure.

Reason for closure

A closed bank account notification, often issued by financial institutions, typically includes essential details such as the account number, closure date, and the reason for closure. Common reasons for closure may include inactivity for a specified period (e.g., six months), customer request for closure due to unsatisfactory service, or account maintenance fees that were deemed excessive (often exceeding $10 monthly). The letter may also indicate the balance remaining, if applicable, which should be refunded to the account holder. Furthermore, important contact information is provided for customers who need to inquire about the closure or seek resolution regarding outstanding transactions or fees.

Contact information for inquiries

A closed account notification typically includes essential information regarding the closure of an account. Customers receive a formal message explaining the status of their account, relevant details like the account number, closure date, and any remaining balance due for withdrawal or payment. Additionally, it provides contact information for inquiries, ensuring customers can reach support representatives for questions or concerns. This information often includes a dedicated phone number, email address, and operating hours to facilitate prompt communication. Furthermore, the notification may highlight options for final statements or confirmation documents to maintain transparency in the account closure process.

Account balance resolution

A closed account notification typically addresses important account details, including the account number, closure date, and remaining balance. Customers should receive this notification to inform them that their account has been officially terminated and ensure any residual funds are resolved. For example, after a formal closure on December 1, 2023, all remaining balances below $10 may be forfeited, while larger amounts will be transferred to a specified emergency savings account under the client's name. Clear instructions regarding settlement methods, such as direct deposits or checks mailed to the registered address, should be provided to ensure smooth resolution of financial matters connected to the closed account.

Comments