When it comes to understanding service charges, it's not uncommon to have questions or even confusion. The purpose of these charges is to cover the costs of maintaining the shared spaces and amenities that enhance our community experience. We're here to break down the specifics so you know exactly where your money goes and how it benefits you. Curious to learn more about the intricacies of service charges and what they mean for you? Read on!

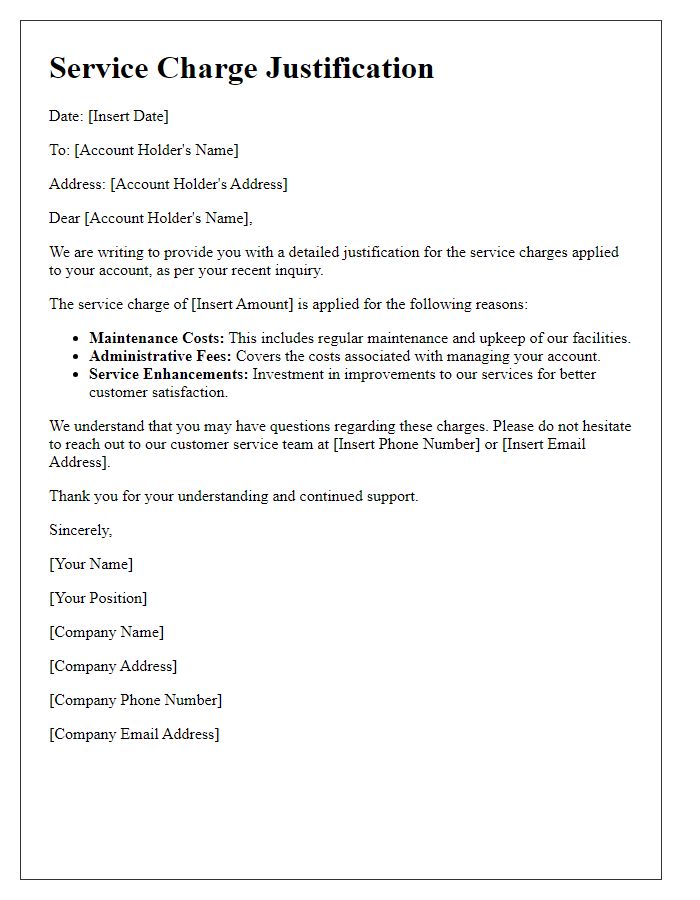

Clear introduction and purpose statement

Service charges in various industries, such as hospitality and utilities, play a crucial role in covering operational costs. These charges often include fees for maintenance, administrative support, and customer service. Understanding the breakdown of these charges allows consumers to better appreciate the services provided. For instance, in restaurants, a standard service charge may range from 10% to 20% of the total bill, ensuring staff are compensated fairly. In the utility sector, service charges can vary significantly by region, reflecting differences in infrastructure and service delivery. Transparency in these charges is essential for maintaining trust and ensuring customer satisfaction.

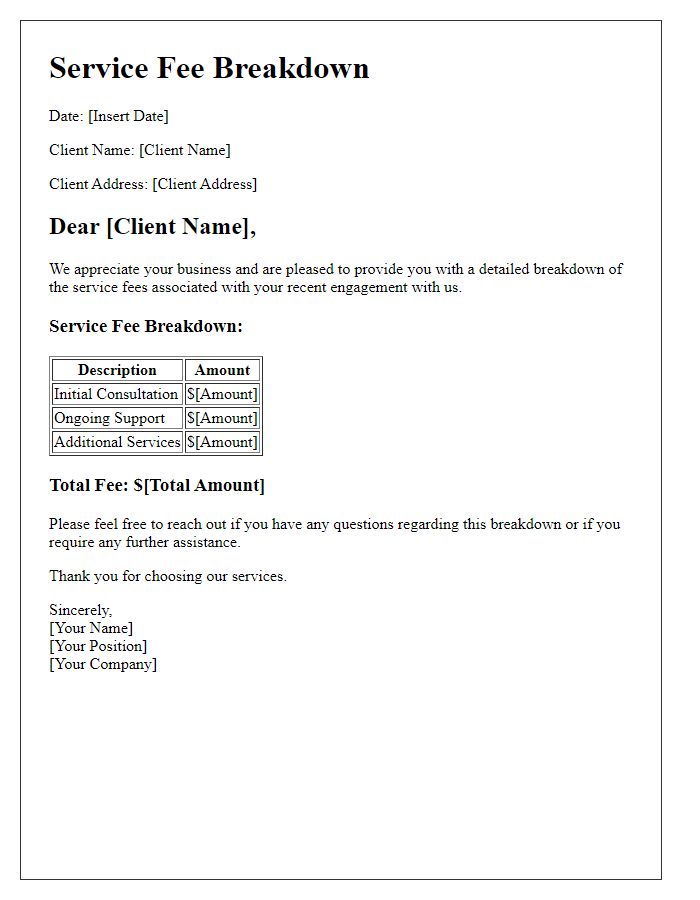

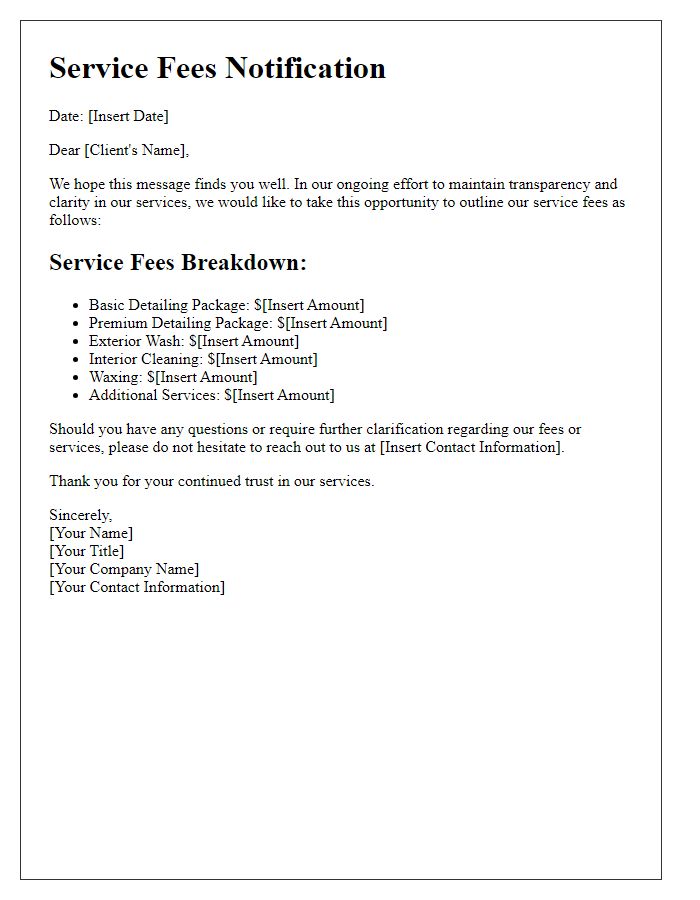

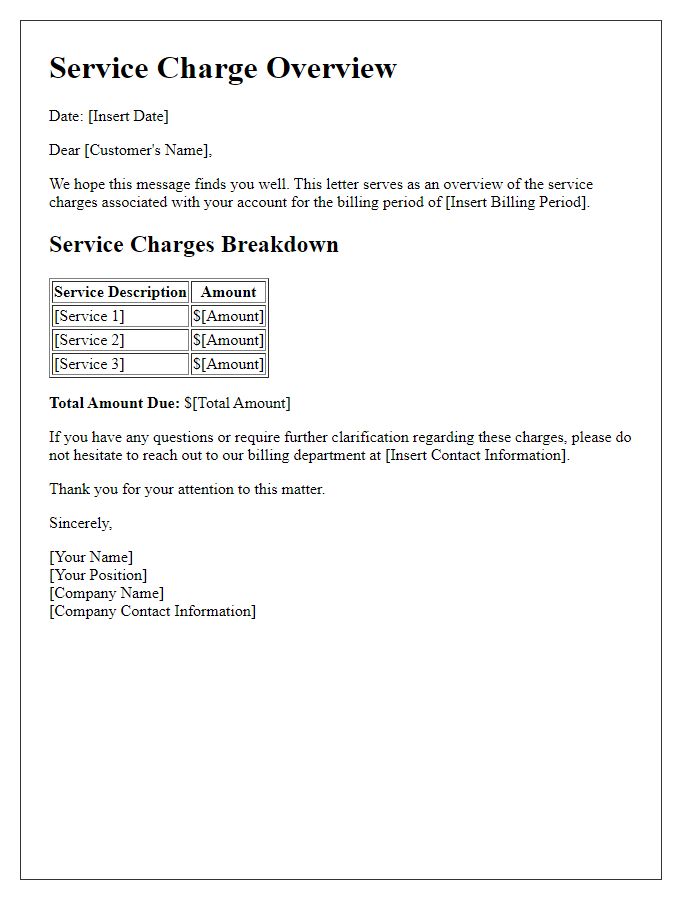

Detailed itemization of charges

Service charges refer to the fees associated with specific services rendered, often covering labor, materials, and overhead costs. For instance, a detailed itemization of charges may include labor fees based on hourly rates, such as $50 per hour for technician services, alongside material costs for components that could be priced at $20 for parts like filter replacements or $100 for specialized equipment. Additional fees may apply for expedited services, commonly around 20% of the total cost, or transportation charges, which can range from $10 to $50 depending on distance traveled. Taxes, often around 7% of the cumulative charges, will also be included in the final invoice, providing a transparent overview of the total expenses incurred for the services provided. By clearly delineating each charge, customers receive a comprehensive understanding of their financial obligations.

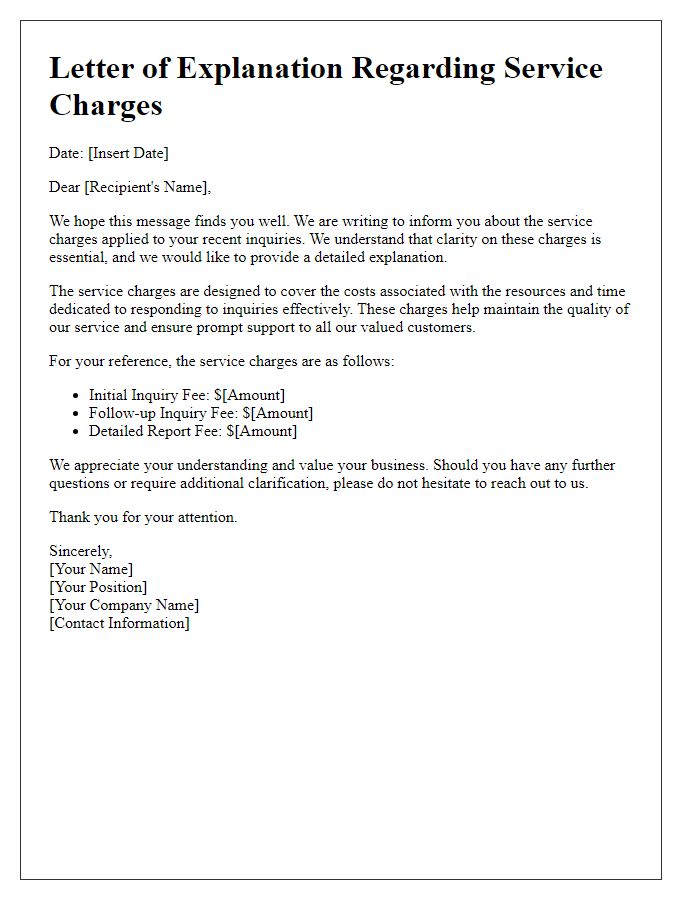

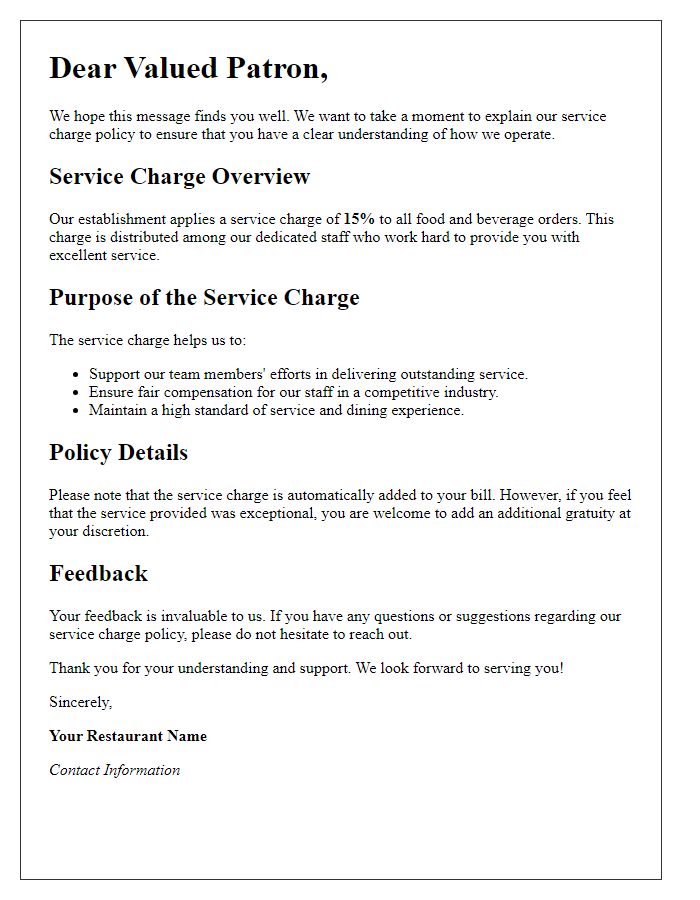

Explanation of charge rationale

Service charges in various industries, such as hospitality and utilities, often stem from multiple factors reflecting the operational costs necessary to maintain quality and efficiency. For instance, in restaurants, service charges may range from 15% to 20% of the total bill, covering expenses such as employee wages, training programs, and benefits to ensure high service standards. In utility sectors like electricity, service charges might comprise infrastructure maintenance costs, regulatory compliance fees, and customer service expenses, often amounting to a standardized monthly fee, such as $5 to $10, which allows for reliable access and support. These charges aim to sustain service quality, enhance customer experience, and accommodate necessary operational investments.

Highlight of benefits and value

Service charges encompass various benefits that enhance the overall customer experience. Transparent pricing structures allow consumers to understand how their contributions support essential services in facilities like public housing developments or community centers. A portion of these fees aids in maintaining amenities such as fitness centers, pools, and outdoor spaces, ensuring these facilities remain in excellent condition for user satisfaction. For instance, regular maintenance (scheduled quarterly) prevents larger repair costs, ultimately saving money over time. Additionally, service charges can contribute to implementing security measures (enhancing resident safety) and community events (fostering local engagement), which create a sense of belonging among residents. Overall, these charges reflect a commitment to quality service and community well-being, enriching the living experience in urban settings.

Contact information for inquiries

Service charges can vary significantly across different industries, including hospitality, retail, and logistics, impacting customer experience and financial planning. For example, a hotel may apply a service charge of 15% on a $200 room rate, resulting in an additional $30 added to the final bill. Restaurants may include a gratuity of 18% for parties of six or more, directly affecting the total dining cost. Customers should note that these fees often cover expenses such as personnel wages, overhead costs, and amenities provided. For inquiries regarding specific service charges, customers can reach out to the customer service department at the business's official contact number, usually listed on their website, or through designated email addresses for clarification and assistance.

Comments