Hey there! If you've ever found yourself needing to verify your account but weren't sure how to go about it, you're not alone. We're here to simplify the process for you, ensuring your account is secure and accessible in no time. In this article, we will guide you step-by-step on crafting a perfect account verification request letter. So, let's dive in and make that account verification a breeze!

Subject Line Optimization

Account verification requests require clear and concise subject lines to ensure prompt attention. Ideal subject lines should include key details like the type of account (e.g., email, social media), the action being requested (e.g., verification, validation), and urgency if applicable. A well-crafted subject line might read "Urgent: Verification Request for [Your Account Type] - [Your Username or Account ID]". Effective subject lines facilitate quick identification of the request and help prioritize it in busy inboxes, increasing the likelihood of a timely response.

Personalized Greeting

In digital platforms, account verification serves as a critical security measure, often required in services like banking or social media. A personalized greeting, containing the user's name, enhances the user experience (UX), demonstrating a tailored approach. For instance, a user named John might receive a message stating, "Dear John," creating a sense of individual acknowledgment. Verification requests typically involve sending a unique code (often 6 digits) to the user's registered email or mobile number. This code must be entered to confirm the identity of the account holder. Additionally, the platform's guidelines should outline security protocols, ensuring that sensitive information remains protected during the verification process. Overall, proper account verification fosters trust in online interactions, particularly amid rising cybersecurity threats.

Clear Purpose Statement

A clear purpose statement for account verification requests emphasizes the importance of safeguarding user data and ensuring account integrity. Account verification is crucial for preventing identity theft, protecting personal information, and maintaining secure access to services. In today's digital landscape, robust verification processes, such as two-factor authentication (2FA), utilize confirmation codes sent via SMS or email to verify user identity effectively. Additionally, ensuring compliance with regulations such as the General Data Protection Regulation (GDPR) enhances user trust and reinforces the necessity of accurate identity verification in financial services or online platforms.

Required Information List

Account verification is a crucial process for online security and user identity protection. Essential information needed for verification includes full name (as stated in official documents), date of birth (to confirm age requirements), and email address (to send verification links). Users must also provide a valid phone number (for two-factor authentication), physical address (for billing and identity verification), and a government-issued identification number (like a passport or driver's license number, typically required by financial institutions). Additional documentation may include proof of address (such as utility bills or bank statements dated within the last three months). This comprehensive collection of data ensures compliance with regulations and enhances the safety of user accounts.

Call-to-Action and Closing Remarks

The account verification process is crucial for maintaining security and user trust in online platforms. Users often receive verification requests via email or notifications, prompting them to confirm their identity. This process typically involves clicking on a verification link, entering a code sent to their registered mobile number, or providing identification documents. Successful verification grants access to features or services, enhances account safety, and prevents unauthorized access. Users should complete these requests promptly to avoid disruptions in service. Key platforms such as Google, Facebook, and banking institutions often employ rigorous verification methods, ensuring user data protection. Failure to verify may result in restricted account functionalities or temporary suspensions. Timely verification reflects user responsibility and adherence to security protocols, safeguarding personal information in an increasingly digital world.

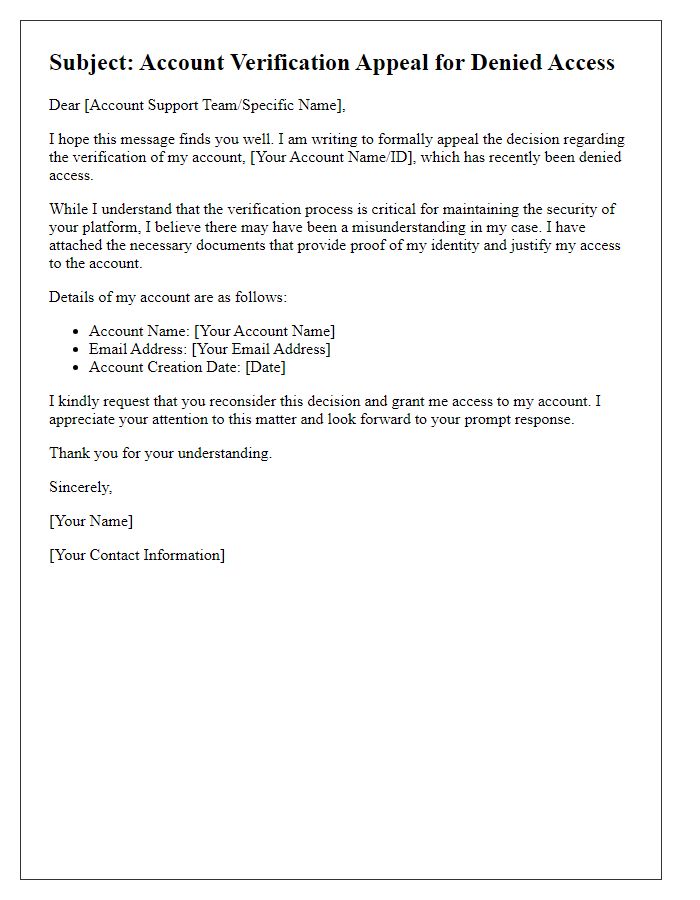

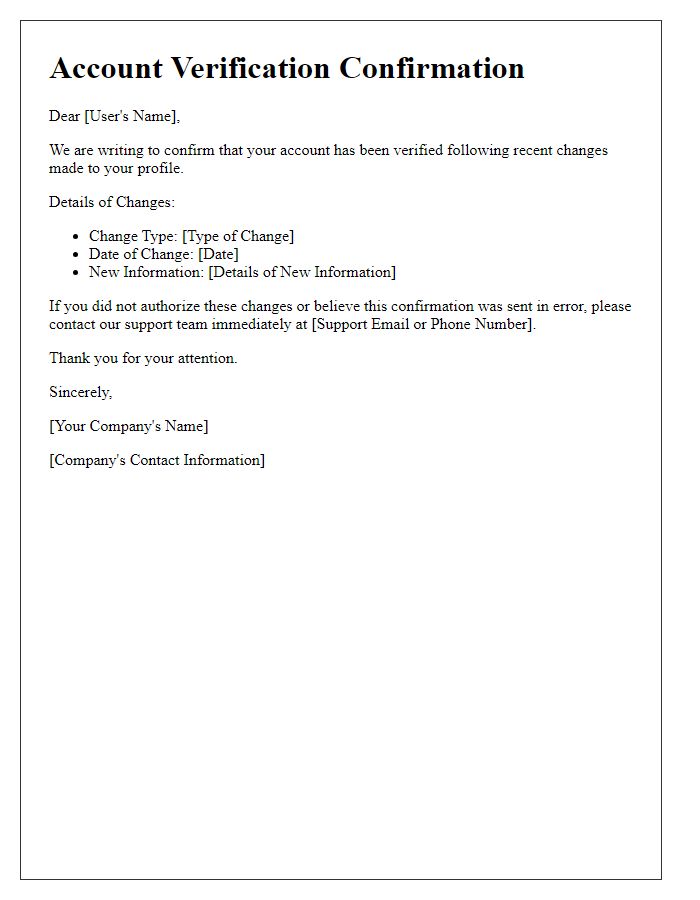

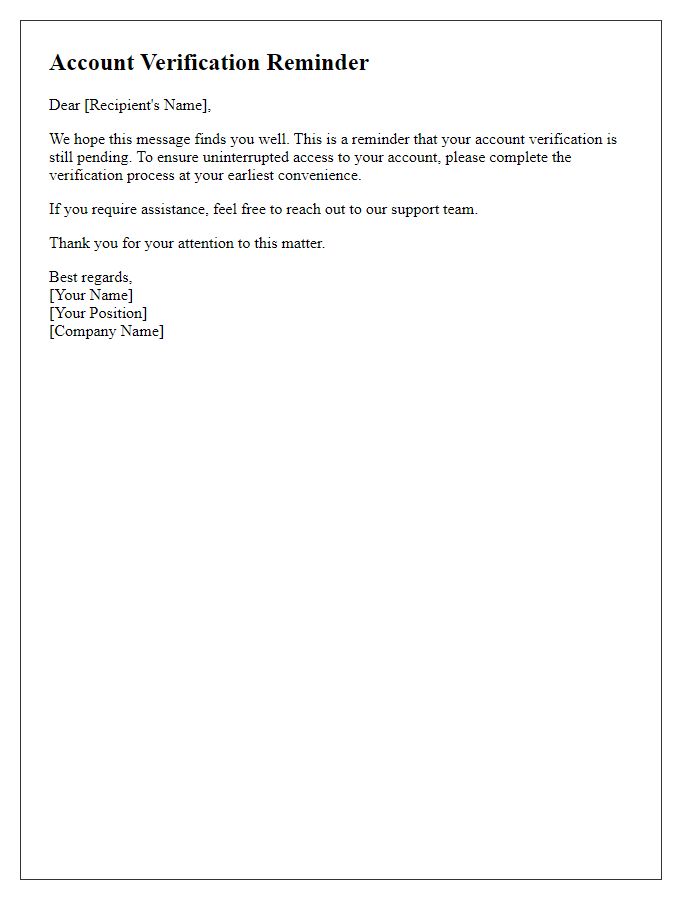

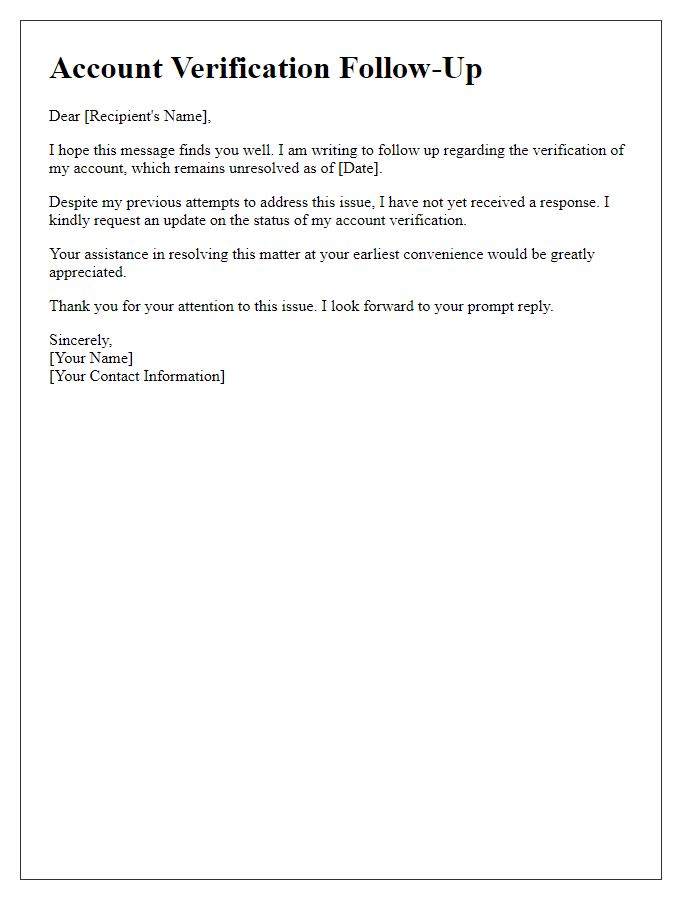

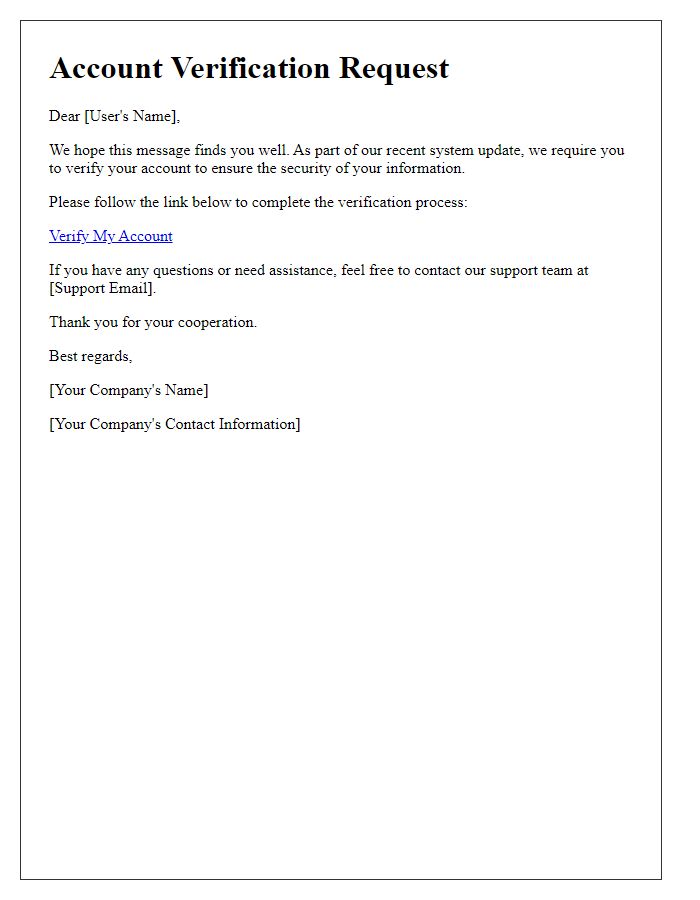

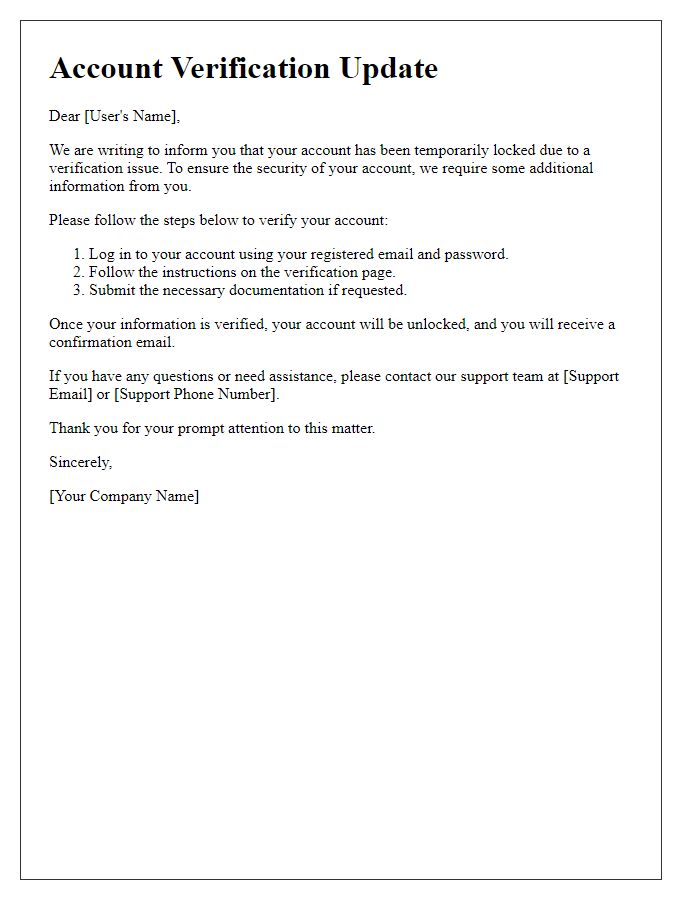

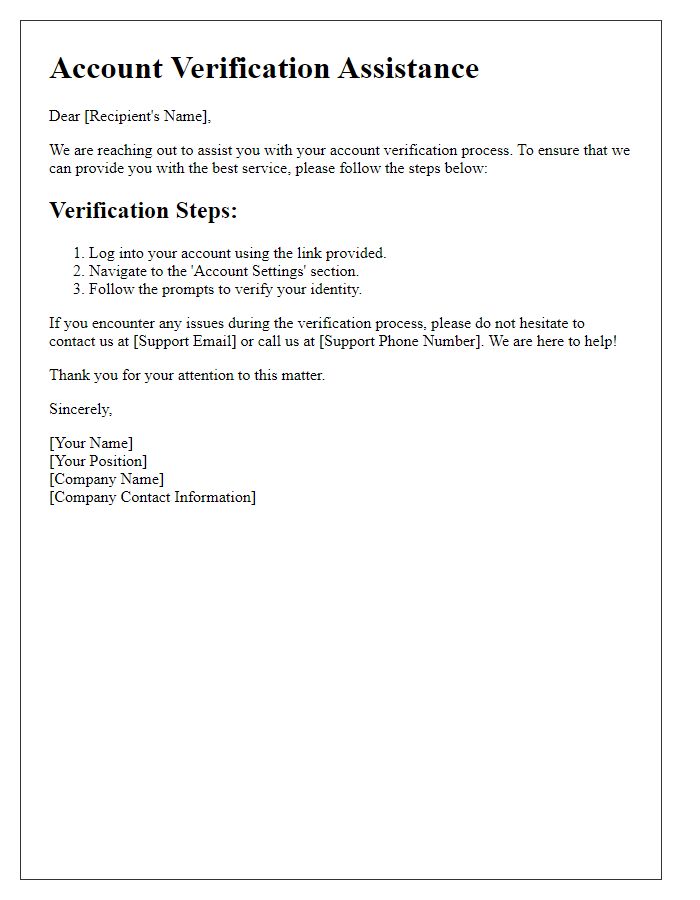

Letter Template For Account Verification Request Samples

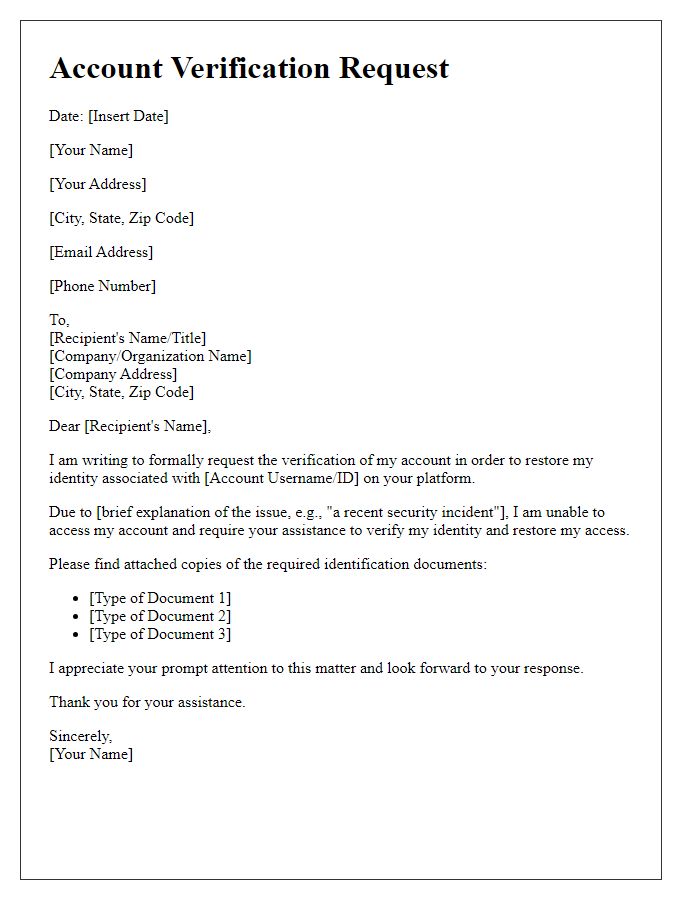

Letter template of account verification request for identity restoration

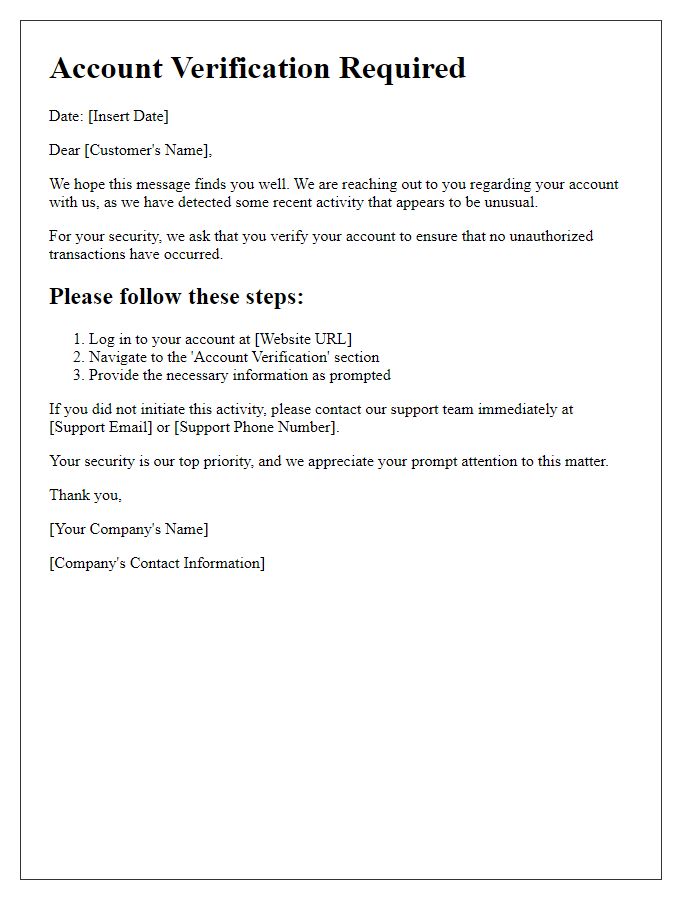

Letter template of account verification clarification for suspicious activity

Comments