Are you contemplating closing your account but unsure of the proper steps? We've all been there, and it's crucial to handle it smoothly to avoid any hiccups down the road. In this article, we'll guide you through a sample letter template specifically designed for account closure acknowledgment, making the process as seamless as possible. So, if you're ready to simplify your account closure experience, keep reading to discover helpful insights!

Clear subject line

Subject: Acknowledgment of Account Closure Request The acknowledgment of account closure request reflects the completion of service termination for your account. On specific date, the account associated with your name or account number was successfully closed as per your instructions. All personal data and transaction history have been securely processed in compliance with privacy regulations, ensuring confidentiality. Any remaining balance or outstanding transactions were addressed according to policy guidelines. For further inquiries or assistance, please contact our customer service team at your convenience. Thank you for your past business with us, and we wish you all the best in future endeavors.

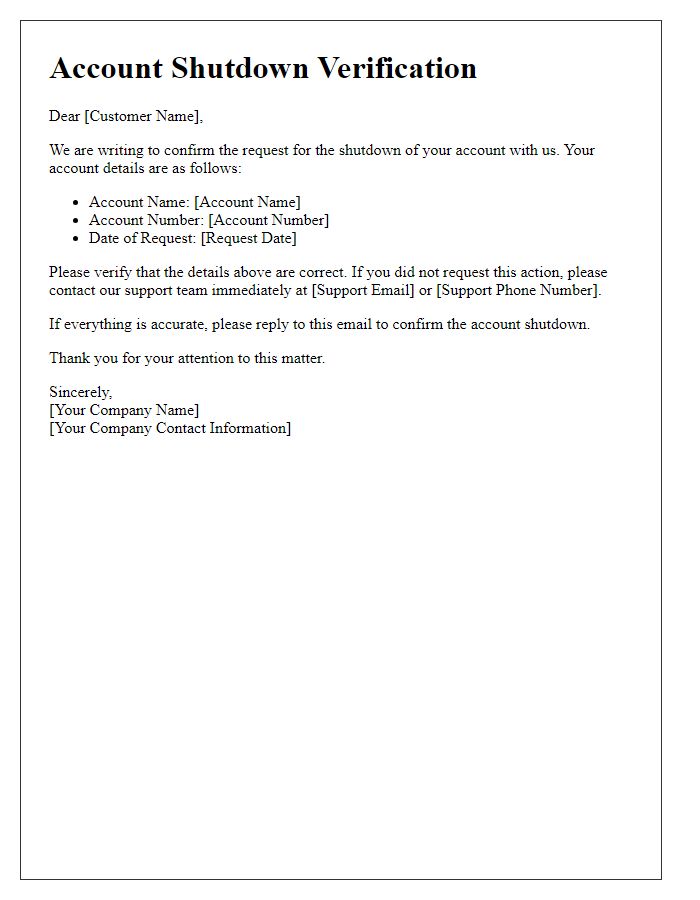

Account details verification

After initiating the account closure process, verification of account details is crucial to ensure accurate and secure handling of sensitive information. Users must provide essential account identifiers, such as account number or user ID, to facilitate this verification. Financial institutions often require confirmation of personal information, including registered email addresses and phone numbers, to authenticate the closure request. Security measures may include sending verification codes to the registered phone number or email, ensuring that only authorized individuals can proceed with the account closure. Completing this verification step protects users from unauthorized account access and potential identity theft, making it a vital part of the closure process.

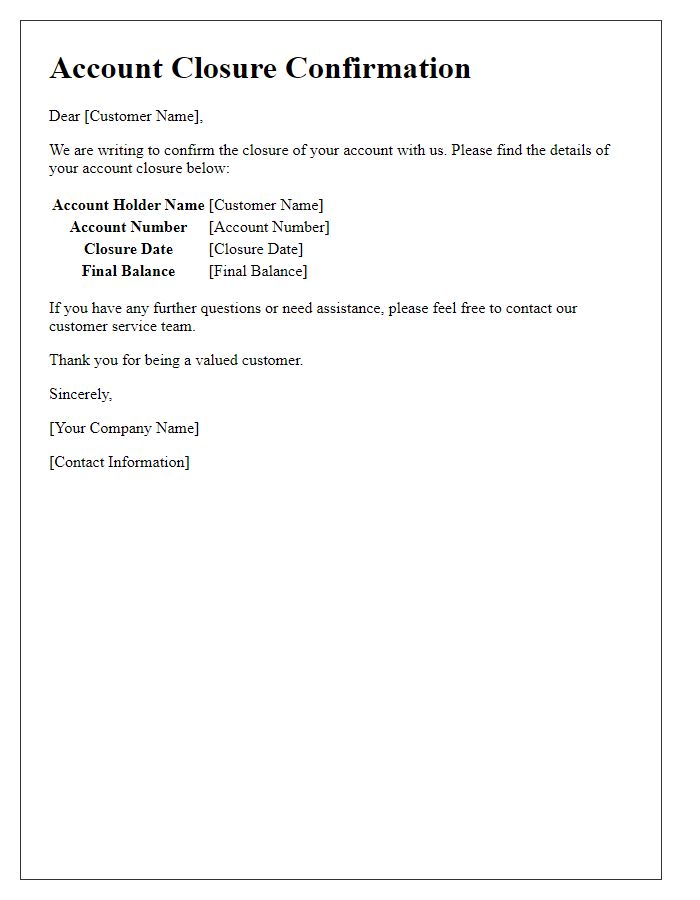

Confirmation of closure

Account closure confirmation occurs when a financial institution processes a client's request to terminate their account, such as a savings account or credit card account. This acknowledgment typically includes important details such as account number (e.g., 123456789), closure date (e.g., March 15, 2024), and final balance (e.g., $150.00). The closure process may also involve settling any outstanding transactions, such as pending deposits or withdrawals. Clients should also note they may receive a final statement outlining closure details and any remaining funds that may be credited to their registered address, such as a mailing address in New York City. Additionally, clients are advised to maintain records for tax purposes and review any terms that might affect re-opening an account in the future.

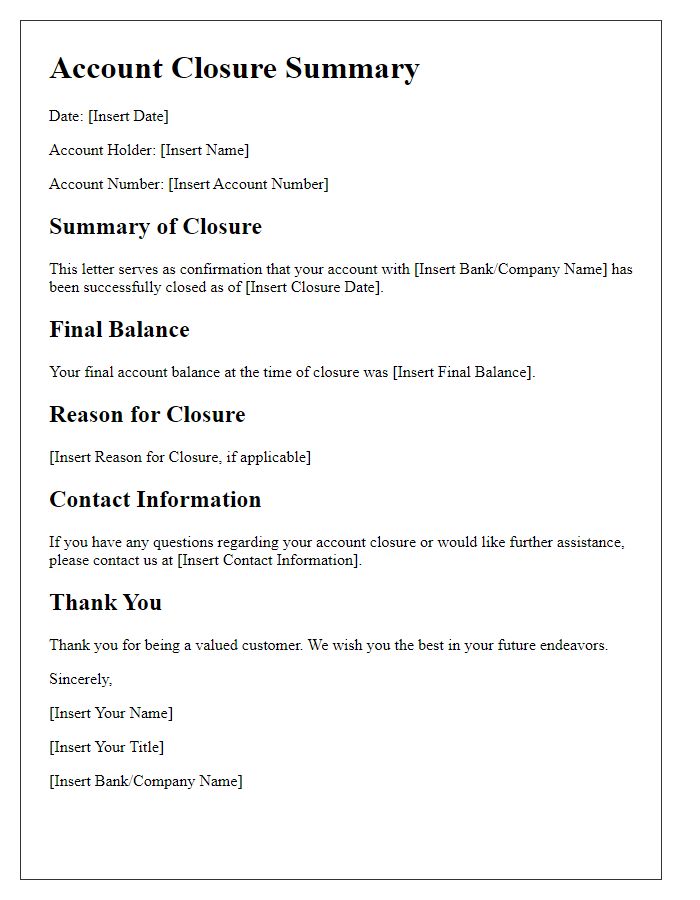

Final balance or outstanding dues

Account closure notifications serve as vital records for both banks and customers, detailing the final account status. Upon completion of account closure, banks typically issue statements reflecting the final balance, which signifies either the total money refunded to the customer or any outstanding dues left unpaid, such as fees or loans. Customers often receive this acknowledgment via registered mail or through secure email communication, ensuring compliance with financial regulations. The statement should include critical information, such as account number, closure date, and an itemized list of transactions leading to the final balance. Accurate documentation allows customers to review their financial history related to the account while providing banks a safeguard against any future disputes related to account settlement.

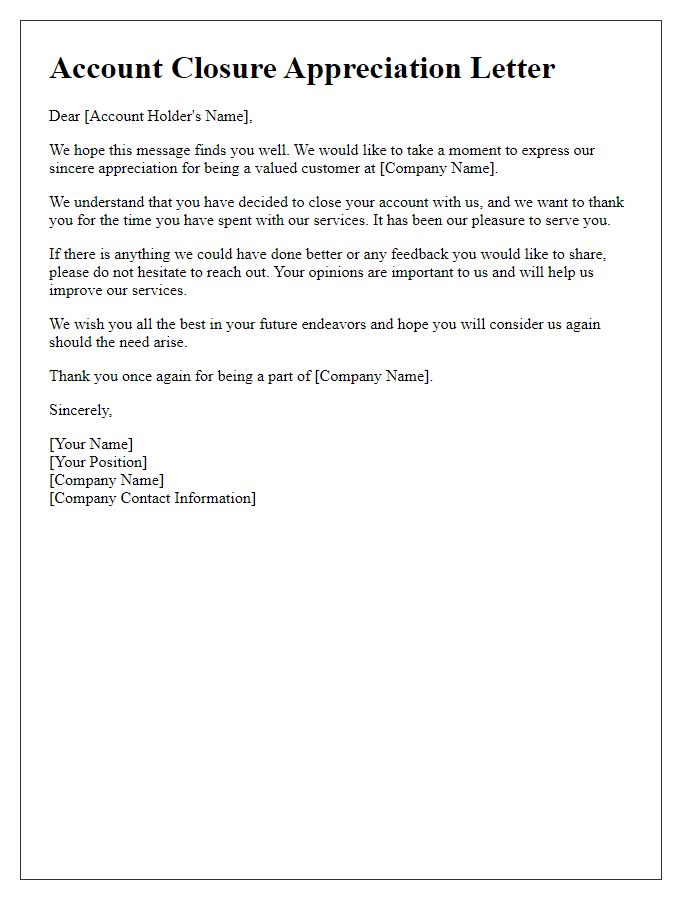

Customer support contact information

Account closure acknowledgment occurs when a customer decides to terminate their business relationship with a service provider, such as a bank or online platform. This process typically involves verifying customer identity and confirming the closure request. Importance of customer support contact information is crucial during this phase, enabling users to address any inquiries or concerns. For instance, many companies provide dedicated phone numbers, email addresses, or live chat options, ensuring assistance is readily accessible. Companies may also include timelines for processing closures, often ranging from 3 to 14 business days, depending on their policies. Additionally, a confirmation number may be issued for tracking purposes, allowing users to verify that their requests have been processed successfully.

Comments