Have you ever found yourself staring at your bank statement, feeling frustrated after spotting an unauthorized transaction? It's a common issue that can leave you feeling vulnerable and unsure of your next steps. Writing a complaint letter may seem daunting, but it's essential for resolving the matter efficiently. Join us as we guide you through the process of crafting a compelling letter to reclaim your financial peace of mind.

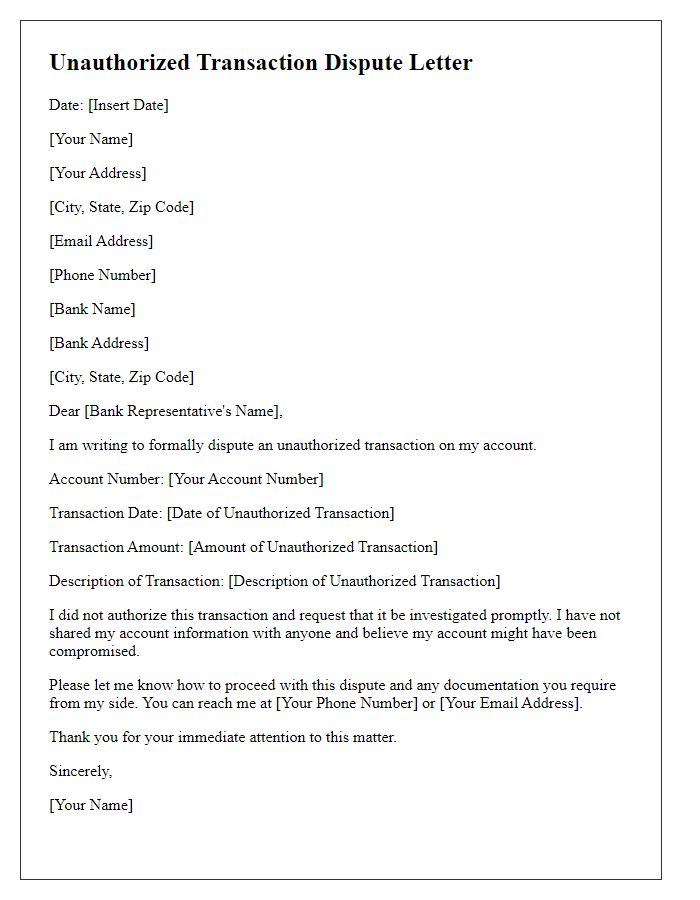

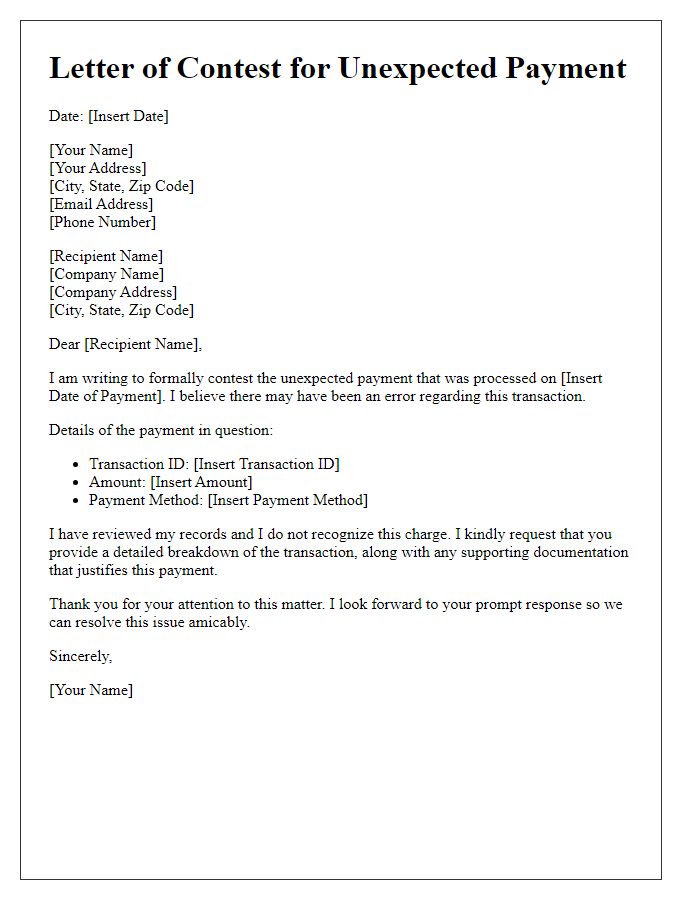

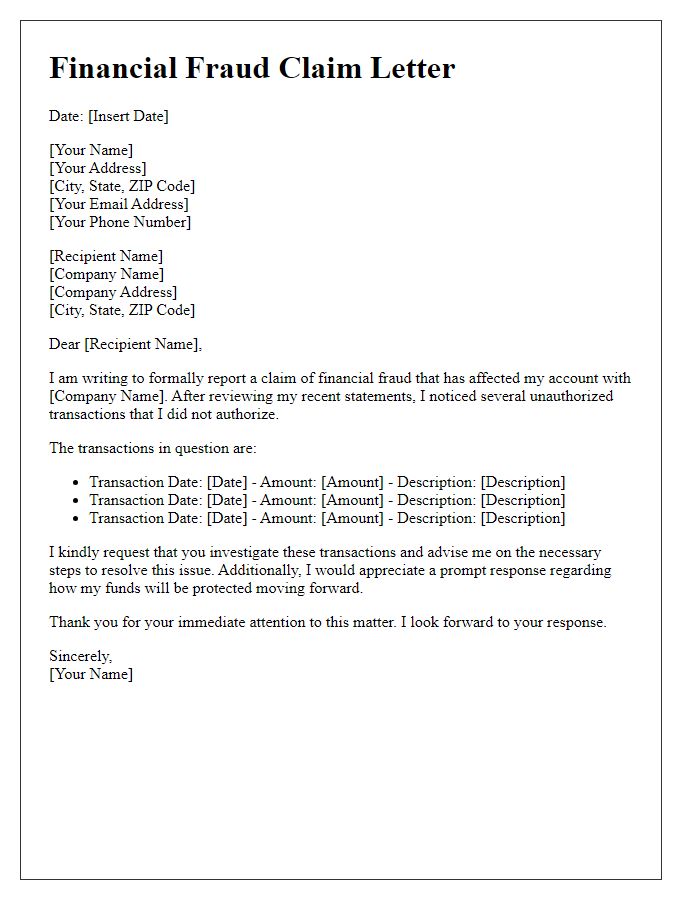

Clear transaction details

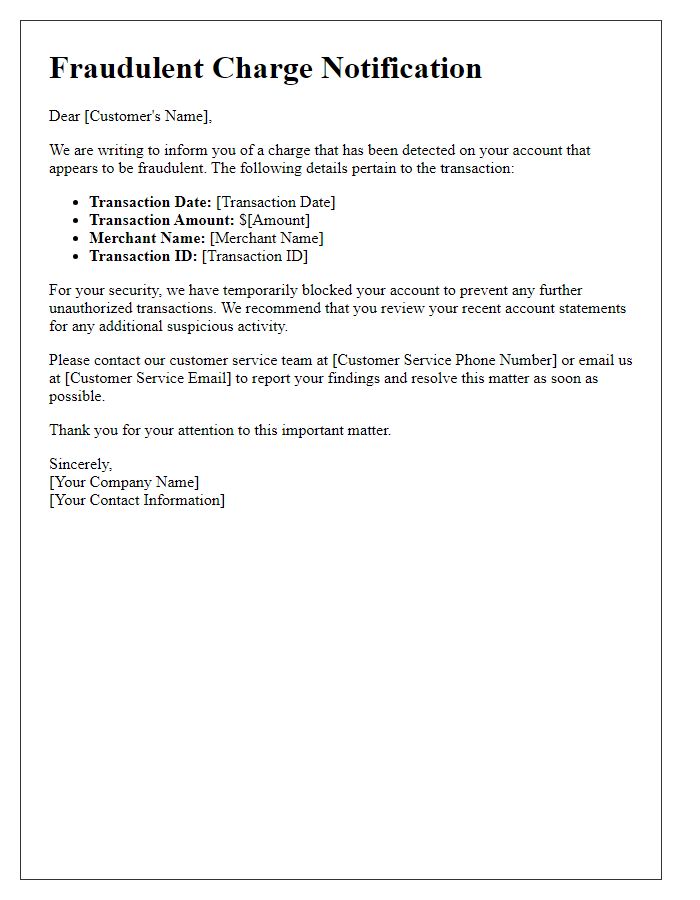

Unauthorized transactions can have serious implications for financial security. Instances of fraud, such as theft of credit card information or phishing scams, can lead to significant monetary losses. For instance, a transaction of $250 on a stolen debit card originating from an online retailer can leave a victim in distress. Notably, fraudulent activities often occur late at night or during weekends, exploiting the lack of immediate customer service. Consumers are advised to report any suspicious transactions promptly to their bank, typically within 60 days of the incident, to mitigate potential damage. Furthermore, using security measures such as two-factor authentication and monitoring account activity frequently can help prevent unauthorized access and ensure financial safety.

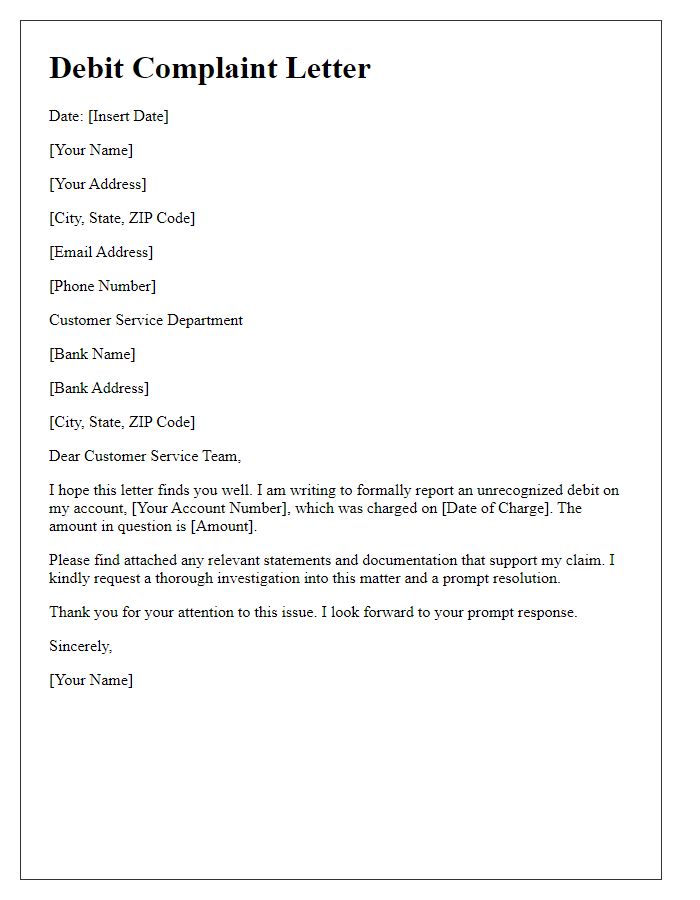

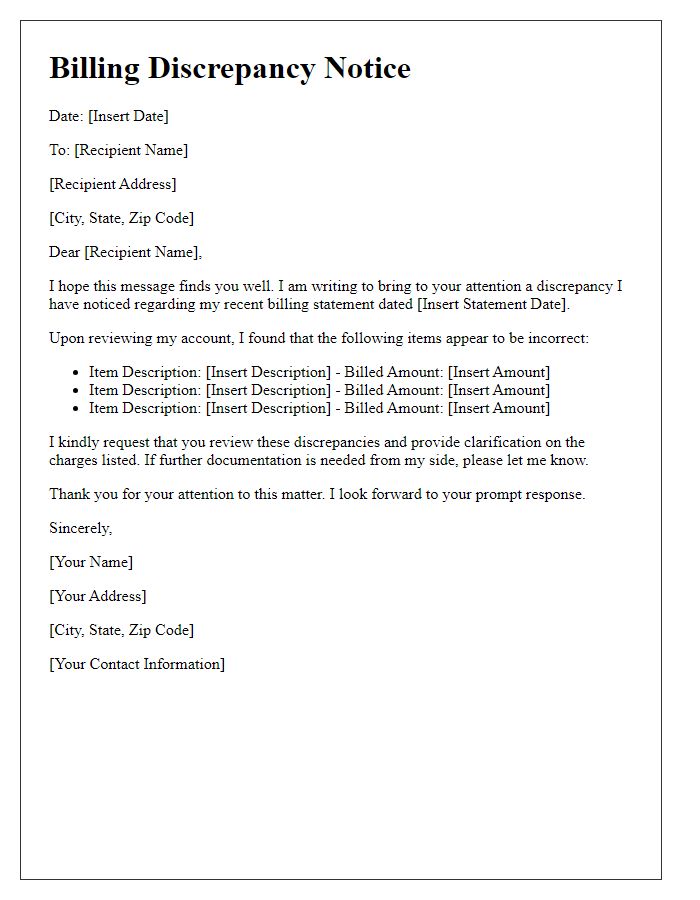

Account information

To address unauthorized transactions effectively, it is crucial to provide complete account information. The account number, typically consisting of 10 to 12 digits, serves as the primary identifier for the financial institution (like JPMorgan Chase or Bank of America). The date of the unauthorized transaction, which could range from recent days to a few weeks earlier, must be noted alongside the amount involved, often varying significantly, sometimes exceeding $100. A brief description of the transaction, including the merchant name and location (for instance, Amazon.com, Seattle), adds clarity. It is essential to include specific instructions or requests, such as a refund request or an account freeze, to ensure prompt action from customer service representatives.

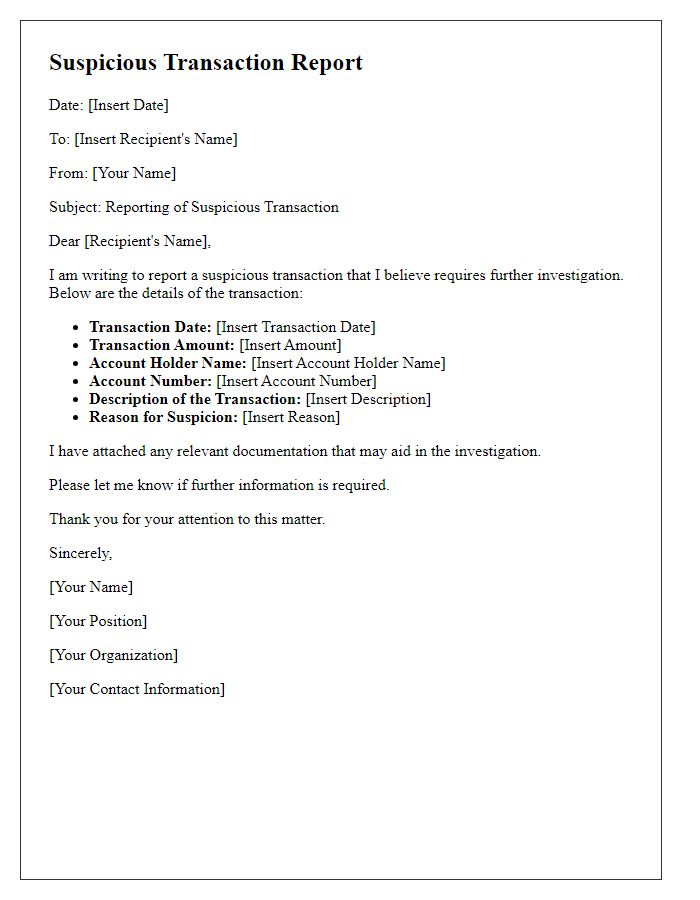

Contact information

Unauthorized transactions can lead to significant financial issues for account holders with banks or online payment platforms. Frequent occurrences of such transactions can indicate potential security breaches, phishing scams, or insufficient account protection measures. Customers seeking to report unauthorized charges should gather relevant details, including transaction amounts, dates, merchants involved, and any prior communications with customer service representatives. Providing clear and organized contact information, such as account numbers, email addresses, and phone numbers, can expedite the resolution process. Quick reaction to unauthorized access ensures timely freezing of accounts to prevent further losses, thereby safeguarding personal finances.

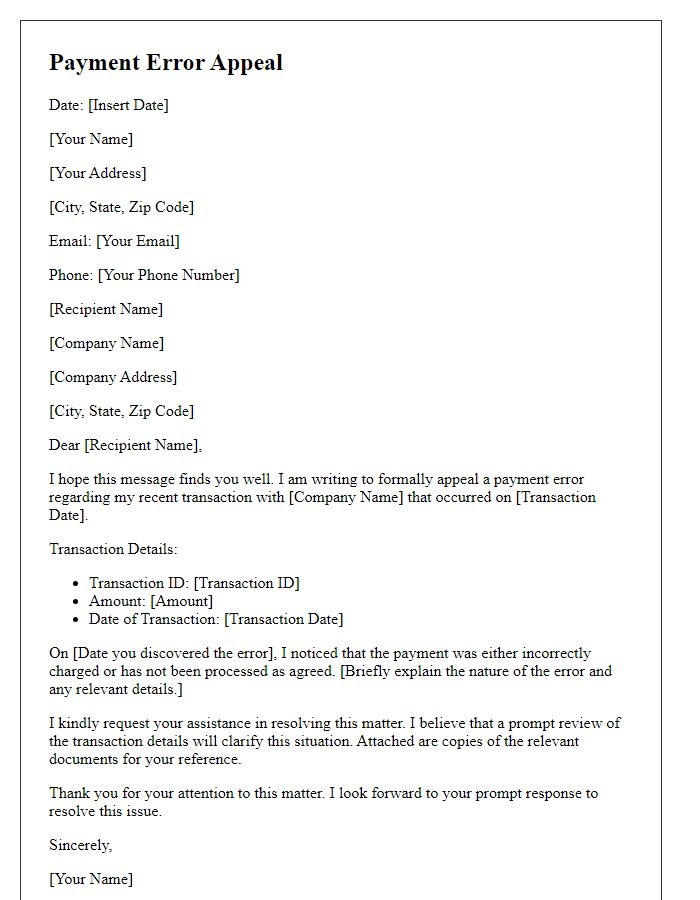

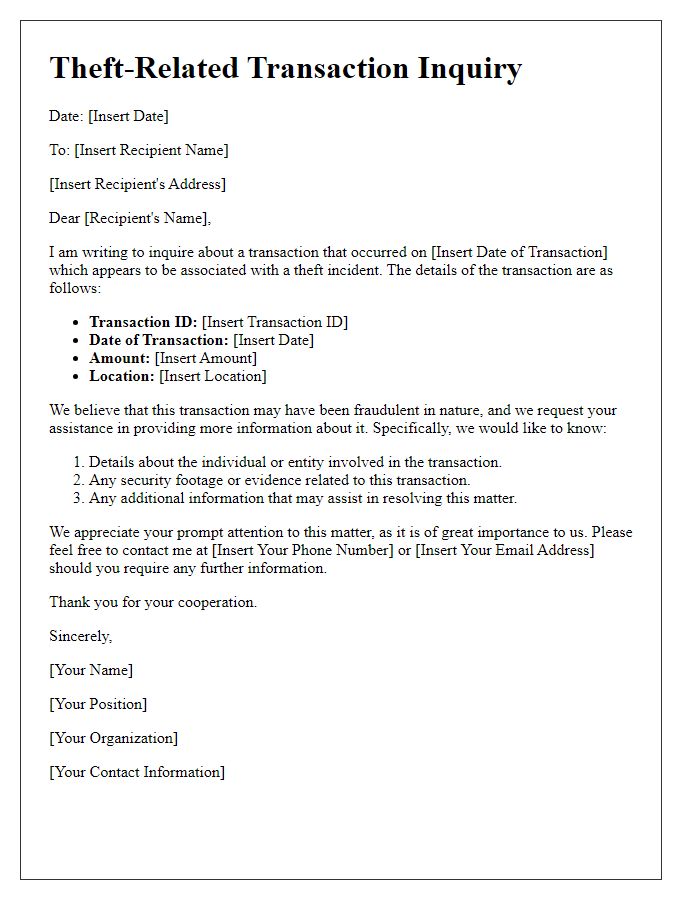

Request for resolution

Consumers often experience unauthorized transactions on financial accounts, leading to significant distress and financial uncertainty. Reports indicate that nearly 31% of individuals encounter issues with fraud involving bank accounts, credit cards, or mobile payment systems each year. Incidents of unauthorized charges can transpire in various places, including online stores or during point-of-sale transactions. Financial institutions typically require detailed information to investigate such claims, including transaction dates, amounts, and merchant names. The resolution process may involve freezing accounts, issuing refunds, and securing personal information to prevent future occurrences. Compliance with regulations such as the Fair Credit Billing Act (FCBA) or the Electronic Fund Transfer Act (EFTA) provides consumers with added protection and recourse in these situations. Prompt reporting of unauthorized transactions is crucial, as resolution timelines can impact potential reimbursement and account security.

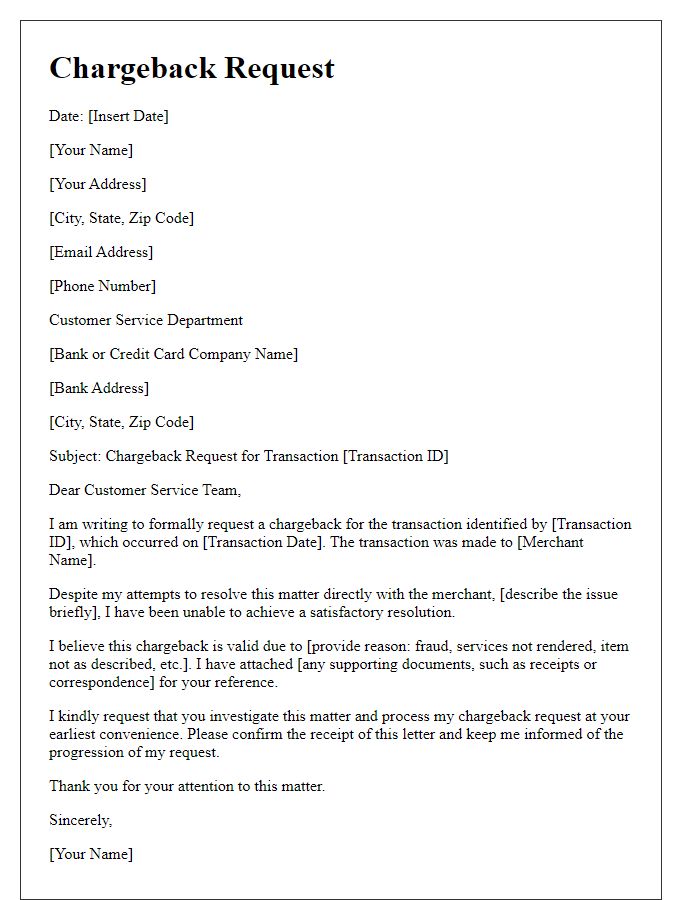

Supporting documentation

Unauthorized transaction complaints often arise from fraudulent activities or technical errors associated with online banking or credit card usage. Essential supporting documentation includes transaction details, such as dates and amounts, the affected bank statement highlighting the disputed charges, and any communication with financial institutions regarding the incident. Additionally, a police report documenting identity theft can bolster claims, while screenshots of online accounts may show discrepancies. Providing an account verification document can ensure the legitimacy of the complaint. Each piece of evidence reinforces the need for an investigation and possible reimbursement.

Comments