Are you tired of chasing down payments and dealing with the stress of overdue invoices? Understanding the right way to communicate your payment terms can make a world of difference in maintaining healthy financial relationships. In this article, we'll explore effective letter templates designed to encourage compliance with payment expectations while keeping the conversation friendly and professional. Ready to streamline your invoicing process? Let's dive in!

Clear and Concise Language

Compliance with payment terms is crucial for maintaining business relationships and ensuring cash flow stability. Invoices, typically issued in a specified billing cycle (e.g., monthly), outline the payment amount due, payment methods accepted, and the deadline for payment, often set at 30 days from the invoice date. Failure to meet these payment deadlines can result in late fees, which may range from 1.5% to 3% of the outstanding amount each month. Additionally, persistent non-compliance can lead to strained relationships with suppliers or service providers. Clear communication regarding payment terms fosters transparency and encourages timely payments, thus securing the financial health of both parties involved.

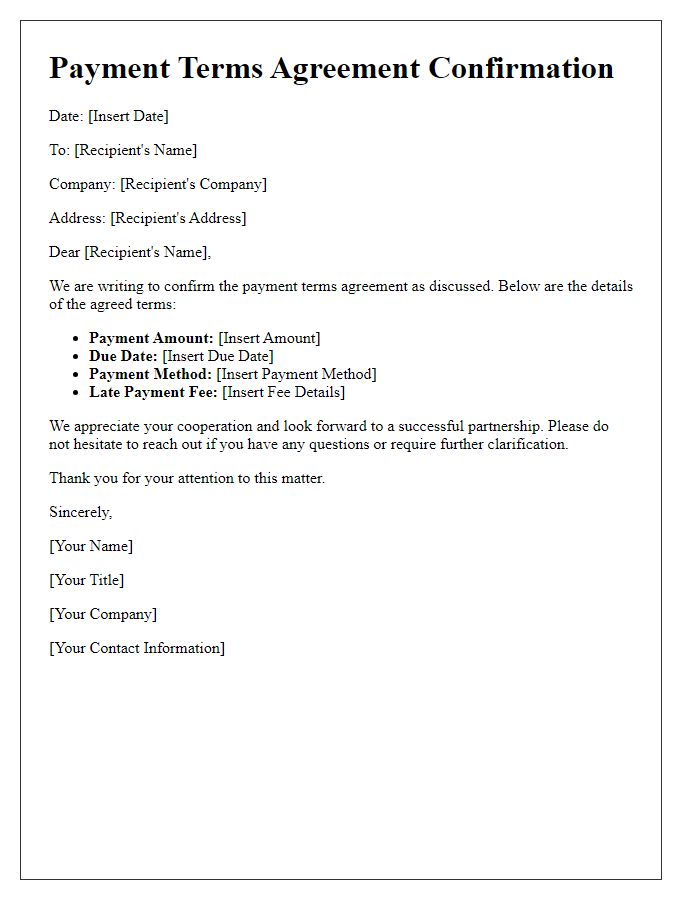

Precise Payment Details

Precise payment details are essential for maintaining positive relationships in business transactions. Clear specifications of required amounts, due dates, and acceptable payment methods streamline financial processes. For instance, invoices should clearly display total amounts in currency format, ensuring accuracy (e.g., USD 1,500.00). The due date (e.g., September 30, 2023) should be prominently noted to prevent late payments. Additionally, offering various payment methods, including bank transfers, credit cards, or digital wallets (such as PayPal), facilitates convenience for clients. Establishing these precise payment details helps minimize disputes, enhances cash flow management, and fosters trust in business relationships.

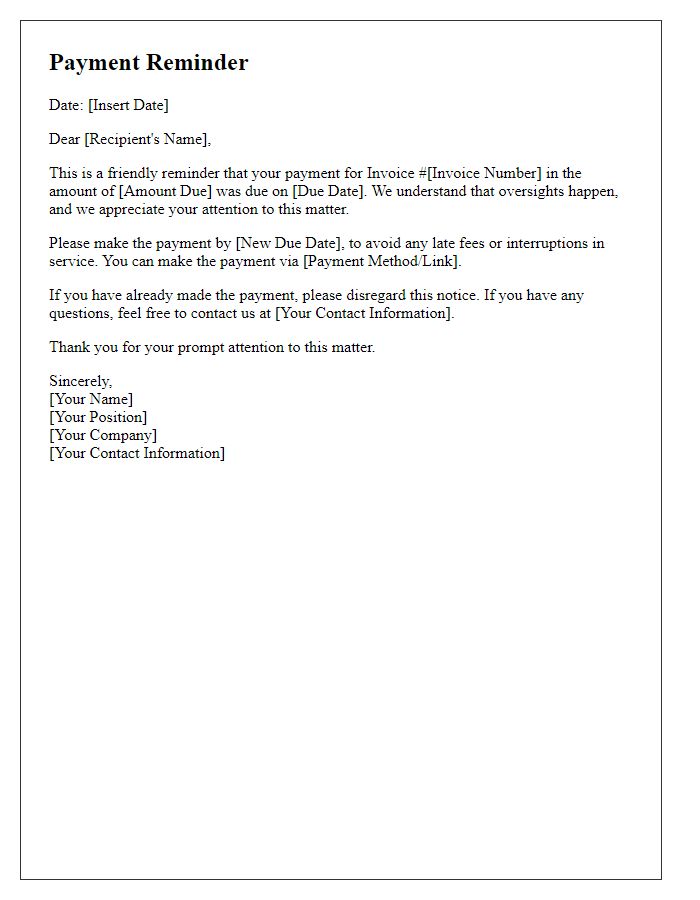

Deadline Specification

A clear payment deadline is crucial for maintaining smooth business operations, particularly for service contracts like those in the construction industry. For instance, invoices are often issued upon project milestone completion, with standard payment terms set at 30 days. Clients located in metropolitan areas like New York City face strict compliance deadlines, typically governed by local regulations that ensure prompt payment to contractors. Missing these deadlines can result in late fees, ranging from 1% to 5% of the total invoice amount per month, depending on the agreed-upon terms. This leads to potential cash flow issues for small businesses, highlighting the importance of adherence to specified payment deadlines to ensure ongoing services and contractor relationships.

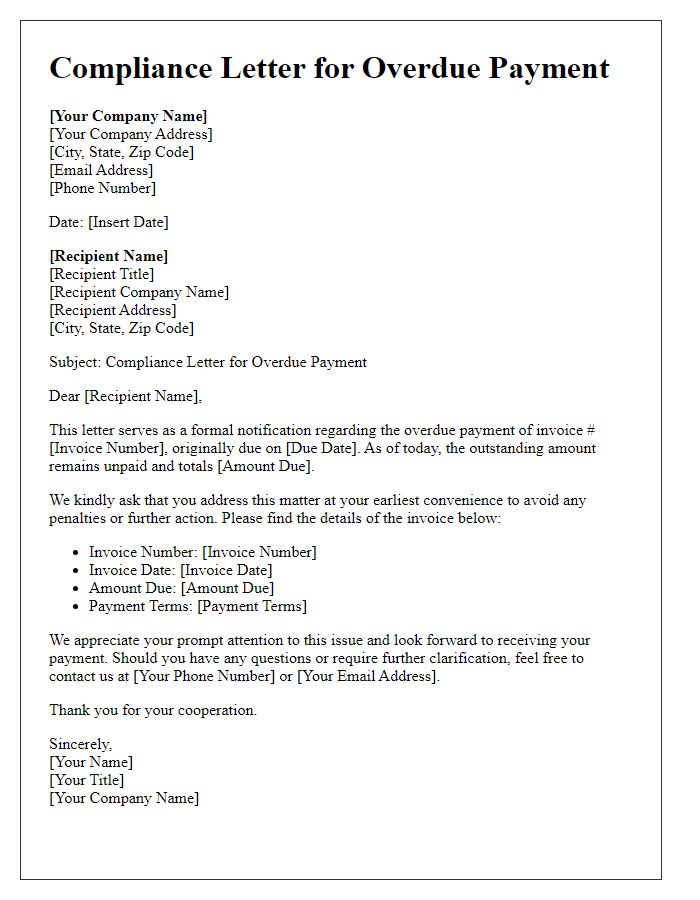

Consequences of Non-compliance

Non-compliance with payment terms can lead to severe repercussions for businesses, including financial penalties. A late payment might incur interest rates, which can range from 1% to 5% per month, depending on the agreement. Additionally, businesses may face legal action or formal collection processes initiated by creditors, escalating costs significantly. Repeated failures in meeting payment deadlines can damage business relationships, resulting in lost trust and future contract opportunities with partners such as suppliers and vendors. In financial reporting, unpaid invoices may adversely affect cash flow projections, leading to potential bankruptcy risks for small and medium-sized enterprises. Furthermore, non-compliance may also lead to a negative impact on credit ratings, hindering future financing options or causing loan applications to be denied by institutions like banks.

Contact Information for Queries

Businesses must maintain clear contact information for queries related to payment terms to ensure compliance and effective communication. Designated points of contact, such as accounts receivable managers or financial officers, should provide updated email addresses and telephone numbers for prompt inquiries. Payment terms, typically outlined in contracts, may include specifics like due dates (commonly 30 or 60 days from invoice date), penalties for late payments, and accepted payment methods, including credit cards, bank transfers, and checks. Clear documentation and accessible contacts streamline resolution processes, preventing misunderstandings and fostering positive vendor relationships.

Comments