Are you looking to boost your credit score without taking on more debt? Adding your rent payments to your credit history could be the perfect solution! It's a simple process that can enhance your credit profile, making you more appealing to lenders. Curious to learn how it works and what steps to take? Read on!

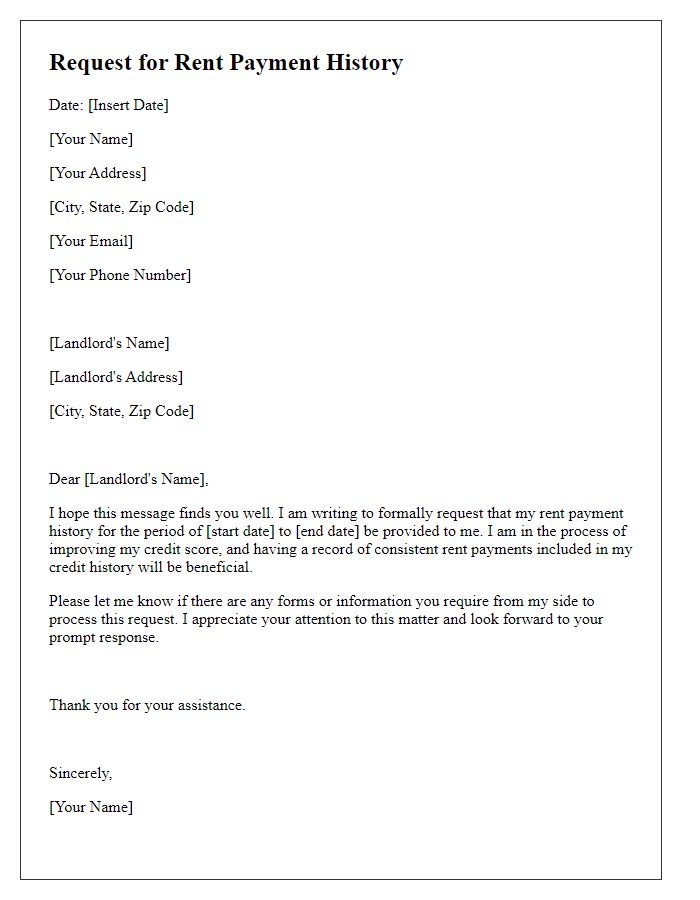

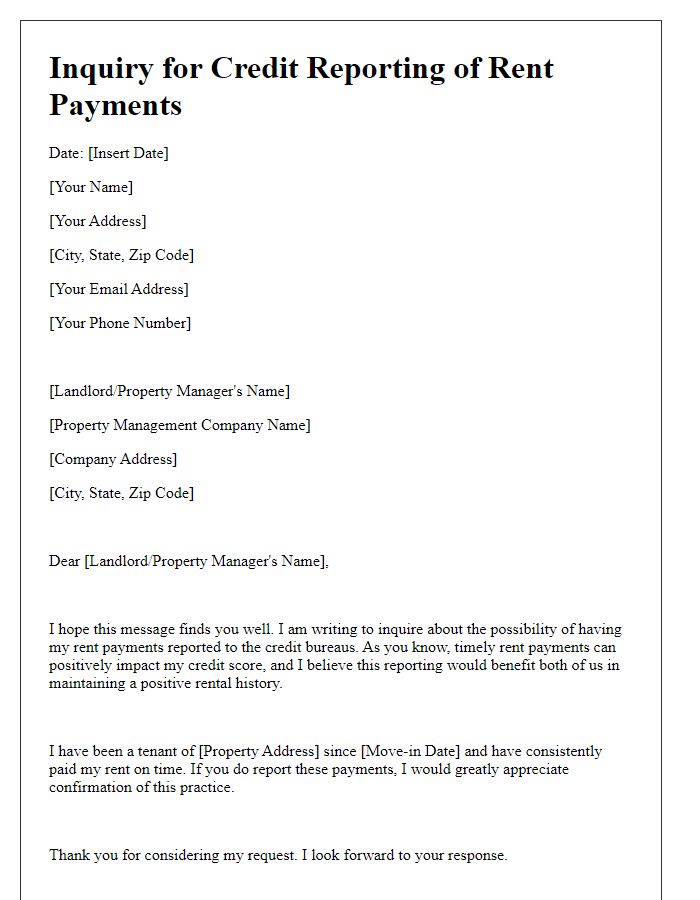

Personal Information and Contact Details

Timely rent payments can positively impact credit scores by adding valuable payment history, particularly for individuals renting residences in urban areas like New York City or Los Angeles. Each month, consistent payments contribute to a credit profile that lenders and financial institutions consider when evaluating loan applications. Reporting platforms, such as RentTrack or Experian RentBureau, facilitate this process, allowing landlords to report payment histories. Individuals often see significant credit score improvements when these payments are accurately documented, potentially opening doors to lower interest rates on mortgages, car loans, and credit cards. Consistent payment patterns, particularly over twelve months, can demonstrate reliability and financial responsibility, crucial factors for major financial decisions.

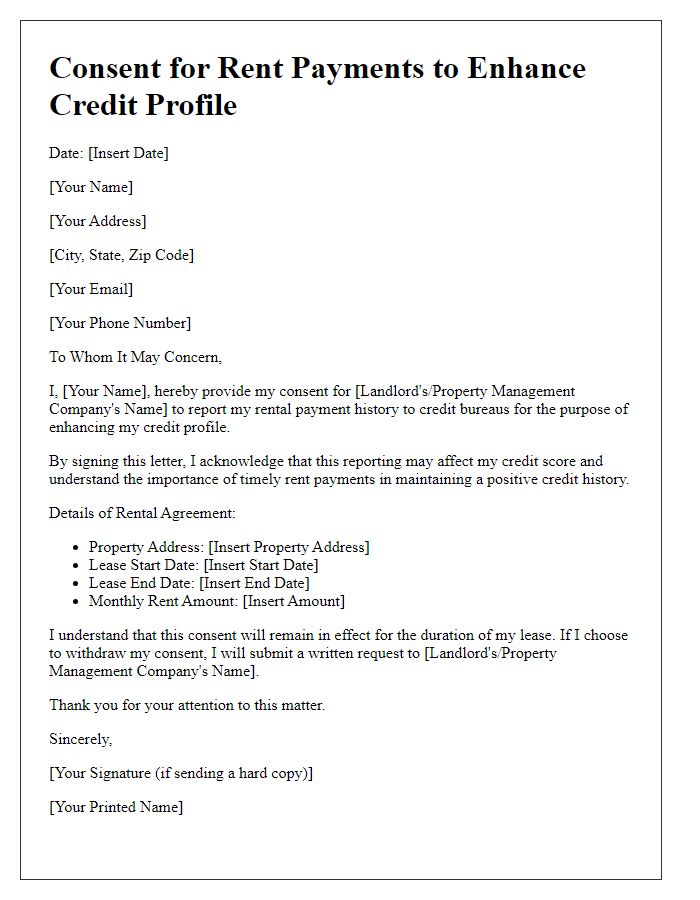

Property and Lease Details

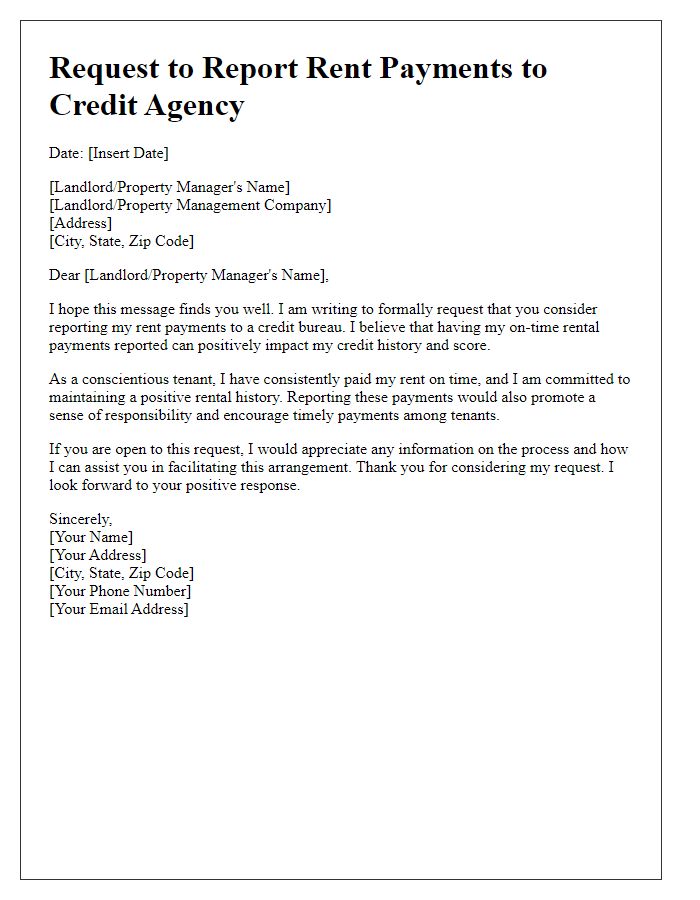

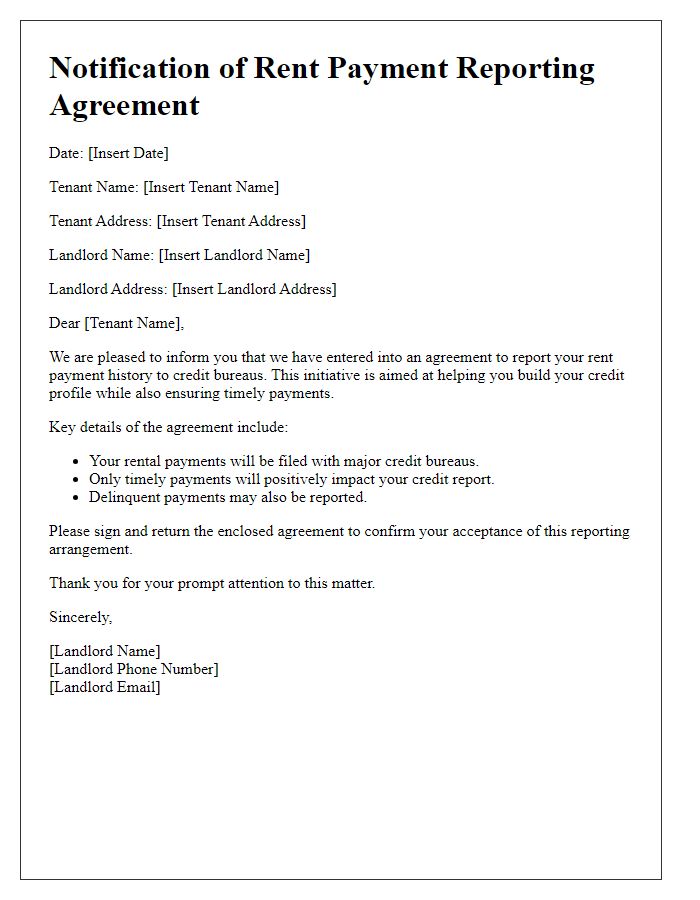

Rent payments can significantly impact credit scores and reports, particularly when managed through a designated property management service or a private landlord. Consistent rent payments can build a positive payment history, especially for residents in urban areas such as New York City or San Francisco where average monthly rents exceed $3,000. Reporting agencies like Experian and TransUnion allow for rent payment tracking, enhancing financial credibility. Lease agreements (typically ranging from 6 months to 2 years) should specify payment due dates, ensuring timely submissions. Moreover, digital platforms such as RentTrack offer systematic reporting to credit bureaus, helping tenants increase their credit score through regular on-time payments.

Landlord's Contact Information

Reliable rent payments can enhance a tenant's credit profile, directly impacting credit scores calculated by agencies such as FICO or VantageScore. A landlord's contact information, specifically their name, address, and phone number, plays a crucial role in facilitating this process. Accurate documentation allows credit reporting agencies to verify payment history efficiently. Timely updates on rental payments (usually reported monthly) can improve creditworthiness, especially for individuals with limited credit histories. Including detailed rent payment records, such as amounts, payment dates, and lease terms, further supports the accuracy of reported information, fostering a positive credit standing.

Explanation of Request and Benefits

Rent payments serve as a significant financial obligation for many individuals, often constituting a large portion of monthly expenses. Incorporating timely rent payments into credit reports can enhance credit scores, provided by credit bureaus such as Experian, Equifax, and TransUnion. Many renters, especially in high-cost urban areas like San Francisco or New York City, face challenges in building credit history since they may lack access to traditional credit products. Additionally, reporting successful payment history can reflect responsible financial behavior, potentially leading to increased access to loans, credit cards, and improved interest rates over time. The inclusion of rent payments might foster greater financial empowerment for renters across the United States, particularly those without prior credit history.

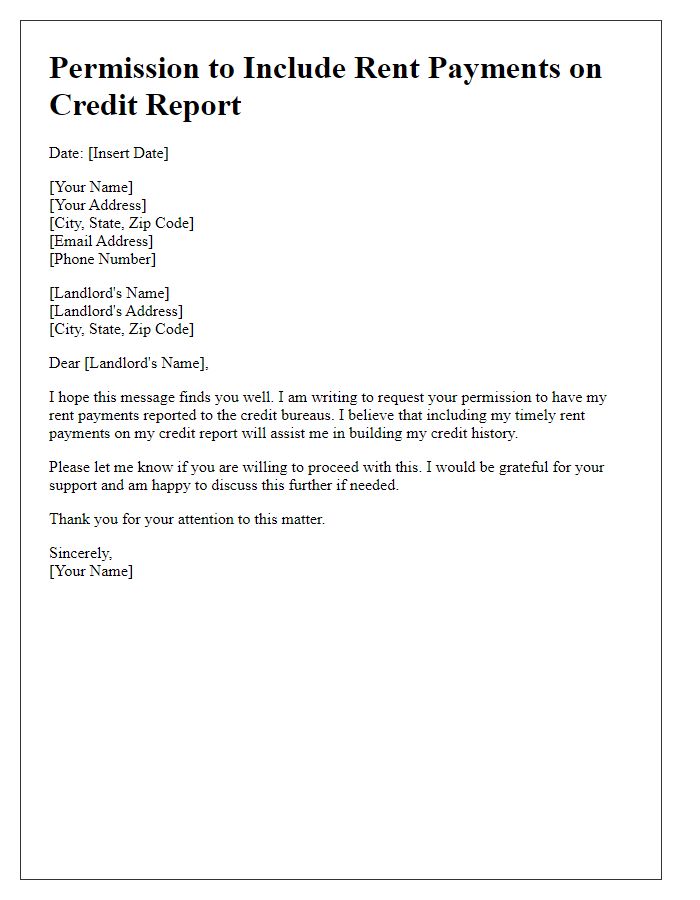

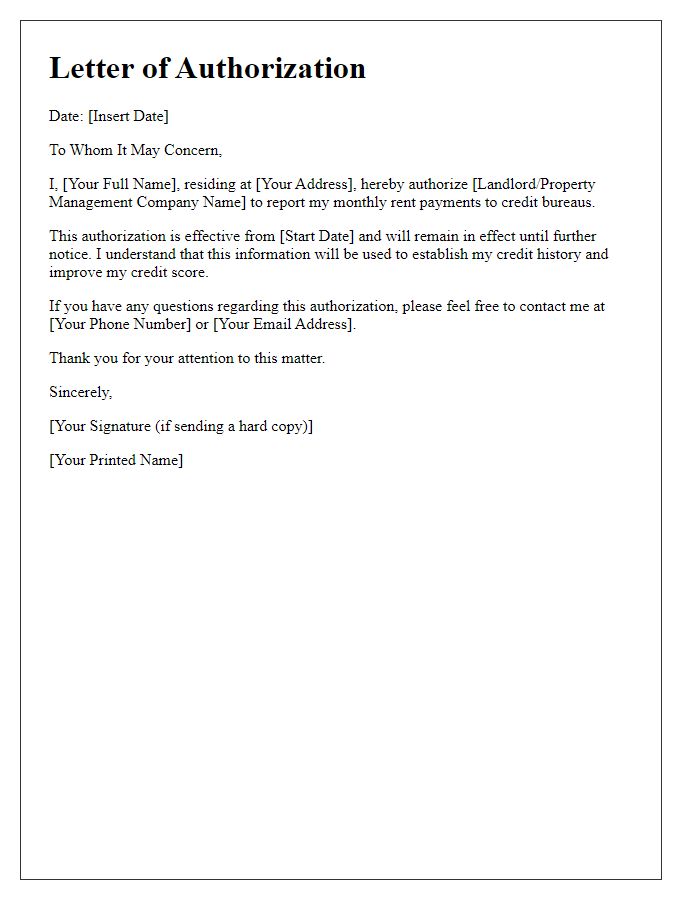

Authorization and Signature

Rent payments, particularly for residential properties like apartments or houses, can significantly influence credit scores when reported to credit bureaus. Some landlords or property management companies may offer to report regular payments to major credit agencies like Experian, Equifax, or TransUnion. A rent payment history of on-time payments can strengthen a credit profile, potentially improving the credit score, especially for individuals with limited credit history. Ensuring to follow a specific authorization process, including providing a signature, is crucial for allowing this reporting. This typically involves consent forms that outline terms and conditions, allowing the landlord to share payment information. Regular on-time payments, often on the first of each month, can thus enhance creditworthiness over time, impacting future borrowing capabilities.

Letter Template For Adding Rent Payments To Credit Samples

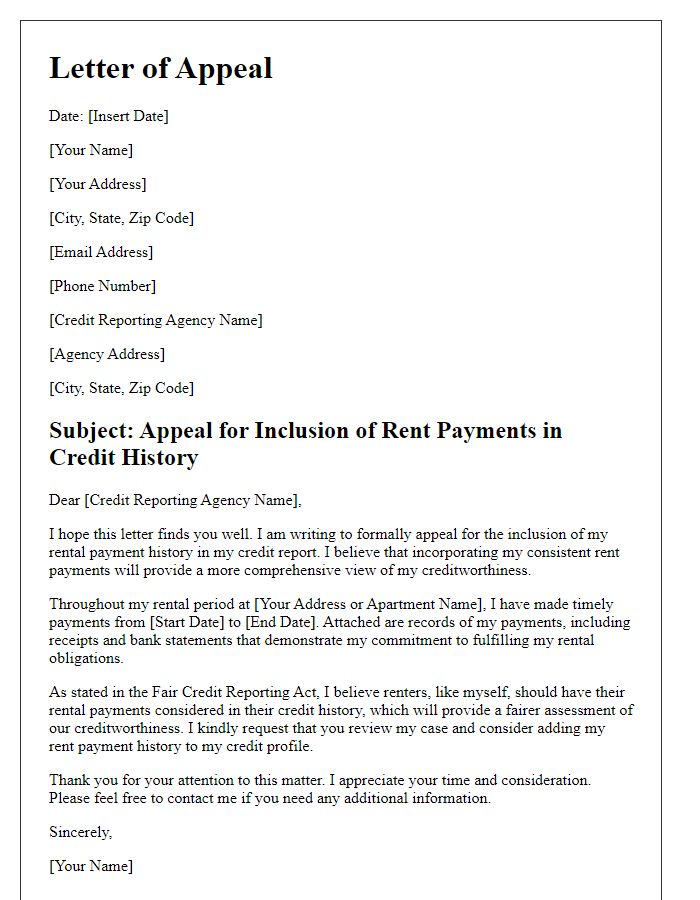

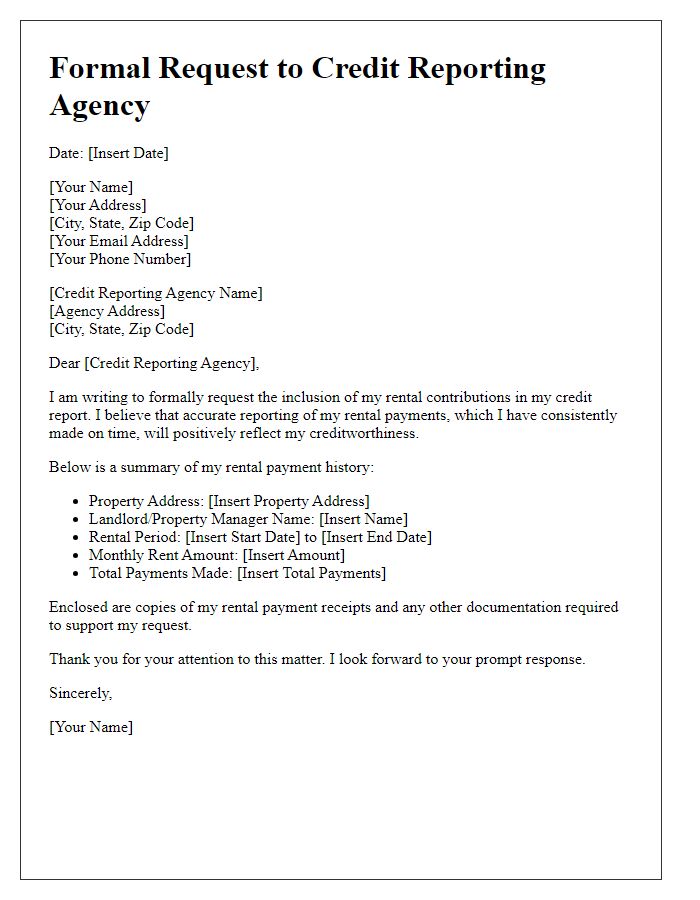

Letter template of Request for Rent Payment History to be Added to Credit

Comments