Are you considering entering into a joint venture, but unsure where to start? Crafting a clear and effective letter for a joint venture agreement is crucial to establish mutual understanding and collaborative goals. This template will guide you through the essential elements, ensuring you cover everything from profit-sharing to responsibility distribution. So, let's dive in and explore how to create a compelling joint venture letter that sets the stage for success!

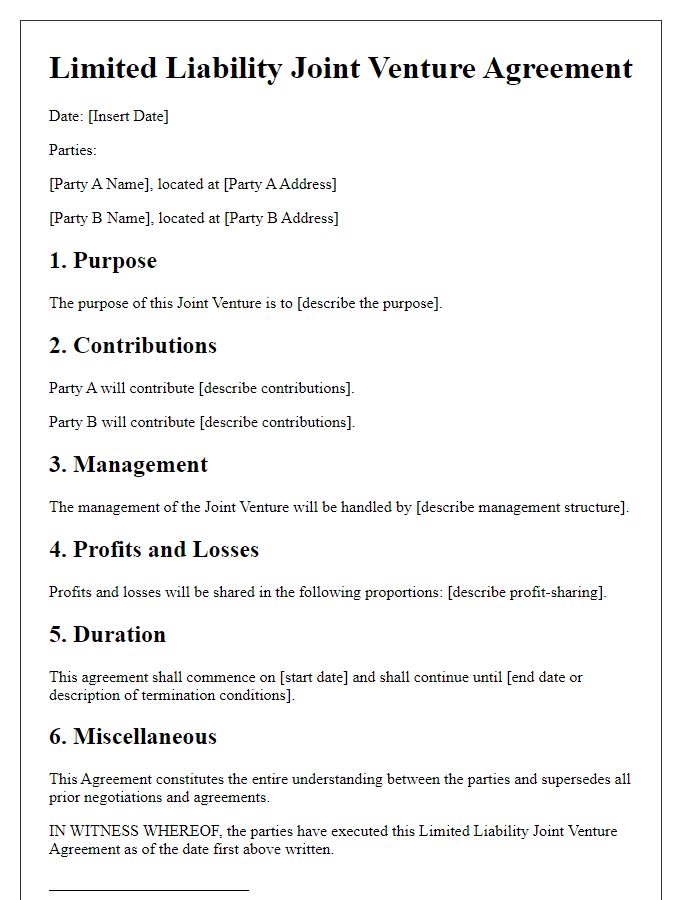

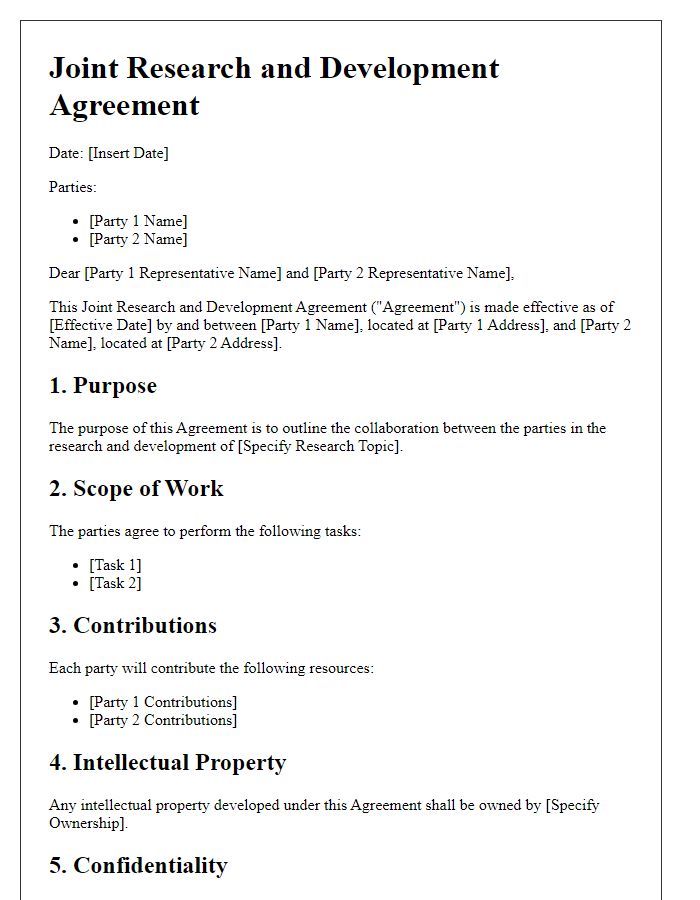

Purpose and Objectives

A joint venture agreement serves to formalize collaboration between two or more entities, typically aimed at pursuing mutual business goals. This partnership, often structured as a separate legal entity or a contractual arrangement, enables the involved parties to pool resources, share risks, and capitalize on each other's strengths. Objectives may include developing new products, entering new markets, or enhancing operational efficiencies. Such agreements often delineate contributions from each party, governance structures, profit-sharing mechanisms, and exit strategies to ensure clarity and mutual benefit. Ensuring alignment on purpose and objectives is crucial for the joint venture's long-term success and sustainability.

Roles and Responsibilities

Joint venture agreements define the specific roles and responsibilities of each partner in a collaborative project. Clear delineation of functions ensures efficient workflow and accountability. For instance, Company A may handle marketing and sales, leveraging its established brand presence in the technology space, while Company B manages production and supply chain logistics, utilizing its experience in manufacturing processes. Documenting these roles prevents overlap and miscommunication. Additionally, each partner's financial contributions and profit-sharing ratios should be outlined, specifying monetary expectations and investment percentages, such as Company A's 60% stake and Company B's 40%. Timelines for deliverables, communication protocols, and dispute resolution procedures should also be detailed to foster a transparent and cooperative partnership.

Financial Contributions

A joint venture agreement establishes a collaborative partnership between two or more parties, focusing on a specific business project or venture. Financial contributions from each party play a critical role in the structure of this agreement, detailing the amount each partner will invest in the project. Contributions can include cash investments, assets, or resources essential for project execution. Clear specifications regarding the timing of these financial commitments, such as initial capital contributions and subsequent funding milestones, are crucial. Additionally, outlining the consequences for any failure to meet financial obligations ensures accountability among partners. Furthermore, the agreement should address how profits, losses, and expenses will be allocated based on the respective contributions, fostering transparency. This comprehensive understanding of financial contributions aids in establishing trust and collaboration within the joint venture.

Profit and Loss Sharing

A joint venture agreement for profit and loss sharing establishes the parameters for two or more parties to collaborate on a business project, such as a new restaurant or technology startup. Key elements include the profit-sharing ratio, which could range from 50/50 to another agreed-upon distribution, based on initial contributions or expertise. Each party's responsibilities must be defined, including operational roles and financial investments. The agreement should detail loss-sharing mechanisms, outlining how losses will be allocated if expenses exceed revenues. It is crucial to include terms regarding decision-making authority, duration of the venture, and exit strategies for partners wishing to dissolve the partnership or sell their stake. Legal frameworks governing such agreements often refer to regulations in jurisdictions like Delaware or California, ensuring compliance with local business laws.

Termination and Exit Strategy

A well-defined termination and exit strategy in joint venture agreements ensures a clear process for ending the partnership when necessary, including structured protocols for dissolution. Specific conditions triggering termination may include breaches of contract, failure to meet performance metrics, or shifts in market dynamics. Both parties must agree on asset distribution guidelines (assets may include intellectual property, physical assets, and financial resources) once the joint venture concludes. Legal frameworks governing the termination should comply with local laws and regulations, such as the Uniform Commercial Code in the United States. Clear communication protocols should be established to ensure smooth transitions, including notification periods (often ranging from 30 to 90 days) for all stakeholders involved, thus mitigating potential conflicts and ensuring an orderly exit process.

Comments