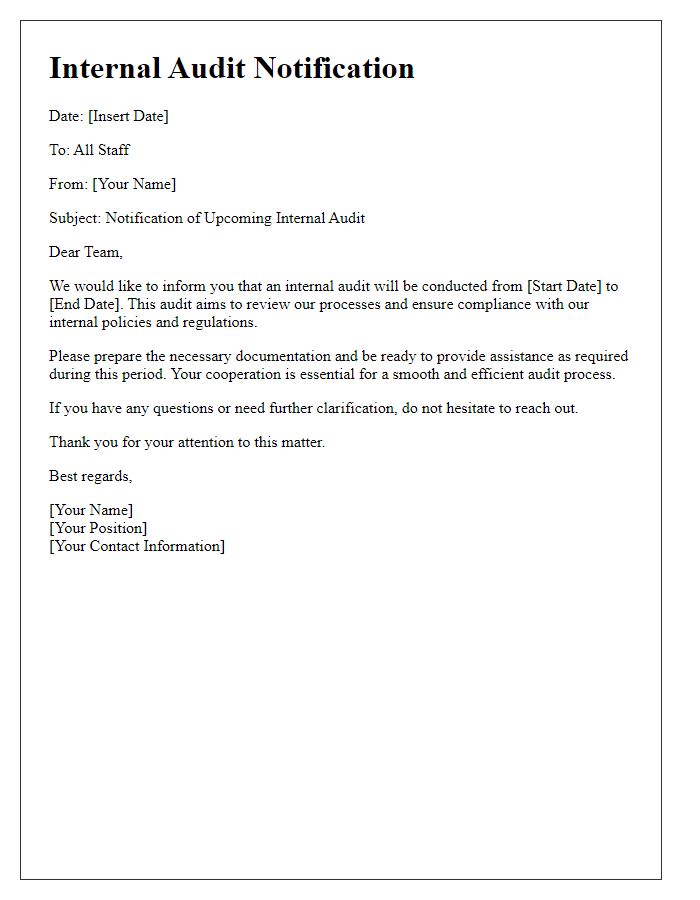

Hello team! As we continuously strive for excellence in our operations, we're excited to announce that our internal audit process is about to kick off. This is an opportunity for us to gain valuable insights that will help improve our efficiency and compliance. We invite you to read more about what to expect during the audit and how you can contribute to making this process a success!

Clear Purpose Statement

Internal audits serve as a crucial mechanism for enhancing operational efficiency within organizations. By systematically evaluating processes, policies, and controls, audits identify potential risks and areas for improvement. Auditors aim to foster accountability and transparency in financial reporting and compliance with regulations, ensuring that organizational practices align with established standards. With an emphasis on continuous improvement, internal audits contribute to the overall health and sustainability of the organization. Results from these assessments inform strategic decision-making, driving better resource allocation and ultimately supporting the organization's mission and objectives.

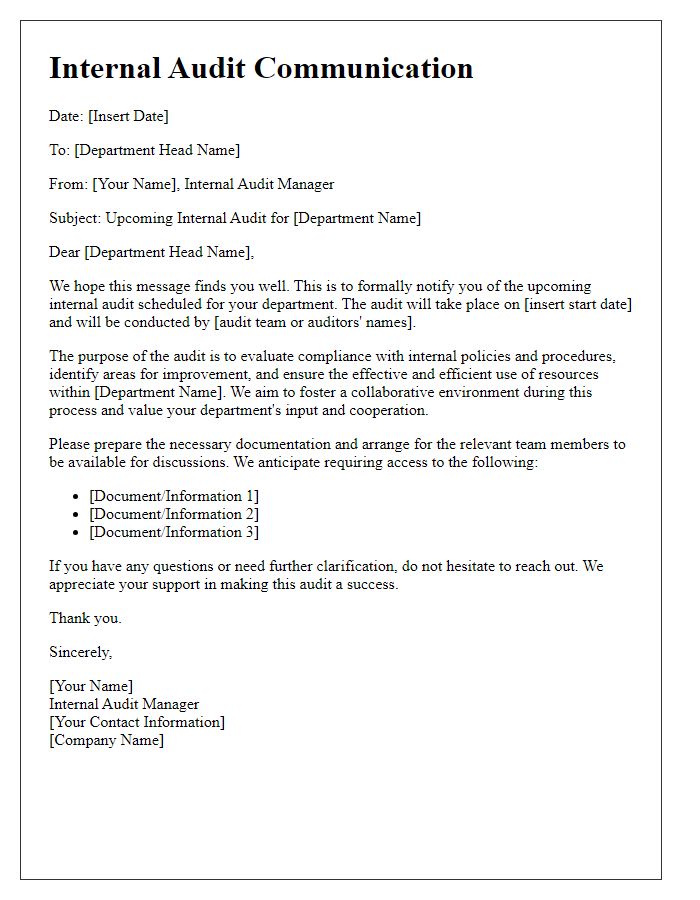

Audit Scope and Objectives

The internal audit process serves as a vital tool for organizations, encompassing a structured evaluation of adherence to policies and effectiveness of operations. Audit scope may include various departments, analyzing financial statements, compliance with regulations, and assessment of risk management strategies. Objectives aim to enhance operational efficiency, identify financial discrepancies (potentially impacting budgetary constraints), and ensure regulatory compliance (such as Sarbanes-Oxley Act for public companies). This comprehensive examination aids in strengthening internal controls and promotes accountability within the organization, fostering a culture of continuous improvement and transparency. Effective internal audits contribute to informed decision-making processes, ultimately driving organizational success.

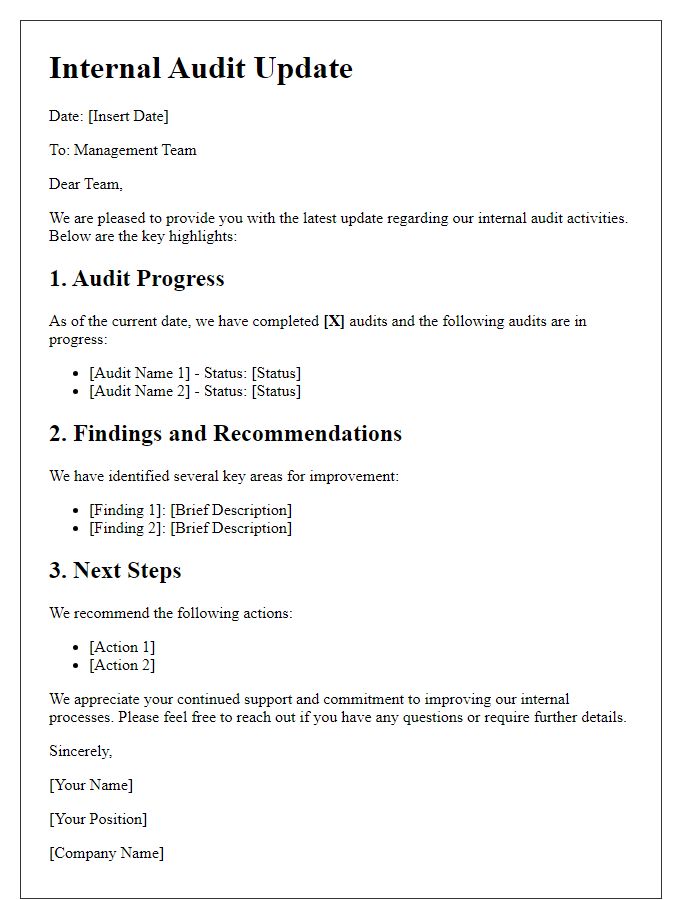

Schedule and Timeline

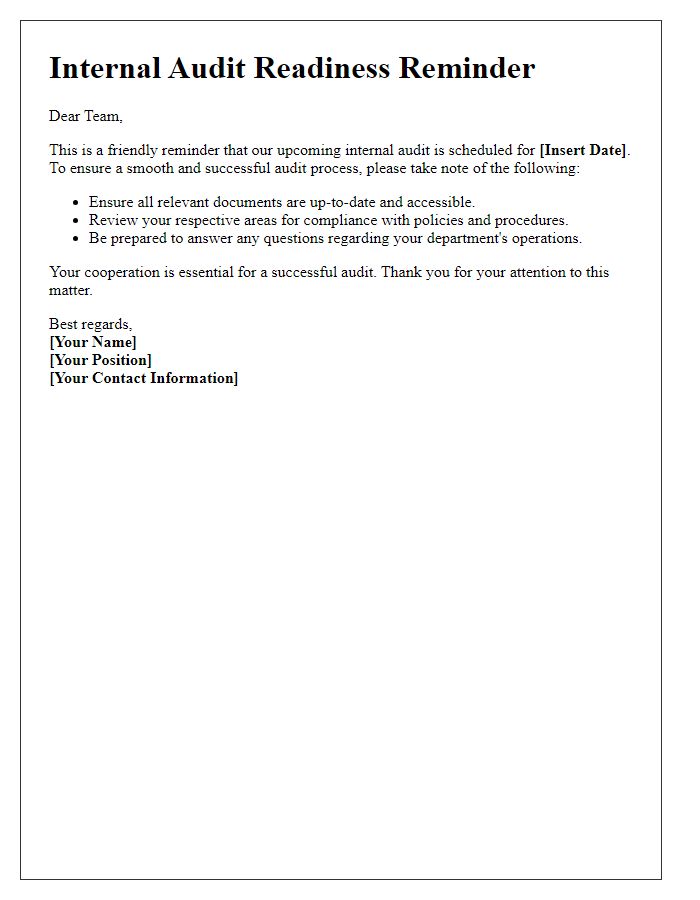

The internal audit process for 2023 commences next month, specifically on March 15, covering all departments within the organization. Auditors will conduct assessments over a period of four weeks, concluding by April 12. This timeline ensures thorough evaluations of compliance and operational efficiency. Key focus areas include financial records, risk management practices, and adherence to regulatory standards, which align with the company's strategic objectives to enhance transparency. Final reports will be distributed to department heads and senior management by April 20, providing insights and actionable recommendations for future improvements. Each department should prepare relevant documentation and be ready for interviews starting from the initial audit date.

Roles and Responsibilities

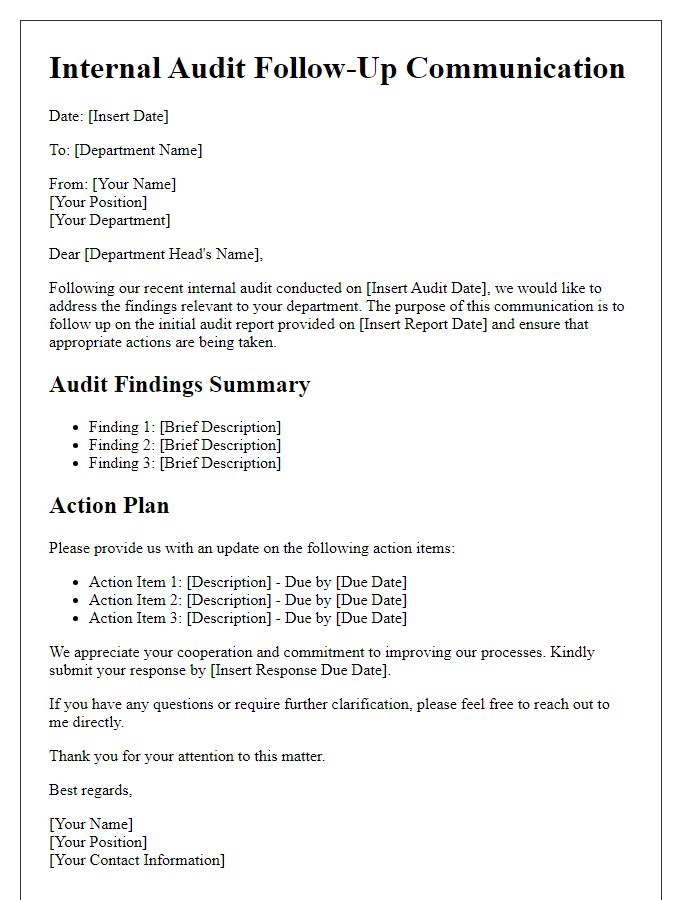

Internal audits play a crucial role in enhancing compliance and operational efficiency within organizations. The audit committee, consisting of board members and senior management, is responsible for establishing the audit framework and ensuring alignment with strategic goals. Auditors, designated professionals with expertise in governance and risk management, are tasked with evaluating internal controls, identifying weaknesses, and recommending improvements. Their duties include conducting compliance assessments, reviewing financial statements, and ensuring adherence to legal requirements such as the Sarbanes-Oxley Act, which mandates accuracy in financial reporting. Key stakeholders, including department heads and staff members, are expected to collaborate by providing necessary documentation and access to relevant systems and processes. The timeline for audits usually spans several weeks, culminating in a comprehensive report outlining findings and actionable recommendations designed to strengthen organizational integrity.

Contact Information for Queries

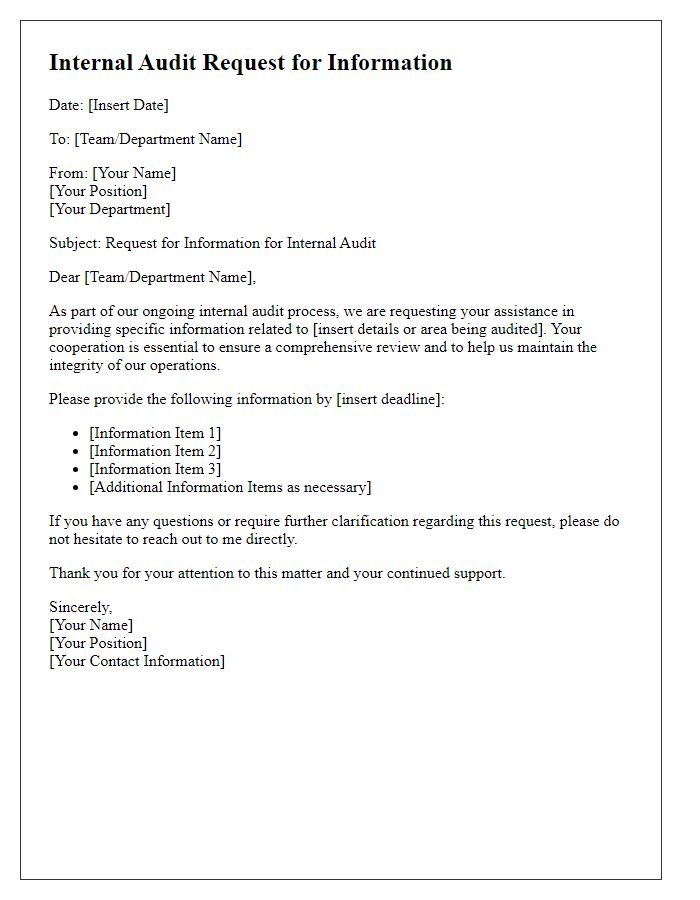

Internal audit announcements provide essential information for ensuring compliance and efficiency within organizations. Clearly outlined contact information allows team members to address queries related to the audit process. Providing specific names (e.g., John Smith, Internal Audit Manager), phone numbers (e.g., +1-555-123-4567), and email addresses (e.g., john.smith@example.com) is crucial for streamlining communication. Establishing a dedicated email line (e.g., auditsupport@example.com) facilitates quick access to support and clarifications. Timely responses and clarifications can drastically improve audit outcomes, enabling smoother operations in accordance with regulatory standards. Regular updates, including specific deadlines and meeting schedules, ensure all employees remain informed and prepared.

Comments