When it comes to understanding your insurance policy, clarity is key. Many people find the language and details of their coverage overwhelming, leaving them confused about what is really included. That's why we've created a comprehensive template to guide you through the important points of your policy, ensuring you're informed and confident in your coverage. So grab a cup of coffee, sit back, and dive into our article for all the insights you need!

Clear Policy Overview

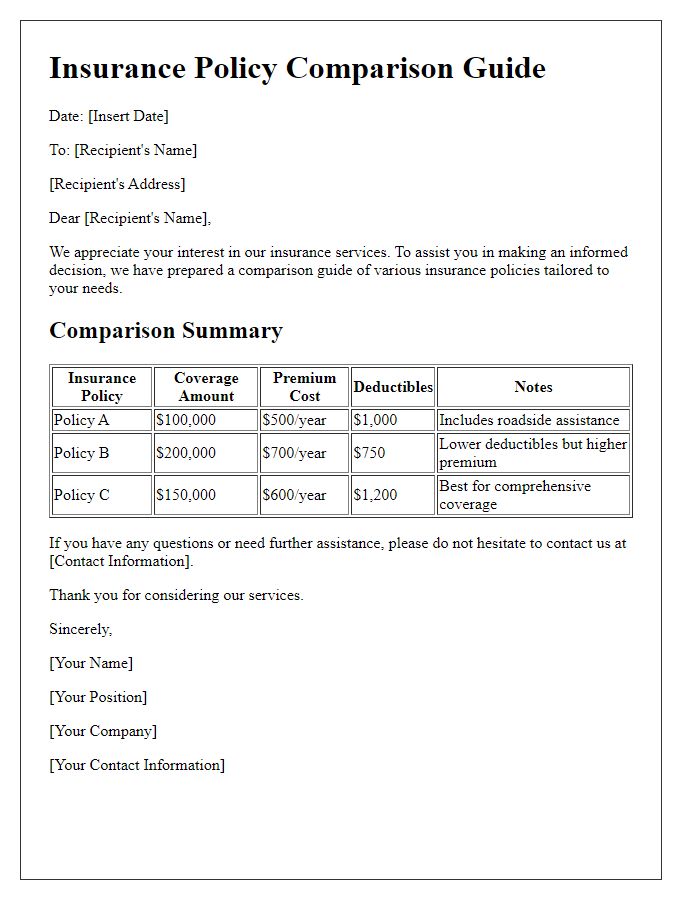

A comprehensive insurance policy overview provides essential insights into coverage terms, exclusions, and premium costs. Insurance policies, including auto, home, and health, often include specific details such as deductibles (the amount paid before coverage kicks in), copayments (fixed amounts paid for services), and coverage limits (maximum payout amounts). Additionally, understanding the policyholder's responsibilities, such as timely premium payments and claim reporting procedures, is crucial. Key events, such as renewals or changes in coverage, often affect the policy's effectiveness, with certain changes requiring formal documentation. Familiarity with policy exclusions, like acts of God or maintenance issues, helps ensure clients are prepared for potential out-of-pocket expenses. An accessible overview aids clients, such as individuals or businesses seeking adequate protection against unforeseen risks, facilitating informed decision-making for their insurance needs.

Key Coverage Details

Insurance policies provide essential coverage details to protect individuals and businesses against various risks. For example, homeowners' insurance typically covers property damage caused by events such as fire, theft, or natural disasters like hurricanes. This often includes liability coverage to protect against lawsuits resulting from accidents on the property. Auto insurance policies generally offer liability coverage for bodily injury and property damage, along with collision and comprehensive options to protect against theft, vandalism, and accidents. Health insurance policies outline coverage for medical expenses, including hospital stays, routine check-ups, and prescription medications, subject to deductibles and co-pays. Detailed coverage limits, exclusions, and conditions are crucial for policyholders to understand the extent of their protection and assess their specific needs based on individual circumstances, such as geographic location and lifestyle choices.

Premium and Payment Information

In the insurance policy overview, premium details such as monthly, quarterly, and annual payment options are essential for consumer understanding. For example, the total annual premium may be $1,200, resulting in monthly payments of $100. Payment methods include automatic bank drafts and credit card transactions. Important deadlines occur on the first day of each billing cycle. Late payment penalties may accrue after a 30-day grace period, potentially increasing the total cost of coverage. Additionally, customers should be aware of how changes in policy terms can affect premium rates, and specific discounts could apply, such as multi-policy or safe driving discounts, which may reduce the annual premium by up to 15%.

Policy Terms and Conditions

Insurance policies outline terms and conditions that govern agreements between coverage providers and policyholders. These terms define the scope of coverage, including exclusions and limits on claims, ensuring that both parties understand the expectations and responsibilities. Key components such as premium payments, deductible amounts, and copayment structures play critical roles in determining financial obligations. Specific events like accidents, natural disasters, or theft invoke different conditions under which claims are submitted and processed, further emphasizing the importance of understanding policy language. Additionally, regulations set by state entities can influence the enforceability of certain clauses, making it essential for policyholders to familiarize themselves with legal implications. Overall, these terms provide a framework for coherent interactions and stress the importance of reading and comprehending the fine print in insurance contracts.

Contact and Support Information

Insurance policy overviews often include detailed contact and support information essential for customer assistance. These documents typically feature sections outlining the names of representatives or departments responsible for inquiries, such as the Claims Department or Customer Service. Providing phone numbers (including toll-free options) and email addresses ensures policyholders have direct access to support. Additionally, office hours (for example, weekdays from 8 AM to 6 PM) are included to specify when assistance is available. Some companies offer online chat options or customer portals to enhance connectivity. Important links to FAQ sections or knowledge bases on the company's website provide further resources for policy questions or issues.

Comments