Are you looking to streamline the process of issuing credit contracts? Writing a clear and effective letter can make all the difference in ensuring both parties are on the same page. In this article, we'll provide you with a detailed template that simplifies the credit issuance process while also highlighting key components to include for clarity and professionalism. So, let's dive in and explore the steps you need to take for a seamless credit contract issuance!

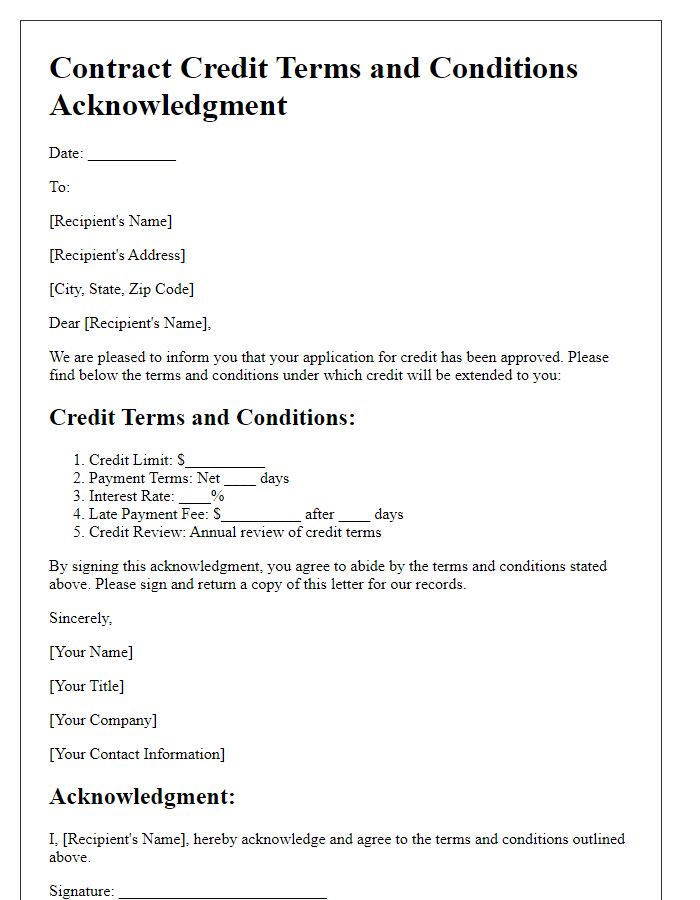

Credit Terms and Conditions

Credit issuance involves a range of specific terms and conditions that must be clearly understood. Credit limits establish the maximum amount lent, usually assessed based on the creditworthiness of the borrower (e.g., credit score, income verification). Interest rates, expressed as an annual percentage rate (APR), outline the cost of borrowing, which can vary from as low as 3% to as high as 30% depending on market conditions and individual risk factors. Payment schedules detail the frequency and amounts due, often occurring monthly or quarterly, with penalties outlined for late payments (e.g., fees, increased interest rates). Collateral requirements may apply, particularly in secured loans, where assets (property, vehicles) serve as guarantees against default. Additionally, late fees typically incur after a grace period, usually 15 days post due date, and loan terms can range from a few months to several years based on the type of credit agreement. Understanding these terms is crucial for managing financial obligations effectively.

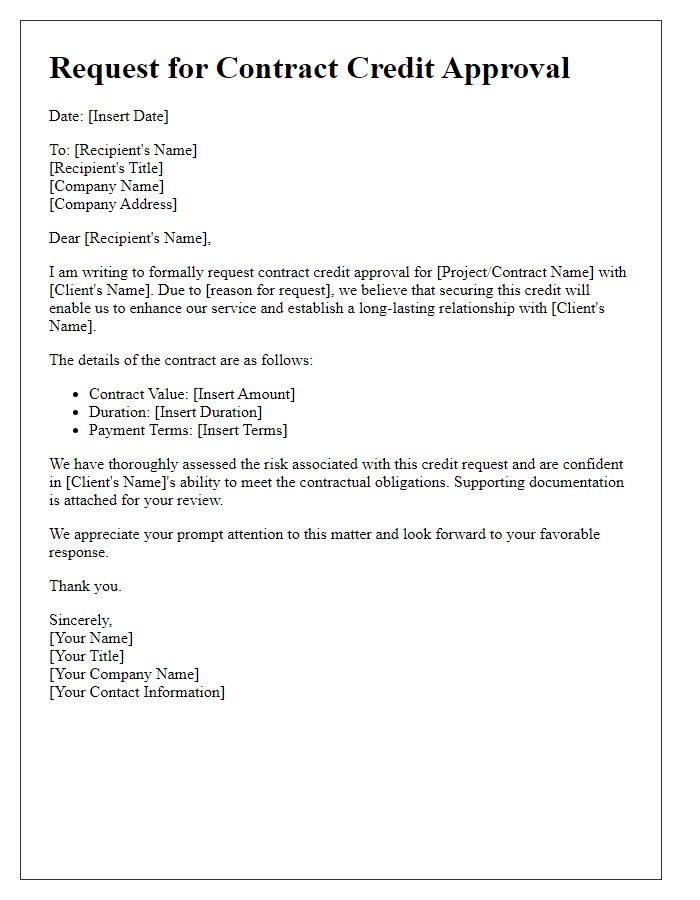

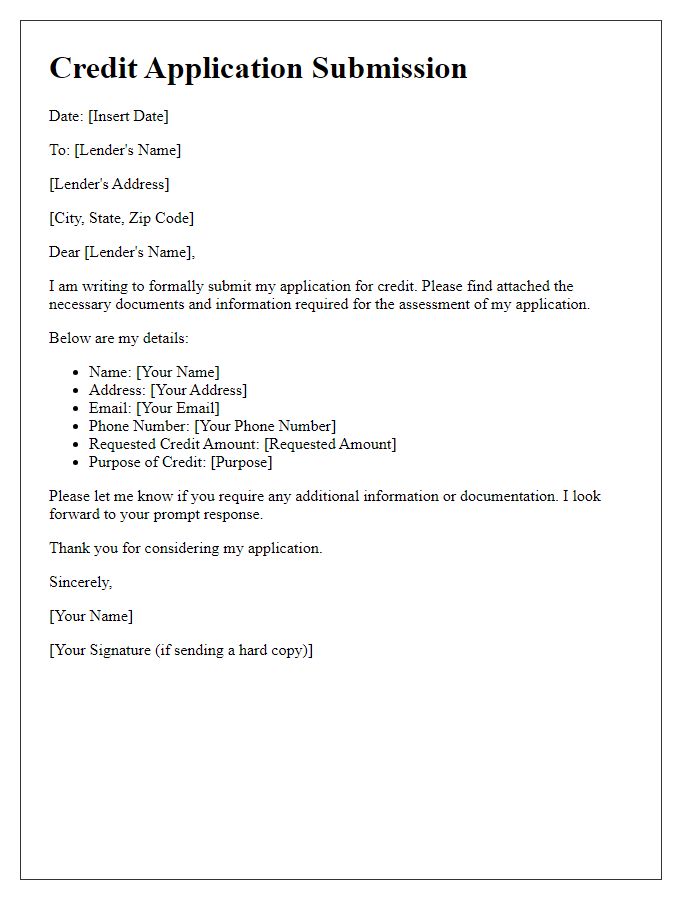

Borrower Information

Borrower information plays a critical role in contract credit issuance, encompassing essential details regarding the individual or entity seeking financing. Key components include the full name of the borrower, their Social Security Number or Tax Identification Number, and current residential or business address, which establishes the borrower's legal identity and jurisdiction. Additionally, the borrower's contact information, including phone number and email address, ensures effective communication throughout the credit process. Financial particulars, such as annual income, employment verification, and any outstanding debts, are crucial for assessing creditworthiness and repayment capacity. The borrower's credit score, typically ranging from 300 to 850, provides insight into their financial history and reliability as a borrower. All these details are vital for lenders to evaluate the risk associated with issuing credit, ensuring secure transactions and compliance with regulatory standards.

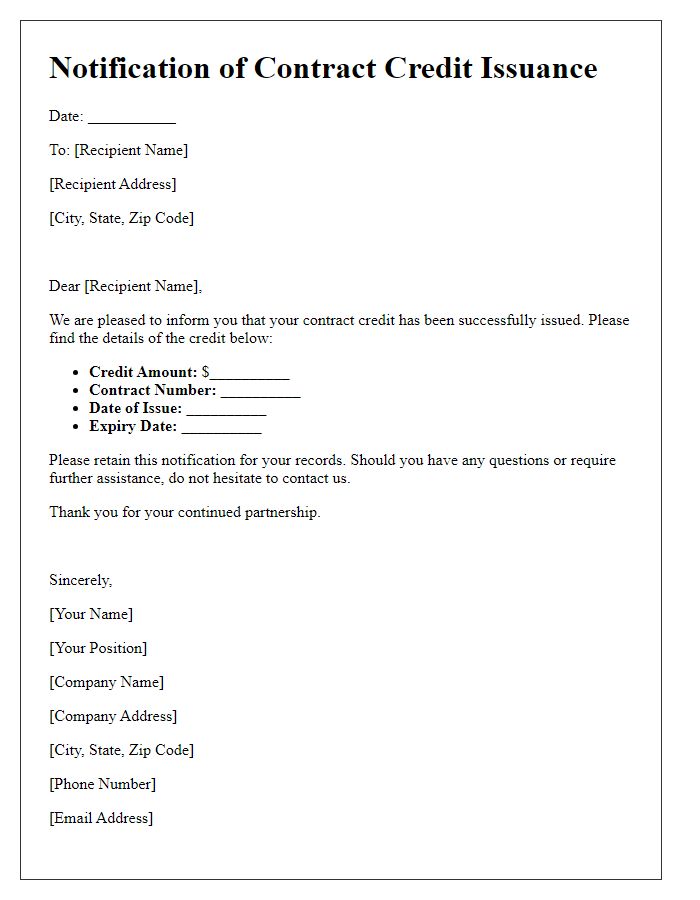

Repayment Schedule

The repayment schedule outlines critical financial obligations for borrowers and lenders engaged in a contractual agreement, such as personal loans or credit lines. This schedule usually specifies payment amounts, interest rates (often expressed as an annual percentage rate, or APR), and due dates over the life of the contract, typically spanning months or years. For instance, a typical repayment plan might include monthly installments due on the first of each month, beginning one month after the loan's issuance. Additionally, the schedule may indicate penalties for late payments, accrued interest calculations, and any grace periods. Clear communication of these terms is essential for maintaining trust between entities like banks, credit unions, or individual lenders and borrowers, ensuring compliance with regulatory standards and fostering financial accountability.

Interest Rates and Fees

Interest rates on contract credit issuance typically vary based on multiple factors such as creditworthiness. Average annual percentage rates (APRs) may range from 5% to 30%, depending on the lender and the borrower's financial profile. Fees associated with contract credit can include origination fees, which often range from 1% to 5% of the loan amount, late payment penalties, and prepayment penalties. Regulatory bodies may impose certain disclosure requirements to ensure transparency. For instance, the Truth in Lending Act (TILA) mandates clear communication about interest rates and fees, helping borrowers understand the total cost of credit over the life of the contract.

Legal Clauses and Obligations

The issuance of credit under this contract shall be governed by the terms set forth herein, including specific legal clauses and obligations binding both parties. The Credit Issuer, hereafter referred to as the Lender, will provide a credit amount up to $100,000 (subject to approval based on applicant's creditworthiness) upon execution of this contract. The Borrower, subsequently, agrees to repay the total amount lent plus interest calculated at an annual rate of 5%, commencing from the date of disbursement. Late payments made by the Borrower, beyond the grace period of 30 days, will incur a penalty fee of 2% for each month of delay. Both parties acknowledge and accept that this contract is subject to the laws of the state of California, specifically under the jurisdiction of the Los Angeles County Court. The Lender reserves the right to demand immediate repayment in full upon default, defined as failure to pay within 60 days of the due date. Furthermore, any amendments to this contract must be documented in writing and signed by both parties, ensuring mutually agreed modifications are enforceable.

Comments