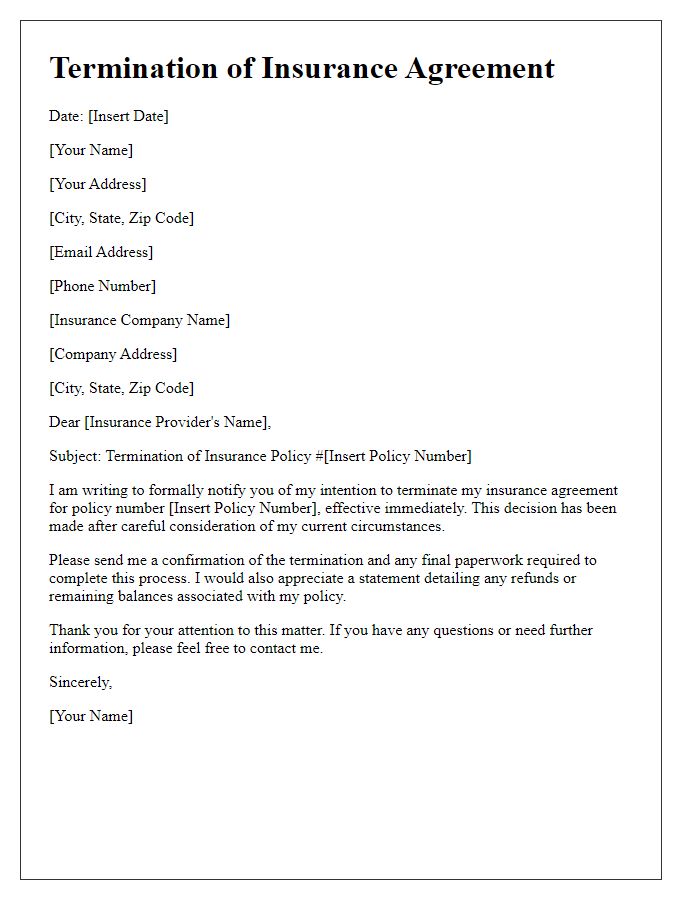

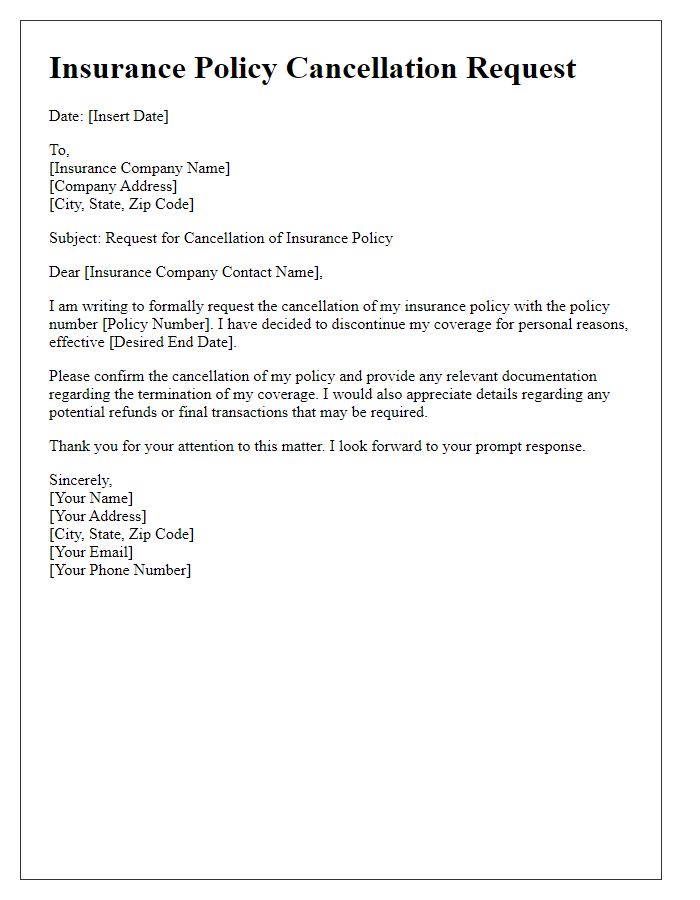

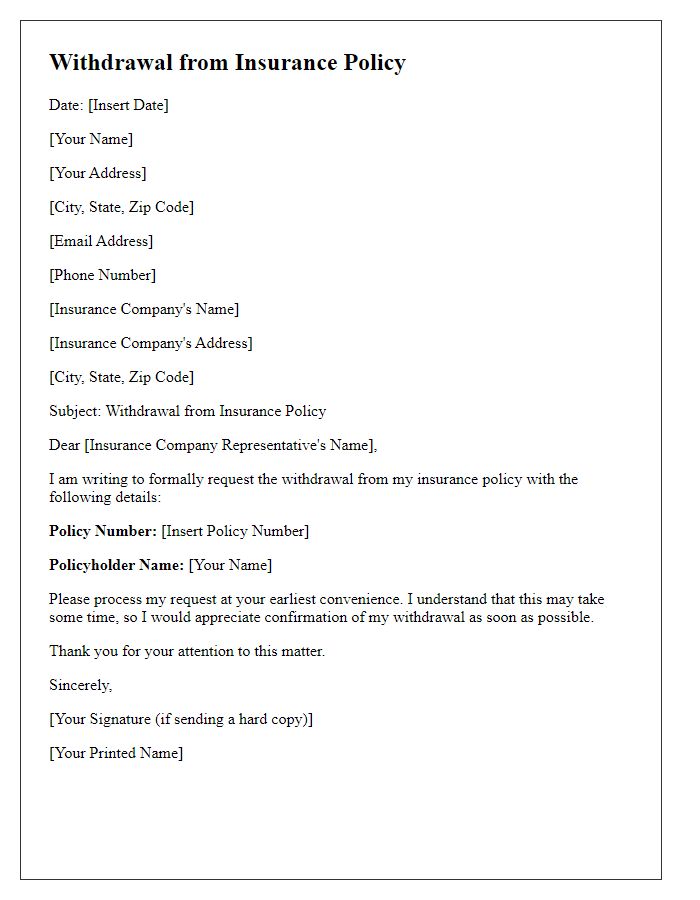

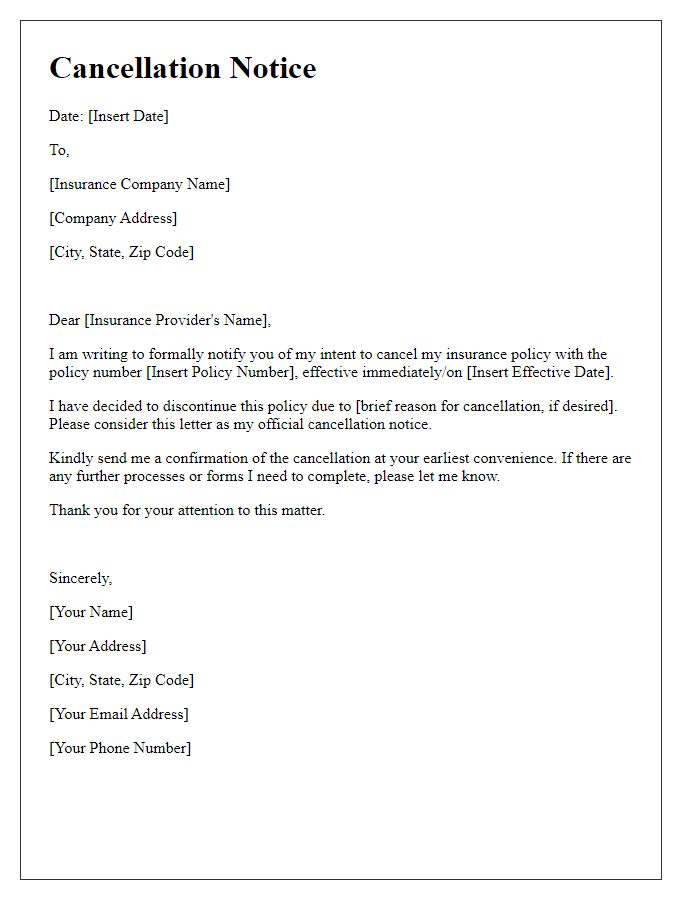

When it comes to managing your insurance, there may come a time when you need to consider terminating a policy. Whether it's due to financial reasons, changes in coverage needs, or simply finding a better option, knowing how to navigate this process is essential. Crafting a clear and concise letter for policy termination can help ensure that everything is handled professionally and without confusion. If you're ready to learn more about how to write an effective termination letter and the key points to include, keep reading!

Policyholder Information

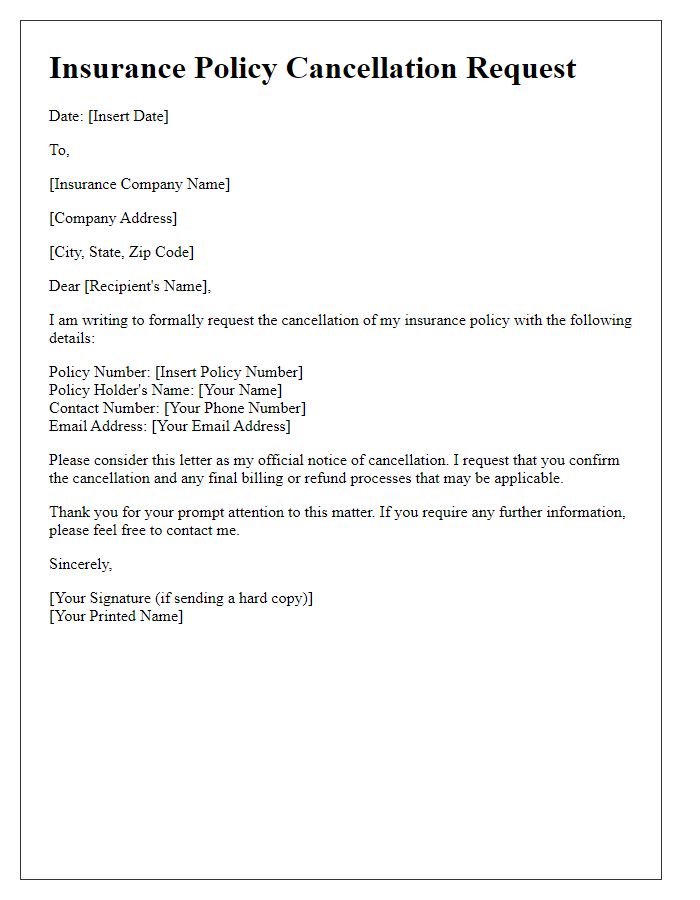

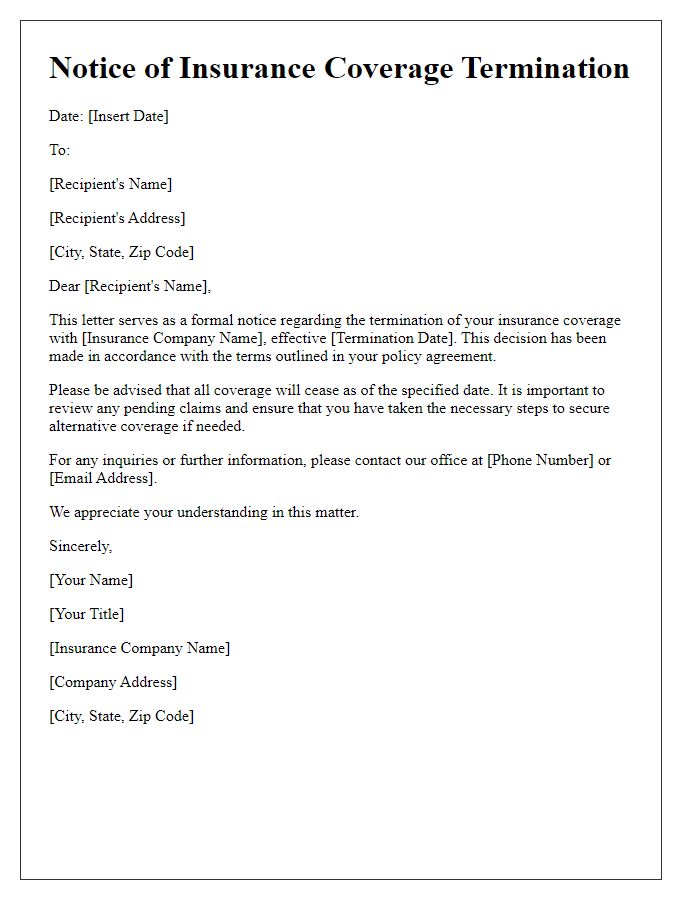

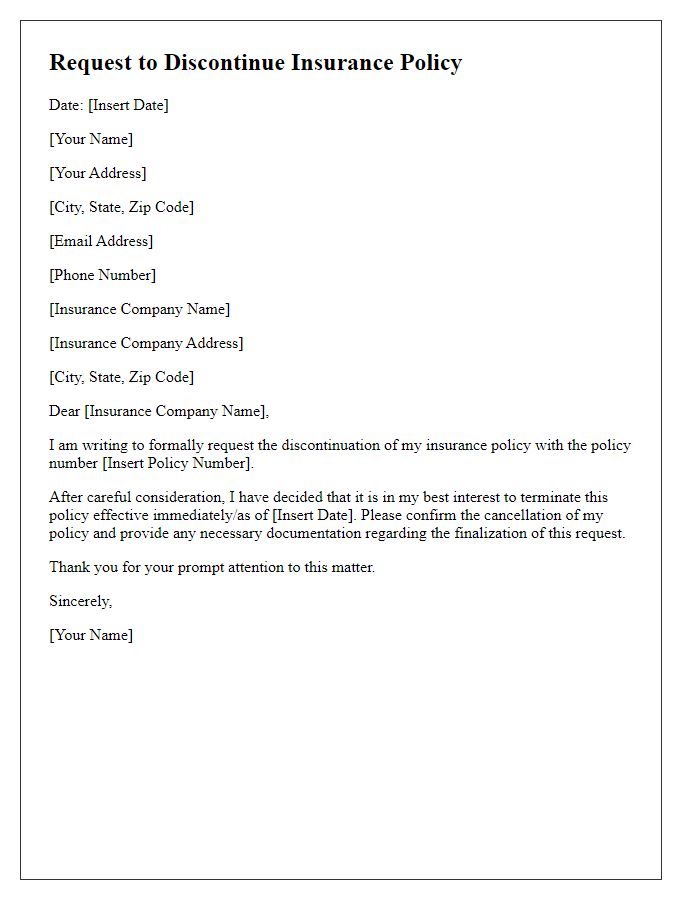

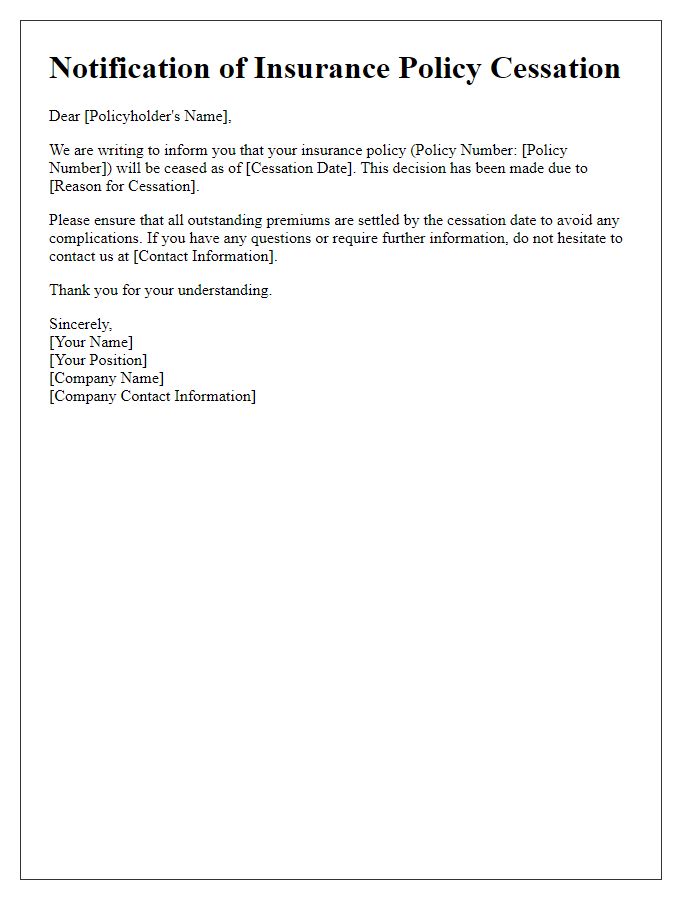

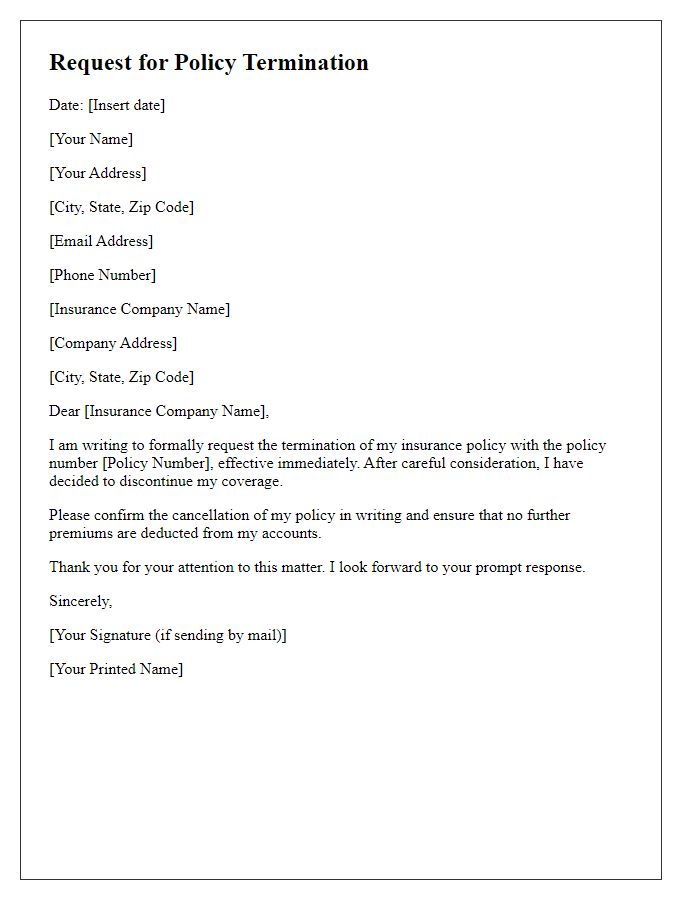

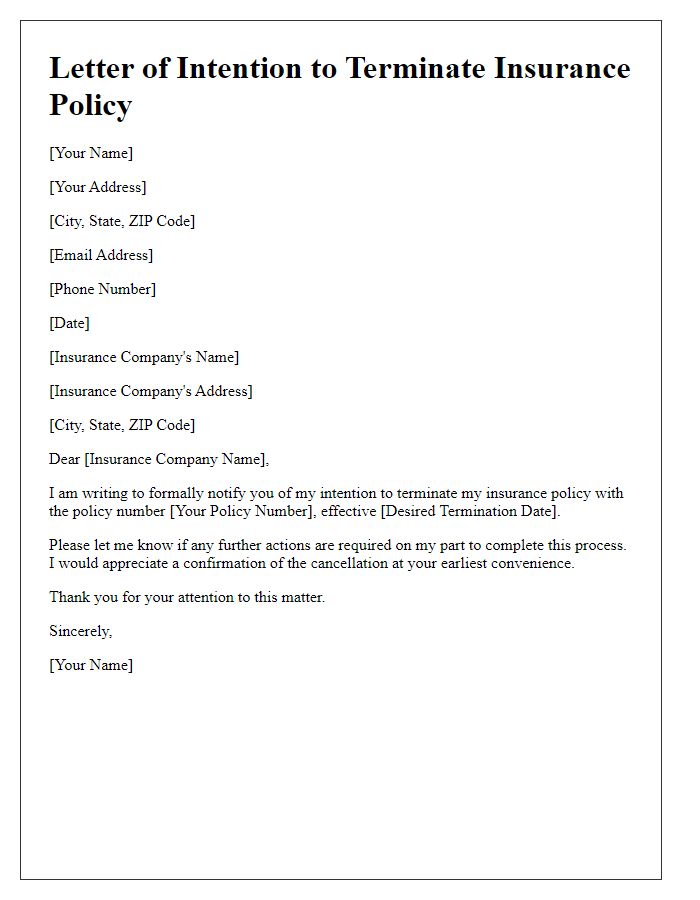

The insurance policy termination process involves critical information related to the policyholder. Policyholder details include full name, address, phone number, and email address. Policy number or account reference serves as a unique identifier for the specific insurance contract. The policy type, such as life, auto, or home insurance, indicates the coverage affected. Dates are essential, including the termination effective date, and any relevant notice periods must be heeded as per the contract provisions. Additional documents like claim history or payment records might also be needed to complete the termination accurately. This process should adhere to regional regulations and terms set by the insurance provider to ensure compliance and avoid potential disputes.

Policy Details

In the context of insurance policy termination, it is essential to address specific policy details to facilitate a smooth process. For example, consider a Homeowners Insurance Policy effective since March 15, 2020, with Policy Number H1234567 issued by Acme Insurance Agency in Chicago, Illinois. The policyholder must provide clear information regarding the intention to terminate the policy, along with the effective date of termination, ideally at least 30 days in advance. This ensures compliance with the agency's requirements and allows sufficient time for processing. Additionally, the policyholder should mention any final premium dues, the return of documents such as the policy booklet, and the request for a confirmation of termination to safeguard against potential disputes in the future. Clear communication in this process is crucial to avoid coverage gaps or any unexpected charges.

Termination Date

The termination of an insurance policy, typically outlined in an official document, signifies the end date of coverage for clients, commonly aligning with a specific date such as December 31, 2023. This process may involve various key elements, including notification requirements, potential refunds for unused premiums, and reasons for termination. Policies like homeowner's insurance or automobile insurance are often terminated due to non-payment, change in risk profile, or expiration of the policy term. Clients should be aware of their rights and obligations post-termination, ensuring they understand factors such as coverage gaps and eligibility for new policies in their respective states, which may have different regulations.

Reason for Cancellation

An insurance policy termination can result in various implications depending on the reason for cancellation. Common reasons include non-payment of premiums, which may lead to policy lapse, or a decision by the policyholder to switch to another provider for better coverage or rates. Other reasons might stem from changes in personal circumstances, such as relocation or changes in financial status, necessitating different insurance needs. Specific events, like the sale of a vehicle or a change in health insurance requirements, can also prompt policy cancellations. It is crucial to review the terms outlined in the policy documents, including implications and any penalties for early termination. Always ensure proper notification, as per the insurance company's requirements, to avoid further complications.

Request for Confirmation

Insurance policy termination can lead to various implications for policyholders. Individuals often seek confirmation to ensure their coverage, typically tied to specific details such as policy numbers or effective dates, is officially concluded. The term "termination" refers to the legal ending of a contract, which, according to state regulations, involves notifying the insurer within a specified notice period, often ranging from 30 to 90 days. In the context of personal insurance, such as homeowner or auto insurance policies issued by companies like State Farm or Allstate, the procedure may also involve final premium calculations based on usage and claims submitted. Documenting the request for confirmation helps policyholders safeguard their interests, especially regarding potential refunds or any ongoing obligations related to unfulfilled claims.

Comments