Are you looking for a straightforward way to ensure your loan guarantee agreement is clear and professional? Crafting a compelling letter template can make all the difference in establishing trust and transparency between parties. It not only outlines the terms of the agreement but also serves as a formal record of the commitment made. Join us as we dive deeper into the essentials of creating an effective loan guarantee agreement letter template!

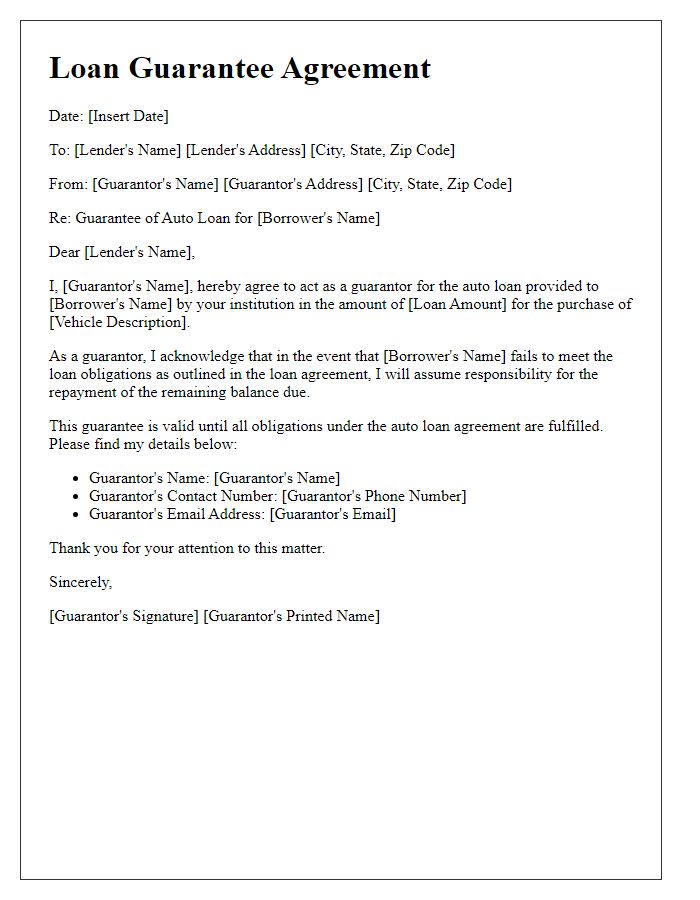

Identification of Parties

A loan guarantee agreement serves as an essential legal document that outlines the responsibilities and obligations of all parties involved in the loan transaction. The identification of parties section includes critical details such as the full names, addresses, and contact information of both the borrower and the guarantor. This section may also specify the lending institution, characterized by its official name and registered business address. The borrower, typically an individual or business seeking funds, must provide identification details to authenticate their identity and legal standing. The guarantor, who provides a financial safety net for the lender, must also present their legal identity and relationship to the borrower. Clarification of the parties involved establishes accountability and facilitates future communication during the loan process.

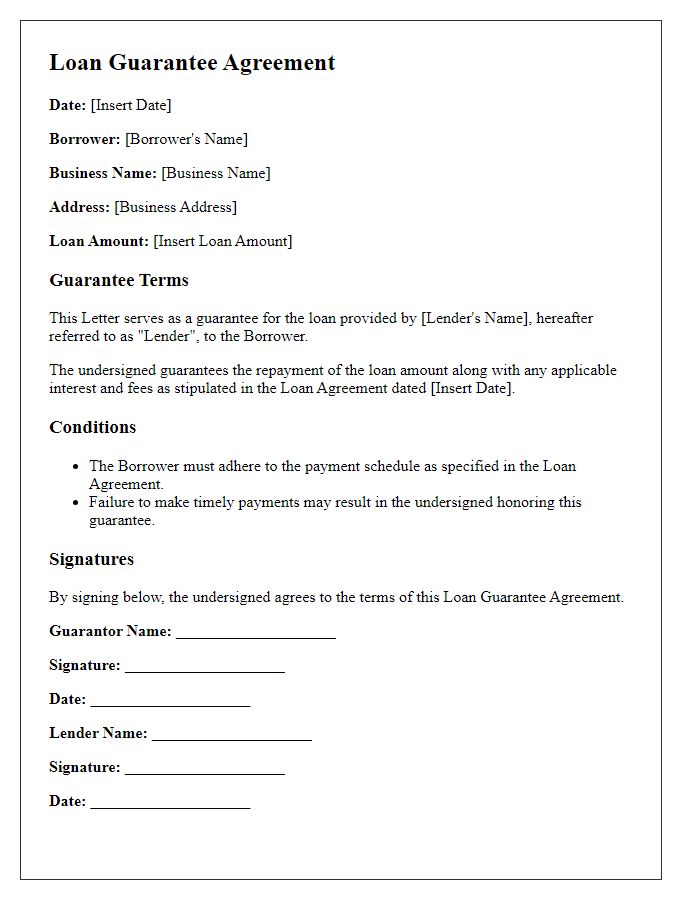

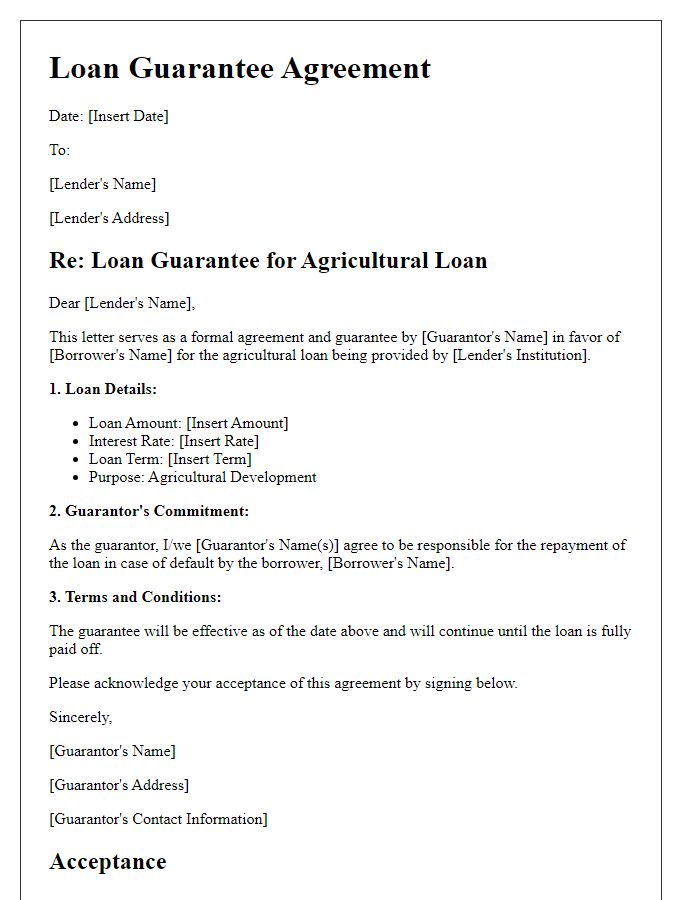

Loan Details

Loan guarantees serve as financial safety nets for lenders, ensuring that they recover their money in the event of borrower default. A typical loan guarantee agreement outlines crucial loan details, including principal amount, which often ranges from thousands to millions of dollars, interest rate, typically expressed as an annual percentage rate (APR), and repayment terms, which may extend over several months or years. Additionally, the agreement elaborates on collateral requirements, often detailing specific assets that secure the loan, and the parties involved, including the borrower, lender, and guarantor, which could be an individual, financial institution, or government entity. Understanding all of these components is essential for all parties to mitigate risks and ensure compliance throughout the loan duration.

Guarantee Terms

A loan guarantee agreement outlines the security terms provided by a guarantor for a borrower's loan from a financial institution. This document typically includes critical elements such as the principal loan amount, often specified in thousands of dollars (e.g., $50,000), the interest rate (for instance, 5% per annum), and the loan duration, which may range from 5 to 30 years. The terms detail the obligations of the guarantor, who agrees to cover the loan payments if the borrower defaults, ensuring protection for lenders, such as banks like Chase or Wells Fargo, in various states. Furthermore, the agreement may include provisions for late fees, prepayment penalties, and conditions under which the guarantee becomes enforceable, reinforcing the legal responsibilities tied to the guarantee aspect of the transaction.

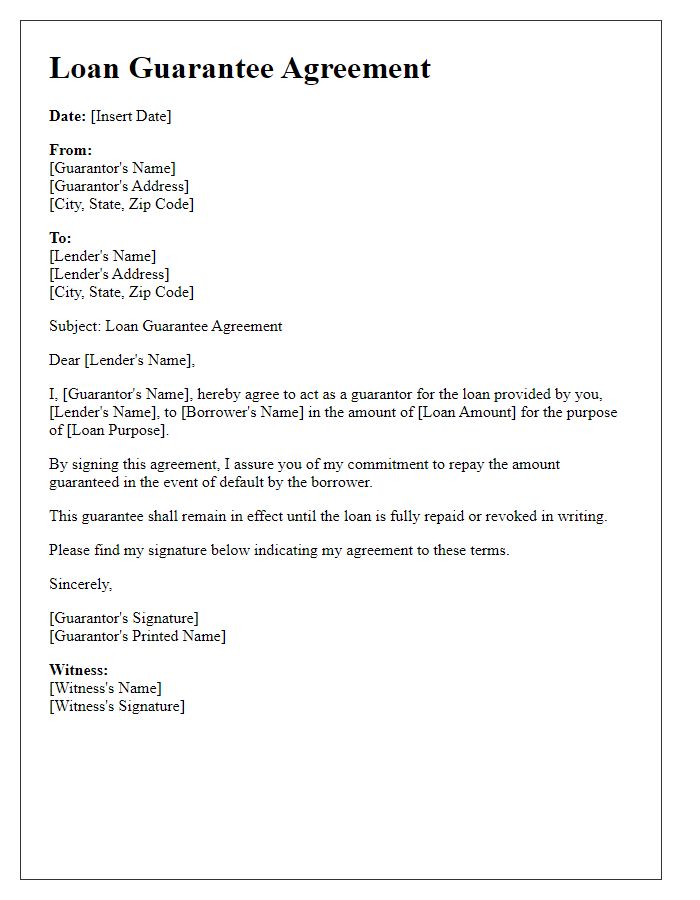

Governing Law

Governing Law defines the legal jurisdiction that will regulate the terms of a loan guarantee agreement. In the context of such documents, typically, the chosen law will be from a specific state or country, which will influence the interpretation of contractual obligations. For instance, if the governing law states New York, it ensures that any disputes arising from the agreement will be addressed under New York State law. This can affect key aspects such as enforcement procedures, penalties for default, and rights of the parties involved. Clarity in this section is vital to mitigate conflicts and enhance legal certainty regarding the responsibilities of the guarantor and the lender.

Signatures

A loan guarantee agreement outlines the responsibilities of the guarantor in a financial transaction. Key elements include the borrower, typically an individual or business seeking funds for a specific purpose, the lender, often a financial institution providing the loan, and the guarantor, who agrees to fulfill the borrower's obligations in case of default. Signatures of all parties involved are crucial as they signify acceptance and commitment to the terms laid out in the agreement. Noteworthy dates, such as when the agreement is signed and potential repayment deadlines, should also be included. Each signature must be accompanied by printed names and titles, along with the date, to validate the document legally. Additionally, notarization may be required for some agreements to enhance authenticity. The agreement often takes place in a formal setting, such as an office or a financial institution, ensuring a professional environment.

Comments