Are you looking to solidify your working relationship with an independent contractor? Crafting a well-structured independent contractor agreement is essential to outline the terms and protect both parties involved. In this article, we'll cover the key components that should be included in your letter template, ensuring clarity and professionalism. So, let's dive in and explore how to create an effective agreement that meets your needs!

Parties Involved

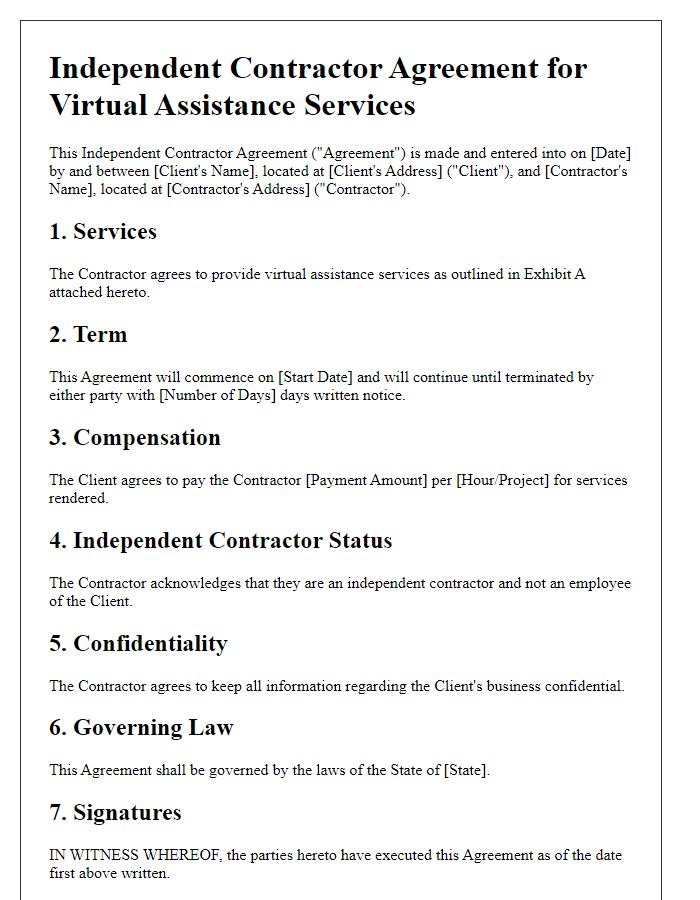

The independent contractor agreement establishes a formal relationship between two parties involved: the Client, typically a business entity or individual seeking specific services, and the Contractor, an independent professional providing specialized skills or expertise. The Client may operate in various industries, such as technology, marketing, or design, and requires the Contractor to deliver agreed-upon services within a designated timeframe. This agreement outlines the scope of work, compensation, and terms of engagement, ensuring clarity and protection for both parties. The Contractor, distinguished by their autonomy and flexibility, operates independently, often managing their own business operations, taxes, and resources, while adhering to the specified guidelines of the Client's project.

Scope of Work

The scope of work section of an independent contractor agreement outlines specific tasks and responsibilities assigned to the contractor. This section often includes detailed descriptions of the services to be performed, such as graphic design, software development, or consulting. Each task should have measurable outcomes or deliverables, such as the completion of a marketing project by May 30, 2023, or the delivery of a fully functional website by September 15, 2023. The agreement may also specify the location of work, such as remote or on-site at the client's office in San Francisco. Additionally, it may include criteria for success, like customer satisfaction levels or adherence to industry standards, ensuring clarity on expectations for both parties involved in the contract.

Payment Terms

In an independent contractor agreement, payment terms are crucial for establishing clear expectations between the contractor and the client. Typically, the payment terms specify the agreed-upon remuneration amount, which could be a fixed fee or an hourly rate. Payment schedules often outline when payments will be made, such as upon project milestones, bi-weekly, or monthly, depending on the project's scope. Additionally, payment methods can vary, with options like bank transfers, checks, or digital payment platforms. Late payment policies might also be included, detailing any penalties or interest accrued if payments are delayed beyond an agreed timeline. Lastly, specifying any required invoice submissions, including due dates and necessary documentation, ensures that payment processes remain smooth and transparent.

Intellectual Property Rights

Independent contractor agreements often involve detailed provisions regarding intellectual property rights, essential for protecting creations and inventions. Intellectual property (IP) can include various forms such as copyrights, patents, trademarks, and trade secrets. In many cases, contractors are expected to assign ownership of any work produced during the agreement to the hiring entity, especially if the work pertains to the project specifications outlined in the contract. Defining what constitutes "work product" is crucial, ensuring clarity on whether preliminary drafts, designs, and final outputs fall under IP ownership. Additionally, the agreement may specify how confidential information (trade secrets) must be handled, emphasizing the contractor's obligation to maintain secrecy beyond the contract's duration. Jurisdictions, such as the United States, vary in IP laws, making it imperative for both parties to understand their rights and responsibilities. Clear definitions and obligations can prevent disputes and foster professional relationships.

Confidentiality and Non-Disclosure

The independent contractor agreement is critical for establishing confidentiality and non-disclosure terms between parties in various sectors. This legal instrument details sensitive information definitions, protecting trade secrets and proprietary data throughout project engagements. Key components include the duration of confidentiality obligations, typically ranging from one to three years post-contract completion, and explicit clauses addressing the consequences of breaches, such as financial penalties or legal action. Defined third parties include clients, employees, and subcontractors, and restrictions on information dissemination are essential for protecting business interests. Specific states, like California, have distinct regulations concerning non-disclosure agreements, which must be considered to ensure legality and enforceability.

Letter Template For Independent Contractor Agreement Samples

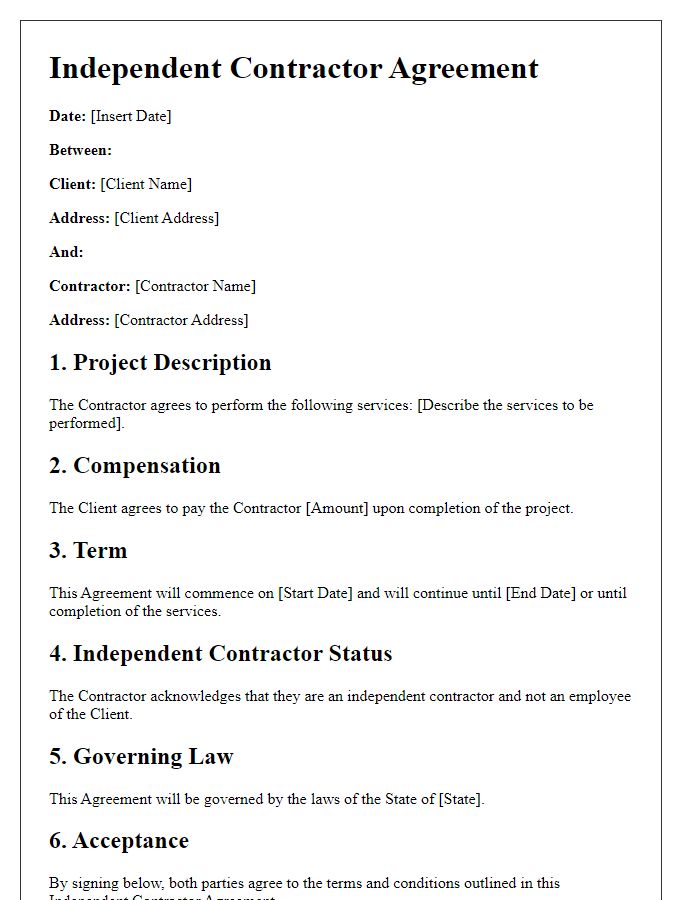

Letter template of independent contractor agreement for freelance services

Letter template of independent contractor agreement for project-based work

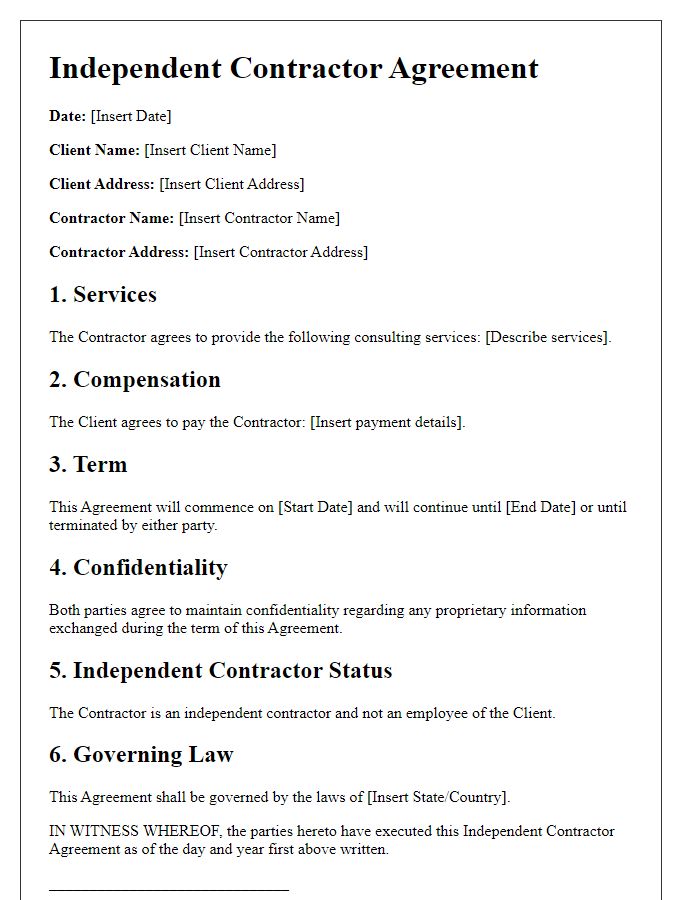

Letter template of independent contractor agreement for consulting services

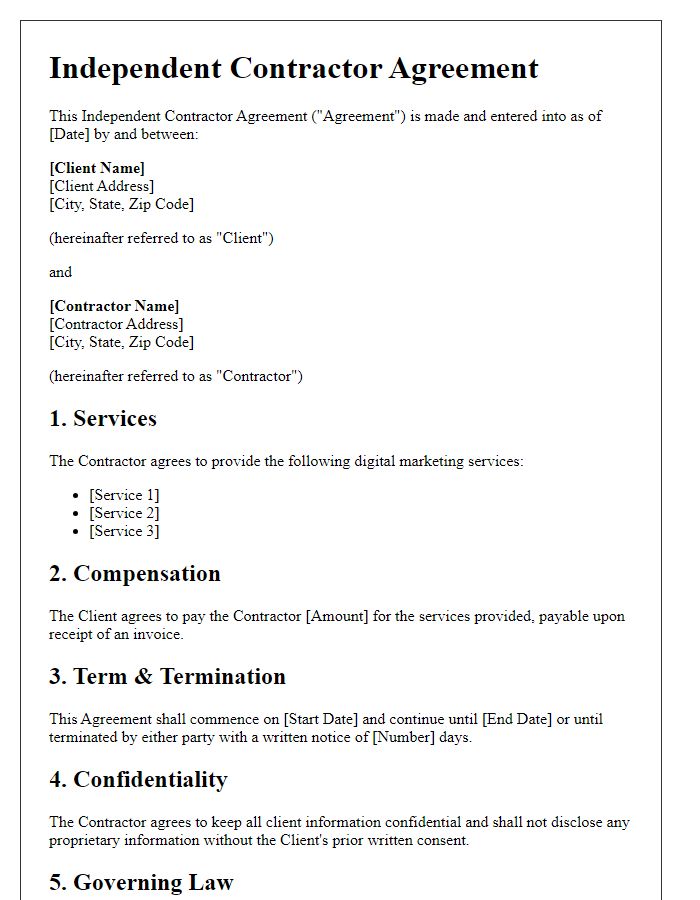

Letter template of independent contractor agreement for digital marketing

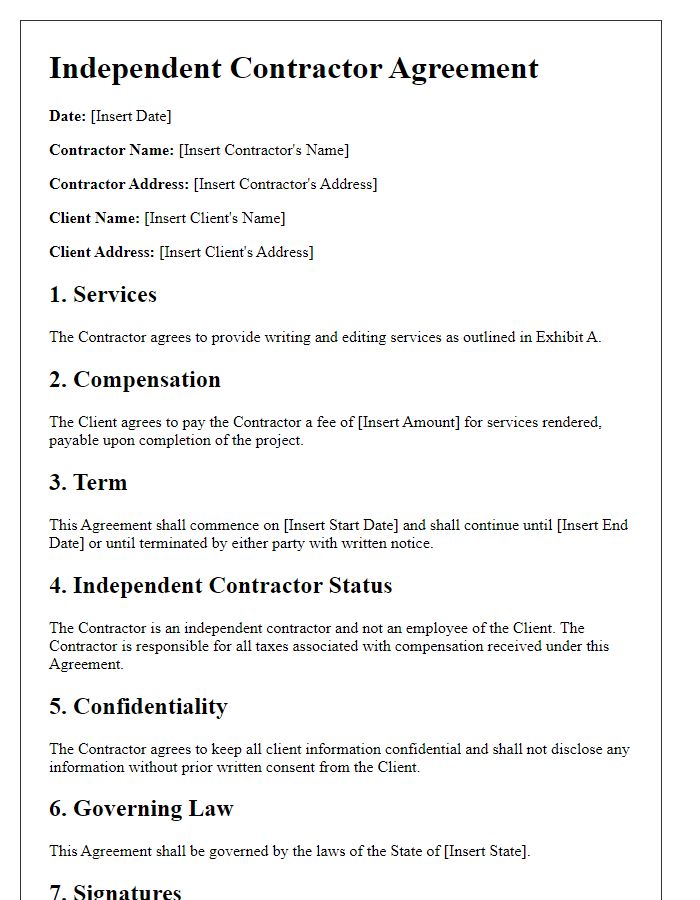

Letter template of independent contractor agreement for writing and editing services

Letter template of independent contractor agreement for construction services

Comments