Are you curious about how your organization measures up against industry standards? Understanding the benchmarks can provide invaluable insights into your performance and highlight opportunities for growth. In this article, we'll explore the key metrics that define success in your sector and how you can leverage them to enhance your strategies. Join us as we dive deeper into the specifics of industry benchmark analysis and discover ways to elevate your businessâread on!

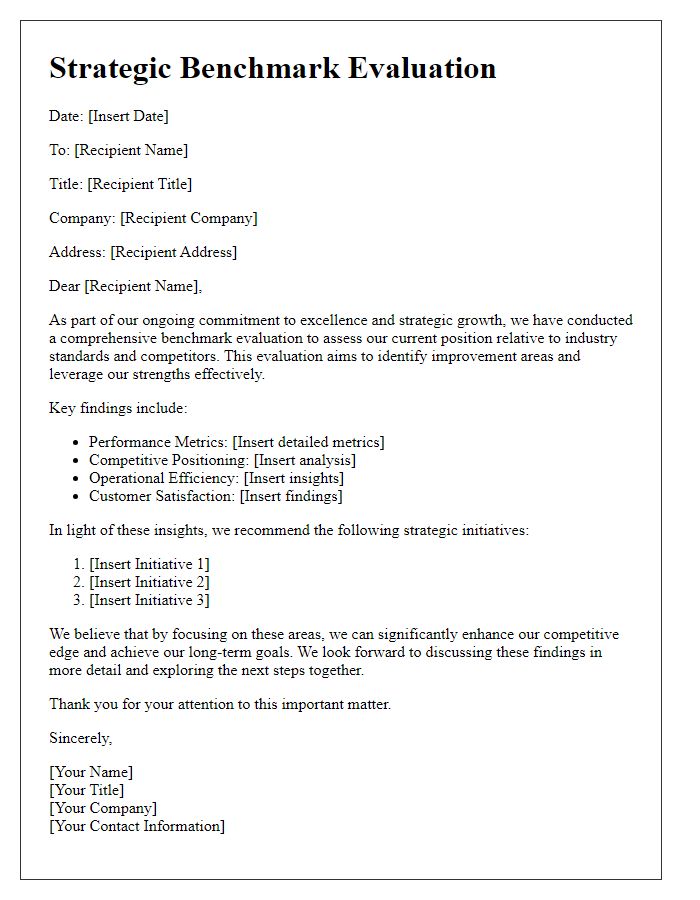

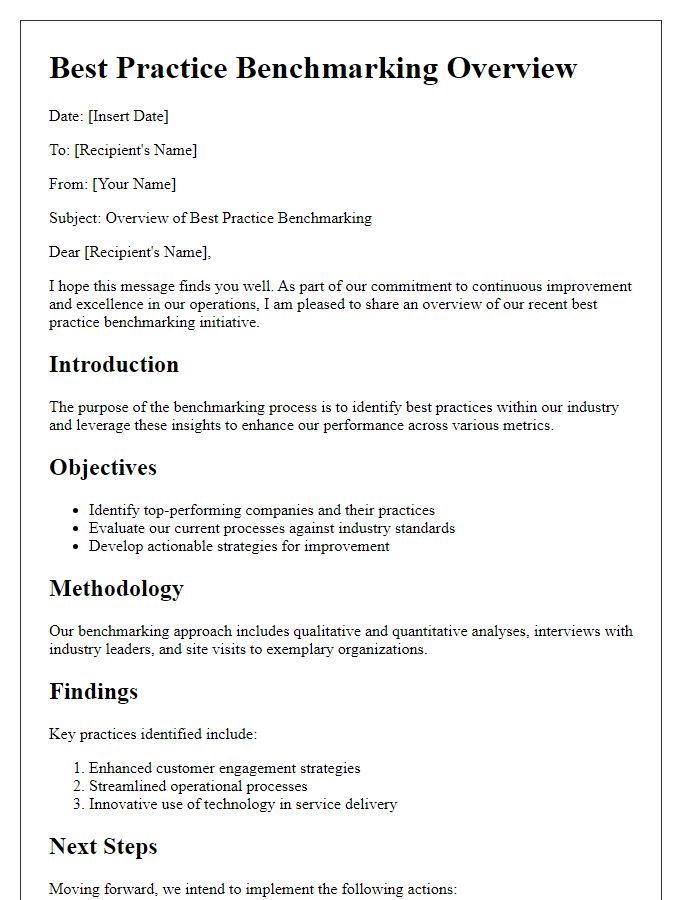

Purpose and Objective

The purpose of industry benchmark analysis is to evaluate and compare a company's performance metrics against established standards within its sector. This assessment aims to identify areas of strength and weakness relative to competitors, facilitating strategic planning and decision-making. Key performance indicators (KPIs) such as revenue growth rate (measured annually, e.g., 10%), profit margins (for instance, standard industry averages at 15%), customer satisfaction scores (often derived from survey results reflecting a scale of 1 to 10), and operational efficiency ratios are crucial in this analysis. Objectives include unlocking insights into market dynamics, enhancing resource allocation, and driving innovation through best practices exemplified by leading entities within the industry, whether in technology (like leading firms in Silicon Valley) or manufacturing (such as automotive giants in Detroit). Each comparison yields actionable intelligence, enabling the company to maintain competitiveness and achieve long-term sustainability.

Industry Overview and Scope

The automotive industry represents a significant sector of the global economy, generating over $2 trillion in annual revenue. This industry encompasses a wide range of activities, including manufacturing, sales, and maintenance of vehicles such as passenger cars, trucks, and buses. Key players such as General Motors and Toyota dominate the market, while emerging electric vehicle manufacturers like Tesla and Rivian are rapidly gaining traction. The industry's scope also includes ancillary services, such as automotive parts supply and aftersales service, constituting a complex ecosystem that supports innovation and sustainability. Regional markets vary significantly; for instance, North America, with its robust consumer base, contrasts with Europe's stringent emissions regulations, influencing industry standards and practices. Furthermore, advancements in technology, particularly autonomous driving systems and electric propulsion, are reshaping the industry's landscape, prompting traditional manufacturers to adapt to evolving consumer demands and regulatory frameworks through investment in research and development.

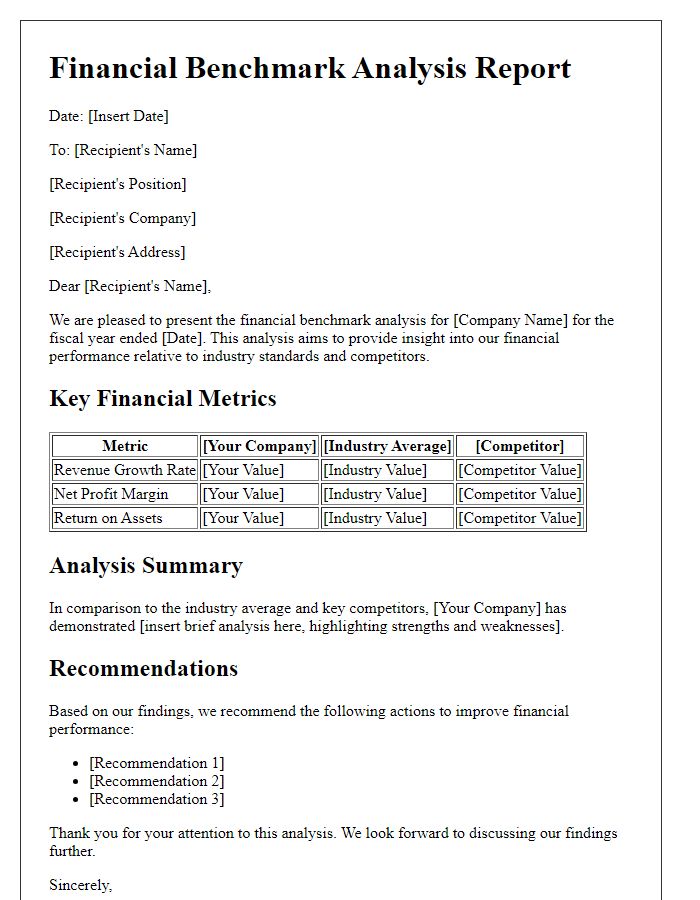

Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) serve as vital metrics that assess the operational efficiency and performance of organizations in various industries, such as technology, healthcare, and finance. These quantifiable measures, such as revenue growth rates, customer satisfaction scores, and employee turnover percentages, provide insights into critical aspects of business performance. For instance, a technology company's monthly recurring revenue (MRR) growth rate may indicate market demand for its software products, while the average response time in a healthcare setting can highlight the quality of patient care. Moreover, industry benchmarks enable organizations to compare their KPIs against competitors and industry standards, facilitating informed strategic decision-making and performance improvement initiatives.

Comparative Analysis and Insights

The Comparative Analysis and Insights report provides a detailed examination of industry benchmarks across various sectors, focusing on key performance indicators (KPIs) such as revenue growth percentage, customer satisfaction scores, and operational efficiency rates. Utilizing data from leading firms like Amazon (with a revenue of $469.8 billion in 2021) and Walmart (with a revenue of $559.2 billion), this report highlights trends in e-commerce and retail industries. Market share analysis reveals that Amazon holds approximately 38% of the U.S. e-commerce market, while Walmart captures 10.8%. Insights into operational costs indicate that companies with automated supply chain systems (employed by sectors including logistics and manufacturing) typically experience up to 30% reductions in overhead expenses. Furthermore, the report explores the impact of digital transformation on customer engagement metrics, noting that firms embracing AI-driven analytics achieve a 20% increase in customer retention rates. Overall, this analysis serves as a strategic tool for decision-makers seeking to enhance competitive positioning within their respective markets.

Conclusion and Recommendations

In the rapidly evolving technology sector, a thorough industry benchmark analysis reveals critical insights for companies aiming to enhance their competitive edge. Comparative metrics, such as revenue growth rates of leading firms like Amazon (35% year-over-year) and Microsoft (15% year-over-year), indicate robust market performance standards. The analysis underscores the significance of adopting innovative practices such as agile project management and continuous integration to boost operational efficiency. Companies should prioritize investment in data analytics tools, as 90% of top performers leverage advanced analytics for strategic decision-making. Moreover, collaboration with industry leaders at events like the Consumer Electronics Show (CES) in Las Vegas offers valuable networking opportunities and exposure to emerging trends. Recommendations include actionable steps towards enhanced R&D funding, prioritizing customer-centric solutions, and establishing partnerships with tech innovators. Emphasizing sustainability in product development could further align with global market trends, potentially increasing customer loyalty in environmentally conscious demographics.

Comments