Are you curious about how your business stacks up against the competition? In today's fast-paced market, understanding industry benchmarks can provide invaluable insights into where you stand and what areas you can improve. By comparing key performance indicators with peers, you can identify strengths and weaknesses that influence growth and success. Keep reading to discover how to effectively conduct an industry benchmark comparison tailored for your specific needs!

Purpose and Objective

Industry benchmarks play a crucial role in evaluating performance and competitiveness across sectors, influencing strategic decisions for improvement. These benchmarks provide quantifiable standards that organizations, such as firms in the technology sector, can utilize to compare key performance indicators (KPIs), including revenue growth, customer satisfaction scores, and operational efficiency rates. The objective of conducting an industry benchmark comparison is to identify areas of potential enhancement, understand market positioning relative to peers, and develop actionable insights to drive innovation and profitability. By analyzing data from recognized sources like Gartner and McKinsey, companies can establish effective practices that align with industry leaders, ultimately leading to sustained success and better resource allocation.

Key Performance Indicators (KPIs)

Competitive analysis of Key Performance Indicators (KPIs) is crucial for industries, such as manufacturing and technology, to identify performance gaps. Organizations like the International Organization for Standardization (ISO) set benchmarks for quality and efficiency. Key metrics, including production output (often measured in units per hour) and defect rates (expressed as a percentage), provide insight into operational effectiveness. Financial performance indicators, such as return on investment (ROI), often benchmarked against industry standards, reveal profitability insights. Employee productivity rates measured in output per employee also serve as a critical KPI in assessing workforce efficiency. By evaluating these quantitative measures, companies can implement strategic initiatives aimed at improving overall performance and enhancing competitive edge.

Comparative Data Sources

When assessing industry benchmarks, utilizing reputable comparative data sources is essential. Organizations often rely on platforms like Statista, which aggregates statistical data from numerous industries, providing insights into key performance indicators (KPIs) such as revenue, market share, and growth rates. The International Data Corporation (IDC) offers extensive research reports focused on technology sectors, delivering data that spans regions like North America and Europe. Market research firms such as Gartner and Nielsen are also critical sources for understanding consumer behavior trends in various markets, ensuring strategic decisions are based on solid analytics. Additionally, trade associations like the American Marketing Association (AMA) frequently publish industry-specific reports that highlight best practices and competitive standings across companies. Utilizing these data sources enables businesses to accurately gauge their performance against peers and identify areas for improvement.

Analytical Methodologies

Industry benchmarks serve as critical standards for comparing analytical methodologies across sectors. These benchmarks often involve quantitative metrics such as accuracy rates, precision calculations, and turnaround times measured in hours, influencing decision-making processes. For instance, in the pharmaceutical industry, benchmarks may include FDA approval timelines and success rates of clinical trials, emphasizing the rigorous evaluation processes necessary for safety and efficacy. Similarly, in finance, benchmarks might involve the efficiency of risk assessment models, showcasing how institutions assess market conditions. Utilizing established benchmarks enables companies to identify areas for improvement and implement best practices, ultimately enhancing operational efficiency and ensuring compliance with industry standards.

Actionable Insights and Recommendations

In the fast-paced technology landscape, industry benchmarks provide critical insights into performance metrics essential for strategic planning. Companies like Apple, Samsung, and Google showcase different operational efficiencies and revenue figures, such as Apple's reported $274.5 billion revenue in 2020, compared to Samsung's $200.6 billion in 2021. Evaluating customer satisfaction scores, Apple's average rating of 4.8 in the App Store contrasts with Samsung's 4.2, illustrating varying user experiences across platforms. Metrics like market share percentages--Apple's 15% versus Samsung's 18% in mobile devices--unveil competitive advantages. The analysis indicates areas for improvement, such as enhancing software integration or streamlining supply chain processes. Organizations should leverage these insights to refine their strategies, ensuring alignment with industry standards while identifying unique opportunities for growth.

Letter Template For Industry Benchmark Comparison Samples

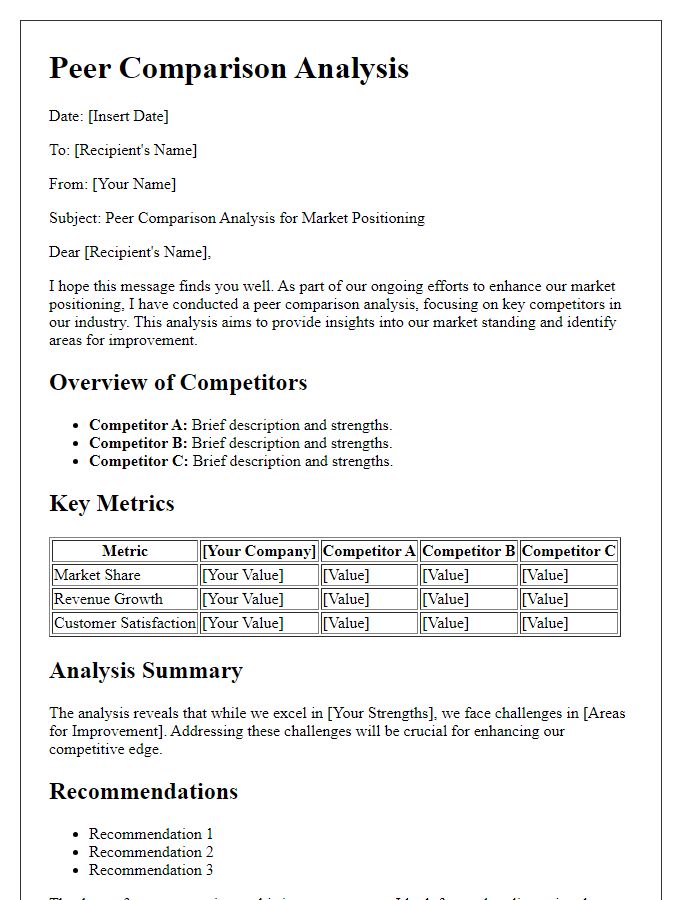

Letter template of industry benchmark analysis for performance evaluation.

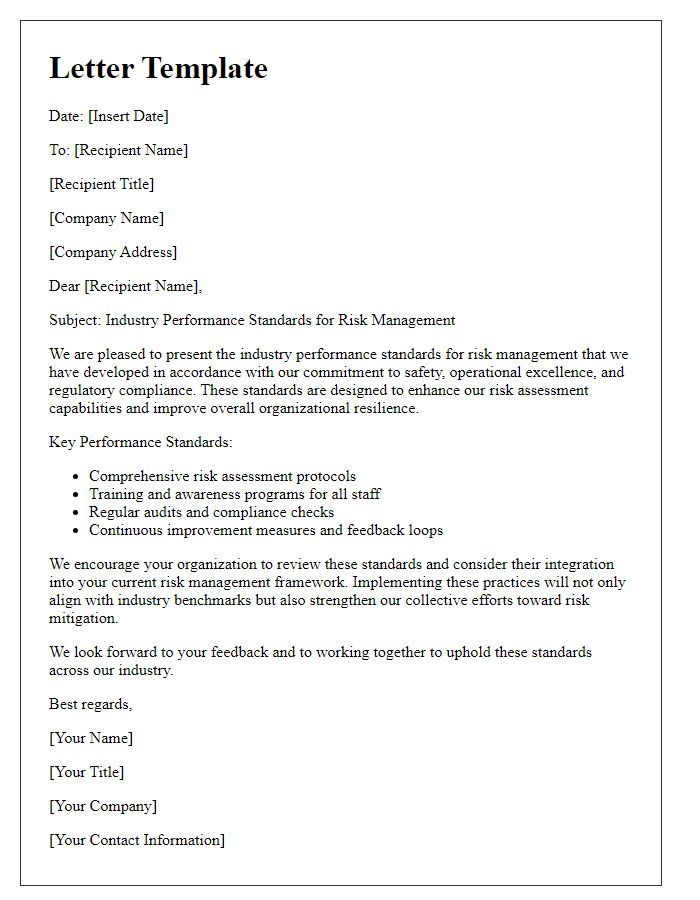

Letter template of industry standards comparison for operational efficiency.

Letter template of best practice benchmarking for organizational growth.

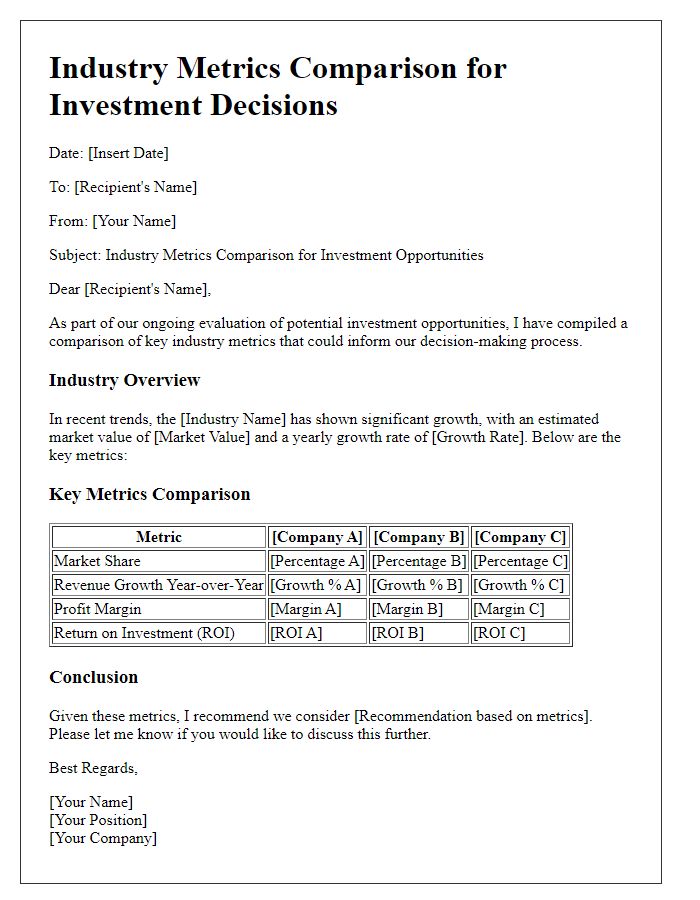

Letter template of industry metrics comparison for investment decisions.

Letter template of competitive landscape benchmarking for innovation strategies.

Comments