Are you excited about starting your new business venture? In this article, we'll explore the essential steps to ensure your business registration is confirmed and valid so that you can kick off your entrepreneurial journey without any hiccups. From understanding the necessary paperwork to tips for keeping your registration compliant, we've got you covered. So, let's dive in and discover how to make the most out of your business registration process!

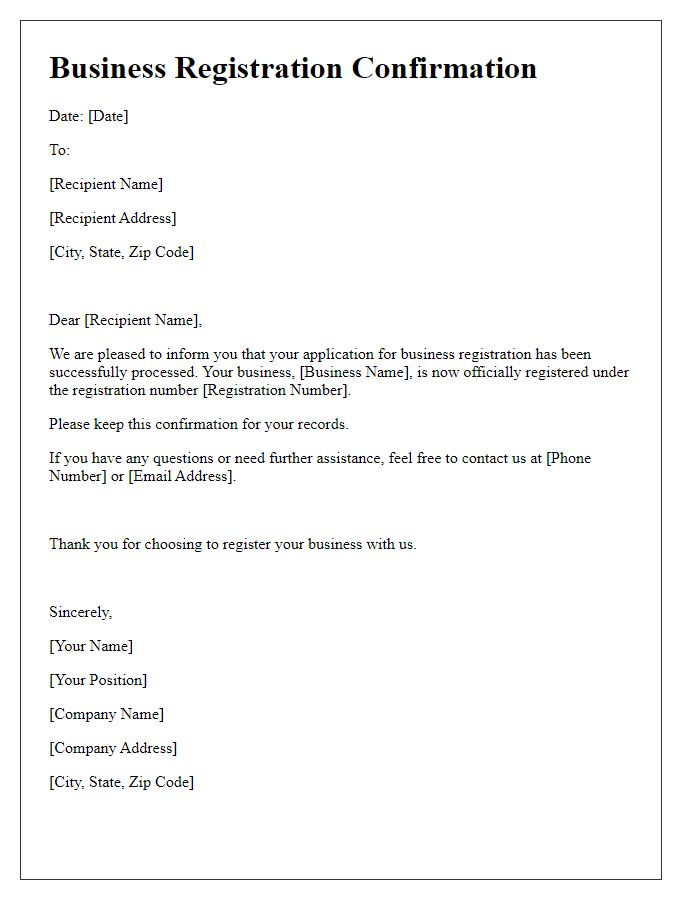

Business Name and Registration Number

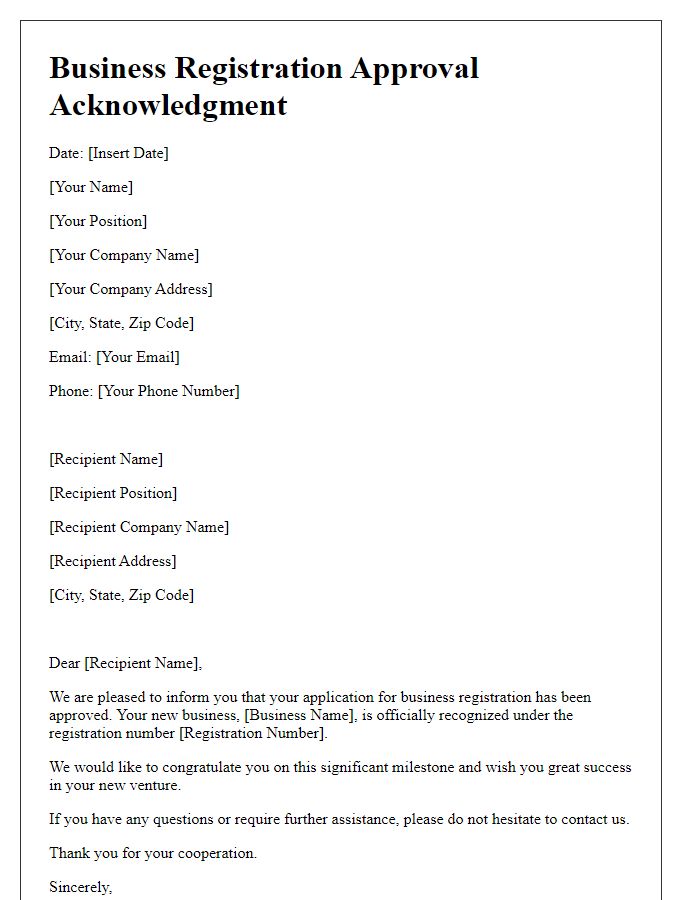

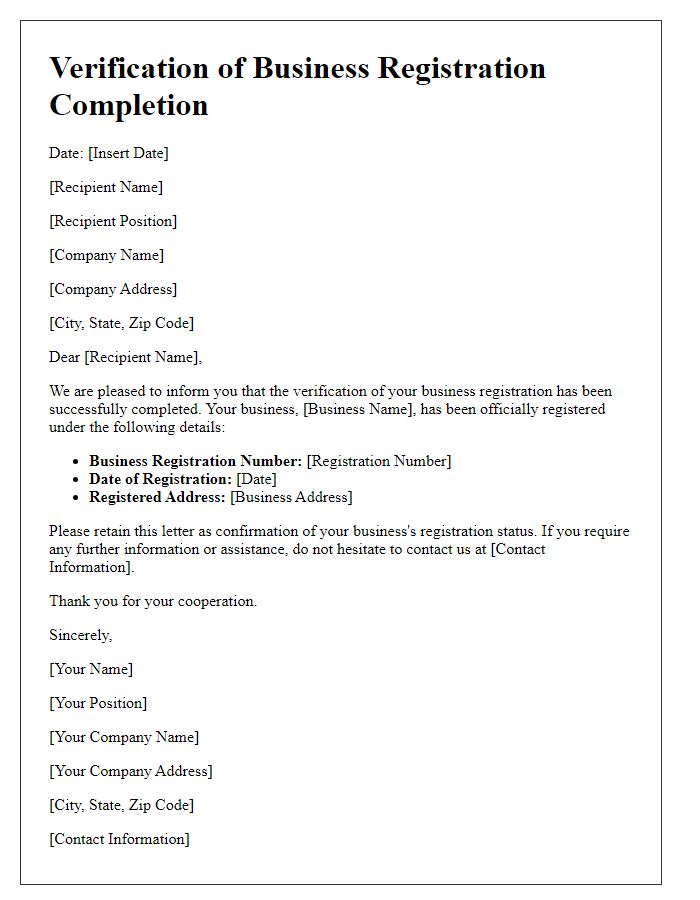

A confirmation of business registration serves as a vital document for entrepreneurs, validating their legal standing. The document typically includes essential details such as the Business Name, which identifies the company's brand and operations, and the Registration Number, a unique identifier assigned during the registration process. Proper registration ensures compliance with local laws in places such as California or New York, where regulations may vary. Additionally, such confirmations often indicate the date of registration, solidifying the establishment's legitimacy in records with governmental agencies, enhancing credibility with potential clients and partners. This reassurance can be particularly beneficial when applying for business loans or contracts, as financial institutions and clients often require proof of formally recognized business status.

Date of Registration Confirmation

Business registration confirmation occurs on a specific date that signifies the official recognition of a business entity by a governmental body. This date serves as a legal milestone, marking when the business becomes registered under relevant laws, such as the Companies Act or Small Business Administration guidelines. Important aspects include registration number, business name, and the issuing authority (often the Secretary of State or local registration office). The confirmation can also include details such as the nature of the business, its physical address, and authorized representatives, all crucial for establishing credibility and enabling legal operations.

Contact Information of Registering Authority

The confirmation of business registration often requires precise documentation including the contact information of the registering authority, such as the Secretary of State's Office in various U.S. states. For instance, the Connecticut Secretary of the State's Office, responsible for business registrations, can be reached at their main office located at 165 Capitol Avenue, Hartford, CT 06106. Their general phone number is (860) 509-6000, while inquiries may also be directed via email at sots@ct.gov. This authority oversees the registration of corporations, partnerships, and other business entities, ensuring compliance with the state's regulatory requirements.

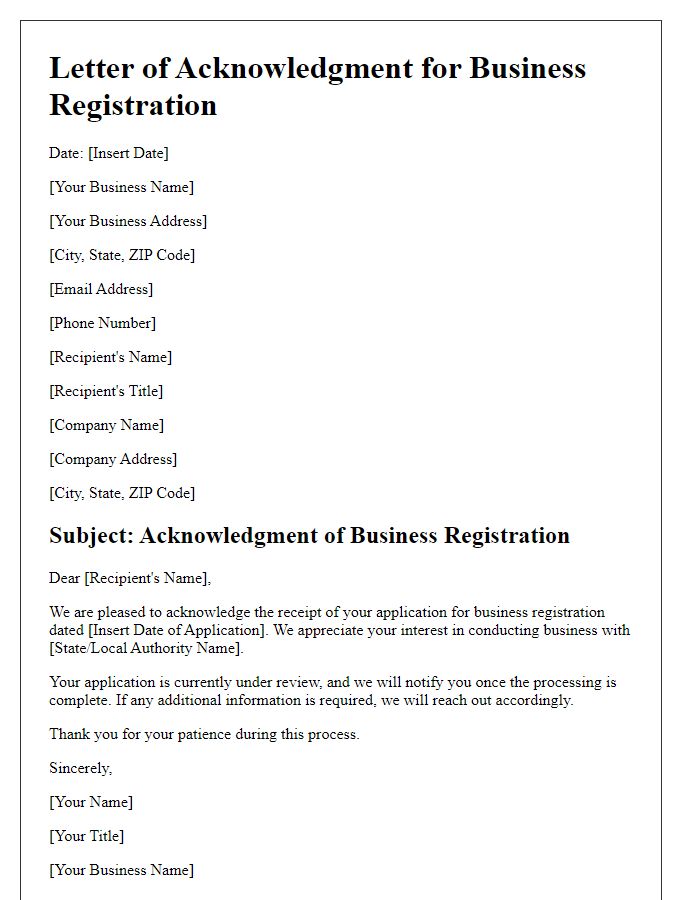

Legal Status and Ownership Structure

Business registration confirmations provide essential details regarding a company's legal status and ownership structure. The document confirms establishment under the relevant jurisdiction, typically a specific country or state, according to local business registration laws. It outlines ownership details, specifying whether the entity operates as a sole proprietorship, partnership, corporation, or limited liability company (LLC) and identifying principal owners or stakeholders. Registration numbers, date of incorporation, and administrative entity responsible for the registration should also be included. This ensures clarity in the legal standing of the business, which is crucial for compliance, taxation, and credibility in the marketplace.

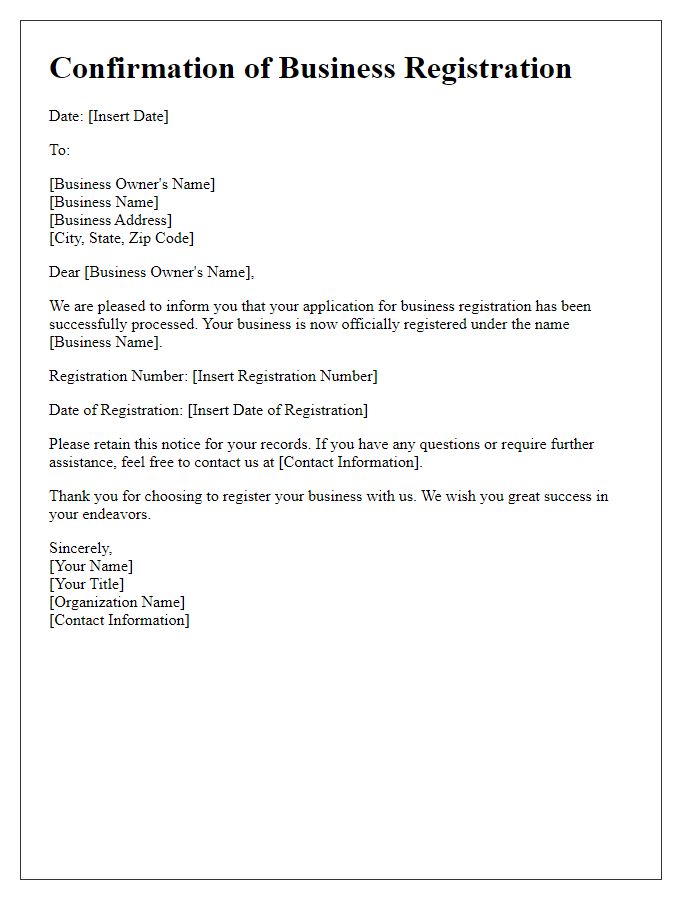

Terms and Conditions Compliance

The confirmation of business registration signifies that the enterprise, operating under the registered name as per government regulations, has adhered to all stipulated terms and conditions set forth by regulatory bodies. Compliance involves alignment with statutes relevant to the specific industry, such as licensing requirements for financial institutions or health regulations for food services. Additionally, adherence to local laws, such as zoning ordinances in urban areas like New York City or environmental regulations in California, is essential. This registration also includes agreements regarding tax obligations, employee rights, and consumer protection laws, ensuring the business operates within legal frameworks established by entities like the Small Business Administration (SBA) or the Internal Revenue Service (IRS) in the United States. Documentation verifying compliance may include certificates, permits, and signed contracts, essential for assuring stakeholders of the business's legitimacy and reliability.

Comments