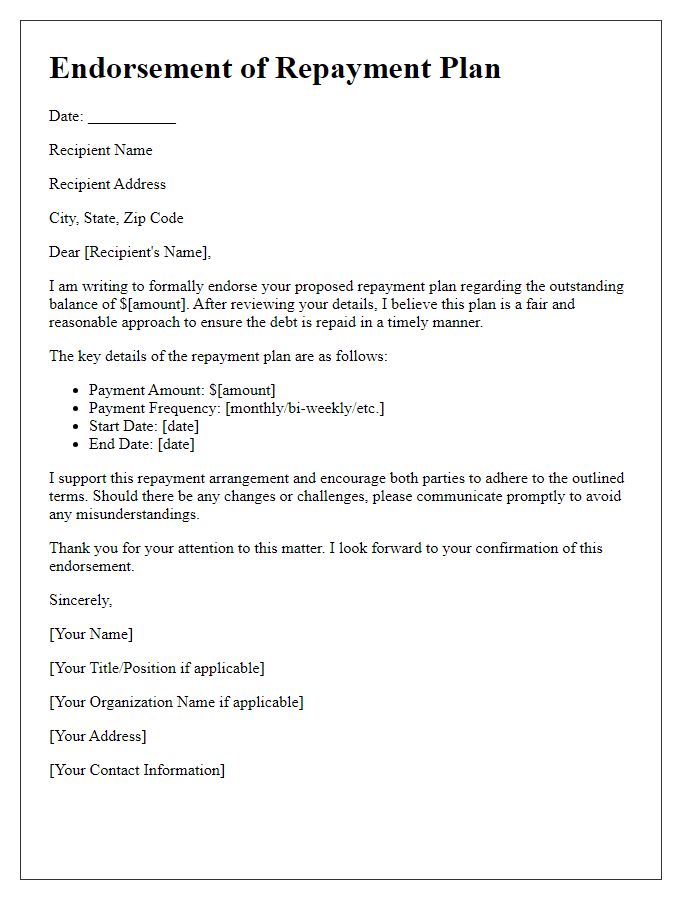

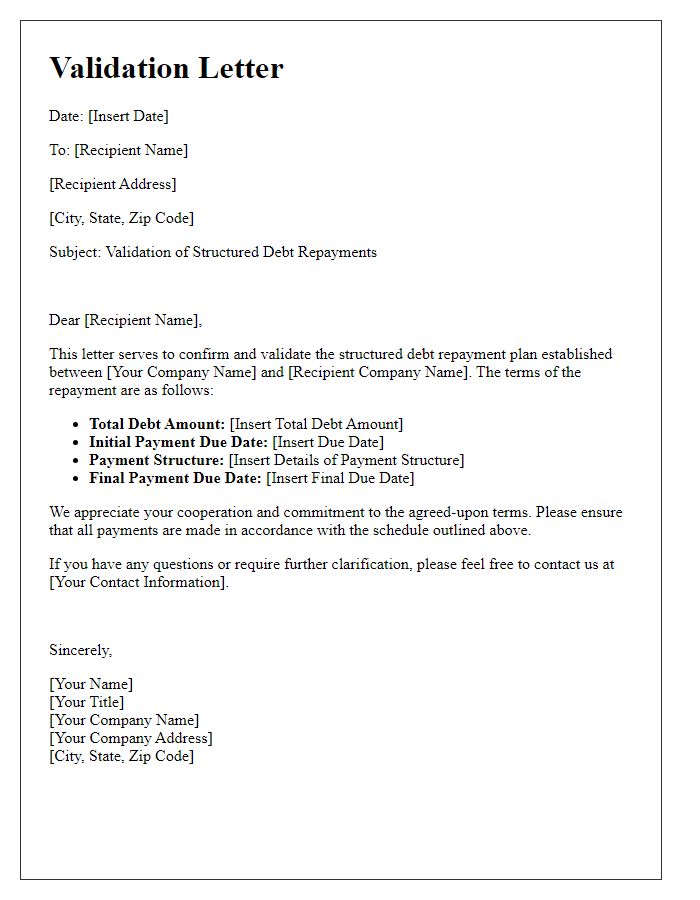

Are you feeling overwhelmed by debt and uncertain about how to proceed? Crafting a confirmation letter for your debt repayment plan can provide clarity and peace of mind. It not only outlines the terms of your agreement but also sets a positive tone for your financial journey ahead. Ready to take control of your finances? Let's dive into how to create an effective letter to confirm your repayment plan!

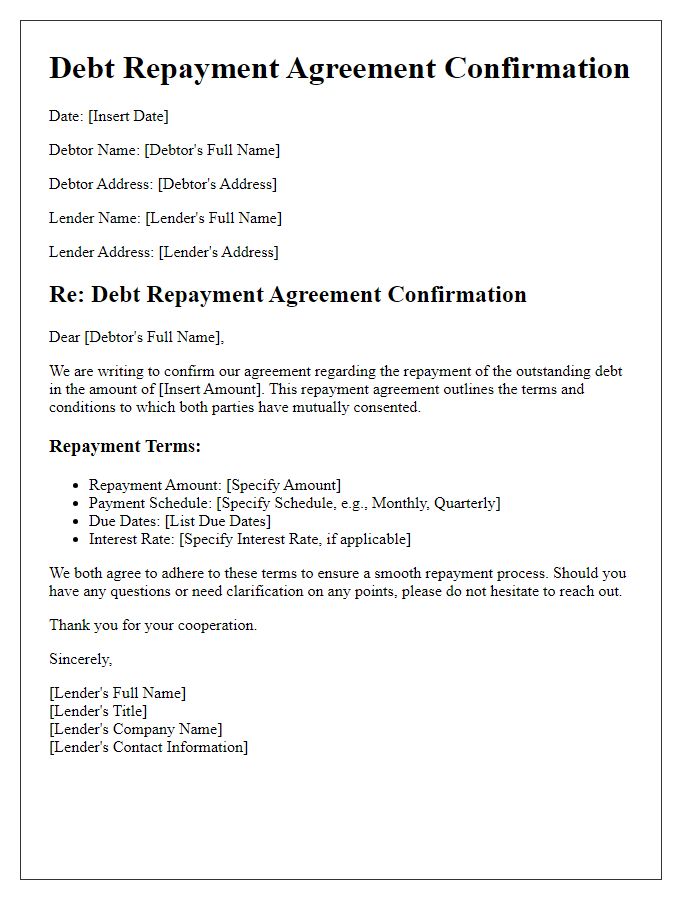

Creditor and Debtor Information

A debt repayment plan outlines the agreement between the creditor, such as First National Bank (established in 1870, based in New York), and the debtor, an individual or organization responsible for repaying borrowed funds. This plan includes critical information, such as the total amount owed ($15,000), monthly payment amount ($300), duration of repayment (5 years), and interest rate (5% APR). It serves to formalize the terms of the repayment, ensuring both parties understand their obligations and rights. Additionally, legal parameters and conditions surrounding defaults may be included, providing clarity on consequences for missed payments. Documentation is essential for maintaining transparency in financial dealings, enhancing trust in the creditor-debtor relationship.

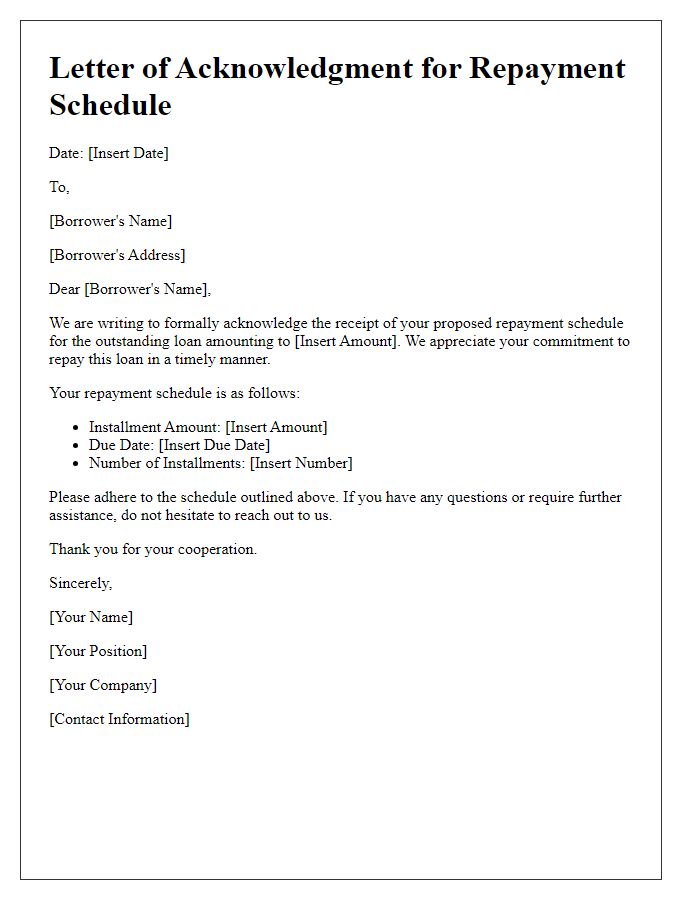

Repayment Terms and Schedule

A detailed debt repayment plan outlines the structured approach to settle owed amounts. The total debt could be $10,000 with monthly payments of $500. This plan spans 20 months, starting on March 1, 2024, and concluding on October 1, 2025. Each payment is due by the 1st of every month. Interest rates might accrue at a rate of 5% annually, potentially increasing the total amount payable. Clear communication is essential regarding any changes in payment capacity or unexpected financial hardships. Documentation should confirm all terms and ensure transparency throughout the repayment process.

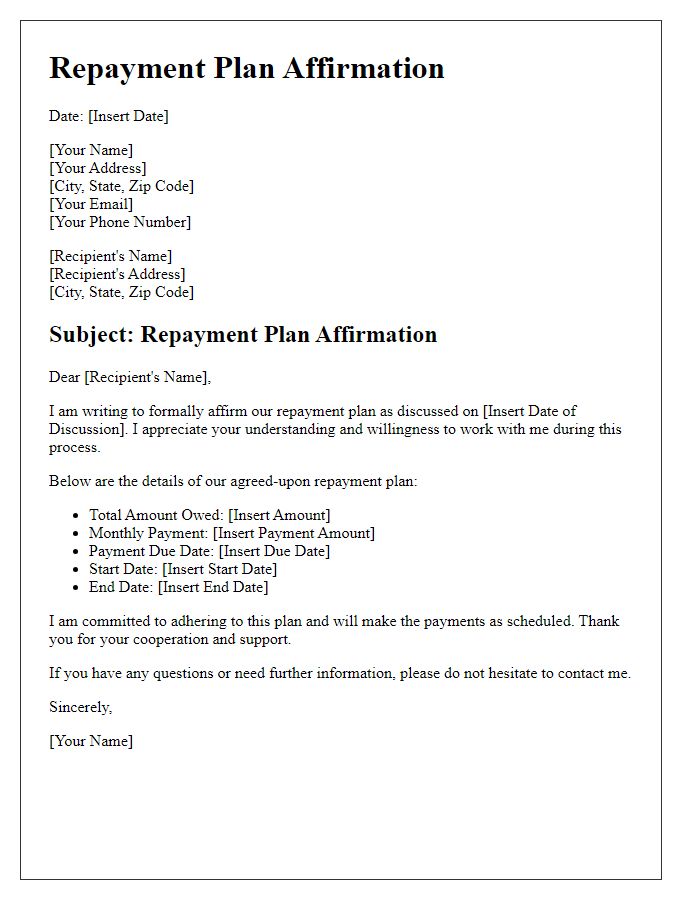

Interest Rates and Fees

Creating a debt repayment plan requires clarity on interest rates, fees, and repayment timelines. Interest rates typically range from 5% to 20% annually, depending on the lender and borrower's creditworthiness. Additional fees such as late payment charges, often around $25, and origination fees can apply, varying by lender. A well-defined repayment timeline is crucial; borrowers may choose terms from 6 months to several years. Utilization of tools such as amortization schedules can help track repayment progress, ensuring that both parties remain informed throughout the repayment period.

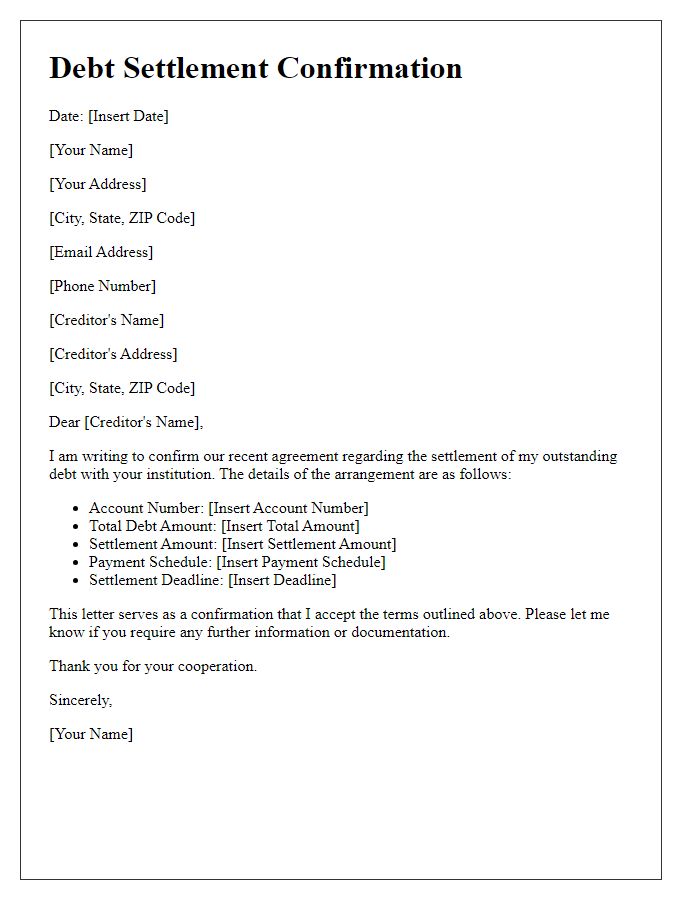

Consequences of Default

Debt repayment plans often include consequences of default that can significantly impact a debtor. Failure to adhere to a repayment schedule, typically outlined in legal agreements, can result in serious repercussions. Key outcomes may include increased interest rates, often exceeding standard market averages of 15-20%, impacting total repayment amounts. Additionally, creditors may charge late fees, potentially adding $25-$50 per missed payment. Ongoing defaults could lead to damage to credit scores, with reductions of 100 points or more, affecting future borrowing capabilities. In severe cases, creditors reserve the right to initiate legal actions, which may lead to court judgments or garnishment of wages, where a portion of future earnings is automatically withheld. Overall, adhering to the repayment plan is crucial to avoid these significant financial consequences.

Signatures and Date

A debt repayment plan confirmation is a crucial document outlining the agreed terms between a debtor and creditor. The plan typically includes essential details such as the total amount owed (e.g., $10,000), agreed monthly payment (e.g., $500), repayment duration (e.g., 20 months), and the start date of payments (e.g., January 1, 2024). Signatures from both parties are imperative, signifying their consent and commitment to the terms outlined in the agreement. The date of signing should be clearly stated, serving as a reference point for the commencement of the repayment schedule. A witness signature may also add validity to the document, ensuring that all parties acknowledge their responsibilities.

Comments