Are you looking to finally close that old account you've been meaning to get rid of? In this article, we'll walk you through the essential steps to draft a letter confirming your account closure request, ensuring a smooth process. Whether it's a bank account, subscription service, or any other account, knowing how to communicate effectively can save you time and hassle. Ready to learn the ins and outs of crafting the perfect confirmation letter? Let's dive in!

Account Information Accuracy

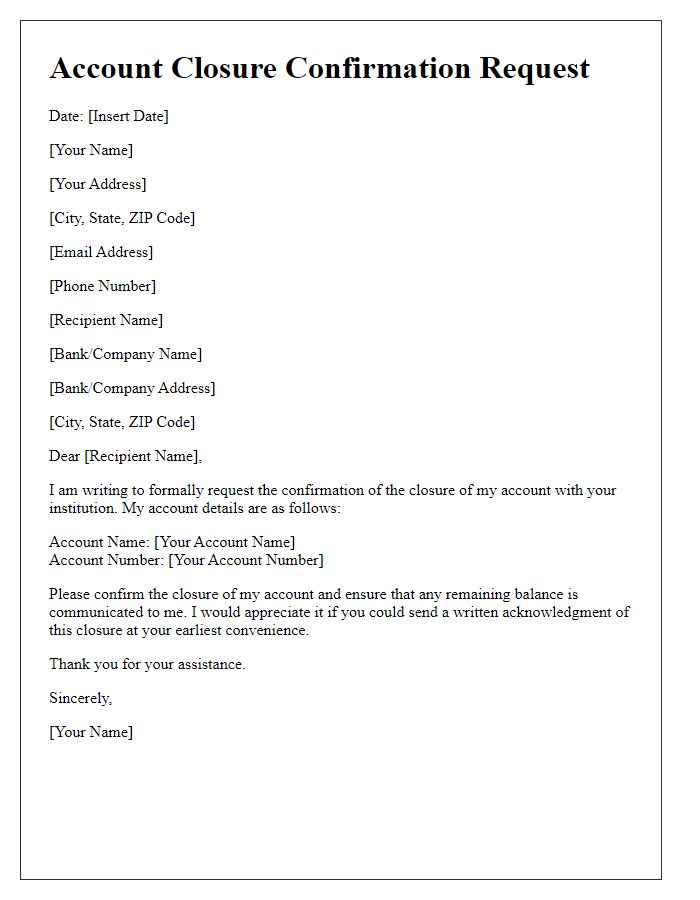

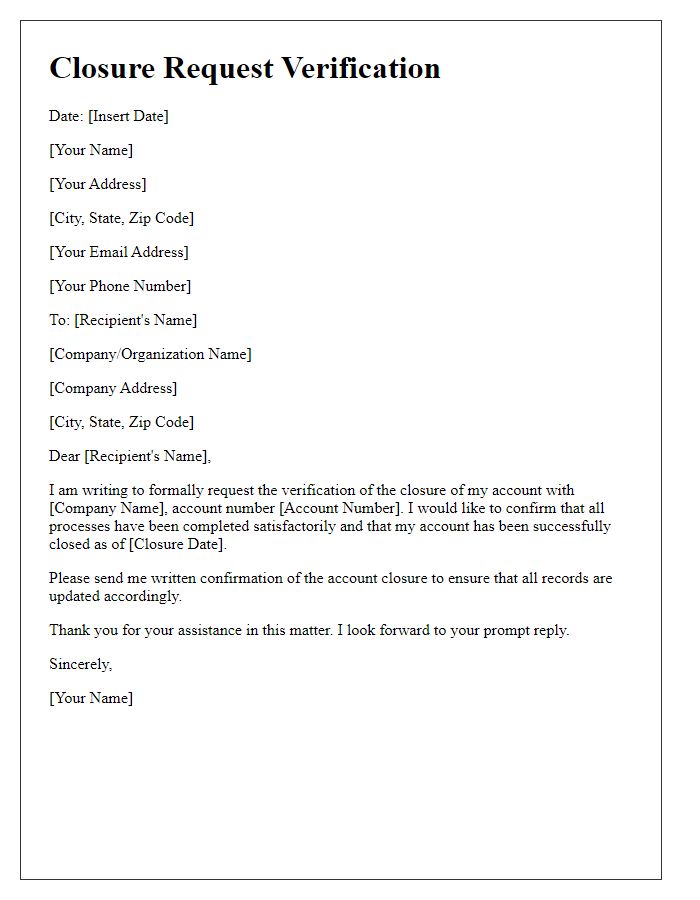

Account closure requests require attention to detail to ensure the accuracy of account information. Users must provide specific details, including account numbers, email addresses, and the reason for closure, which must be verified against the database. Additionally, personal identification elements, such as full names and addresses, are essential for confirmation. This process ensures that only authorized users can initiate account terminations, protecting against unauthorized access or errors. Prompt response times, often defined by company policy, influence user satisfaction during the closure process. After verification, users will receive confirmation via email, detailing completed actions and any remaining steps, such as clearing outstanding balances or retaining important information.

Confirmation of Closure Date

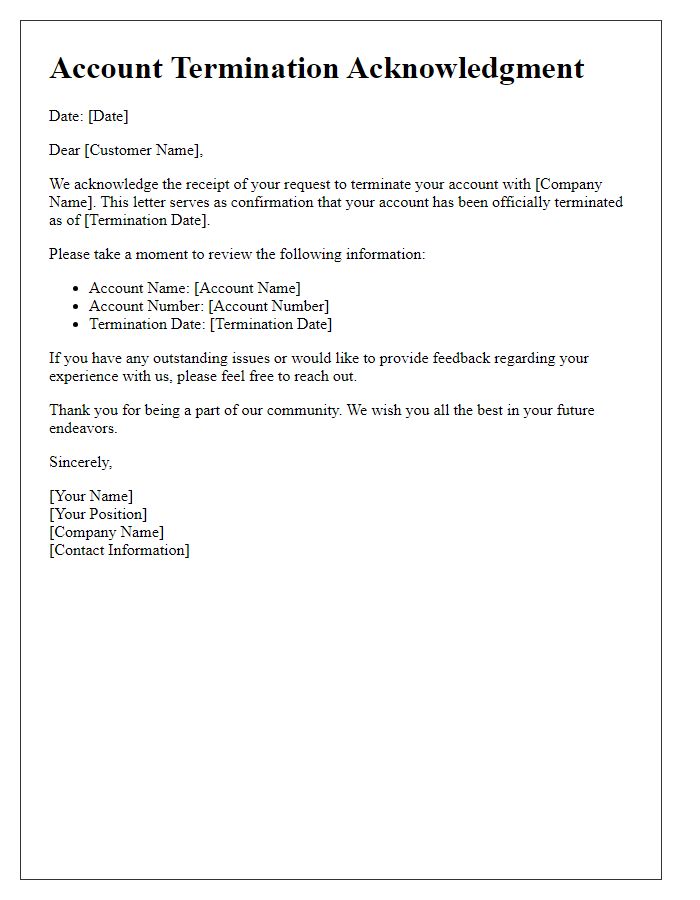

A confirmation of account closure request serves as a formal acknowledgment of the termination of financial relations with a banking institution or service provider. This document typically indicates a specific closure date, which may range from the initiation of the request to a period specified by the organization, often within 30 days. The account details, including the account number tied to the checking, savings, or credit account, are referenced for clarity. It is essential to provide contact information for any follow-up, ensuring customers can reach out for statements or any remaining balance inquiries. Furthermore, it may include affirmations regarding the fulfillment of terms and conditions, securing a transparent record for both parties involved.

Final Account Balance

Confirmation of an account closure request involves several key elements. A final account balance statement summarizes the total amount available prior to the closure. For instance, if the account closure request pertains to a savings account at a prominent bank like Wells Fargo, account holders should expect a confirmation notice detailing the last transaction history and outstanding balance, such as $1,500. Additionally, clients should be informed about any potential fees associated with the closure process, typically ranging from $10 to $50. The notice may specify a timeline for the closing process, often taking 5 to 7 business days, along with instructions on how to retrieve any remaining funds after closure. This communication plays a crucial role in ensuring clients have clarity about their financial standing during the transition.

Contact Information for Further Queries

Upon receiving the request for account closure, users must ensure that all relevant personal data and account information are accurately documented. Users should include contact details, such as an email address and phone number, for further queries, facilitating effective communication regarding any post-closure issues. It is essential to specify the primary reason for the account closure, whether for privacy concerns, financial dissatisfaction, or other personal reasons. Additionally, confirming the timeline for closure, typically within a period of 30 days after the request, provides clarity and reassures users. Users should also mention any pending transactions, outstanding balances, or promotional obligations associated with the account that may need resolution prior to finalization.

Security and Privacy Assurance

The account closure process involves several critical steps to ensure the security and privacy of user data. Upon receiving a closure request, a confirmation email is sent to the registered email address to verify the user's intent, providing a safeguard against unauthorized closure attempts. This email includes a unique reference code linked to the user's account, enhancing security. Once the user confirms the closure, data deletion protocols are initiated, following regulations such as GDPR (General Data Protection Regulation), which mandates complete removal of personal information within 30 days. Additionally, notifications are provided regarding the status of data retention periods, which may vary based on legal requirements. Users are encouraged to review privacy policy documentation related to the specific service, ensuring clarity regarding the implications of account closure and data management practices.

Comments