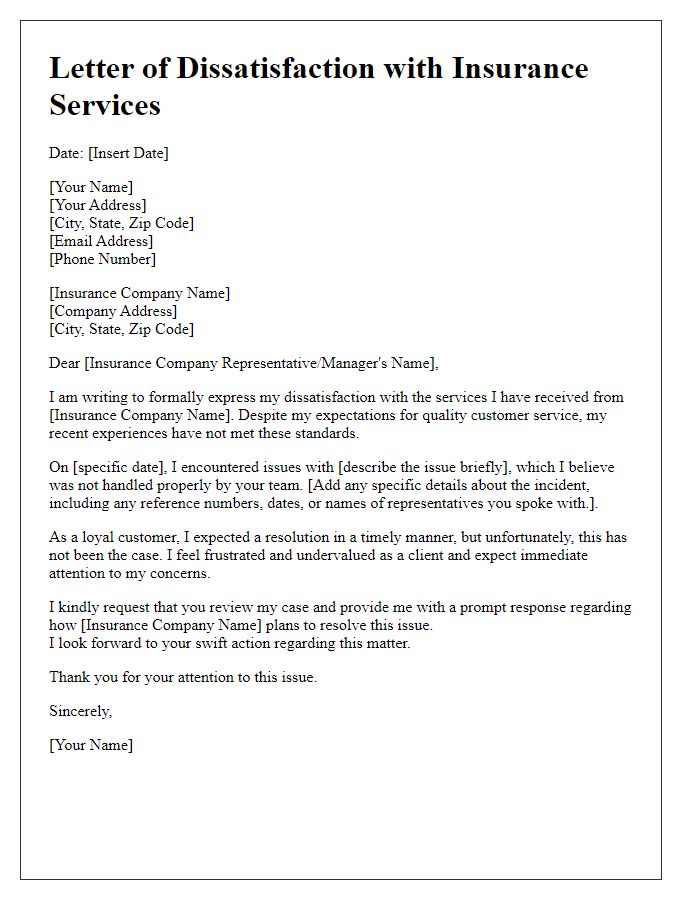

Dealing with insurance claims can feel a bit overwhelming, right? If you've ever found yourself frustrated over a denied claim or slow response times, you're not alone. In this article, we'll share a handy letter template specifically designed for lodging complaints with your insurance provider. Ready to make your voice heard? Let's dive into the details!

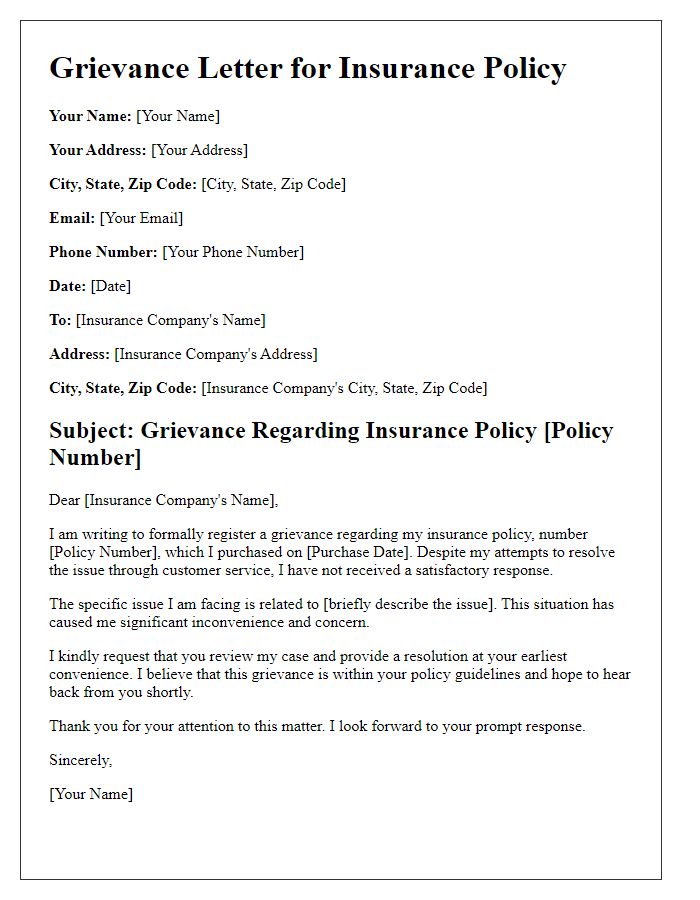

Policy Information

Insurance policies often include critical details that impact claims, including policy number, coverage limits, deductible amounts, and premium payments. For example, a homeowner's policy (HO-3) typically covers dwelling protection up to a specified limit, commonly ranging from $100,000 to $1 million, depending on the value of the property. The deductible, often between $500 and $2,500, determines the amount the policyholder must pay out-of-pocket before the insurance starts covering losses. Including specific policy details in complaints ensures proper identification in the insurer's records, facilitating a smoother resolution process and potentially expediting the claims investigation. Accurate policy information fosters effective communication on issues such as delayed claims processing or insufficient payout amounts.

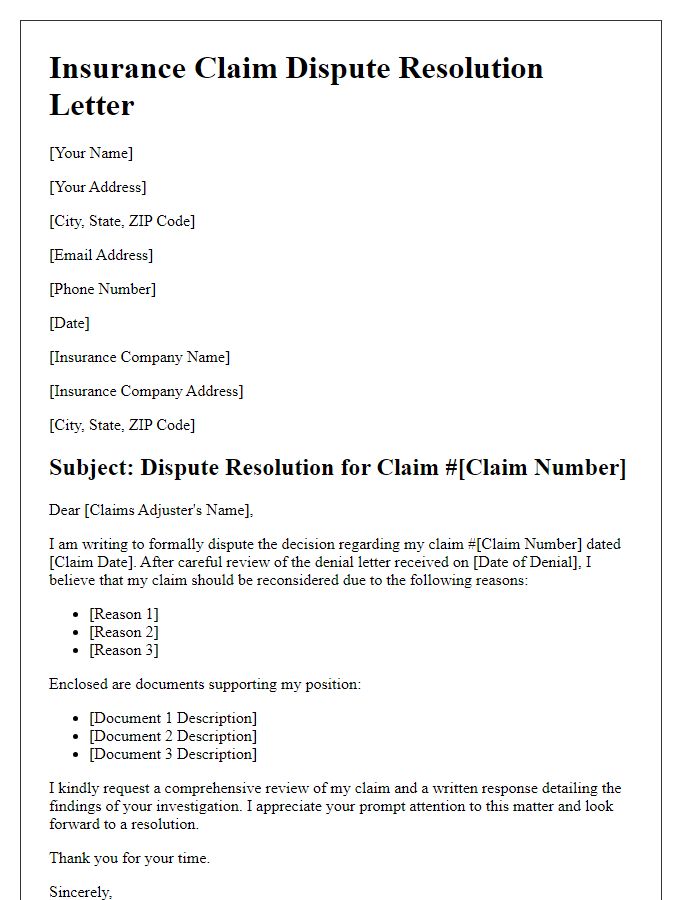

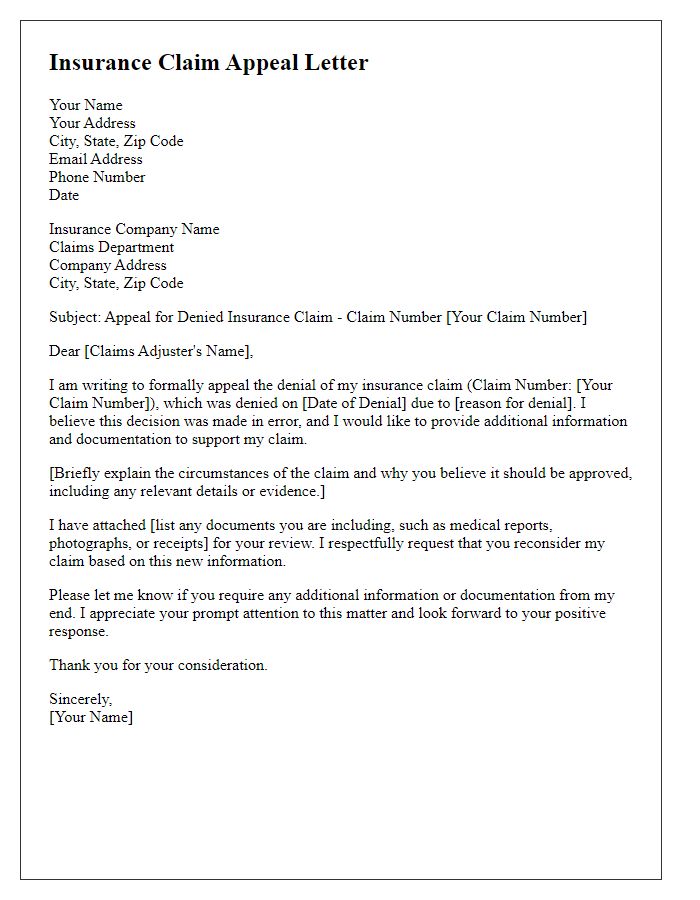

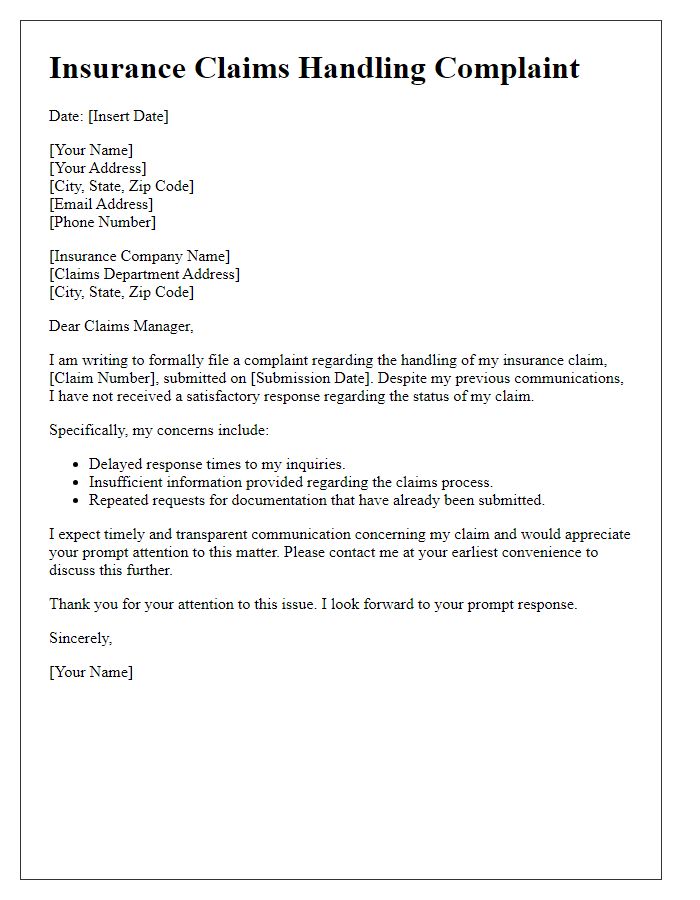

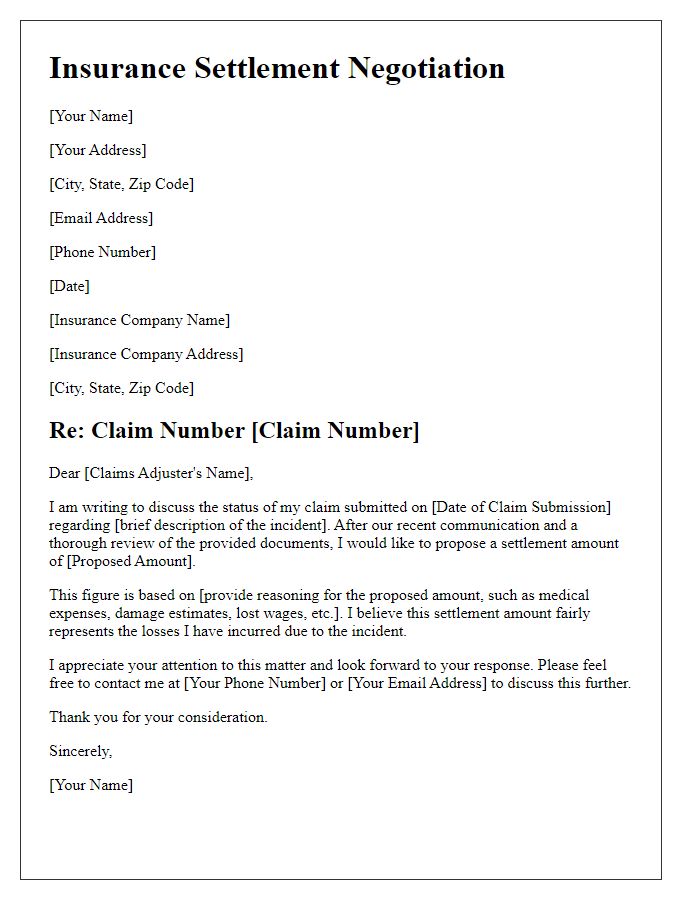

Claim Details

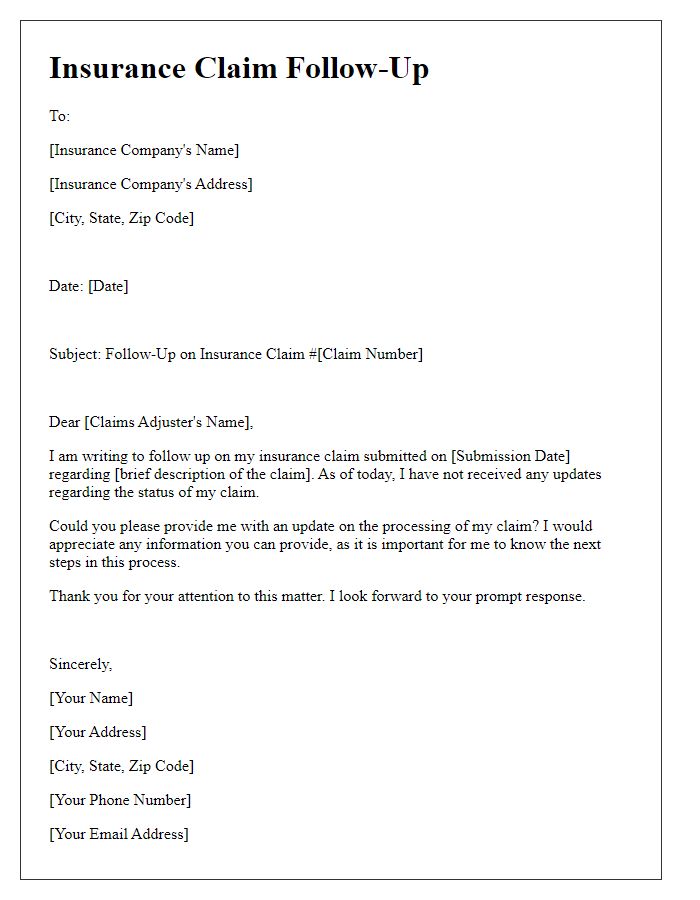

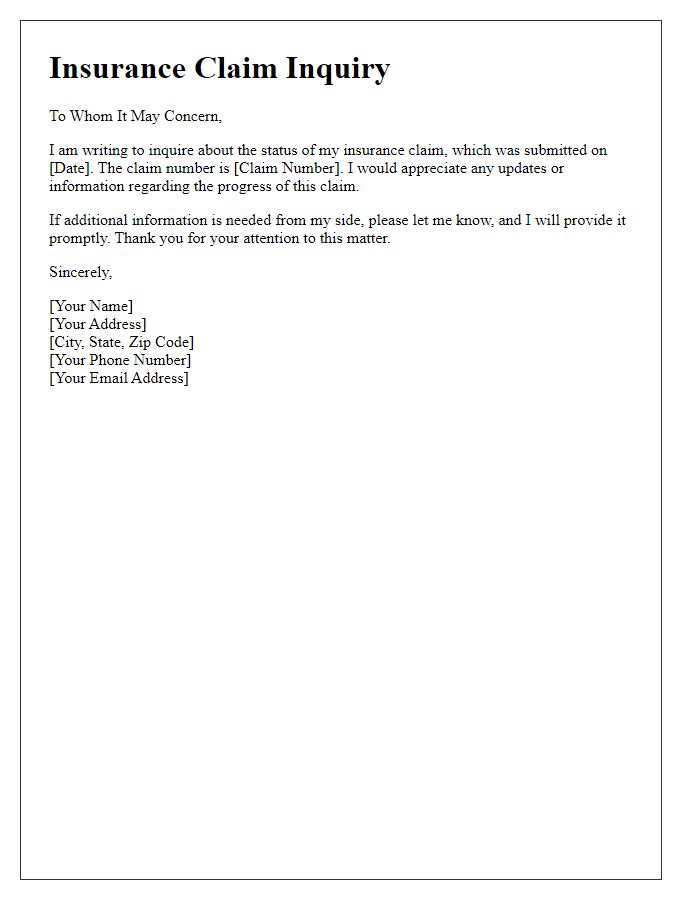

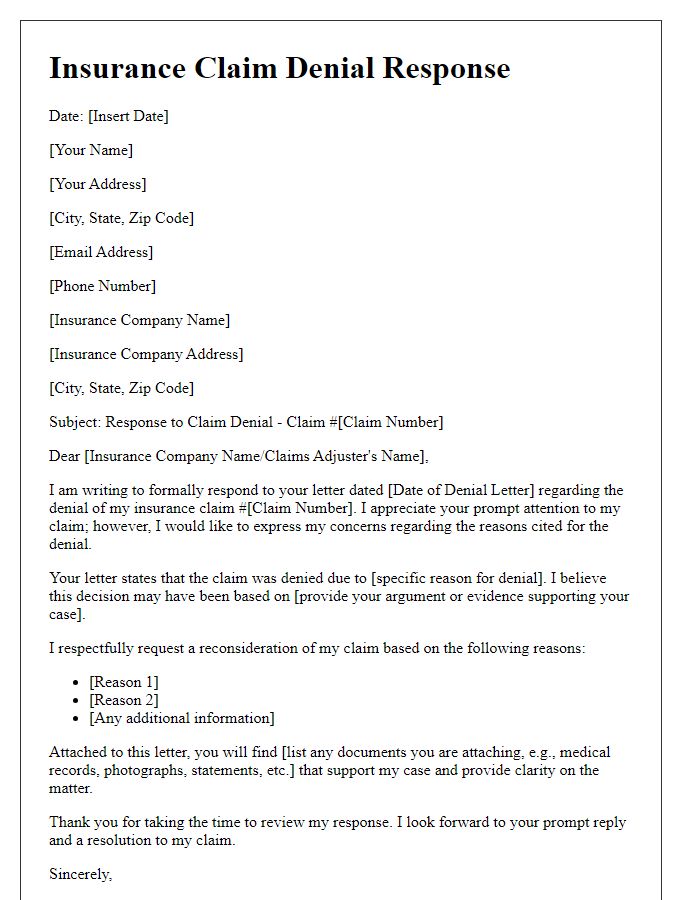

An insurance claim complaint involves several key components and details. The claim number typically assigned by the insurance agency identifies a specific case, allowing for efficient tracking and processing. Policyholders should include crucial dates such as the incident date (when the event leading to the claim occurred), the date of claim submission, and any follow-up dates for additional correspondence. It is essential to provide a thorough description of the incident or loss, detailing the circumstances, damages involved, and any relevant police reports or incident numbers. Furthermore, attaching supporting documents like photographs, repair estimates, or medical records can strengthen the case. Claims should reference specific policy details (policy number and coverage limits) to clarify entitlements. Note the expected response timeframes established by the insurance provider, typically ranging from 15 to 30 days for initial claims processing. Highlight any previous communication attempts with claims adjusters or representatives to demonstrate efforts made for resolution.

Supporting Documents

A comprehensive insurance claim requires various supporting documents to substantiate the request. Typical documents may include the claim form provided by the insurance company, photographs of the damage incurred, repair estimates from certified contractors, and previous correspondence related to the claim. Additional items like police reports for theft or accident claims, medical records for health-related incidents, and a list detailing personal property, including serial numbers and purchase receipts, enhance the claim's credibility. Furthermore, documentation proving the policyholder's identity, such as a government-issued identification card or utility bills, can facilitate a smoother claims process. Properly organizing and submitting these documents ensures the insurance company has all necessary information to assess the claim efficiently.

Resolution Requested

Insurance claims can lead to dissatisfaction amongst policyholders when resolution delays occur. The claim process might take weeks or months, particularly for complex damages like natural disasters, motor vehicle accidents, or significant property losses. Customers often encounter frustrating obstacles, like inadequate communication from insurance representatives, confusing claim forms, or unclear coverage details in their policy documents. High-stress situations resulting from unexpected events can amplify the need for timely compensation. Effective resolution requires prompt response times from dedicated claims adjusters, clarity in the documentation process, and transparency in the overall investigation of the claim's validity. Prompt resolution greatly enhances trust in insurance providers and increases customer satisfaction.

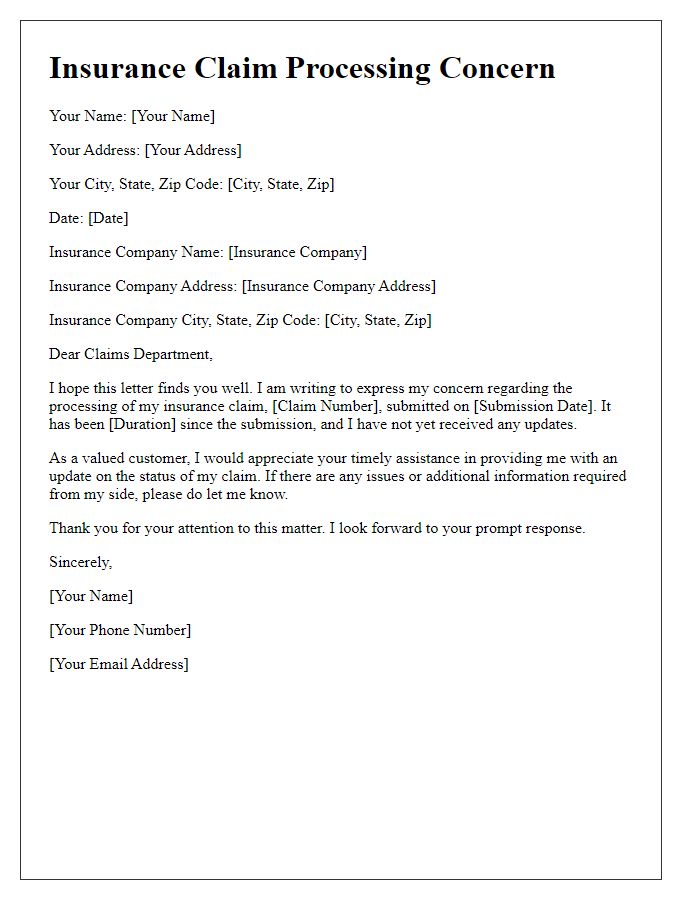

Contact Information

Insurance claim complaints often require clear communication of personal details and outlined issues. Key elements include full name, policy number associated with the claim, and contact telephone number, ensuring the insurance company's claims department can easily reach the individual. Providing an email address can facilitate faster correspondence. Details about the specific claim, including dates of incidents, damage amounts, and reference numbers, should be documented concisely. Accurate information aids in expediting the resolution process, improving chances for satisfactory outcomes in claims-related disputes.

Comments