Are you feeling stressed about inaccuracies on your credit report? You're not aloneâmany people face this frustrating issue, and it's essential to address it promptly. In this article, we'll guide you through a simple and effective complaint letter template that can help you tackle discrepancies and ensure your credit report reflects your true financial status. Stick around as we dive into the details and arm you with the tools you need to take action!

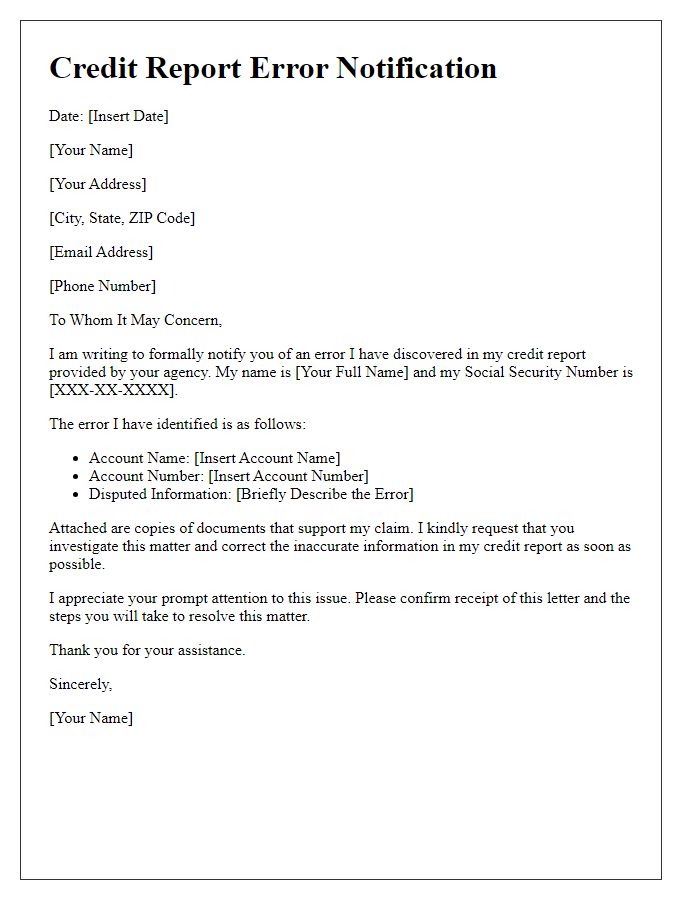

Accurate account information

Inaccurate credit report information can significantly impact an individual's financial health. A credit score, which ranges from 300 to 850, affects loan approvals and interest rates. Reporting errors often stem from mistakes by credit bureaus like Experian, Equifax, and TransUnion, which maintain data for millions of consumers. A discrepancy, such as an incorrect account balance or a misleading late payment, can emerge from data input errors, outdated information, or identity theft incidents, leading to serious repercussions. Timely correction of such inaccuracies is critical, especially since a recent survey indicated that about 79% of consumers found at least one mistake on their credit report, highlighting the importance of vigilance in managing credit history.

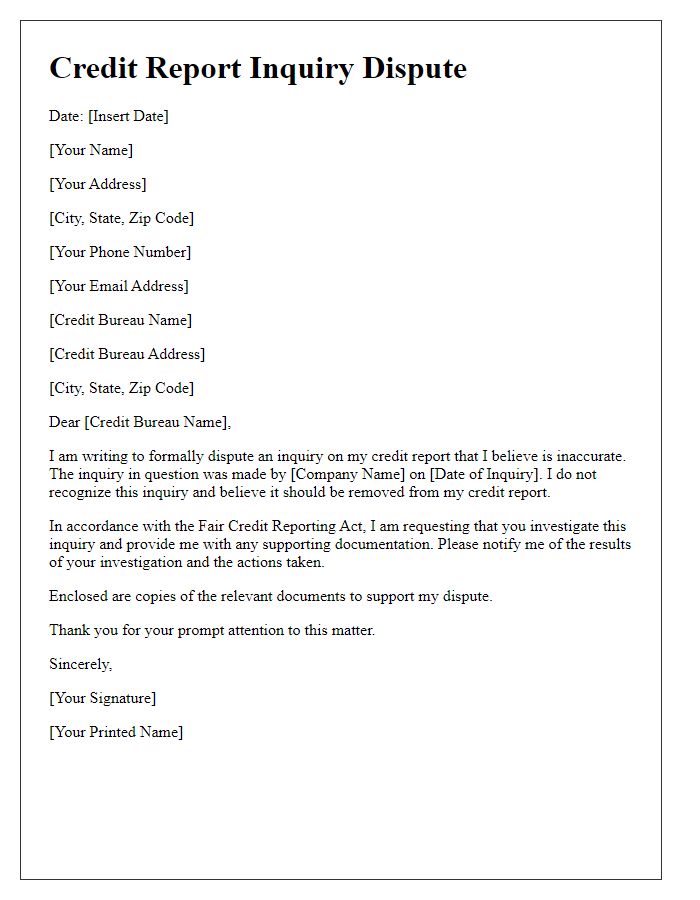

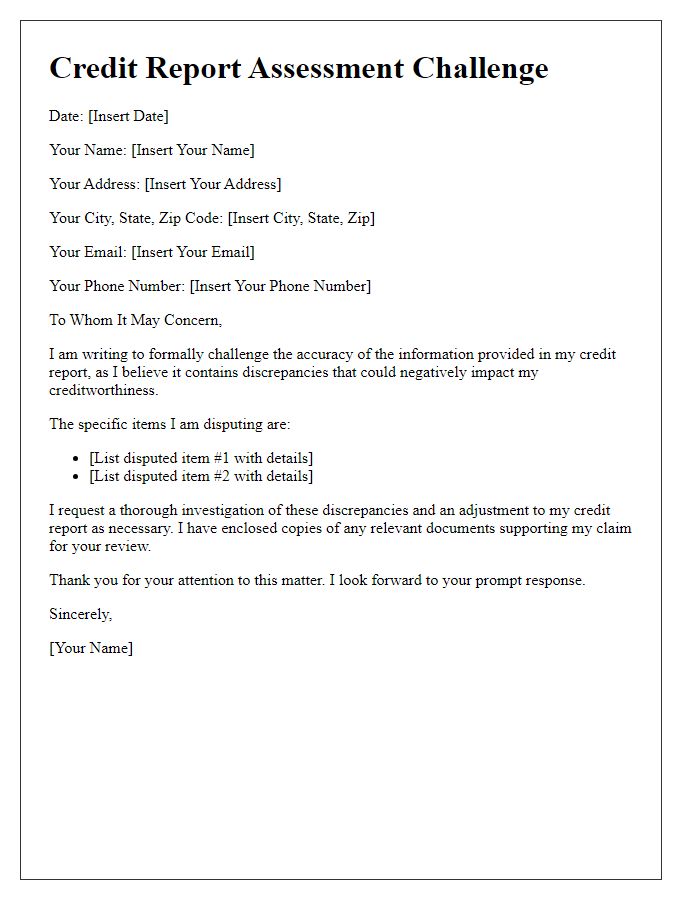

Dispute reason details

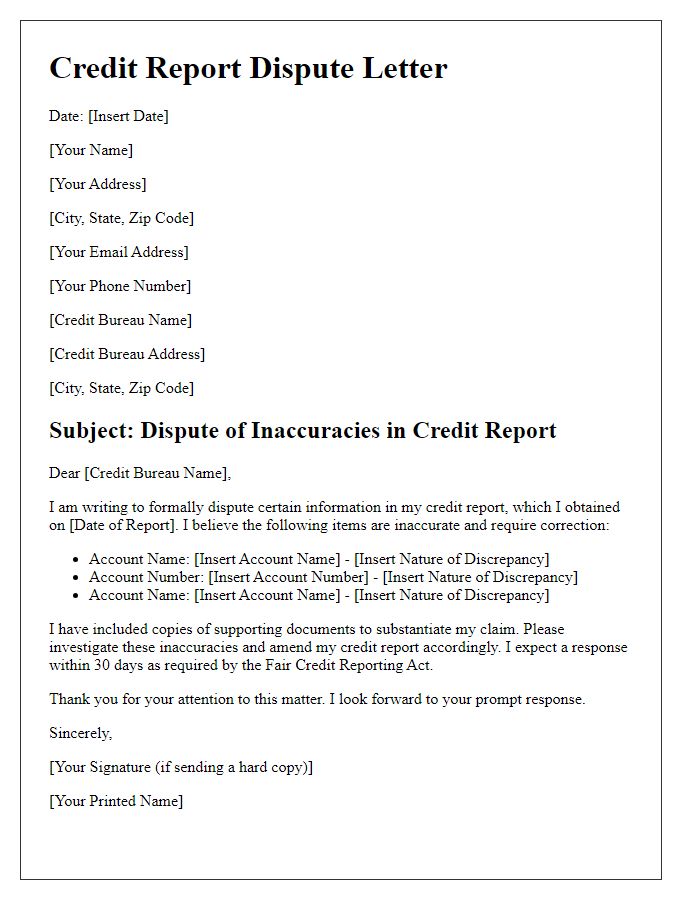

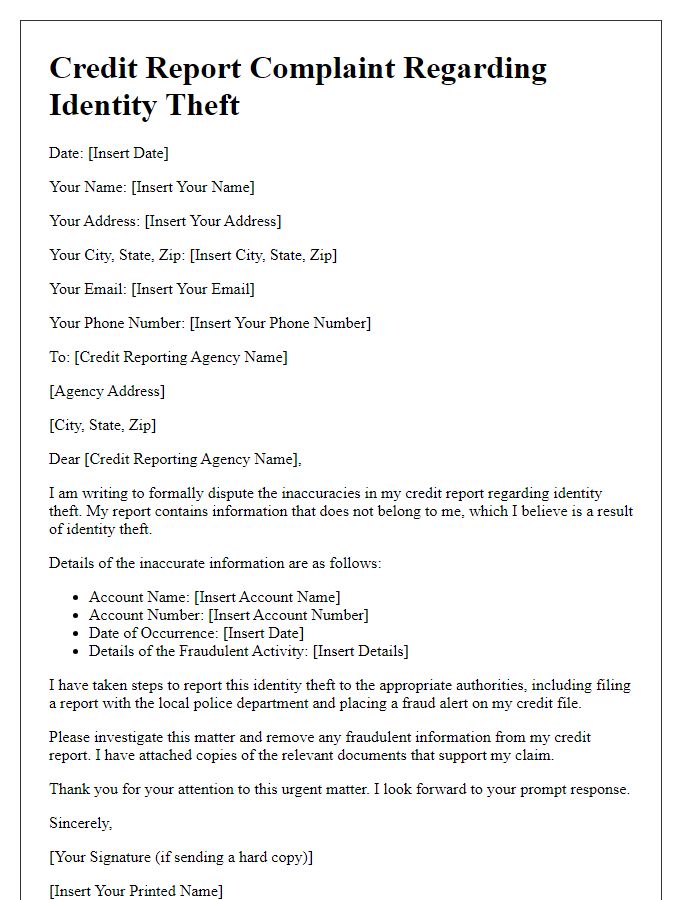

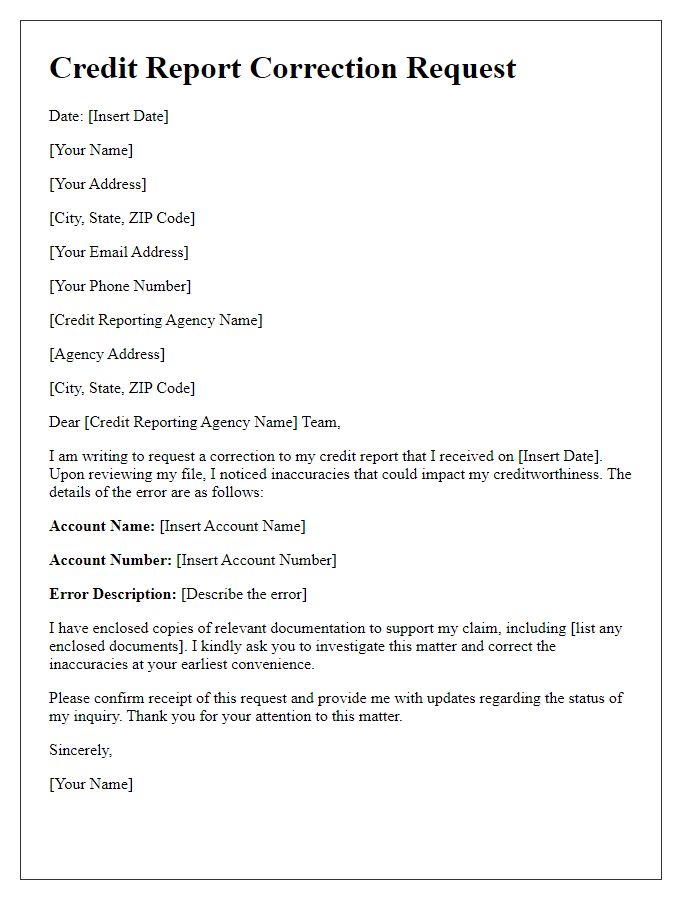

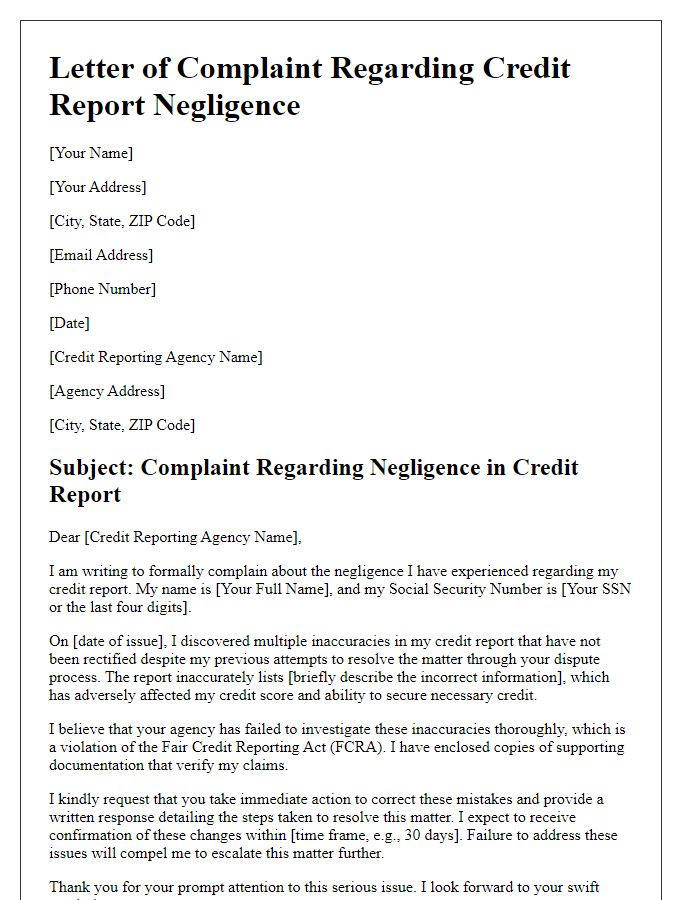

A credit report complaint can arise due to inaccuracies in reported information on consumer credit files, such as Experian, Equifax, or TransUnion reports. Common disputes may include errors in personal information (like name, address, or Social Security number), incorrect account statuses (like paid accounts listed as delinquent), or accounts that do not belong to the individual. For instance, a mistaken account may arise when a debt collector incorrectly reports a balance for debts not incurred by the individual, leading to potential harm in loan applications or interest rates. Correcting these errors is essential to maintaining a healthy credit score, which is a numerical representation of creditworthiness that significantly impacts financial opportunities. Accurate credit reporting is governed by the Fair Credit Reporting Act (FCRA), which mandates timely investigations of disputes within 30 days, aiming to protect consumer rights throughout the process.

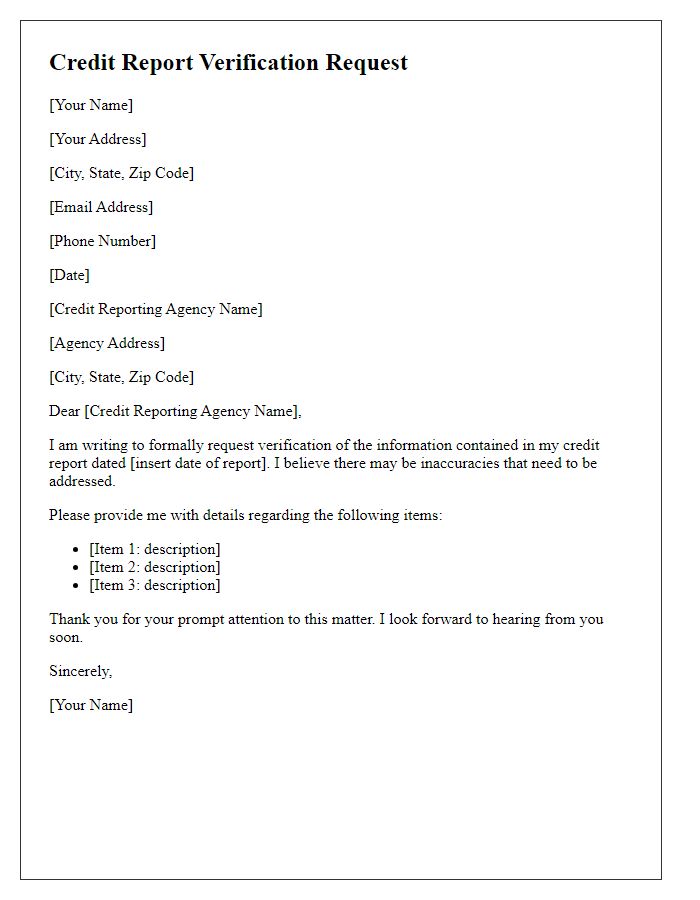

Supporting documentation

When disputing errors on a credit report, it is crucial to include supporting documentation to enhance the credibility of the claim. Key documents may include credit reports obtained from major bureaus--Equifax, Experian, TransUnion--highlighting disputed items. A copy of the previous correspondence with creditors, displaying attempts to resolve discrepancies, serves as evidence of diligence. Any account statements from financial institutions, showing payment history and current balances, provide context for the dispute. Additionally, receipts from payments or correspondence, such as emails and letters, validating claims can strengthen the case. Properly organized documentation helps ensure that the claim is taken seriously by credit agencies.

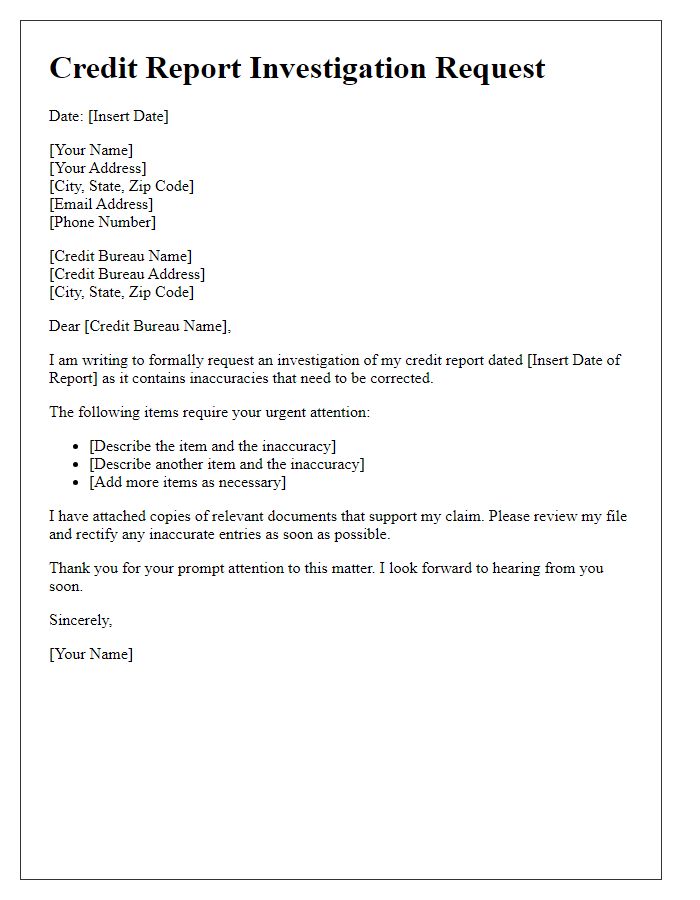

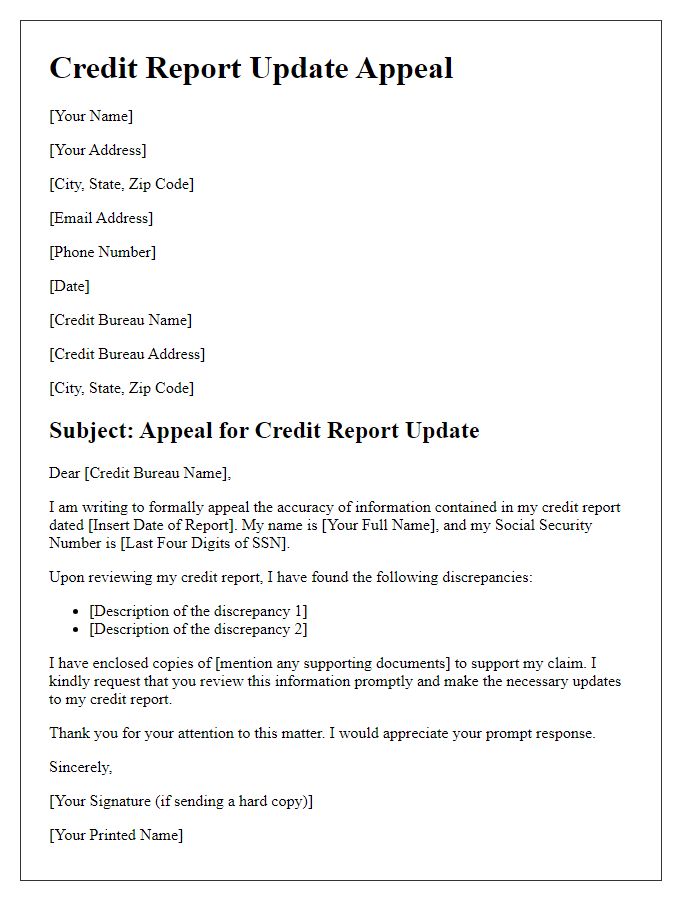

Formal request for correction

A credit report complaint may arise due to inaccuracies in payment history or incorrect personal information listed by major agencies like Experian, Equifax, or TransUnion. Such discrepancies can impact one's credit score, which ranges from 300 to 850, influencing loan approvals and interest rates. A formal request for correction should include specific details like the report number, date of issuance, and a clear outline of the inaccuracies found. Additionally, relevant documentation such as bank statements or correspondence with creditors must be included to support claims. Addressing these inaccuracies is crucial, as a 100-point drop in a credit score can significantly alter loan terms and affect financial opportunities.

Contact and follow-up instructions

A credit report complaint can arise from inaccuracies in personal financial data, which may impact credit scores negatively. Individuals experiencing discrepancies should reach out to the credit reporting agency, such as Equifax, TransUnion, or Experian, via their designated customer service hotline or online dispute resolution portals. It is recommended to provide essential documentation, such as proof of identity (e.g., government-issued ID) and relevant account details (e.g., loan or credit card numbers). Follow-up instructions typically emphasize the importance of tracking the dispute's progress by retaining reference numbers and noting any communication dates for future inquiries. The Fair Credit Reporting Act mandates the agency to address disputes within 30 days, ensuring consumers' rights are protected during the process.

Comments