Have you ever received a bill that made you do a double take? Overbilling can be frustrating and leave you questioning your service provider's integrity. It's important to address these issues promptly and effectively to ensure that you're not paying more than you should for the services you use. Join me as we explore how to craft a compelling complaint letter to tackle overbilling effectively!

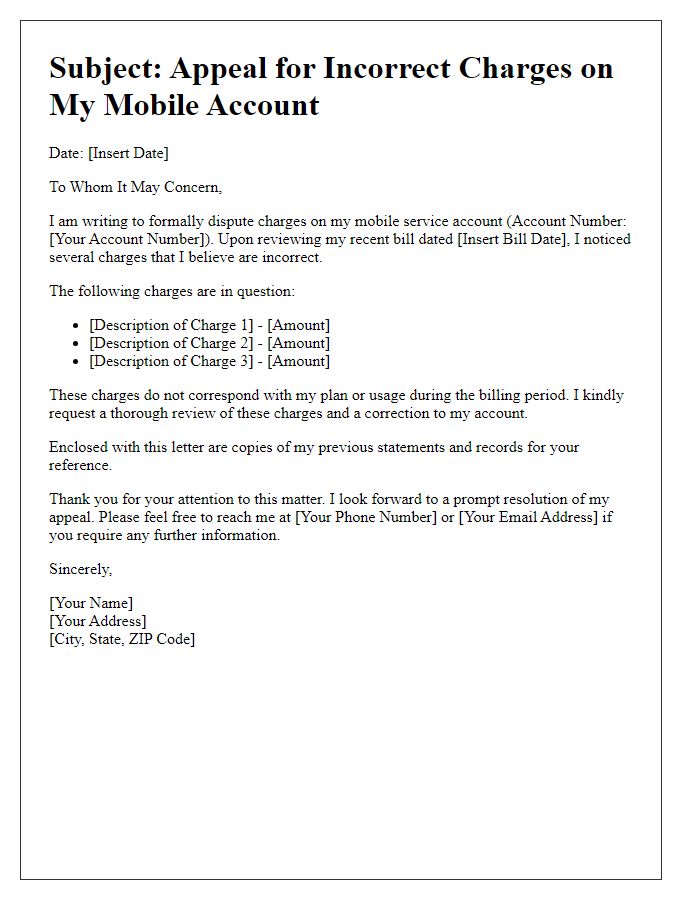

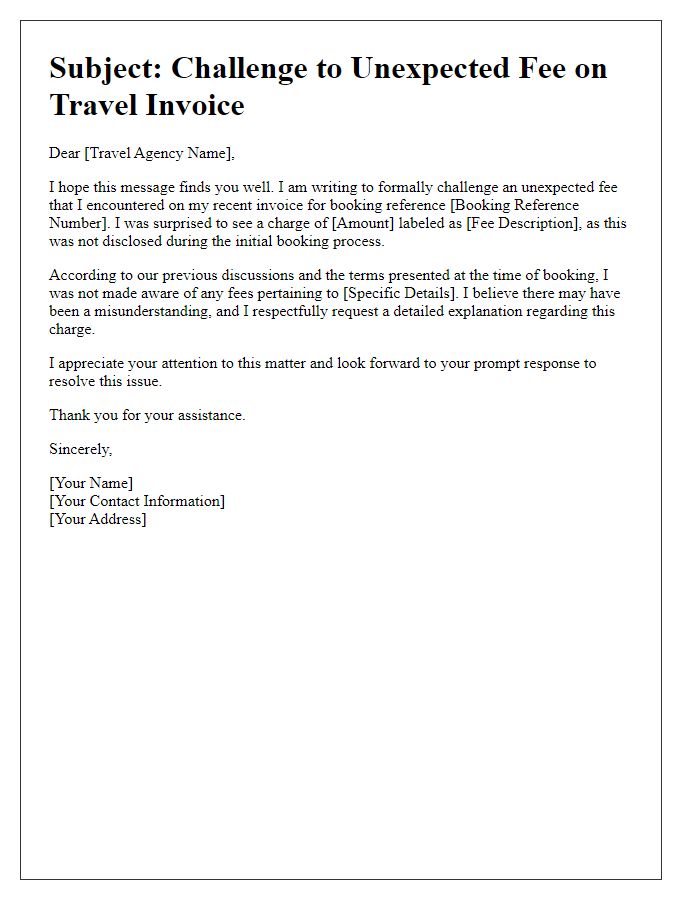

Clear Subject Line

A recent review of billing statements indicates discrepancies regarding service charges from XYZ Service Provider. Charges dated between January and March 2023 show a total increase of 25% compared to previous months, leading to confusion about potential service upgrades or rate changes. For instance, the monthly plan costs for standard internet services typically amount to $49.99, yet the recent bill reflects a charge of $62.49 without prior notification. Additionally, the detailed breakdown of services lacks itemization, making it challenging to identify specific line items contributing to the overall total. Immediate clarification on this matter is necessary to resolve overbilling issues and avoid future billing errors.

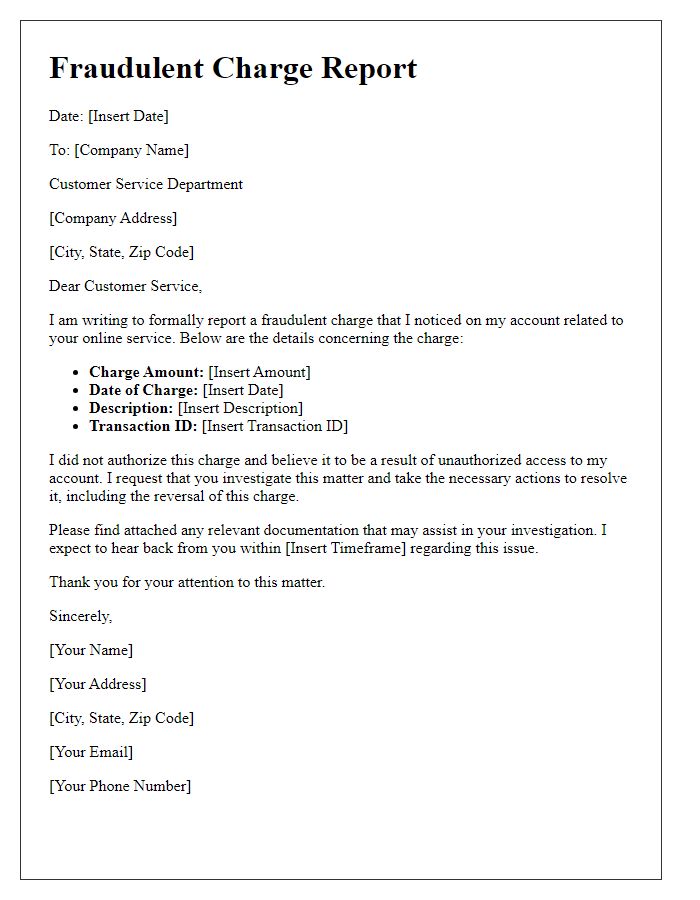

Account and Billing Details

Overbilling by service providers can lead to significant frustrations for consumers, especially when examining account statements. For instance, a telecommunications company may mistakenly charge an individual $150 instead of the agreed $100 monthly fee due to an error in their billing system. This discrepancy often arises from automated systems failing to update promotional discounts or adjustments, resulting in inflated charges. Additionally, customers may notice unexpected fees, such as a $20 late payment penalty, even if payments were made on time, causing confusion and dissatisfaction. Addressing such issues promptly with clear documentation, including account numbers and the billing cycle dates, is essential for a swift resolution.

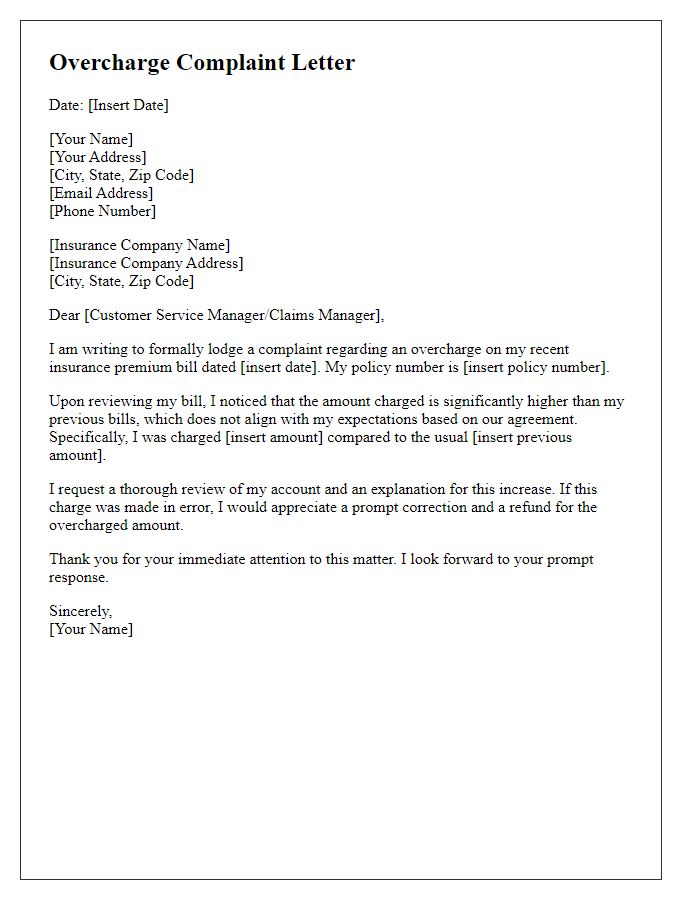

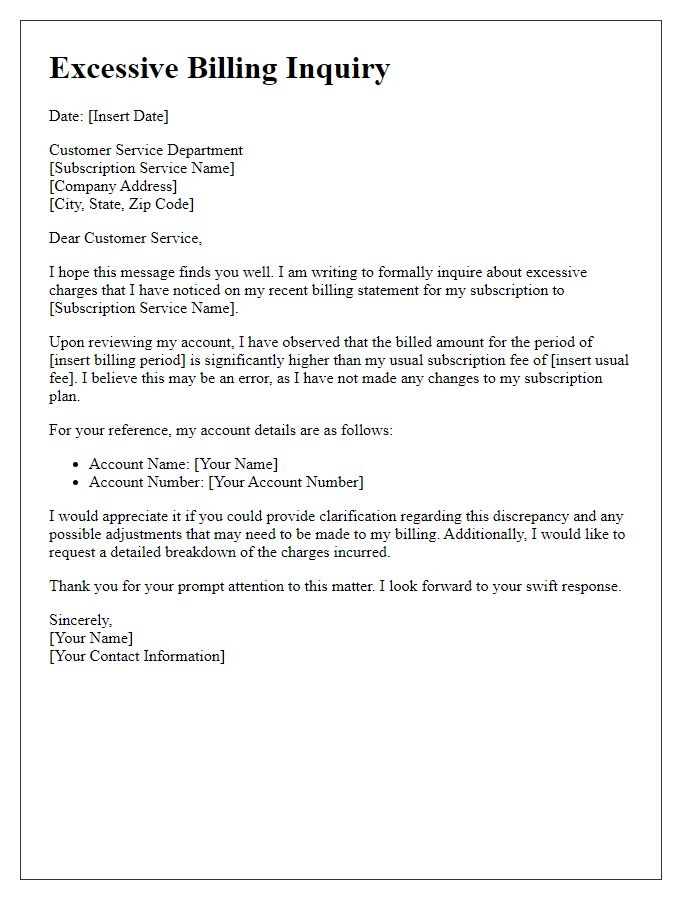

Description of Overbilling Issue

Customers frequently encounter overbilling issues with service providers, leading to significant financial discrepancies. For instance, a client may receive a monthly bill of $150 instead of the agreed-upon amount of $100, resulting in a 50% overcharge. Miscalculations in billing cycles, incorrect application of discounts, and failure to update previous billing adjustments often contribute to these errors. In scenarios where services are bundled, incorrect pricing for individual components can further exacerbate the issue. Accurate documentation, such as previous invoices or promotional offers, becomes essential evidence when addressing these discrepancies with customer service representatives. Resolving overbilling issues promptly can restore customers' trust and maintain long-term relationships.

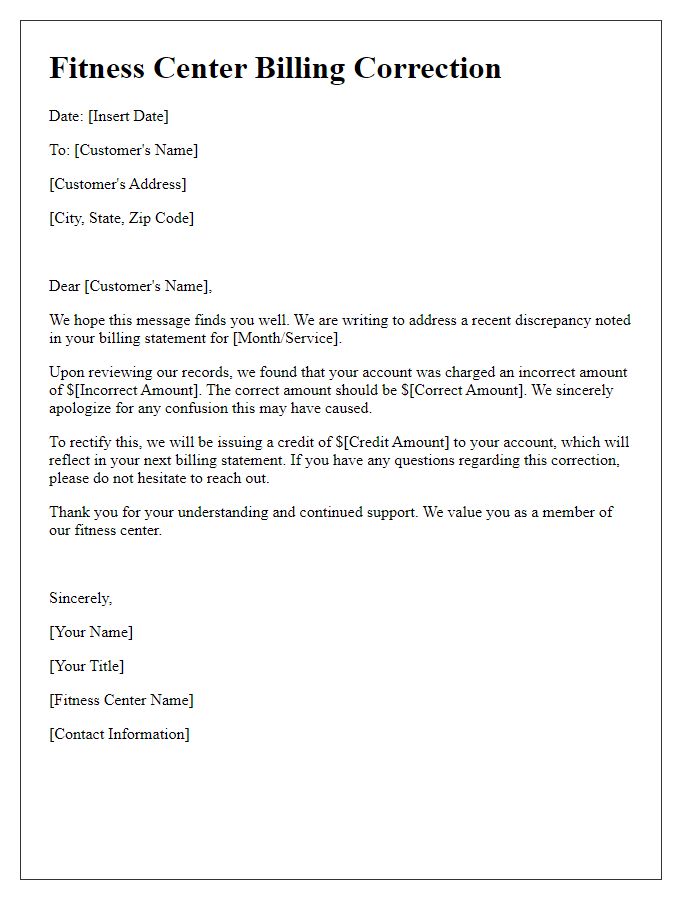

Request for Resolution and Deadline

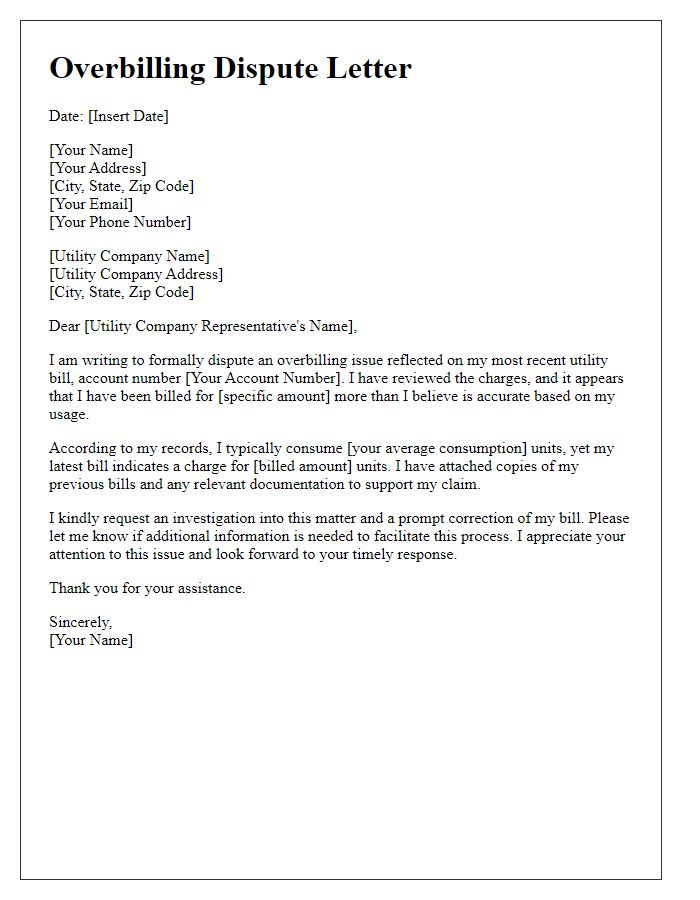

Overbilling complaints often arise in the context of utility services, such as electricity, water, or internet providers. When a customer receives a bill that exceeds the expected amount, concerns about the accuracy of metering or service charges emerge. Customers may notice discrepancies in charges reflecting erroneous rates or unaccounted usage. In such instances, documentation related to past billings and service agreements becomes crucial for clearly illustrating the inconsistency. Furthermore, regulatory bodies often exist in specific regions, such as the Public Utility Commission in the United States, which oversees billing practices. Customers typically request a thorough investigation of their account along with a prompt resolution, often specifying a deadline of 30 days for the provider to address the issue adequately.

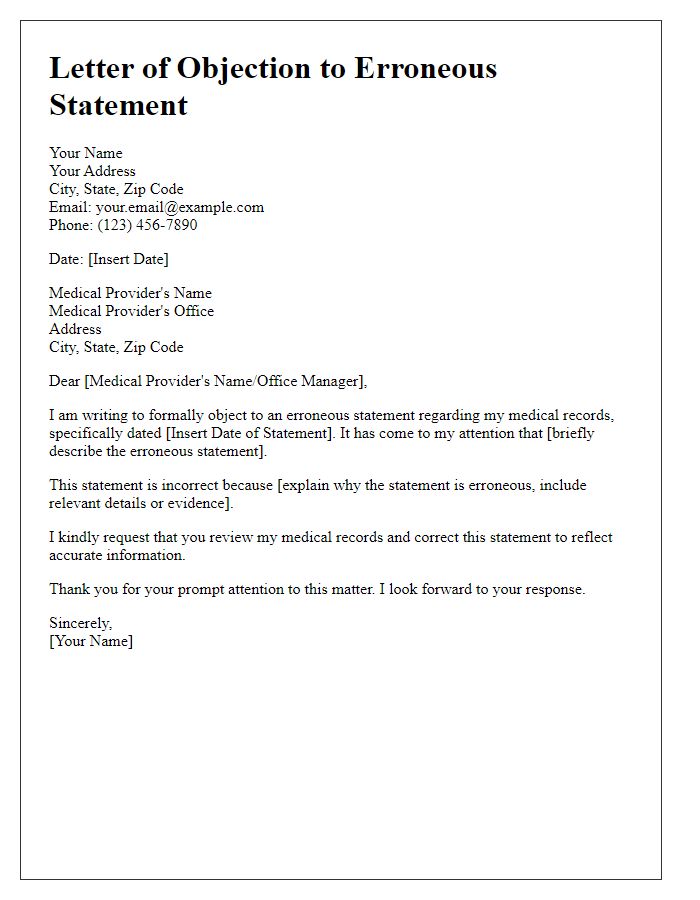

Contact Information and Signature

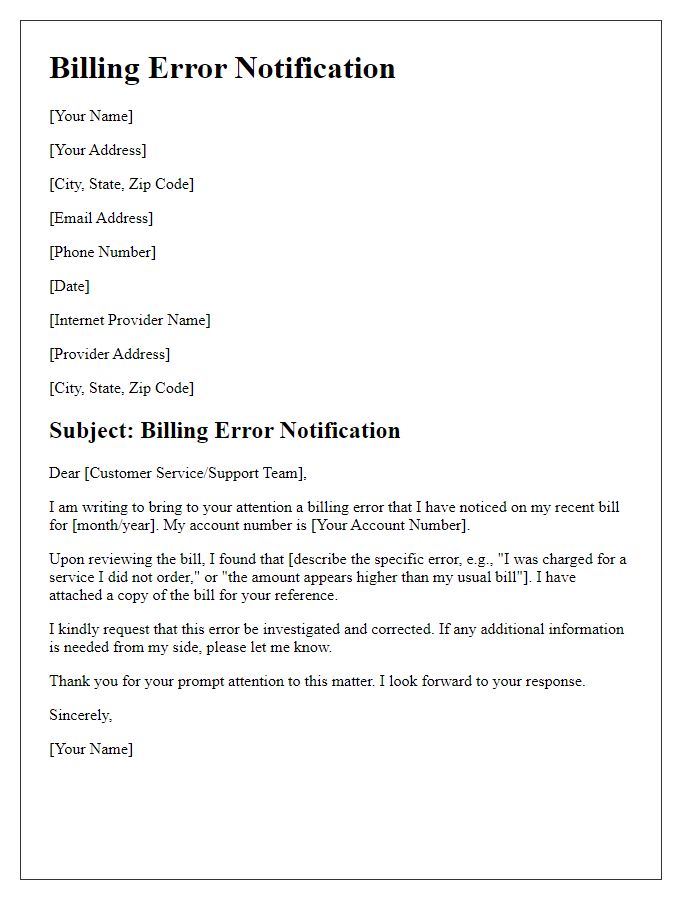

Inaccurate billing practices frequently lead to customer dissatisfaction within service industries. For instance, a monthly utility bill may exceed the expected amount by 20%, resulting in consumer confusion and frustration. This discrepancy often requires contacting customer service departments to clarify and rectify the situation, potentially involving multiple phone calls or emails. Resolution timelines can vary widely, ranging from 48 hours to several weeks, influencing customer trust. Additionally, thorough documentation, including account details, billing statements, and previous communications, significantly aids in the dispute process, ensuring accurate tracking of the resolution.

Letter Template For Overbilling Complaint To Service Provider Samples

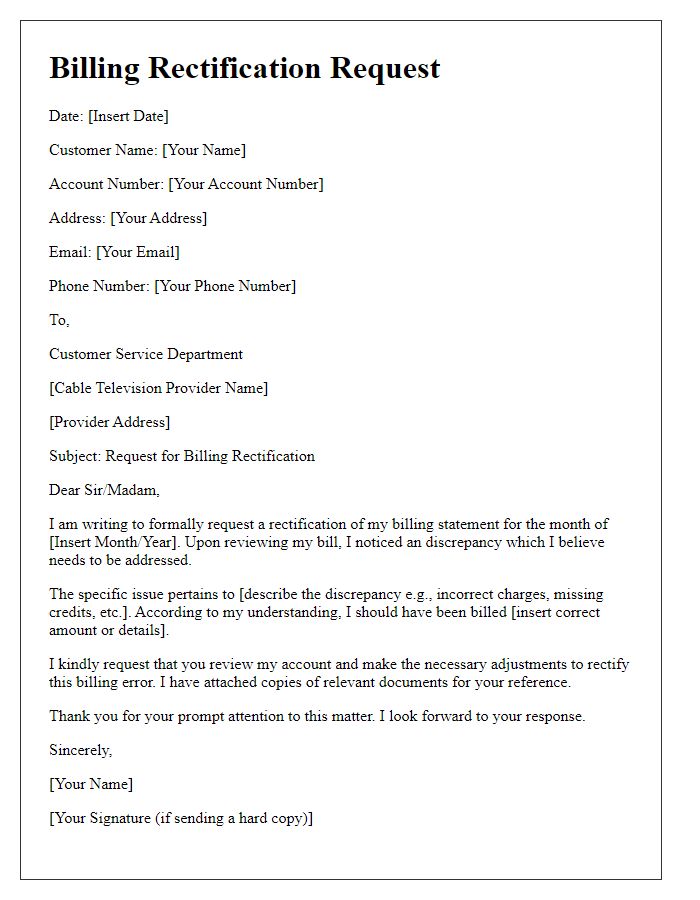

Letter template of billing rectification request for cable television provider.

Comments