Are you feeling frustrated by unexpected deductions on your recent paycheck? You're not aloneâmany individuals encounter this perplexing issue, leaving them wondering where their hard-earned money has gone. In this article, we'll guide you through the steps to effectively address these unexplained deductions and express your concerns to your employer. So grab a cup of coffee, settle in, and let's dive into how you can reclaim your peace of mind and finances!

Accurate account details and information

Unexplained deductions from bank accounts can create financial confusion for consumers. A typical case involves discrepancies in monthly statements from financial institutions, like Bank of America or Chase, where unauthorized charges appear unexpectedly. These deductions, sometimes amounting to several hundred dollars, affect budgeting and can lead to overdraft fees if the account balance drops below the required threshold. The consumers often seek clarification regarding unclear transaction descriptions, which may include vague terms such as "service fee" or "monthly maintenance charge". All account holders should closely monitor their statements, report inconsistencies promptly to customer service representatives, and maintain accurate records of transactions for effective dispute resolution.

Clear description of deductions

Unexplained deductions from paychecks, such as fees or taxes not previously discussed, can lead to financial discrepancies for employees. For instance, a deduction of $150 labeled as "administrative fee" appearing on a paycheck dated March 15, 2023, raises questions, particularly when employees were not informed of this fee during onboarding in January 2022. Similarly, deductions tied to health insurance plans can create confusion; an unexplained $75 deduction for a plan not selected by an employee can cause budget planning issues. In addition, recurring deductions without explanation, like a bi-weekly amount for "miscellaneous charges," need clarification to ensure transparency in payroll processes. Documenting each deduction's date, amount, and description allows individuals to address discrepancies effectively with their employer or payroll department.

Evidence of transactions or statements

Unexplained deductions from bank accounts can lead to financial discrepancies, causing distress among account holders. Numerous account holders, especially in metropolitan areas like New York City, report discrepancies due to unauthorized withdrawals or fees. For instance, transaction statements from August 2023 show unexpected charges labeled as "service fees," amounting to $150 in total, which were not agreed upon in the initial account terms. Unattended, these irregularities may affect budgeting, leading to potential overdraft situations and damaging credit scores. Documenting evidence of these transactions is crucial for addressing the issues with the financial institution, as thorough records, including bank statements and transaction receipts, provide necessary support for claims.

Specific request for resolution or action

Unexplained deductions from a bank account can lead to significant financial distress for account holders. In many instances, individuals discover these deductions during monthly statements, leading to confusion regarding their origin. Common sources of these deductions may include service fees, erroneous charges, or unauthorized transactions. For individuals engaged with institutions such as Chase Bank or Bank of America, immediate clarification is often sought through customer service channels. A specific request for resolution involving a detailed account review can enhance transparency, ensuring that unnecessary fees are rectified. Furthermore, a request for written confirmation of the findings can serve as a record for future reference, safeguarding account holders against potential repeated errors.

Contact details for follow-up communication

Unexplained deductions from bank accounts can create significant inconvenience for account holders. These deductions, often occurring without prior notification, can arise from various sources such as service charges, fees, or unauthorized transactions. Individuals affected by these deductions might find discrepancies in their monthly statements, outlining reductions that are not accounted for. This situation can lead to increased frustration, prompting the need for immediate clarification from financial institutions. Providing contact details, such as customer service phone numbers or emails, enables a smoother resolution process, facilitating follow-up communication between the customer and the institution to rectify the issue effectively.

Letter Template For Complaint About Unexplained Deductions Samples

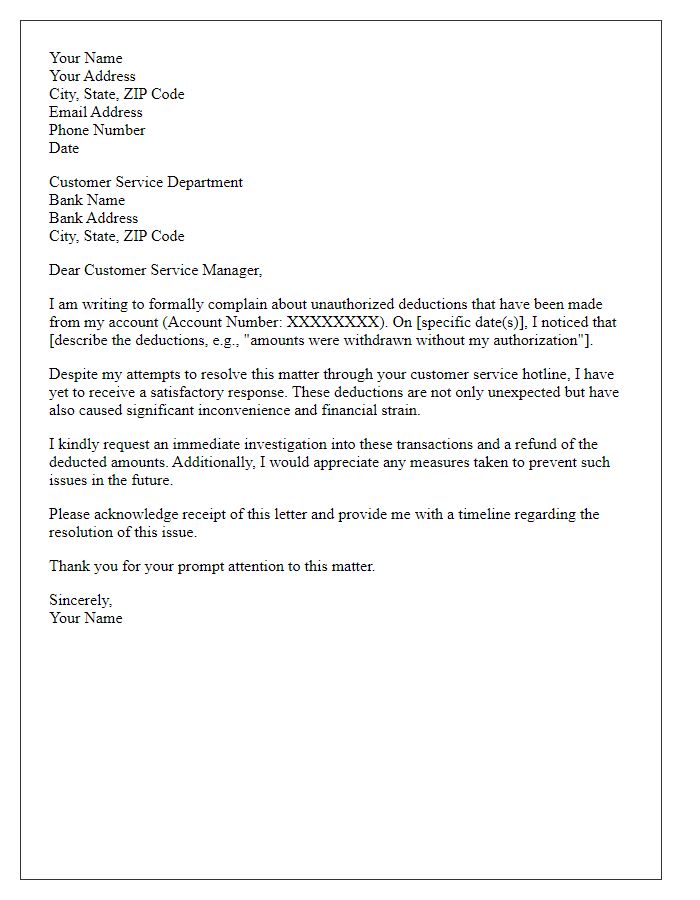

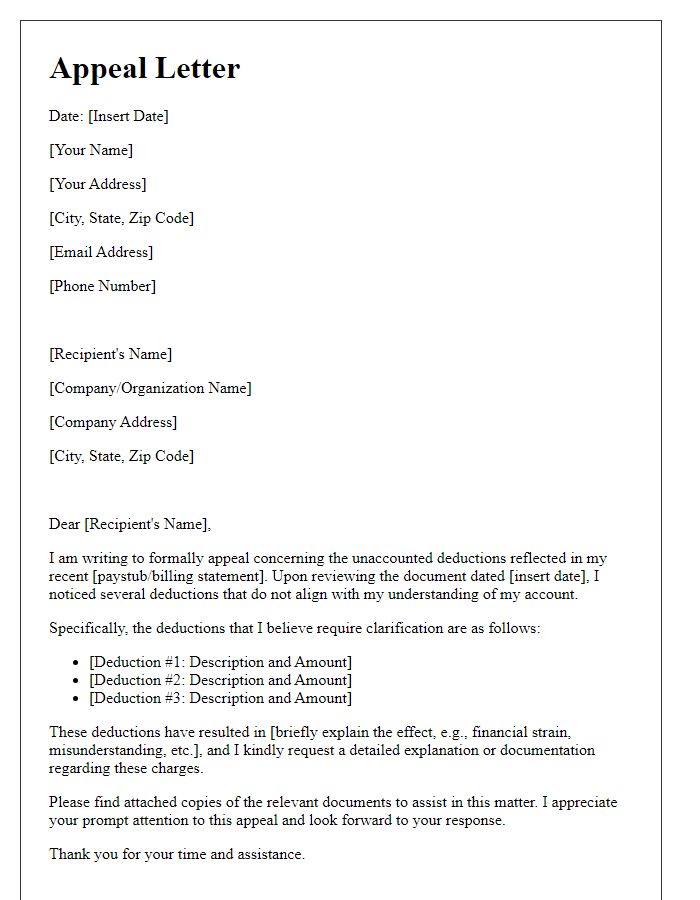

Letter template of complaint regarding unauthorized deductions from my account.

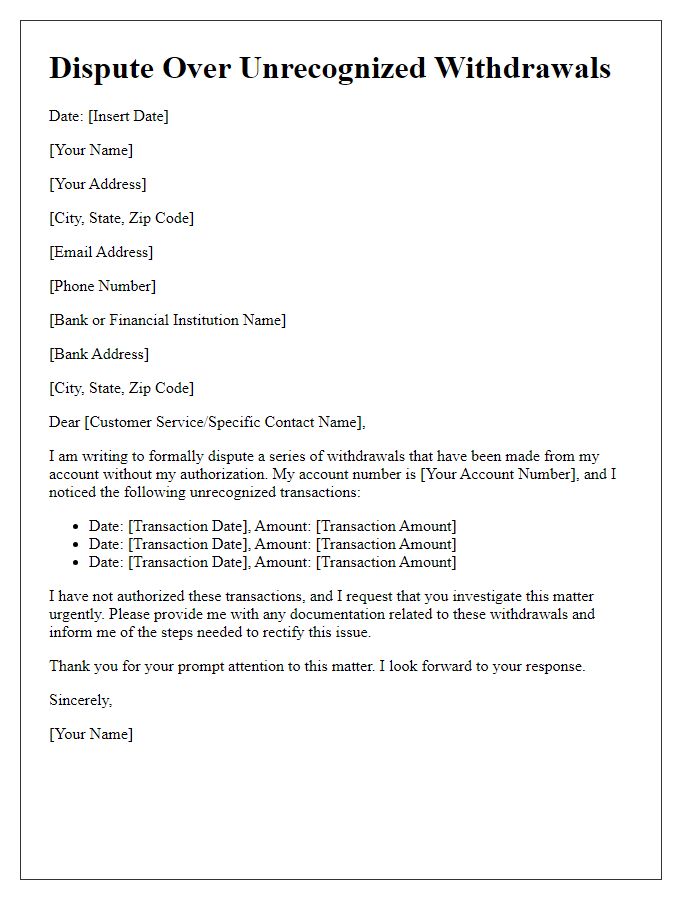

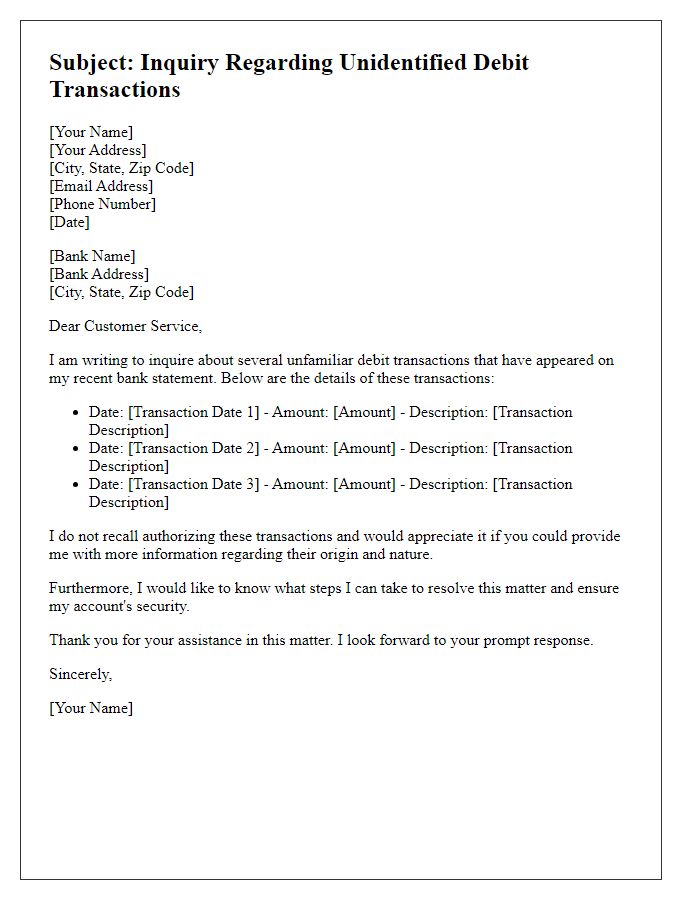

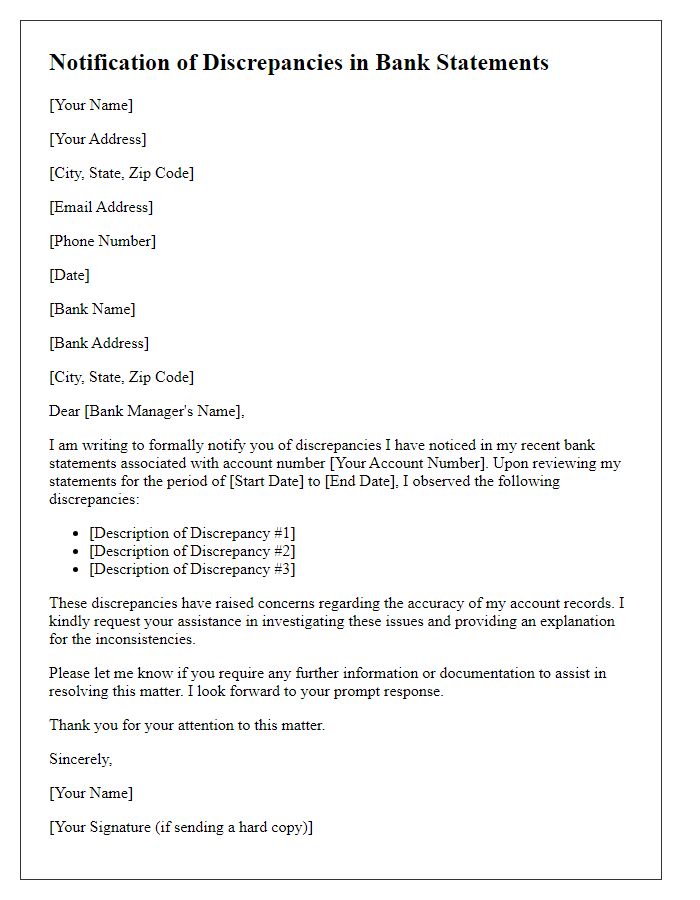

Letter template of dispute over unrecognized withdrawals from my balance.

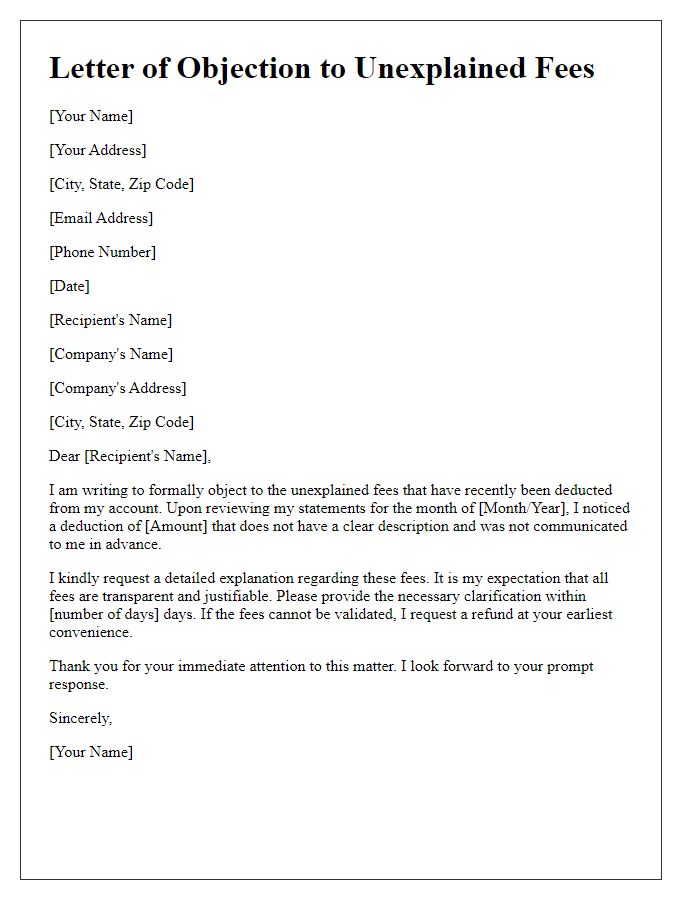

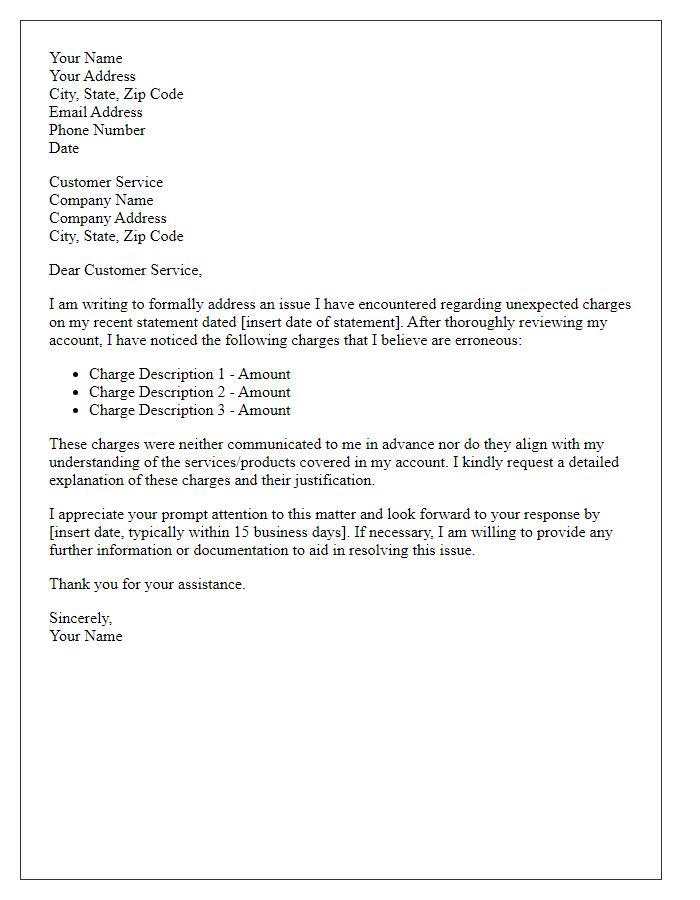

Letter template of objection to unexplained fees deducted from my funds.

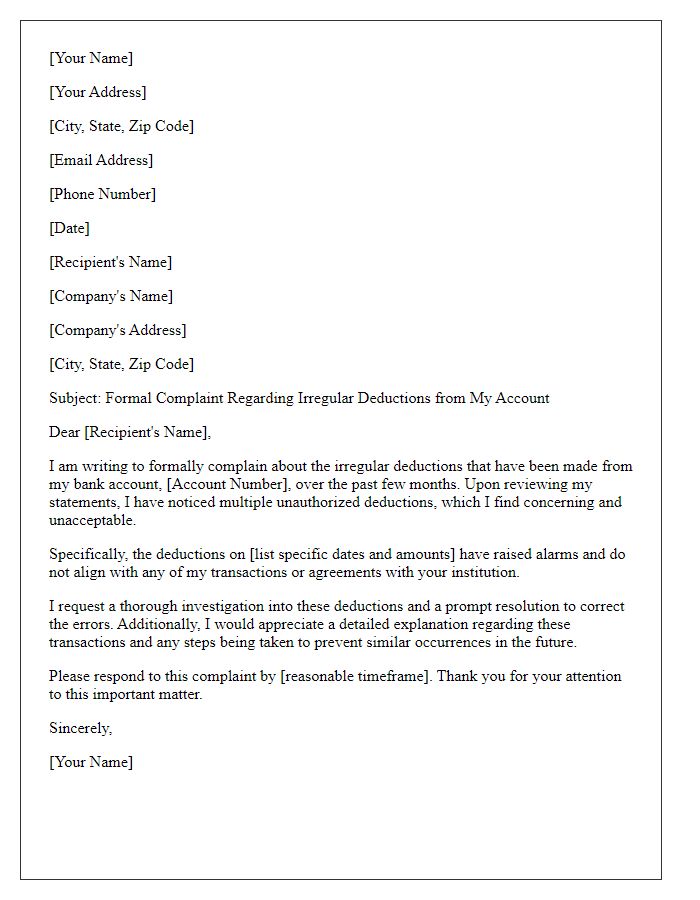

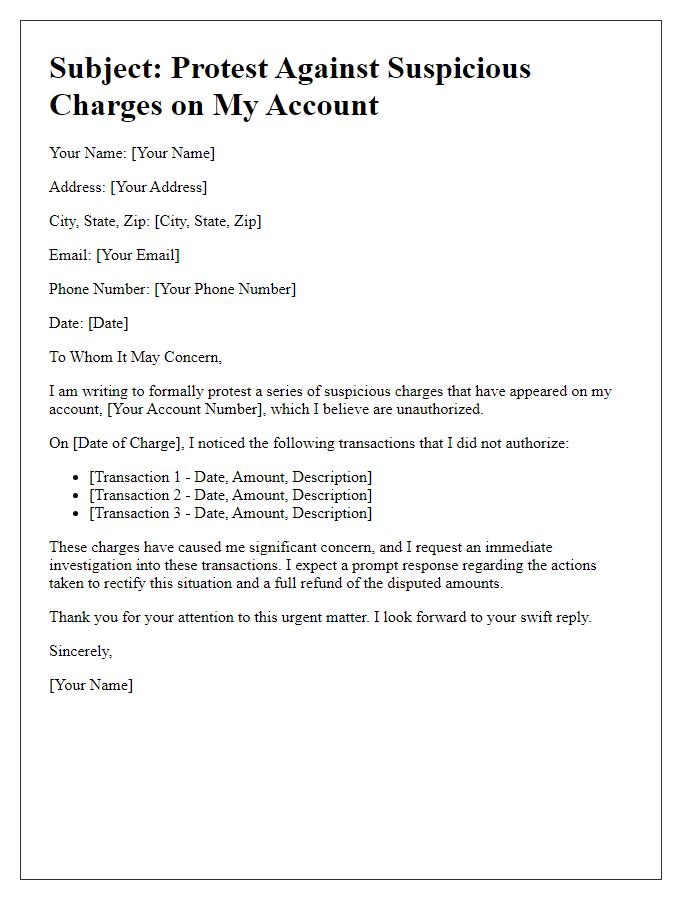

Letter template of formal complaint about irregular deductions from my account.

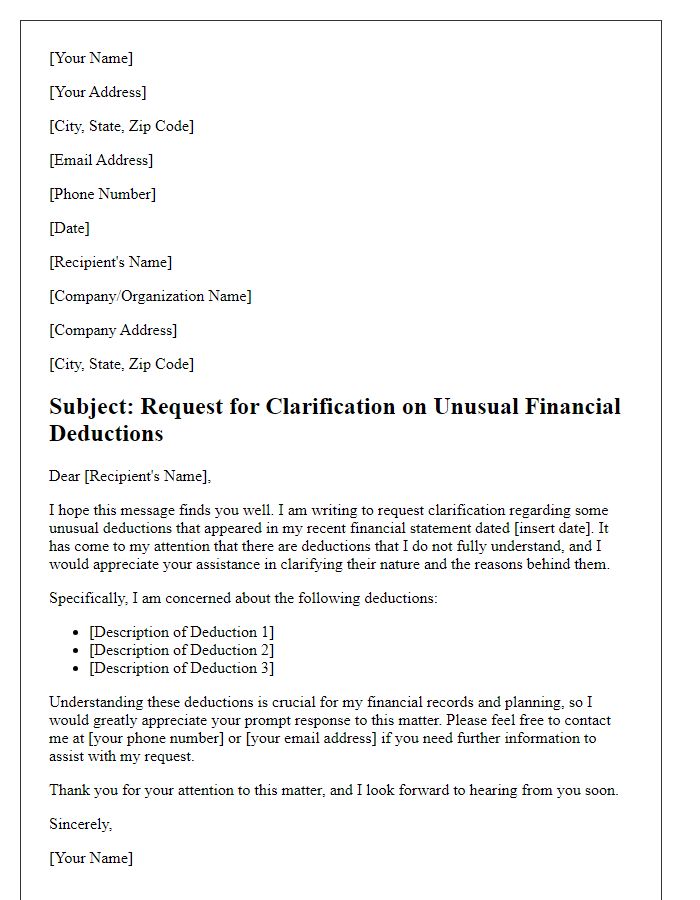

Letter template of request for clarification on unusual financial deductions.

Comments