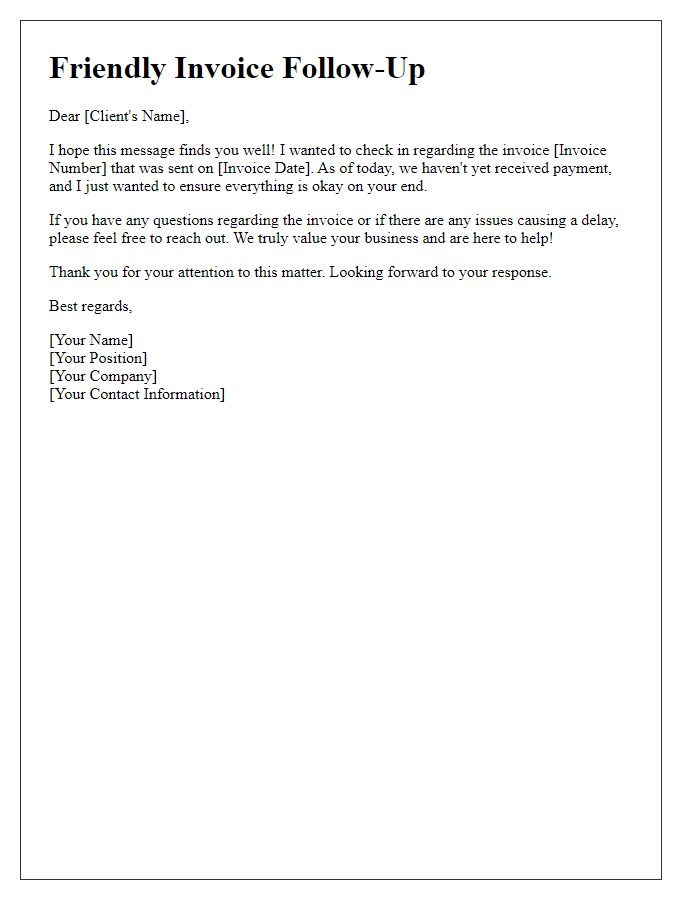

Hey there! We all know that keeping track of invoices can sometimes slip our minds, especially in the hustle and bustle of daily life. That's why a gentle reminder about an unpaid invoice can go a long way in maintaining good relationships with clients and ensuring smooth transactions. In the following article, we'll explore some effective letter templates that can help you craft the perfect reminder. Stick around to learn how to approach this sensitive topic with professionalism and grace!

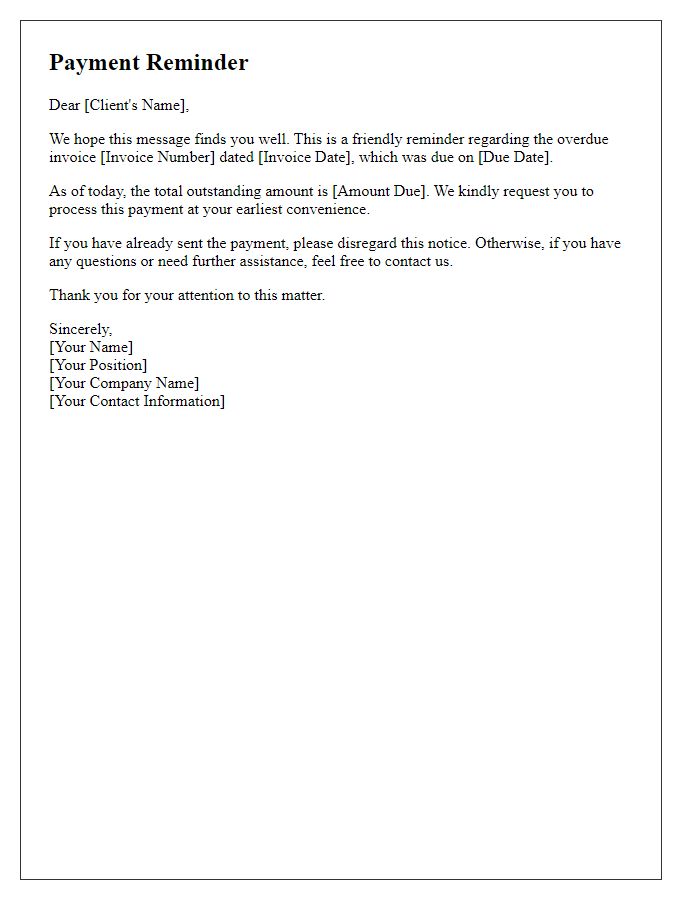

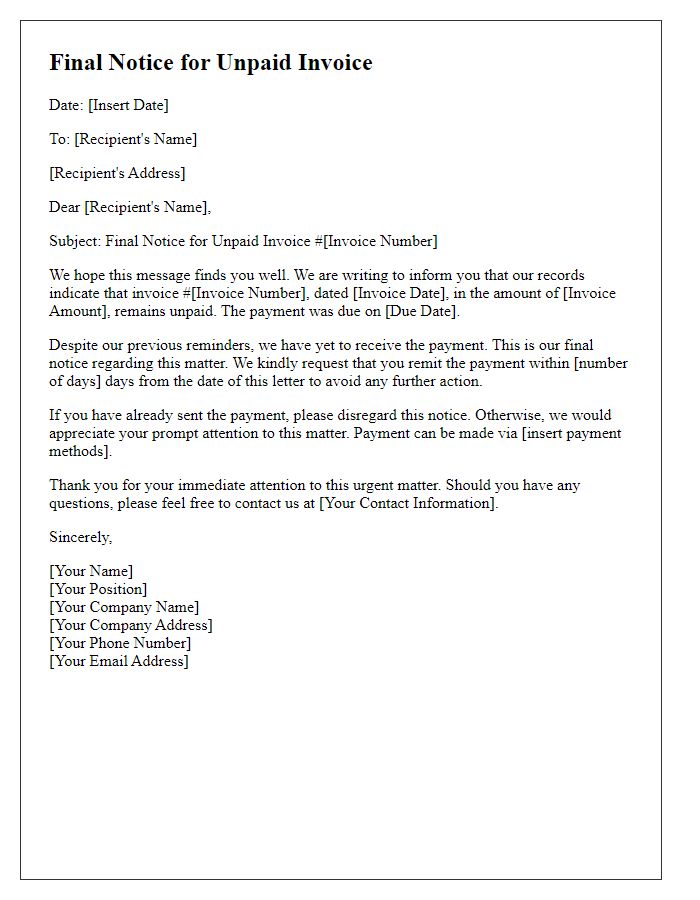

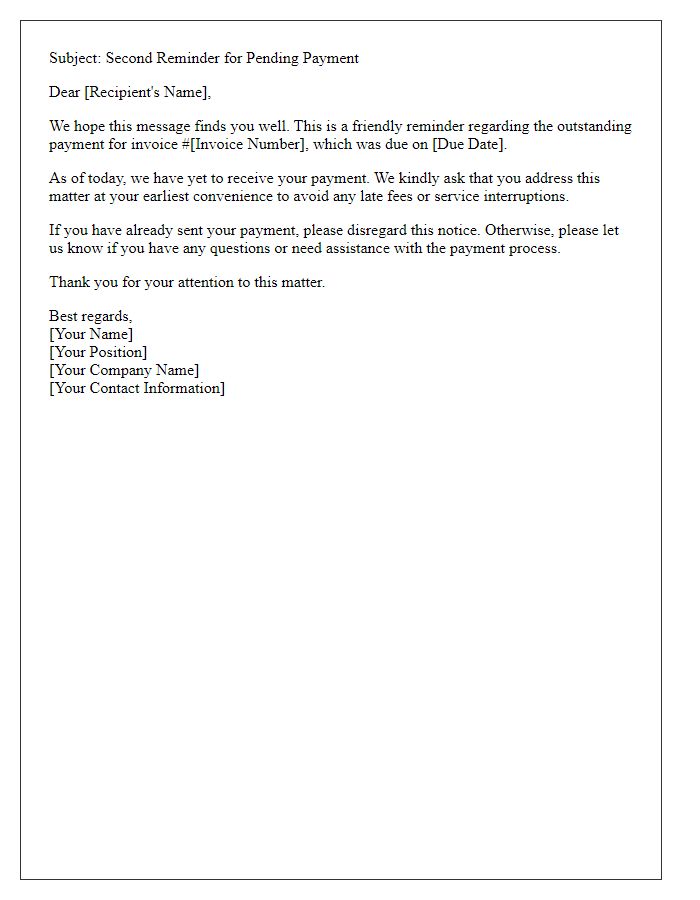

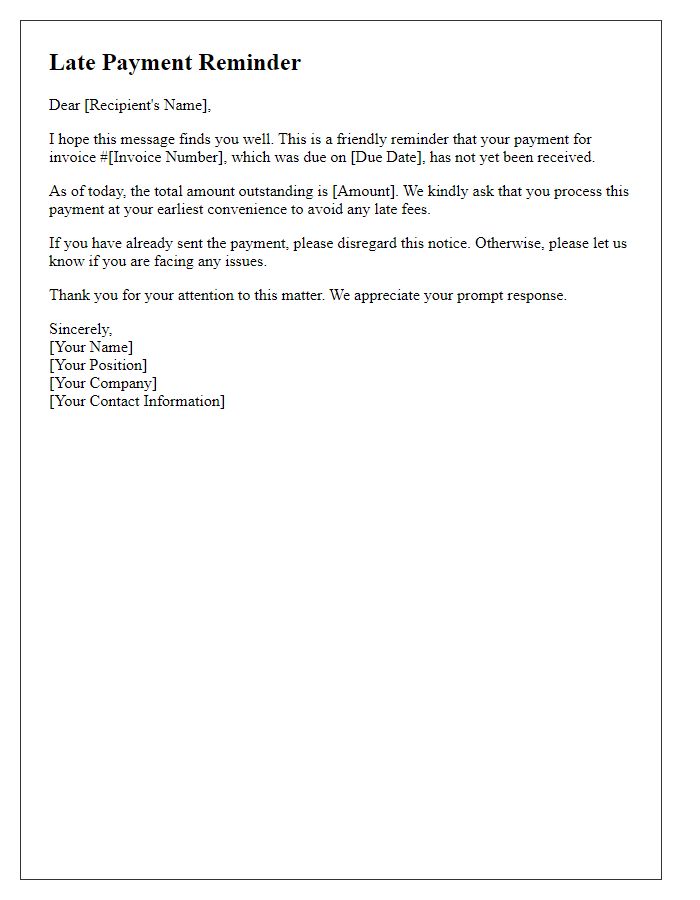

Professional tone and language

The unpaid invoices can lead to cash flow issues for many businesses. Unsettled invoices, especially those overdue by 30 days and amounting to $1,500 or more, may negatively impact supplier relationships and operational capacities. Regular follow-ups are crucial in maintaining a healthy accounts receivable cycle. Automated reminders through email services can improve efficiency, ensuring timely payment without directly contacting clients. Additionally, including clear payment terms and contact information can streamline communication and encourage prompt resolution of outstanding amounts.

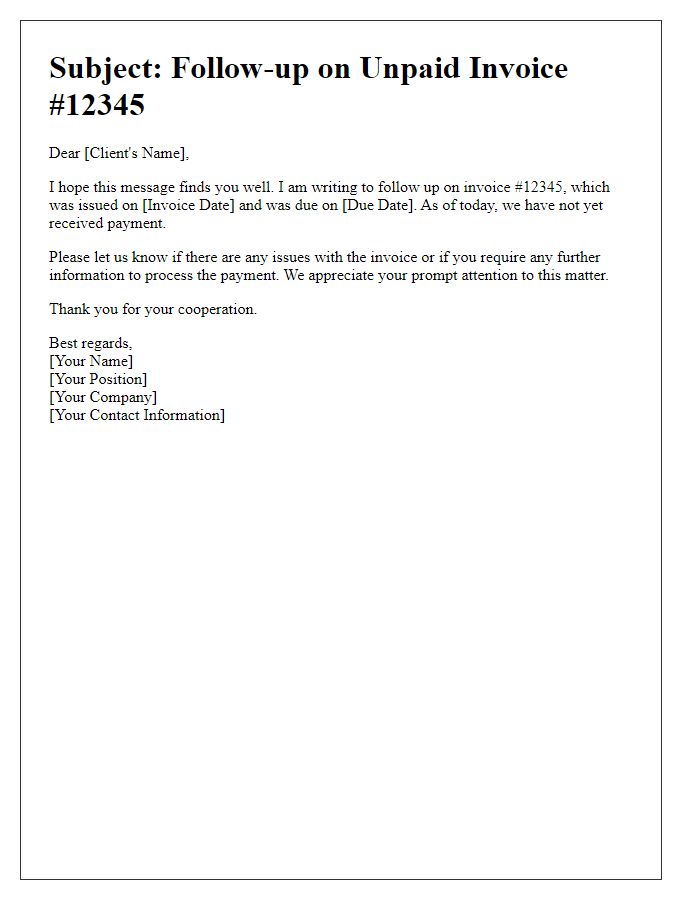

Clear subject line

Unpaid invoices can disrupt cash flow for businesses, particularly small enterprises that rely on timely payments from clients. An invoice typically includes essential details such as the invoice number (e.g., #12345), issue date (for instance, September 1, 2023), and due date (e.g., September 30, 2023). As payment reminders are sent, it's important to maintain professionalism, even when addressing overdue amounts, which could impact financial stability. A clear subject line, like "Reminder: Unpaid Invoice #12345 Due," captures attention and encourages prompt action. The reminder should also reiterate the amounts due and any applicable late fees, ensuring clarity about the terms of payment.

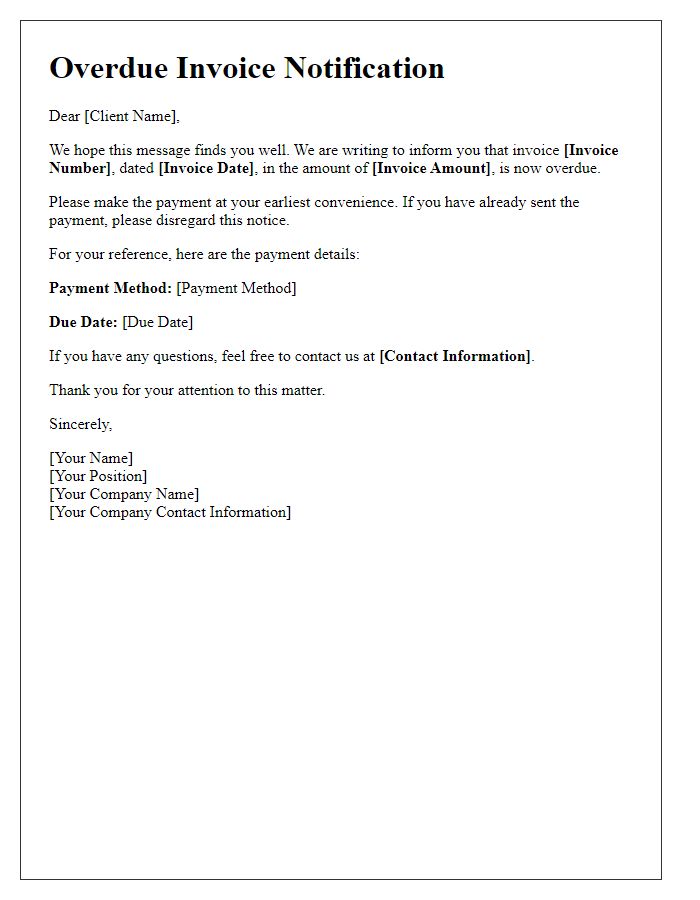

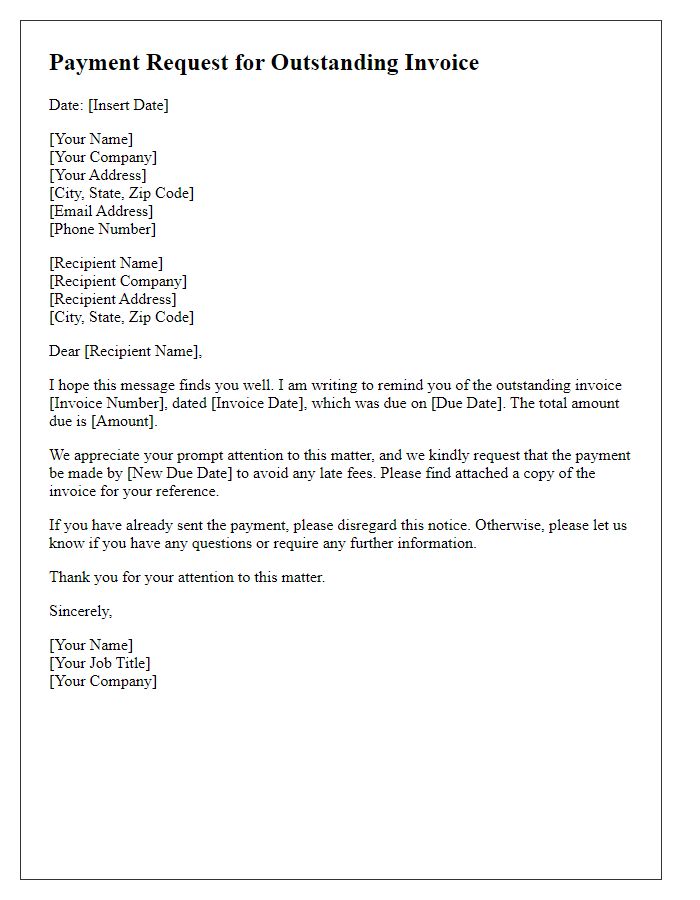

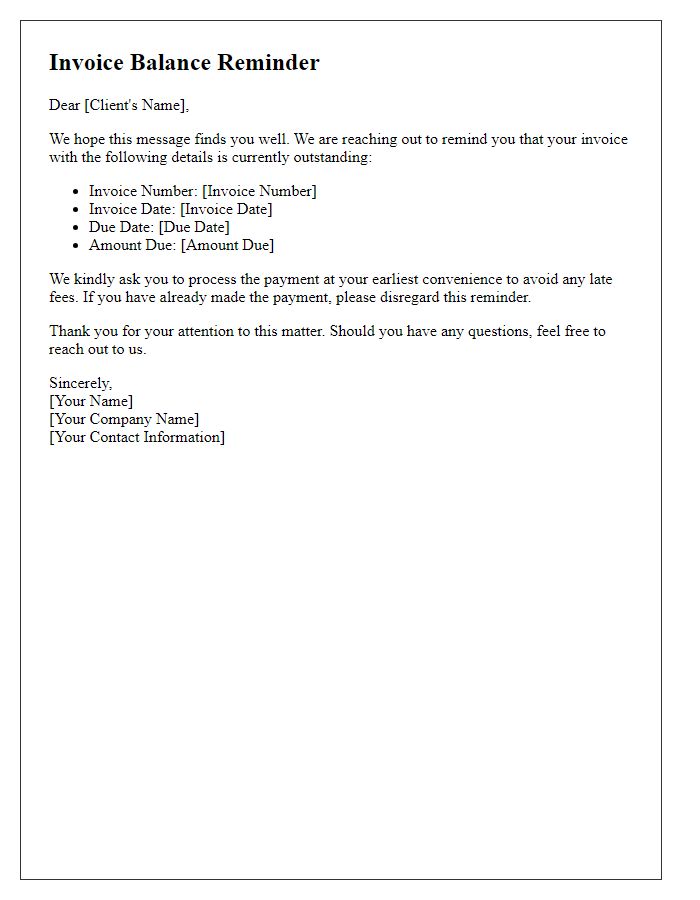

Invoice details (amount, date, invoice number)

An unpaid invoice reminder serves as a crucial communication tool for businesses. Invoice details typically encompass the total amount owed, the issuance date, and a unique invoice number assigned for reference. Timely reminders can aid in maintaining cash flow, with a notable emphasis on overdue amounts which, as per industry standards, may incur late fees after a grace period of 30 days. Maintaining accurate records, including the initial agreement terms, assists in fortifying the business's position while negotiating payment. Regular follow-ups, often within two weeks of the due date, can enhance the likelihood of recovering funds efficiently.

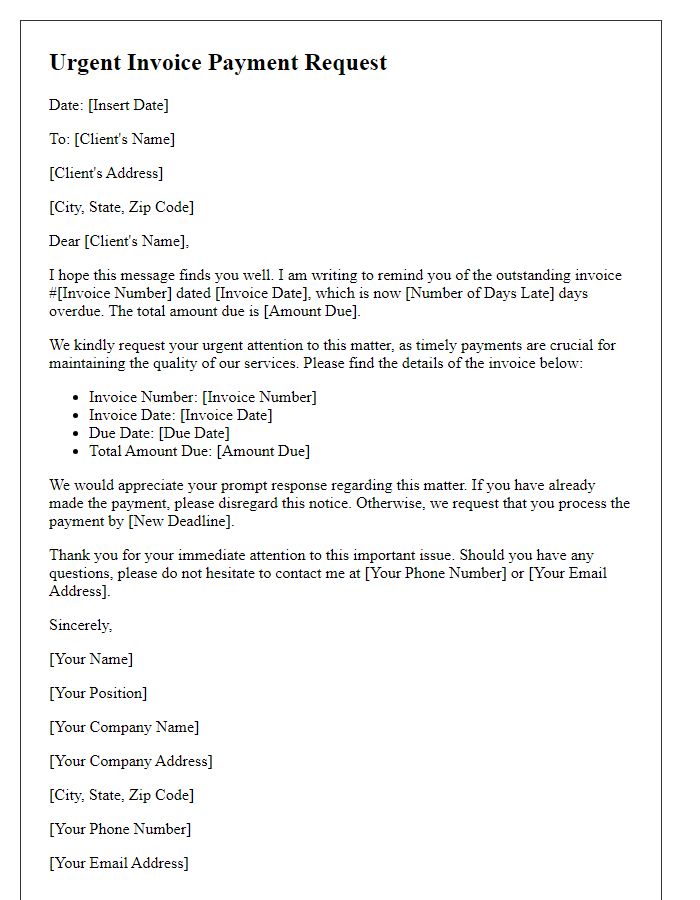

Payment terms and options

Unpaid invoices can significantly impact cash flow in businesses, leading to potential operational challenges. Invoice amounts that remain unsettled beyond the due date can incur late fees (often a percentage of the total invoice amount). Payment terms typically dictate a grace period, often 30 days from the invoice date, and the consequences of late payments can affect relationships with suppliers and clients. Options for payments may include direct bank transfers, credit card transactions, or digital payment platforms like PayPal or Stripe, enabling faster and more efficient transactions. Businesses may also adopt automated reminders to improve collection rates and maintain financial stability.

Call to action and contact information

Unpaid invoices can disrupt cash flow for businesses, particularly small enterprises reliant on prompt payments. Invoice reminders should be concise and clear, emphasizing the due date and outstanding amount to ensure timely response. Common practices include mentioning specific invoice numbers and dates to eliminate confusion. Providing alternative payment options and easy access to contact information fosters open communication. Encouraging prompt action helps maintain a good relationship while ensuring financial stability. Transparent processes contribute to effective financial management for both parties involved, enhancing business relationships.

Comments