Negotiating a debt settlement can feel overwhelming, but with the right approach, you can find a path forward. It's essential to understand your options and prepare effectively to communicate with creditors. In this article, we'll guide you through creating a persuasive letter that clearly outlines your situation and proposes a settlement. So, let's dive in and explore how you can take control of your financial future!

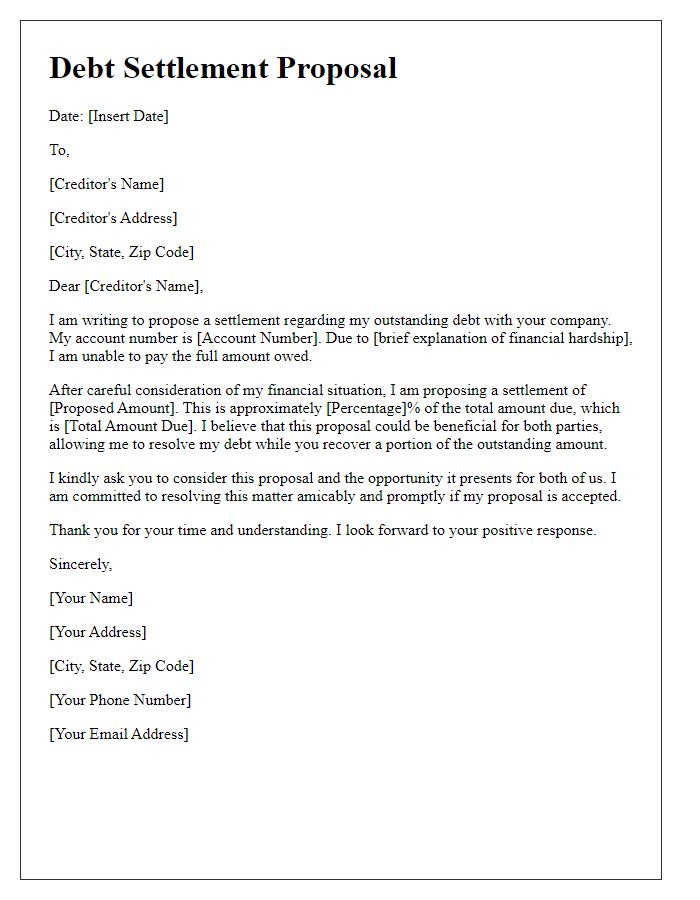

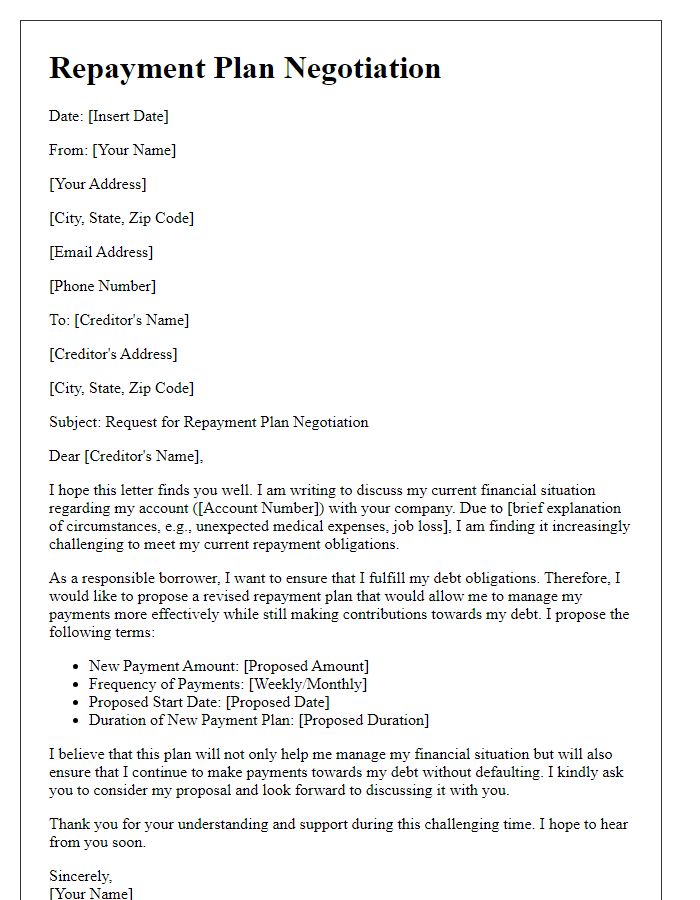

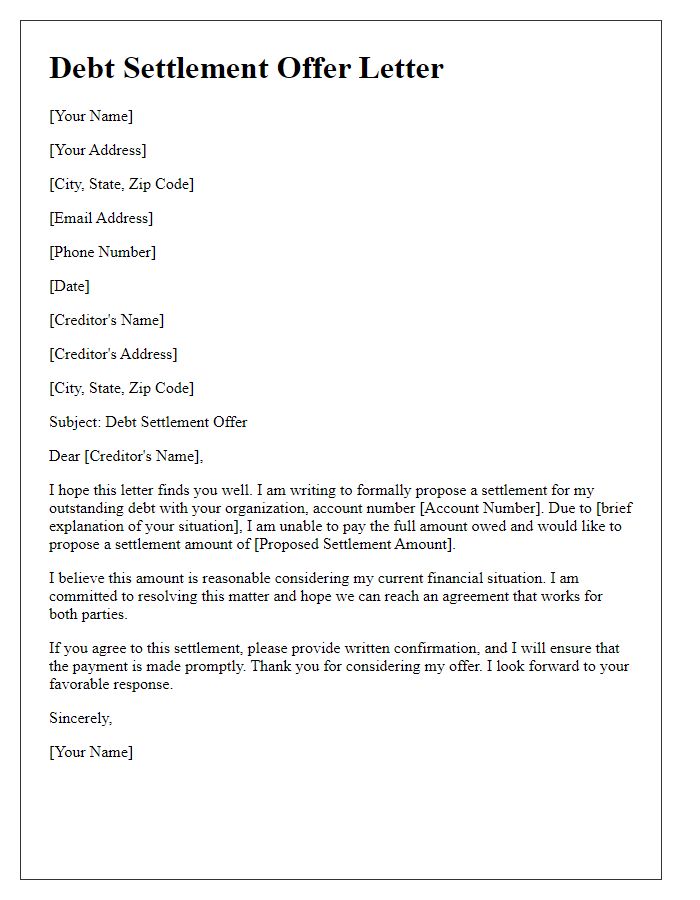

Professional tone and language

Debts can significantly impact one's financial stability and mental health. Engaging in productive negotiation for debt settlement is crucial for individuals facing overwhelming financial burdens. A clear and concise communication method is essential in reaching an agreement with creditors. Consumers often seek to settle debts through a payment plan, which may involve reduced payments or a lump sum offer. When dealing with debts such as credit card balances, medical bills, or personal loans, it is important to present a realistic financial situation to creditors, highlighting challenges such as job loss, unexpected expenses, or market changes. Successful negotiations often lead to a more manageable repayment structure, avoiding further actions like collection calls or lawsuits, thus paving the way for reinstating financial health.

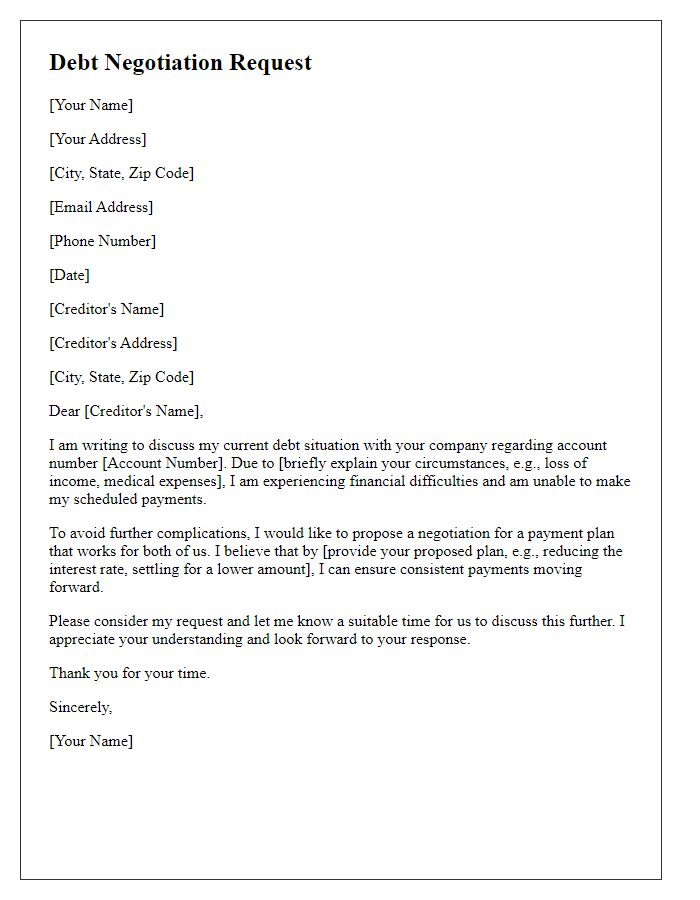

Creditor and Debtor Information

In debt settlement negotiations, understanding both creditor and debtor information is essential for effective communication. The creditor, typically a financial institution or a collection agency, represents the party owed money, often managing multiple accounts, known for credit services like personal loans or credit lines. The debtor, an individual or business, struggles with financial obligations, usually holding unpaid balances that exceed 30 days past due, leading to potential legal action or credit score impacts. Gathering accurate details such as account numbers, outstanding debt amounts, and contact information for both parties is crucial, ensuring a clear discussion framework during negotiations. Proper documentation can significantly enhance the likelihood of achieving a favorable settlement.

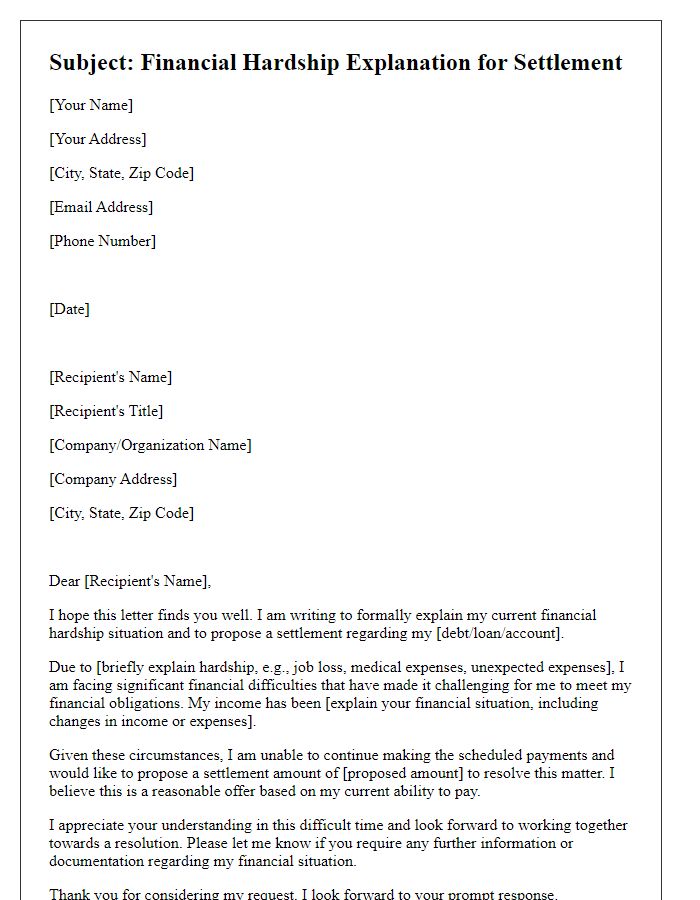

Specific Debt Details

Specific debt details play a crucial role in debt settlement negotiations, particularly regarding the terms and amounts owed. The creditor's name, such as ABC Bank, signifies the organization holding the account, while the account number serves as a unique identifier for the debt, often featuring eight to twelve numeric characters. Outstanding balance, for instance $5,000, reflects the total amount owed by the debtor. The specific type of debt, such as credit card debt or medical bills, can influence negotiation strategies and potential settlements. Additionally, date of last payment is important, as it may affect the status of the debt, with payments made over 180 days ago possibly elevating the urgency for settlement. The original creditor's name, alongside notes on whether the account has been sent to a collections agency, like XYZ Collections, provides context for the negotiation process. Understanding these components allows for a more informed and effective approach to achieving a satisfactory settlement.

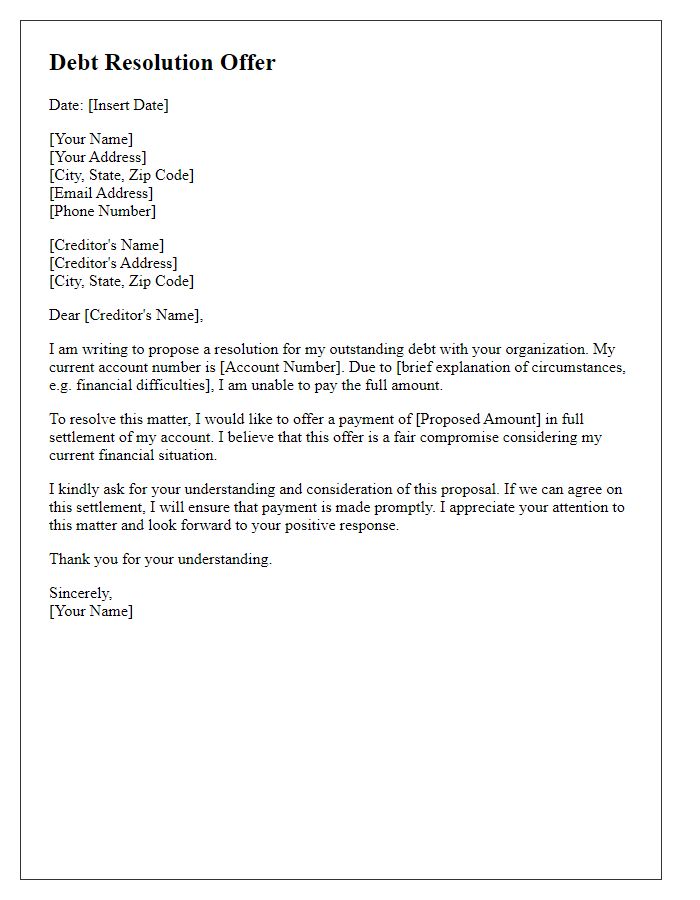

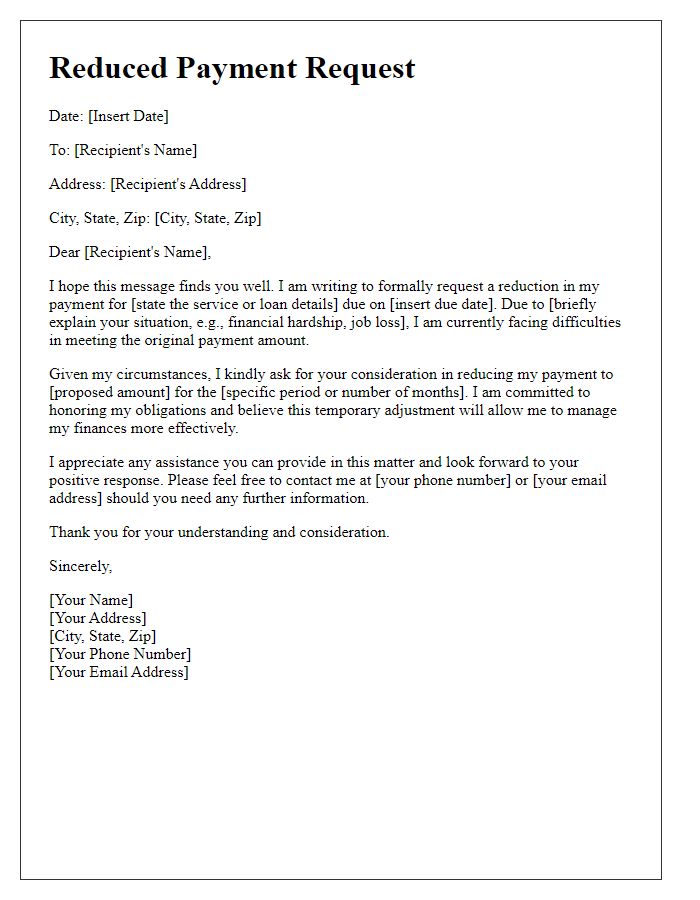

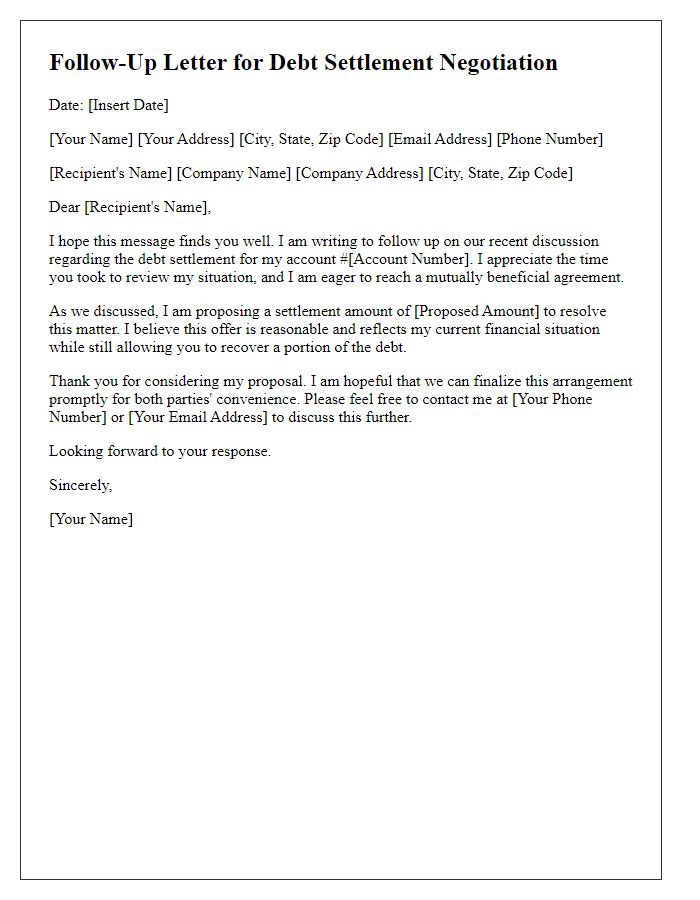

Proposed Settlement Amount and Terms

Debt settlement negotiations often involve carefully outlining proposed settlement amounts and terms to collectors or creditors. When contacting a creditor, it's important to specify the outstanding balance owed, for instance, $10,000, and propose a reduced settlement amount, such as $5,000, which represents a 50% discount on the total debt. The proposal can suggest a payment plan, for instance, three installments of $1,666.67 over three months, outlining the preferred dates for each payment. Additionally, stipulating important conditions, like requesting a written confirmation that the settled amount clears the associated debt entirely and will be reported to the credit bureaus, adding clarity and security to the agreement. Key factors in this negotiation include understanding the laws in your state, such as the Fair Debt Collection Practices Act (FDCPA), and potential implications on credit scores, which can be around a 40-point drop if not handled correctly. Recognizing the creditor's willingness to negotiate, often influenced by market trends and financial hardship can also play a significant role in reaching a successful agreement.

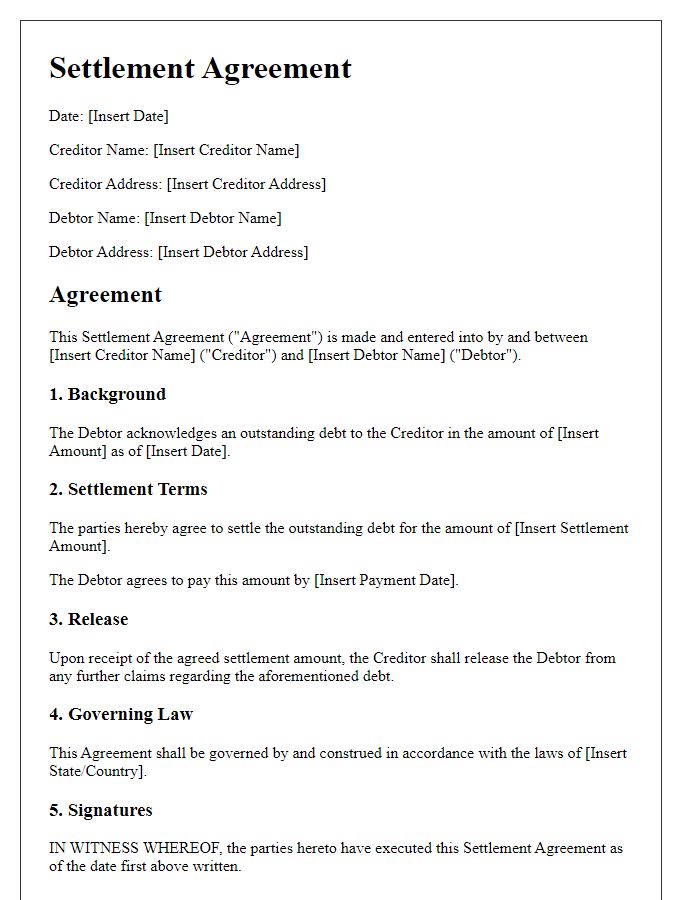

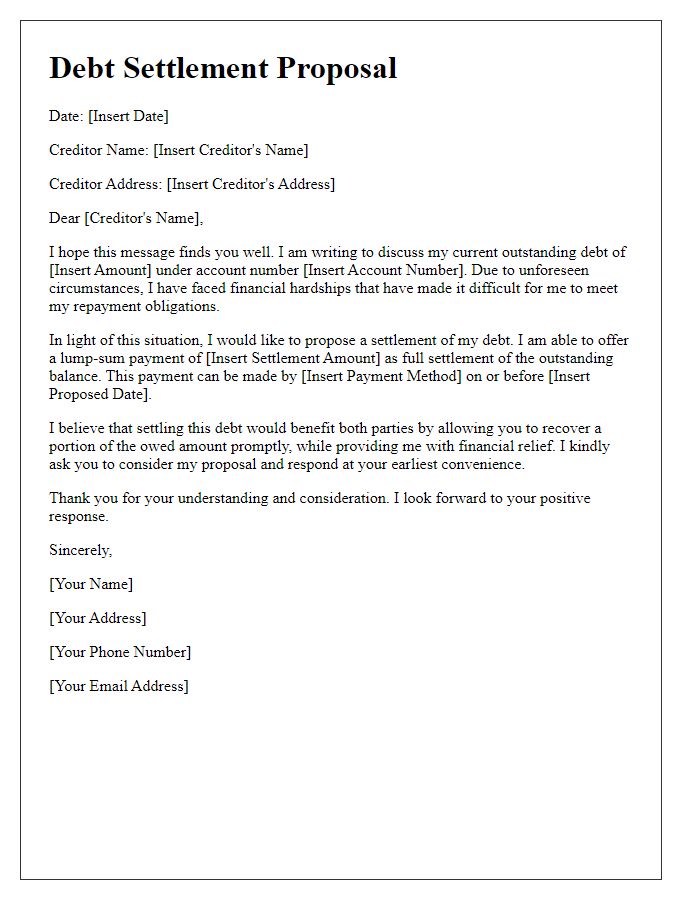

Request for Written Agreement

A written agreement for debt settlement negotiations solidifies the terms of the arrangement between creditors and borrowers. Such agreements outline specific details including the total debt amount, reduction percentage often ranging from 30% to 70%, and a clear payment schedule, which might span over several months. This documentation ensures both parties understand their obligations, protecting the creditor's interests while offering the borrower a path towards financial recovery. It's crucial to include the creditor's name, account number, and the settlement amount to avoid any ambiguity. Proper signatures from both parties finalize these terms, providing a legal framework for the agreement and ensuring enforceability in case of future disputes.

Comments