Are you dealing with property damage and unsure how to start your claim? Writing a compelling letter can significantly increase your chances of receiving the compensation you deserve. In this article, we'll guide you through the essential components of a property damage claim letter, making the process easier and more effective. So, let's dive in and help you take that first step towards resolving your property issues!

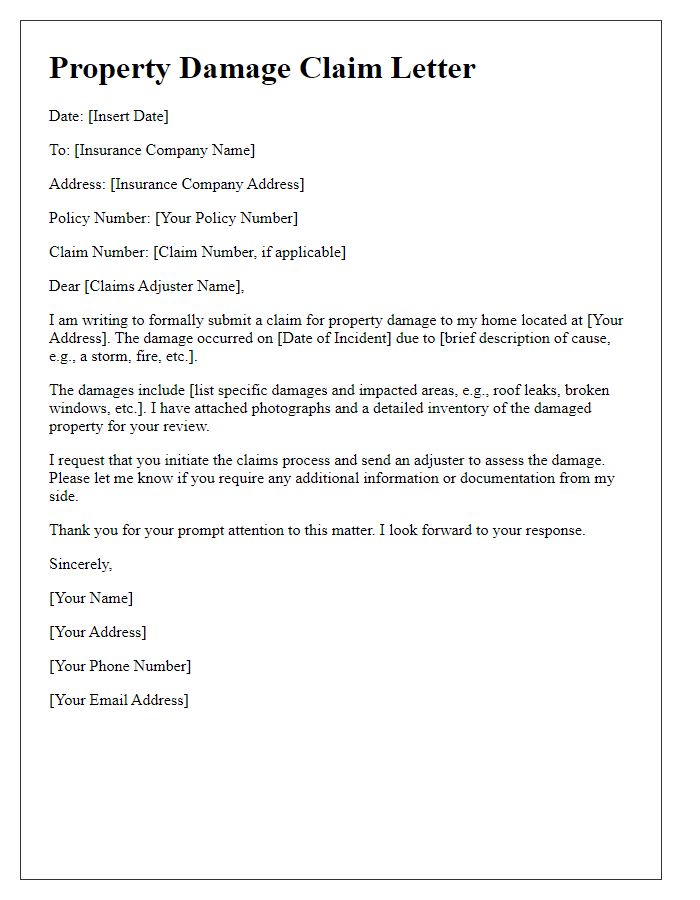

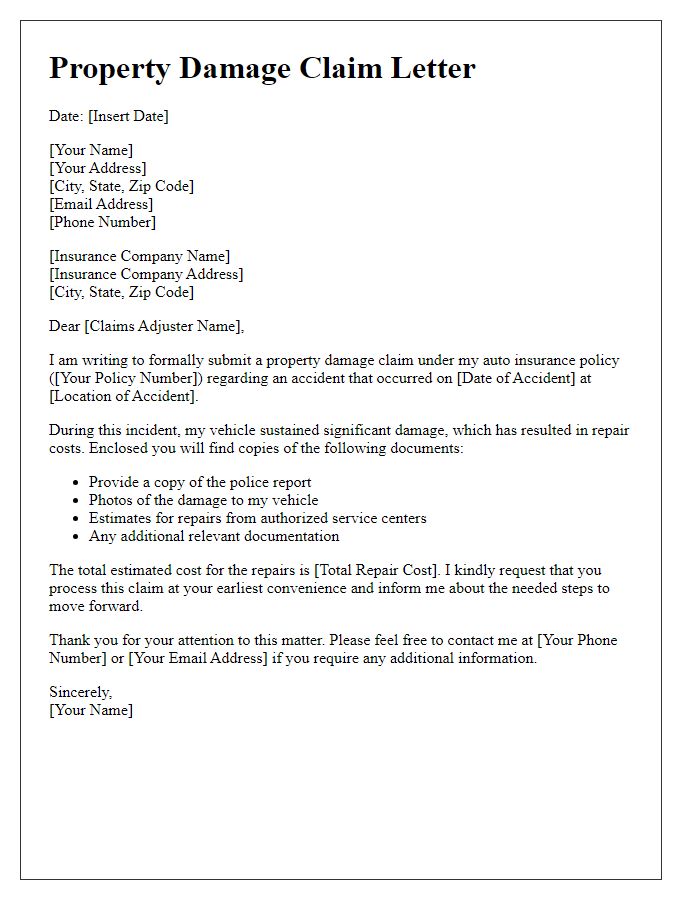

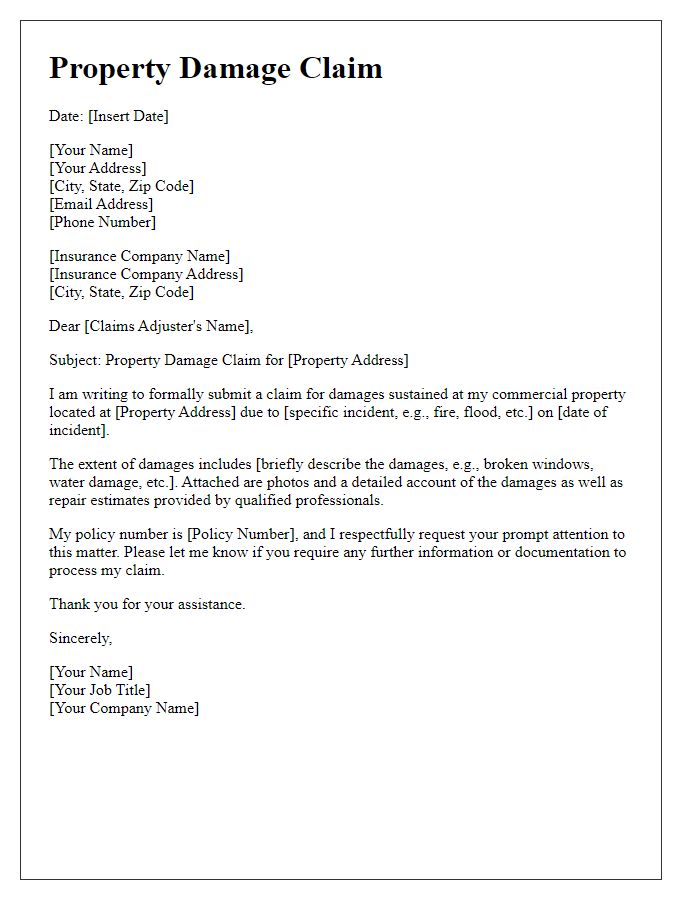

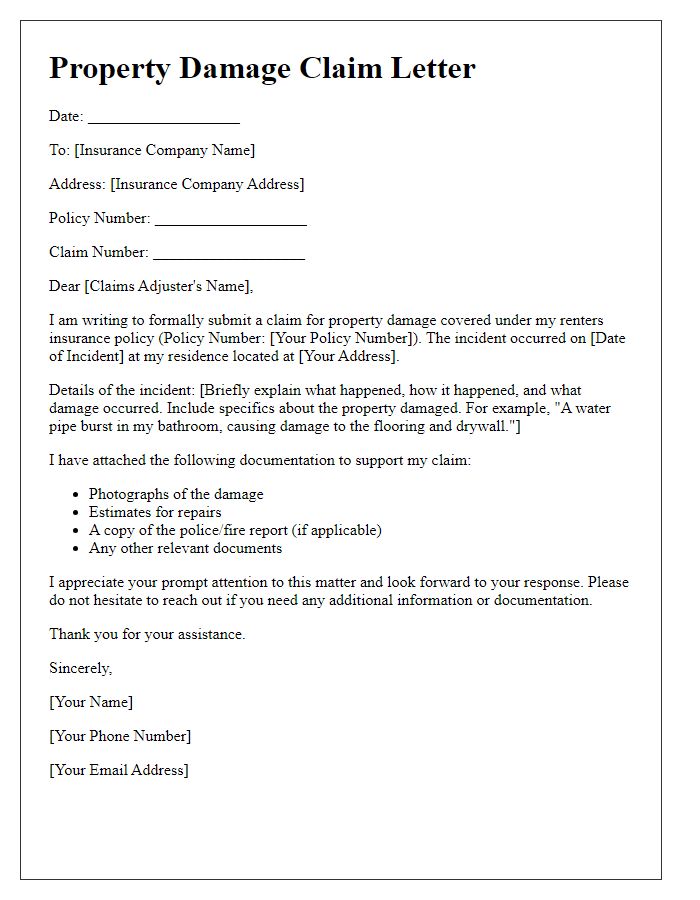

Clear Identification of Policyholder and Insurer

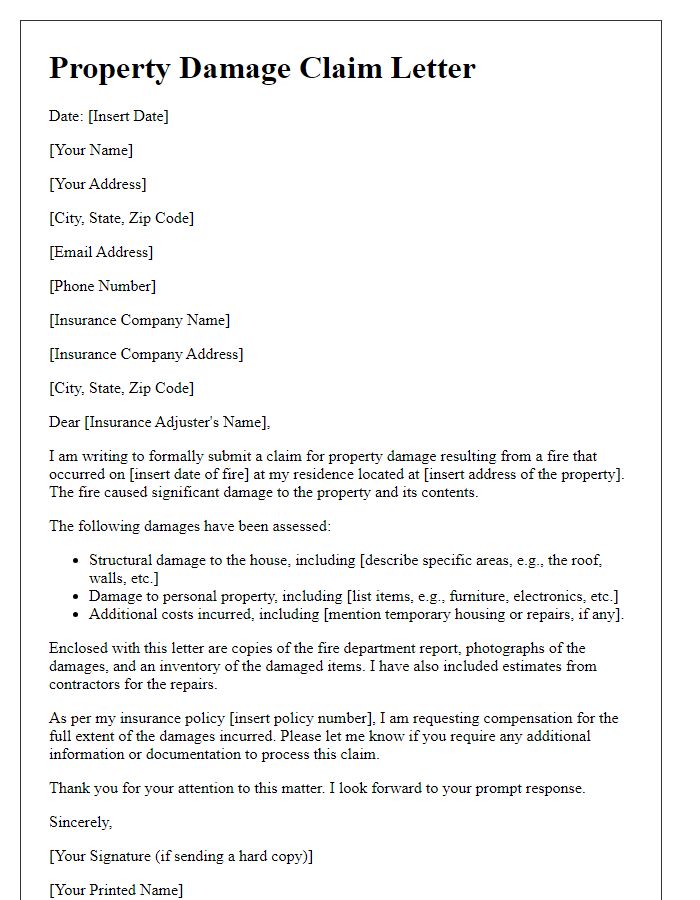

A successful property damage claim begins with clear identification of the policyholder and the insurer. The policyholder, for example, John Smith, residing at 123 Maple Street, Springfield, must be clearly stated alongside the policy number (P123456789) associated with the property insurance policy. The insurer, Springfield Mutual Insurance Company located at 456 Elm Avenue, Springfield, should also be identified. Providing these details ensures proper processing of the claim and establishes a direct link between the policyholder and the insurer's records. Accurate identification is crucial in expediting claims related to property damage, such as those caused by natural disasters or accidents, under the coverage terms outlined in the policy.

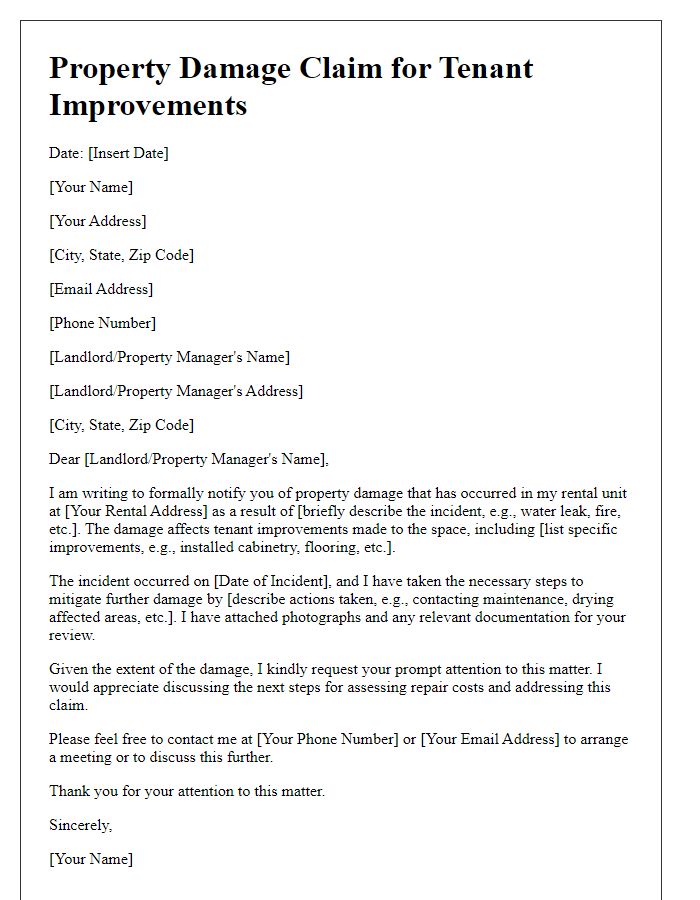

Detailed Description of the Damage

A property damage claim for water intrusion in an apartment located at 123 Maple Street, Springfield, can outline significant issues. The living room walls, measuring approximately 200 square feet, exhibit extensive staining and peeling of paint due to moisture exposure, necessitating remediation. Additionally, hardwood flooring in the same area shows warping, compromising its structural integrity. The kitchen, adjacent to the living room, has suffered damage with cabinets displaying signs of mold growth, particularly in the corners and around plumbing fixtures. Affected appliances, including the refrigerator and dishwasher, require inspection as water damage may lead to electrical hazards. The estimated repair costs exceed $10,000, considering professional restoration services and potential replacement of fixtures. Prompt assessment and action are essential to mitigate further deterioration and protect the overall value of the property.

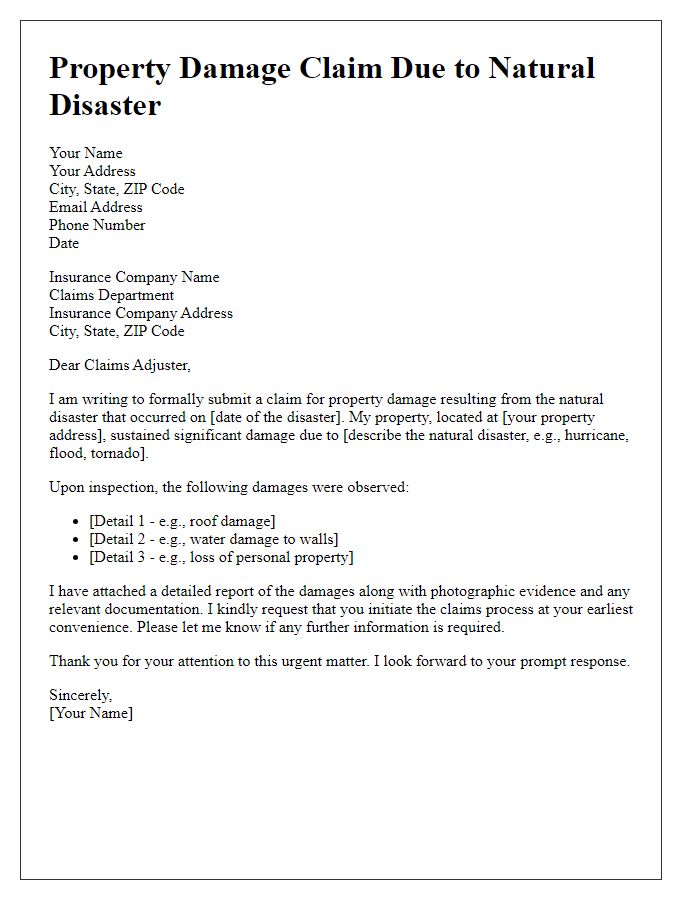

Accurate Date and Time of Incident

Accurate documentation of the date and time of incidents, such as property damage, is crucial for insurance claims. For example, an incident happening on January 15, 2023, at approximately 3:30 PM in a residential area of Miami, Florida, can significantly impact claim processing. Insurers require precise details to verify events and ascertain liability. Notably, if damage results from a severe weather event, such as a hurricane, records indicating wind speeds beyond 100 mph can be pertinent for establishing context. Timely reporting of the incident to the insurance provider is essential to facilitate swift assessment and resolution of claims.

Supporting Documentation and Evidence

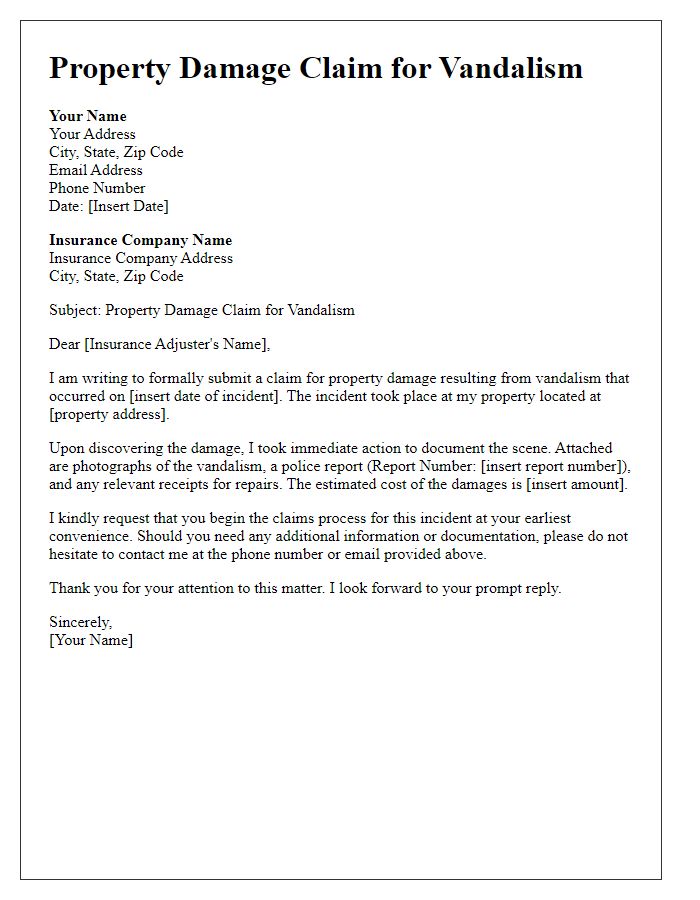

Property damage claims often require comprehensive supporting documentation and evidence to ensure a smooth claims process. Essential documents include detailed photographs depicting the extent of damage, emphasizing crucial areas such as walls, flooring, and personal belongings affected by incidents like fires or flooding. Receipts for repairs or professional assessments from licensed contractors serve as vital proof of incurred costs, documenting the financial impact on property owners. Insurance policy details, including coverage limits and deductibles, are crucial for determining eligibility and potential compensation amounts. Additionally, police reports may be necessary if the damage resulted from criminal activity, aiding in validating the claim. Notably, timestamps on all documentation reinforce the timeline of events, which may significantly influence the claims investigation.

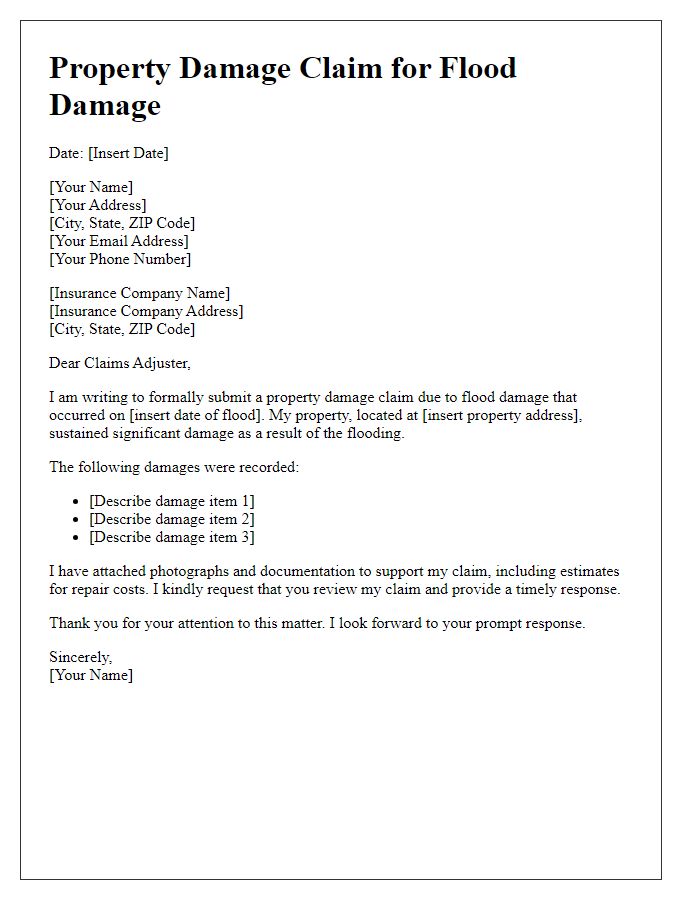

Request for Specific Compensation Amount

Property damage claims often arise from events like natural disasters, accidents, or vandalism, leading to significant repair costs. Homeowners frequently seek compensation from insurance providers to cover expenses resulting from damages to structures such as roofs, windows, or plumbing systems. When filing a claim, it's crucial to document the extent of damage with photographs and repair estimates. Claimants typically request specific compensation amounts, often based on detailed assessments from licensed contractors, to ensure coverage for necessary repairs. Effective communication with the insurance company, including submitting all relevant information promptly, helps streamline the claims process and may lead to expedited compensation.

Comments