Are you considering enrolling in a pension plan and feeling overwhelmed by the options? Don't worry; we're here to simplify the process for you! A pension plan is a fantastic way to secure your financial future, ensuring that you have the resources you need during retirement. If you'd like to dive deeper into the benefits and steps of enrollment, keep reading!

Personal Identification Information

Enrolling in a pension plan requires accurate personal identification information to ensure proper processing and secure management of retirement savings. This essential data includes full name, date of birth, Social Security Number (typically nine digits), residential address, phone number, and email address. Accurate documentation of these details helps financial institutions, such as Fidelity or Vanguard, maintain compliance with regulations and effectively administer benefits. Additionally, providing information regarding employment status, including job title and employer name, aids in the correct calculation of contributions and retirement benefits. Ensuring this data is up-to-date and correct is vital for the seamless operation of the pension plan throughout an individual's career and thereafter.

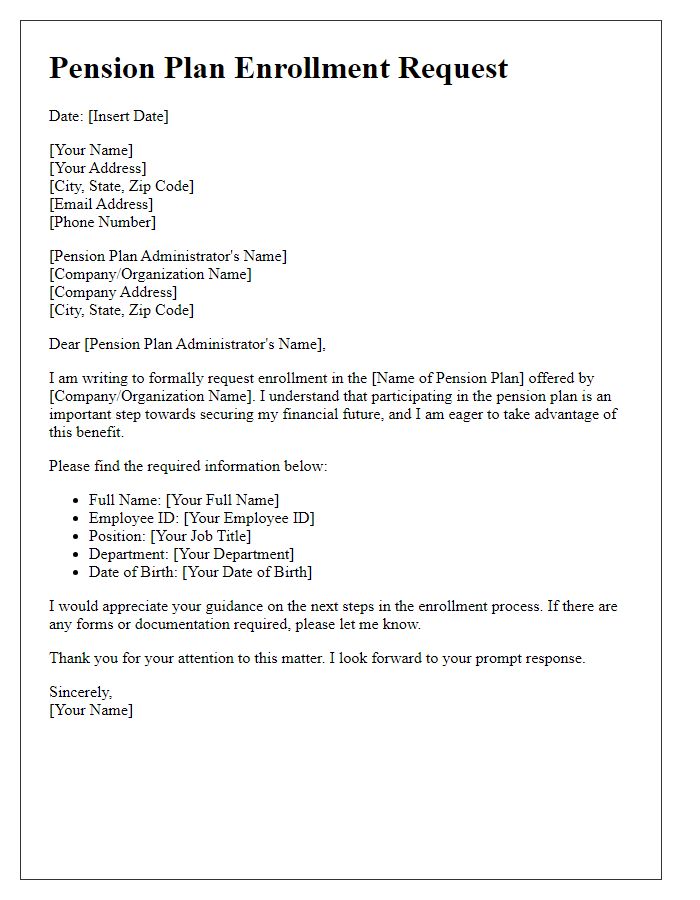

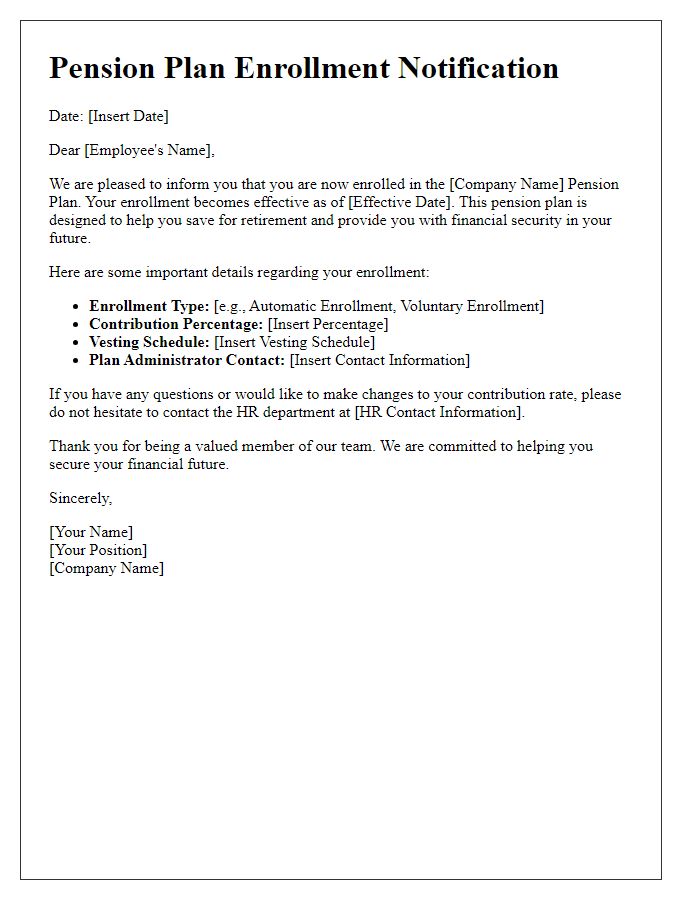

Enrollment Instructions

Pension plan enrollment requires careful completion of various forms and documents. Participants must provide personal information such as social security numbers (usually nine digits) and contact details including address and phone number. The enrollment process typically involves reviewing the plan's summary document, detailing benefits and features. Deadlines for enrollment vary by employer, often set on the last day of the month or quarterly. Documentation should be submitted to the designated Human Resources department or a specific online portal, such as BenefitConnect or ADP. Disclosures about investment options, risk levels, and contribution rates will be necessary for informed decision-making. Participation can often be initiated during open enrollment periods, allowing employees to make adjustments to their contributions or investment choices annually.

Plan Options and Benefits

Understanding the diverse pension plan options available is crucial for securing financial stability during retirement years. The various plans, such as defined benefit and defined contribution, offer distinct benefits tailored to individual needs. Defined benefit plans, like those provided by corporate employers, guarantee a specified monthly payout at retirement, based on factors like salary history and years of service. Defined contribution plans, which include 401(k) options, allow employees to contribute a portion of their income before taxes, often supplemented by employer matching contributions. Contribution limits for 2023 set by the IRS indicate $22,500 for 401(k) plans, with a catch-up option of an additional $7,500 for those aged 50 and older. Investment choices within these plans can range from stock funds to bonds, aiding in building a diverse portfolio. Participation in these plans can also yield tax advantages, with deferred taxes on contributions until withdrawal during retirement. Engaging with a financial advisor can help individuals navigate these options effectively, ensuring the selection of a plan that aligns with their retirement goals and financial situation.

Contribution Details

Pension plan enrollment requires detailed contribution information to ensure an effective savings strategy for retirement. Employees usually contribute a percentage of their salary, often matching employer contributions, which are common in plans like 401(k) or defined benefit schemes. For example, the typical employee contribution can range from 3% to 10% of their monthly salary, while employers might match up to 5%. Contribution limits are subject to IRS regulations, with the maximum annual contribution capped at $22,500 for individuals under 50 (2023 figure). Additionally, employees aged 50 and above can make catch-up contributions of $7,500, allowing for increased savings as they approach retirement. It's essential to evaluate the investment options available within the plan, which may include stocks, bonds, and mutual funds, choosing those that align with long-term financial goals. Understanding tax implications, such as pre-tax versus post-tax contributions, can significantly impact future retirement income.

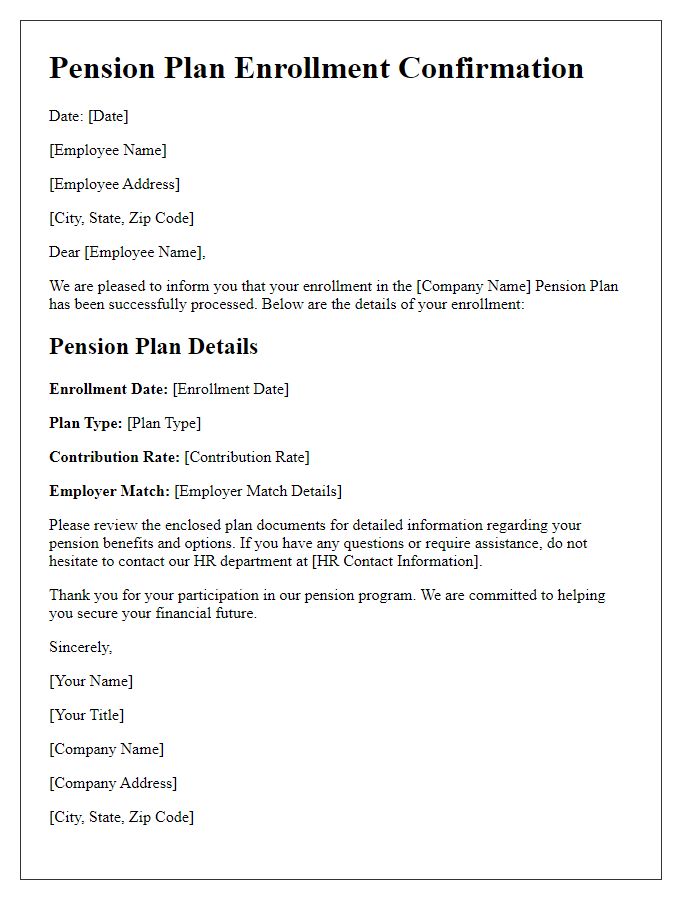

Contact Information for Assistance

Contacting the pension plan administrator is essential for enrollment clarity and assistance. The Pension Benefit Guaranty Corporation (PBGC) can provide valuable resources, including information on defined benefit plans, retirement strategies, and enrollment processes. Representatives are available at 1-800-400-7242 during business hours, Eastern Time, for personalized assistance. Additionally, plan-specific inquiries can be directed to the Human Resources department of the employer, accessible through the company's internal portal or by visiting the office. Ensure all required documents are prepared, such as identification, employment records, and previous retirement savings plan details, for a seamless enrollment experience.

Comments