Updating your bank account information is an important step to ensure that your finances stay on track and remain secure. Whether you've changed banks, switched accounts, or simply need to correct some details, communicating these changes clearly is essential. In this article, we'll walk you through a straightforward letter template that makes notifying your bank a breeze. So, grab a cup of coffee and let's dive into how you can effortlessly update your banking details!

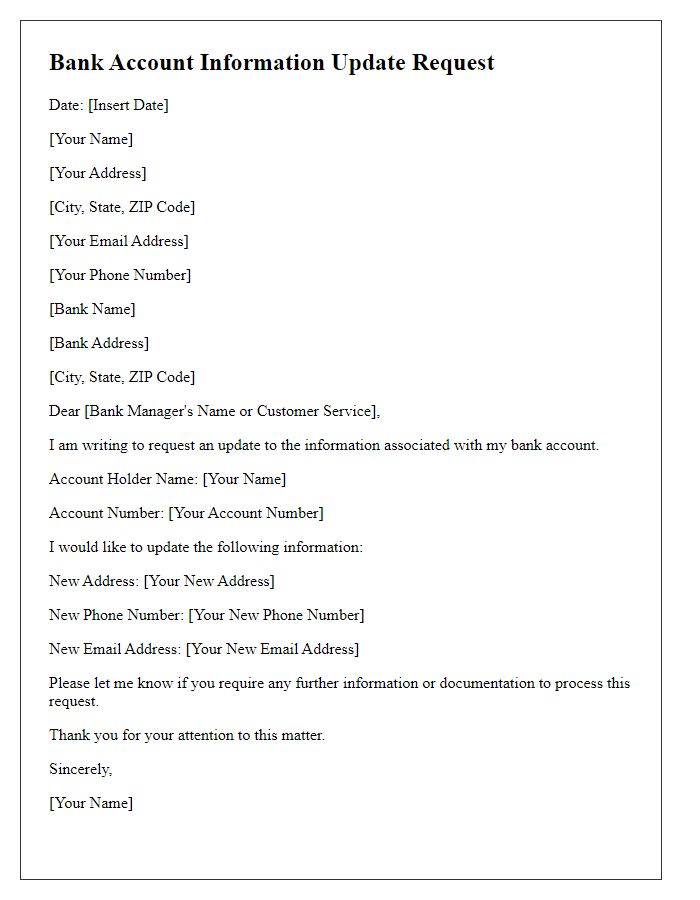

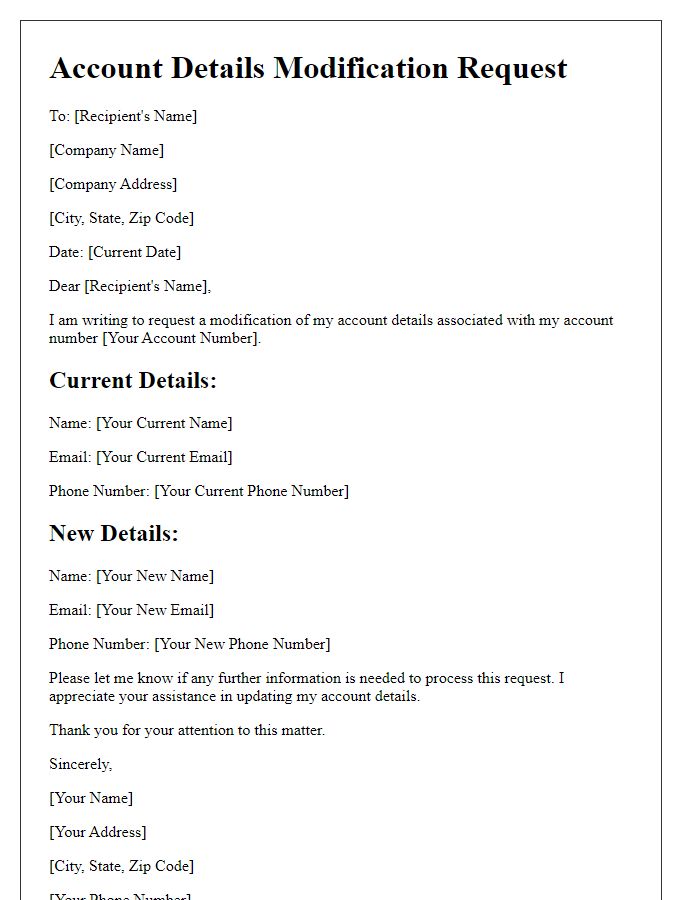

Account Holder's Full Name

Account holder information must be kept current to ensure smooth banking transactions and communications. Changes in account holder details can arise due to life events such as marriage, relocation, or changes in legal name. For instance, an individual named John Doe may need to update his bank account details after marrying Jane Smith to reflect his new name as John Smith. The account number, which uniquely identifies the account within the banking system, also must be checked for accuracy. Additionally, ensuring that the registered address aligns with residence changes is essential for receiving important bank communications and statements securely. Providing updated identification, such as a driver's license or utility bill, might be necessary to verify changes and maintain account security.

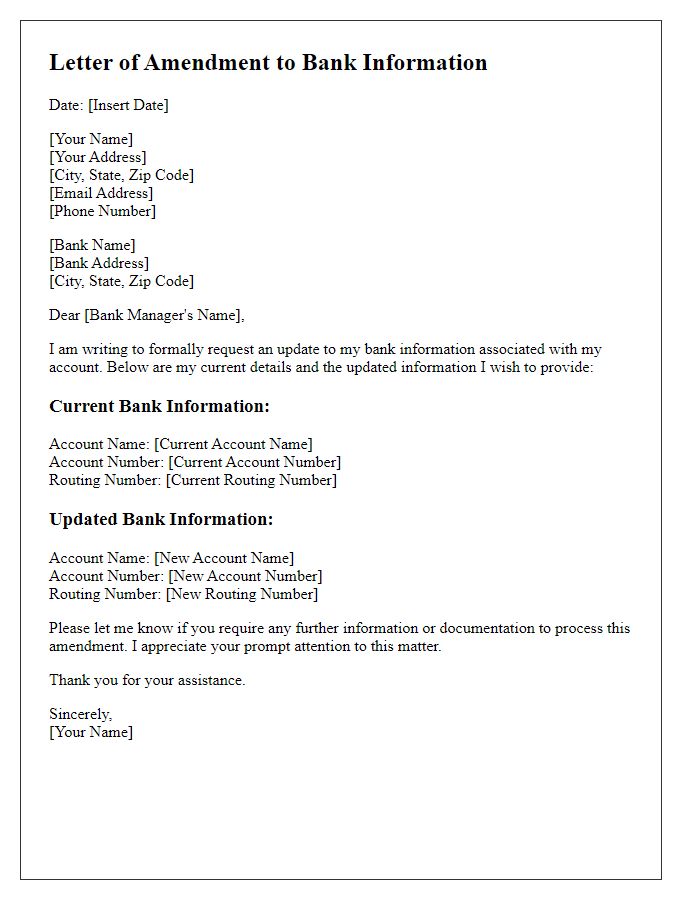

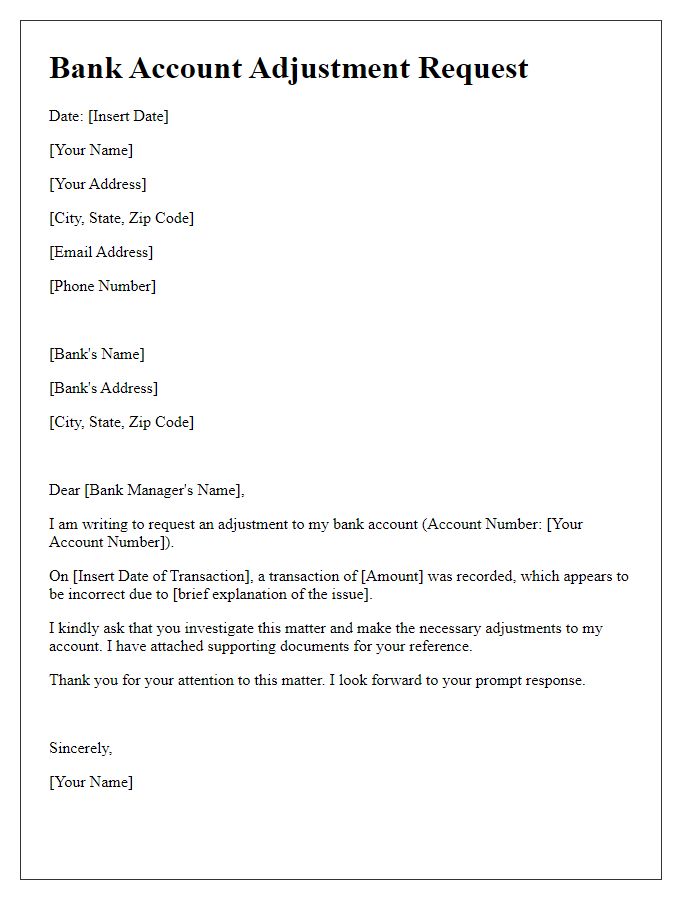

Current Bank Account Details

Current bank account details must be accurately maintained to ensure seamless transaction processing. This includes the account number, which typically consists of 10 to 12 digits, and the routing number, a 9-digit code indicating the financial institution. Essential personal identification information, such as the account holder's name and address linked to the account, must match what the bank has on file to prevent verification issues. Additionally, it is crucial to keep track of any changes in bank policies or requirements regarding account updates, as regulations can vary significantly between banks, such as those in the United States or the United Kingdom.

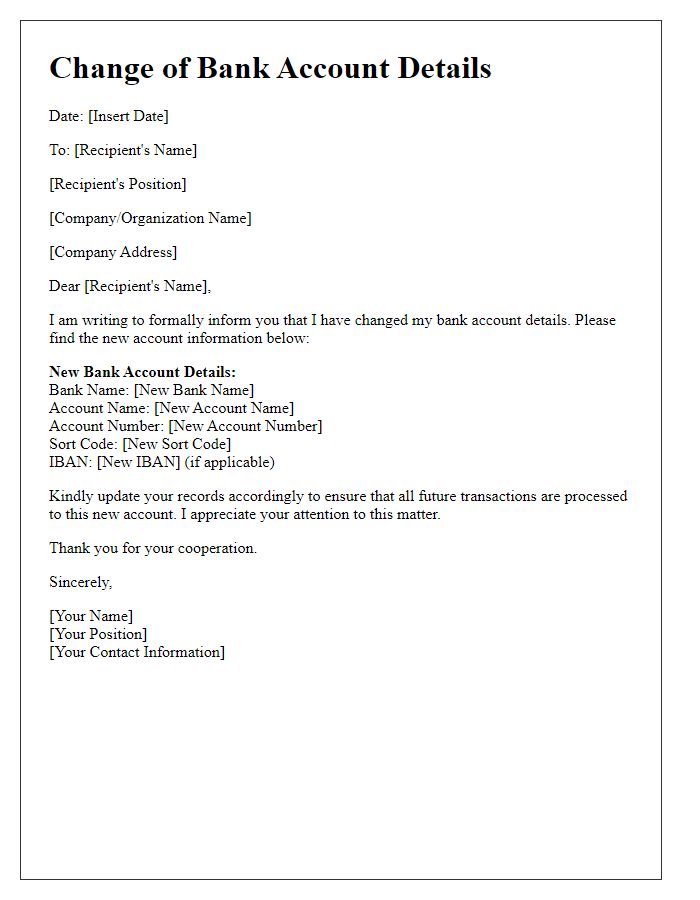

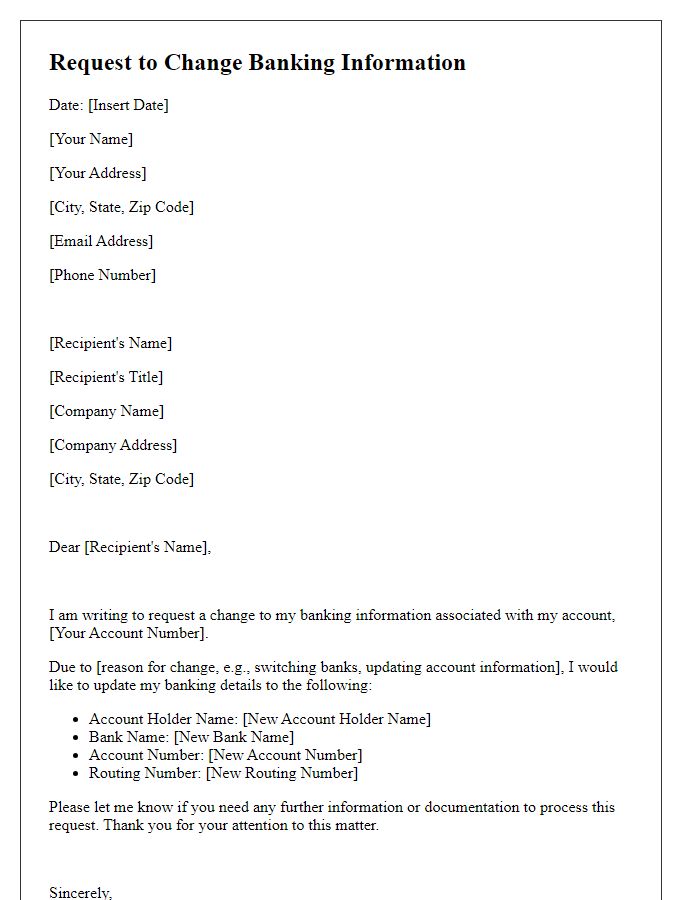

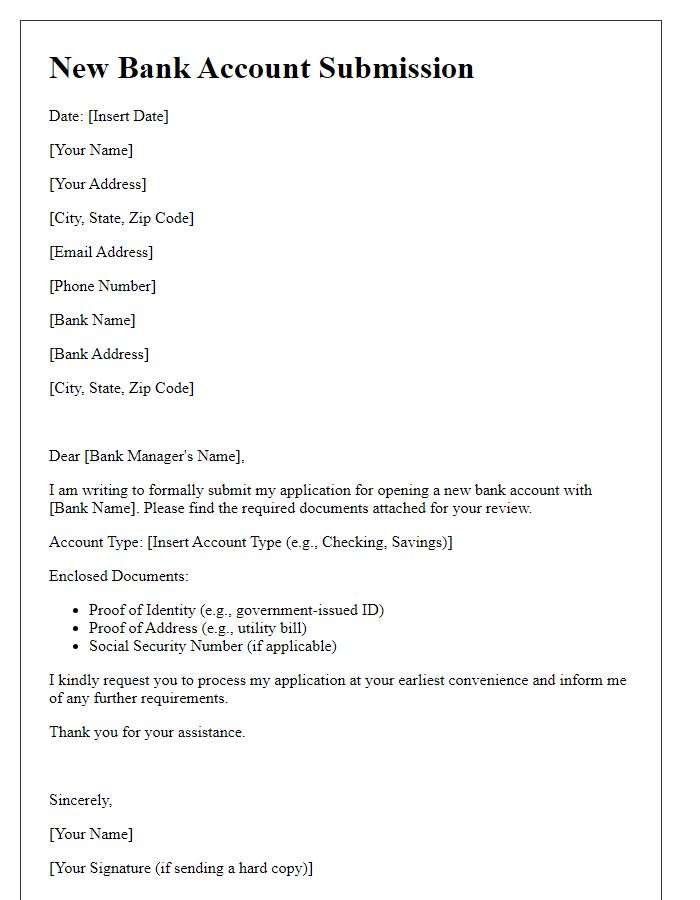

New Bank Account Information

Updating bank account information is crucial for managing personal finances effectively. When changing bank accounts, individuals must provide essential details, including the new account number, the bank's name, and the associated routing number, which is typically a nine-digit code used in the United States to identify specific financial institutions. Furthermore, the transition may involve updating recurring payments such as utility bills, mortgage payments, or subscription services to ensure no disruption in services. Financial institutions may require formal documentation, including a government-issued photo ID and proof of address, to validate the account change. It's advisable to initiate this process promptly to prevent delays in transactions or potential overdraft fees due to missed payments.

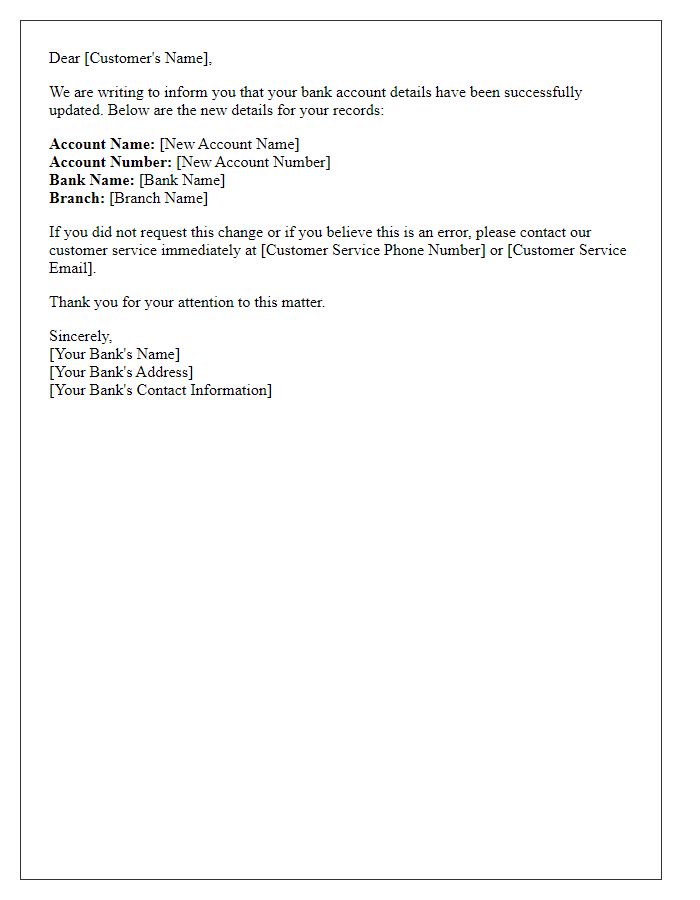

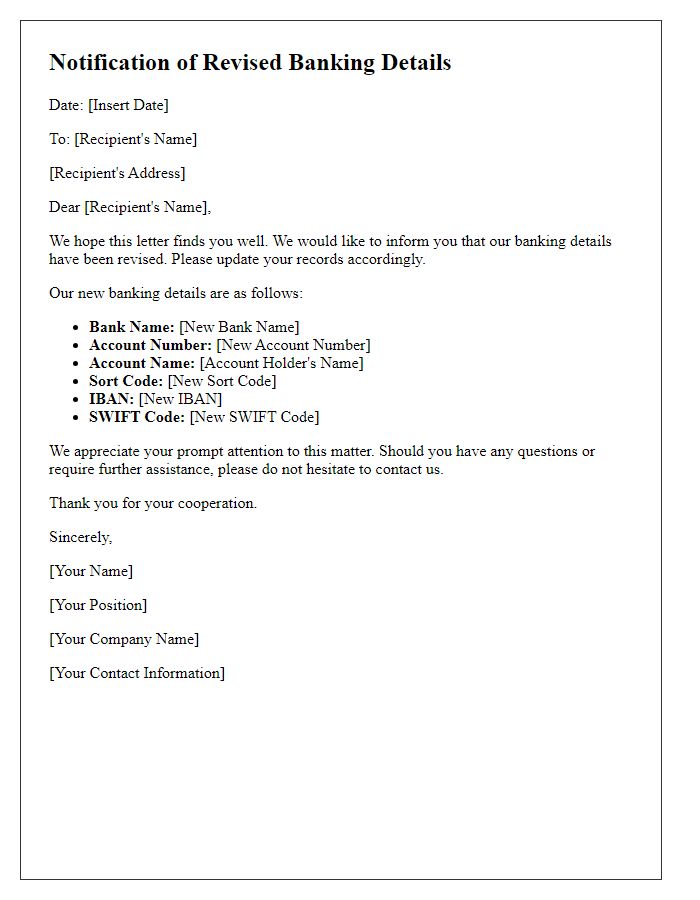

Effective Date of Change

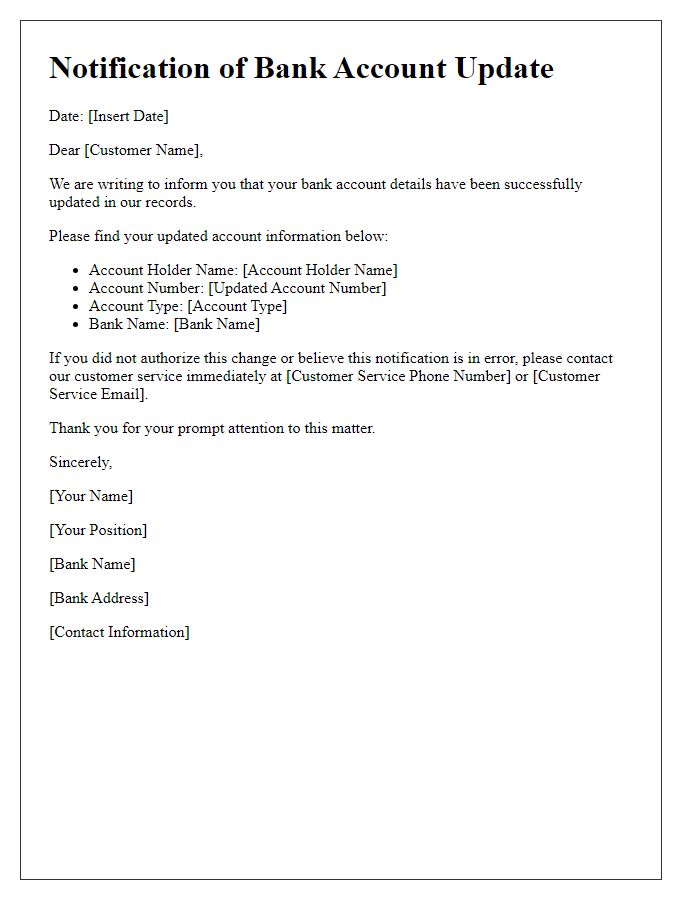

Updating bank account information is crucial for seamless financial transactions. Ensuring accurate details, such as account numbers and routing numbers, is vital to prevent disruptions in payments or direct deposits. It is advisable to inform the financial institution, like XYZ Bank, at least three business days before the effective date of change, allowing sufficient time for processing. Customers should specify all updated information clearly, including account ownership details and the current address for correspondence, ensuring compliance with federal regulations. Timely updates can help maintain financial security and avoid potential errors in future transactions.

Contact Information for Verification

Updating bank account information requires careful attention to detail, especially regarding contact information for verification. Essential elements include current phone numbers, email addresses, and physical addresses that match those on file with the bank, such as Bank of America or JPMorgan Chase. Accurate data can expedite the verification process, reducing delays when changing account details. Additionally, providing a secondary contact number can enhance communication, ensuring that any queries by bank representatives can be resolved swiftly. It is crucial to double-check the information against legal documents to avoid potential discrepancies.

Comments