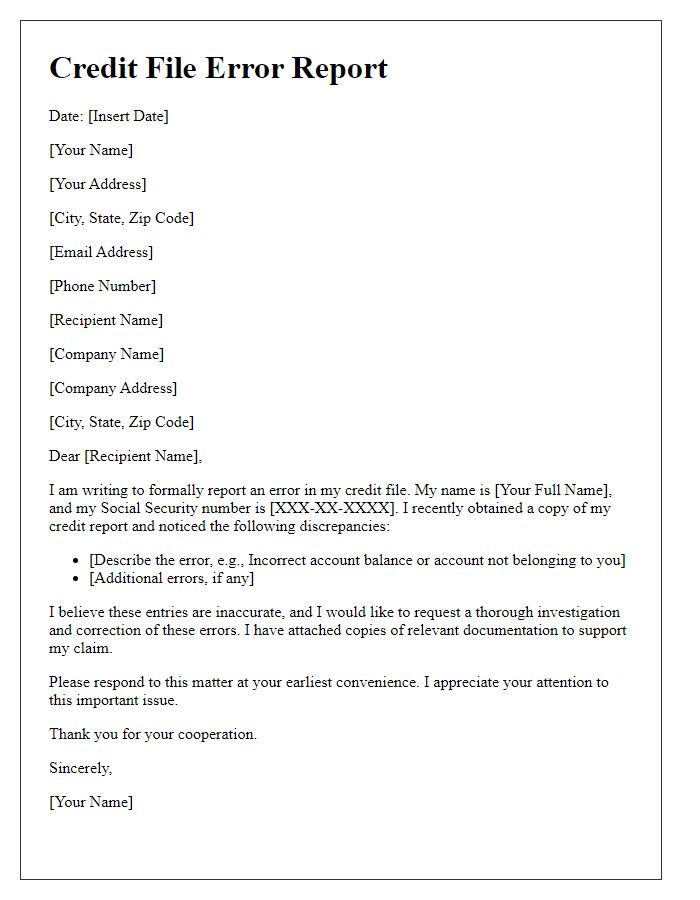

Have you ever taken a closer look at your credit report only to find something that doesn't quite add up? It can be frustrating to spot an error, especially when it's linked to your financial future. But don't worry, disputing inaccuracies is your right, and it's easier than you might think! Let's dive into how you can effectively communicate with credit bureaus and set the record straight, so you can read more and tackle this issue head-on.

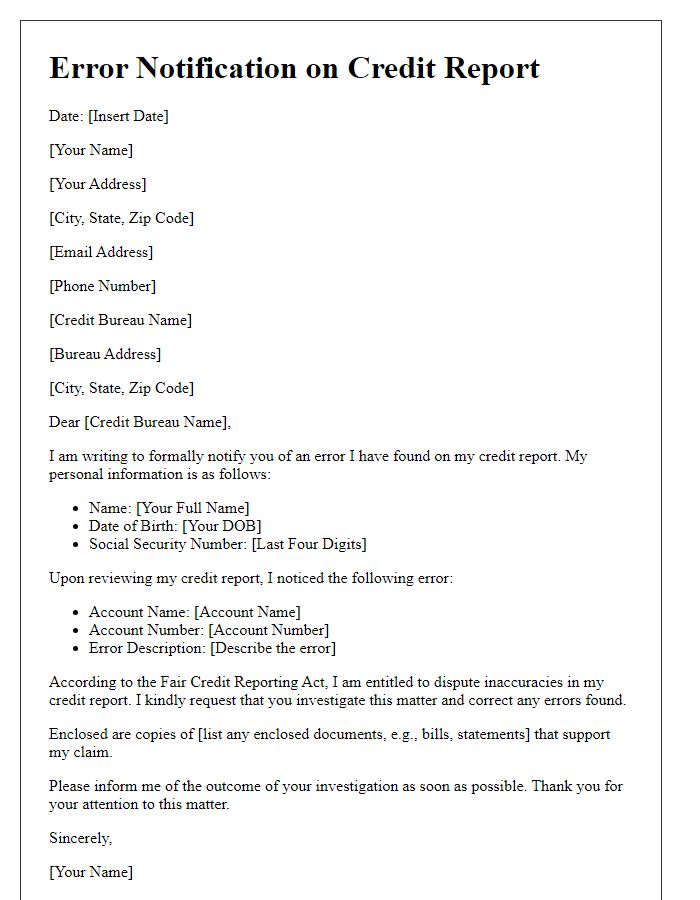

Accurate Personal Information

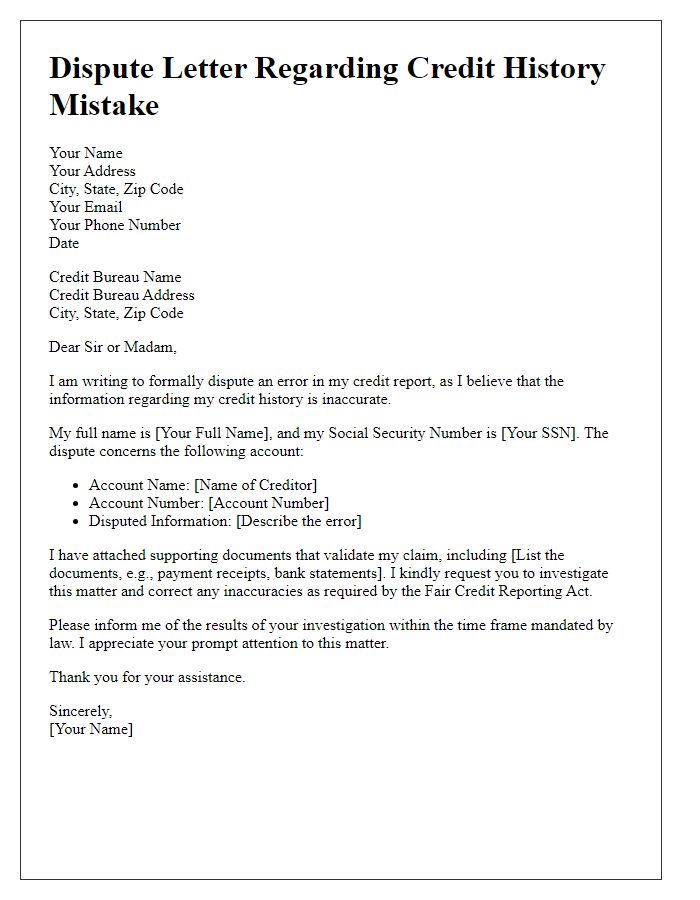

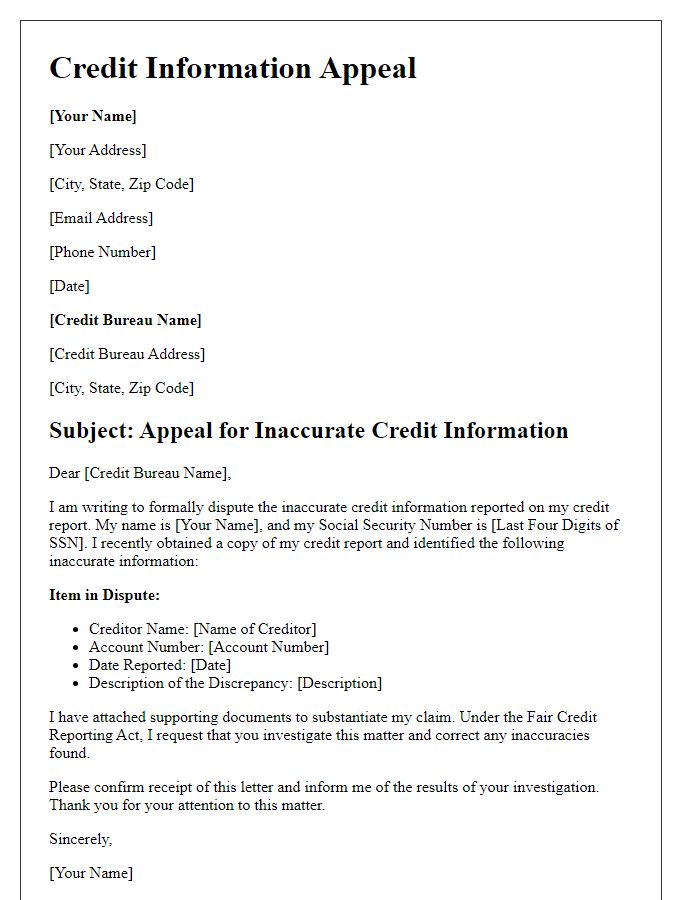

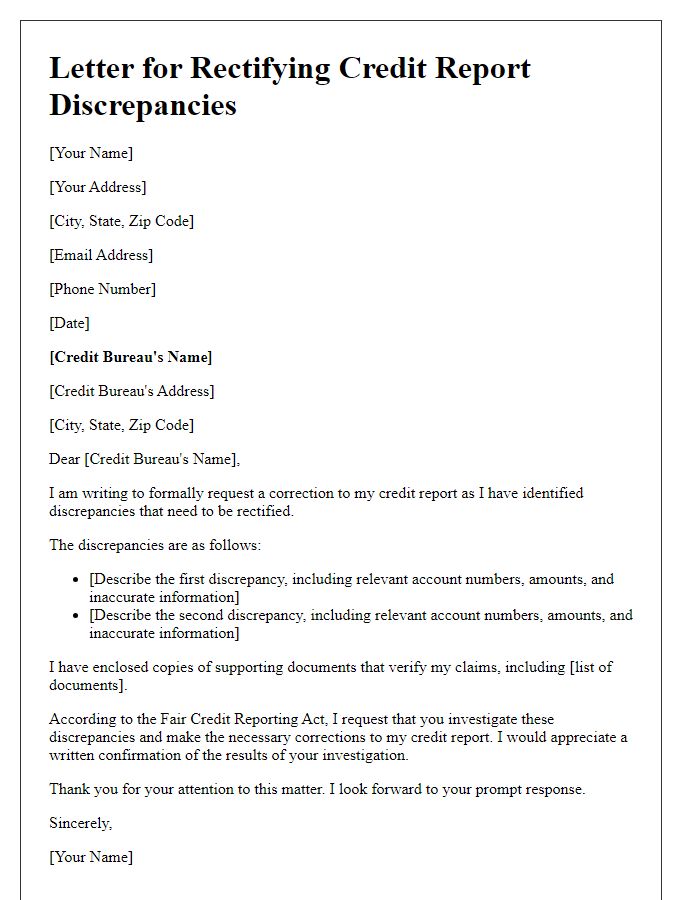

Disputing inaccuracies in credit reports is essential for maintaining accurate financial records. Credit reports, compiled by agencies such as Equifax, Experian, and TransUnion, must reflect precise personal information, including name, address, Social Security number, and employment details. Errors in these key areas can lead to severe consequences, such as affecting credit scores and limiting loan opportunities. Under the Fair Credit Reporting Act, individuals have the right to dispute incorrect information. Steps involve submitting documentation, such as identification or proof of residence, to substantiate claims. Timely resolution is critical, with agencies required to investigate disputes within 30 days, ensuring integrity in credit reporting.

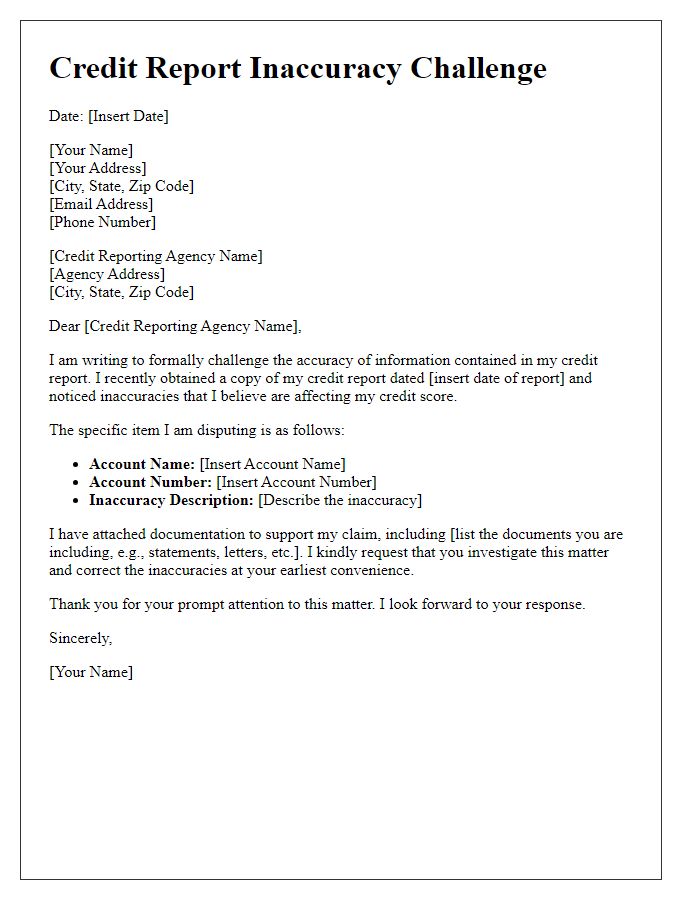

Clear Error Description

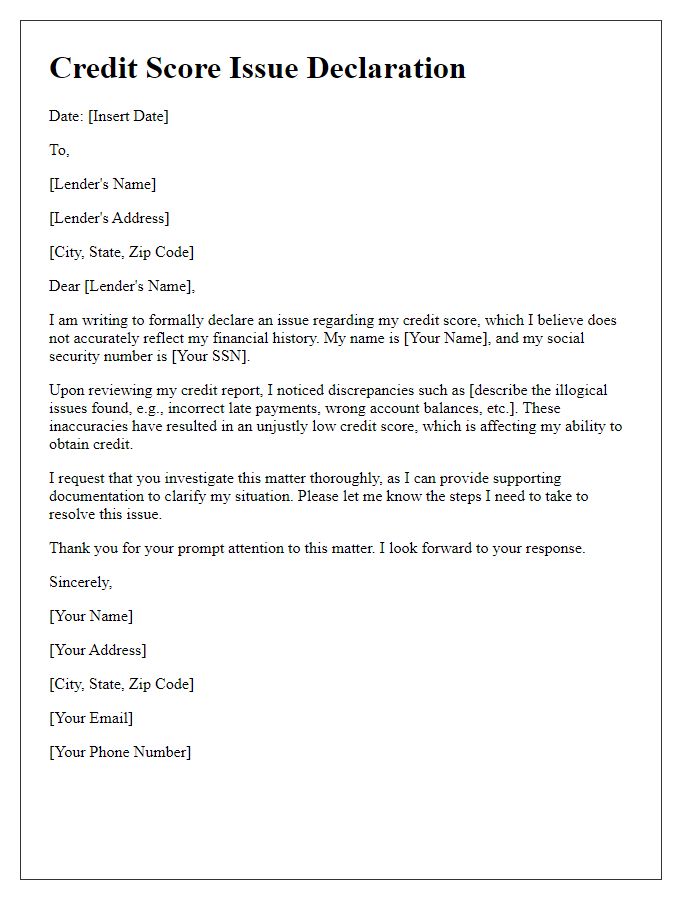

Incorrect credit report entries often arise from clerical mistakes or identity confusion. For example, a report might incorrectly reflect missed payments on a credit history compiled by TransUnion or Experian. Errors can include inaccurate account balances, wrong creditor names, or outdated personal information. Identifying these discrepancies is crucial, as credit scores significantly influence loan approvals, interest rates, and ultimately financial opportunities. Promptly addressing these inaccuracies, typically within 30 days of discovery, prevents negative impacts on creditworthiness, allowing for a clearer financial picture moving forward.

Reference to Supporting Documents

A credit report error can severely impact an individual's financial standing. Disputing inaccuracies requires meticulously referencing supporting documents, such as recent credit statements, identity verification forms, and relevant correspondence with creditors. For instance, when an erroneous late payment from XYZ Bank (which could date back to June 2023) appears on a credit report, attaching the payment confirmation receipt (documented by the bank as received on May 15, 2023) is crucial. Furthermore, personal identification, such as a driver's license number or social security number, must be clearly outlined to validate identity throughout the dispute process with credit bureaus like Experian, Equifax, and TransUnion. Documenting all interactions will create a transparent dispute trail that strengthens the challenge against erroneous information.

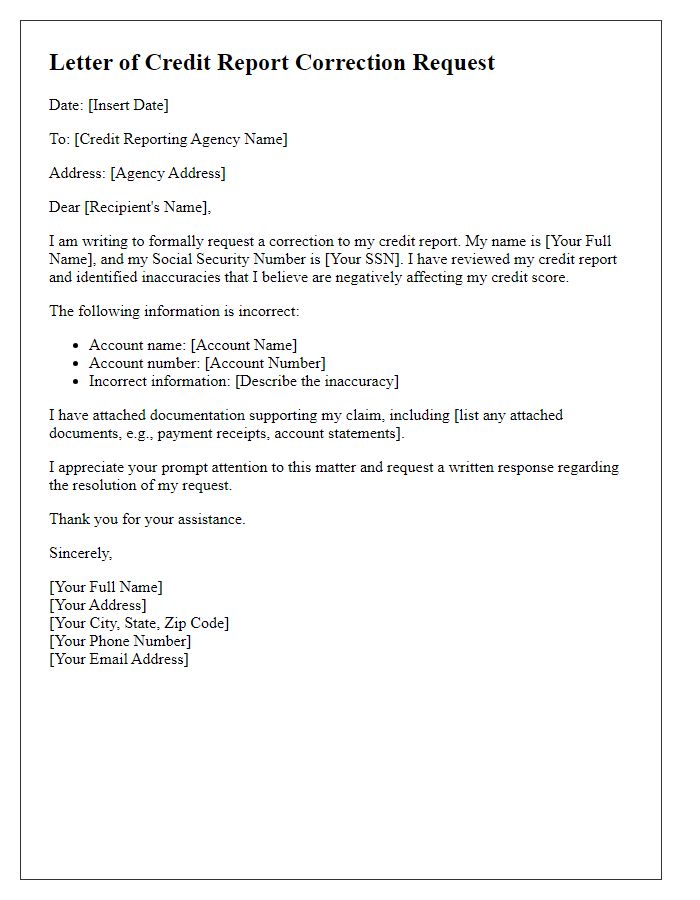

Request for Correction and Update

Errors in credit reports can significantly impact financial decisions and personal credit scores. A common issue is inaccurate information on reports from major credit bureaus like Experian, TransUnion, and Equifax, affecting individuals' ability to secure loans or mortgages. The dispute process often requires a formal request citing specific inaccuracies, like incorrect account balances or unauthorized inquiries. Detailed documentation, including account statements and identification, reinforces the request for corrections. Following Federal Trade Commission (FTC) guidelines, individuals may expect a resolution within 30 days once the credit bureau receives the dispute. Timely updates can improve overall credit health and maintain financial reliability.

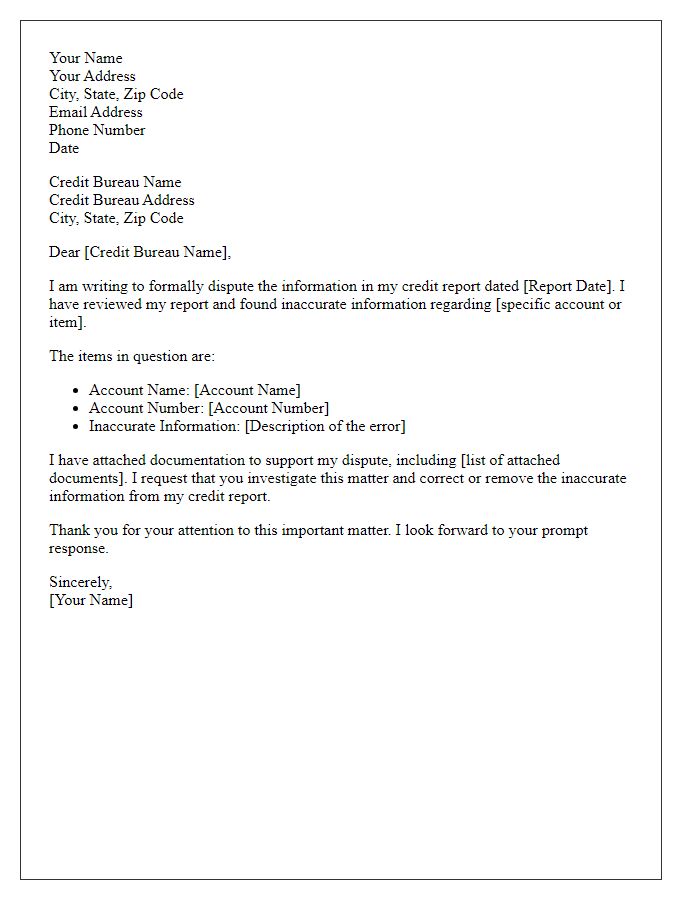

Contact Information for Follow-Up

Disputing a credit report error requires precision and clarity. Include your full name, mailing address, and phone number at the top of the letter to facilitate easy communication. Additionally, specify the date of the letter, which is important for tracking purposes, and reference your credit report number obtained from national credit bureaus like Experian, Equifax, or TransUnion. Providing an email address can enhance the follow-up process. Detail the specific error in your credit report, including the account number and the nature of the discrepancy, to ensure that the credit bureau can quickly locate and address the issue.

Comments