Hey there! It's always a great feeling to know that your payment has been received, right? In this article, we'll walk you through a handy letter template that you can use to confirm the receipt of payment in a professional yet friendly manner. Whether you're a business owner or just managing personal finances, having a clear confirmation letter can build trust and accountability. So, let's dive in and explore how you can create one that suits your needs!

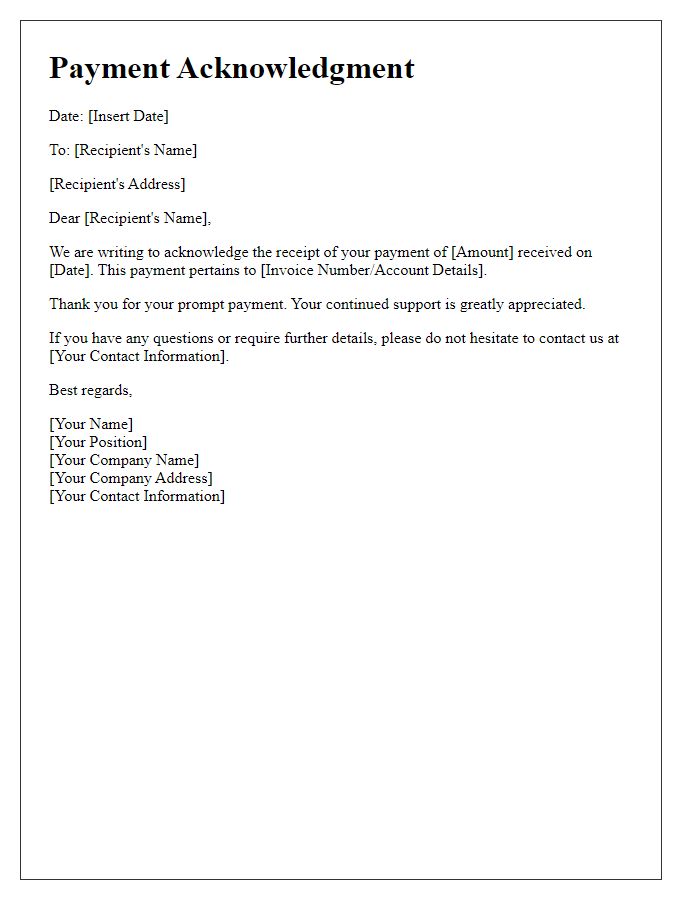

Sender's contact information

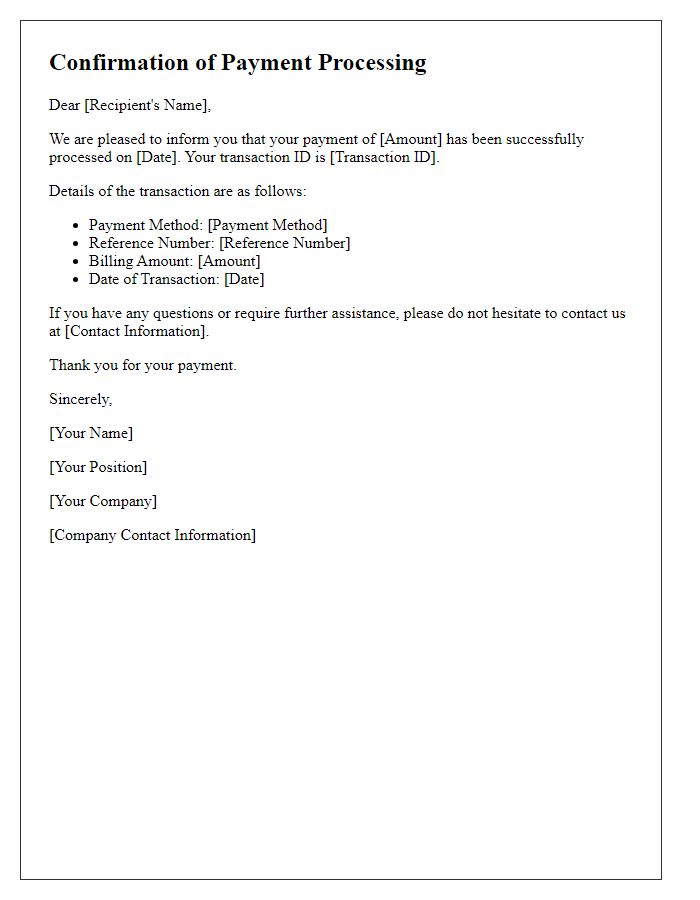

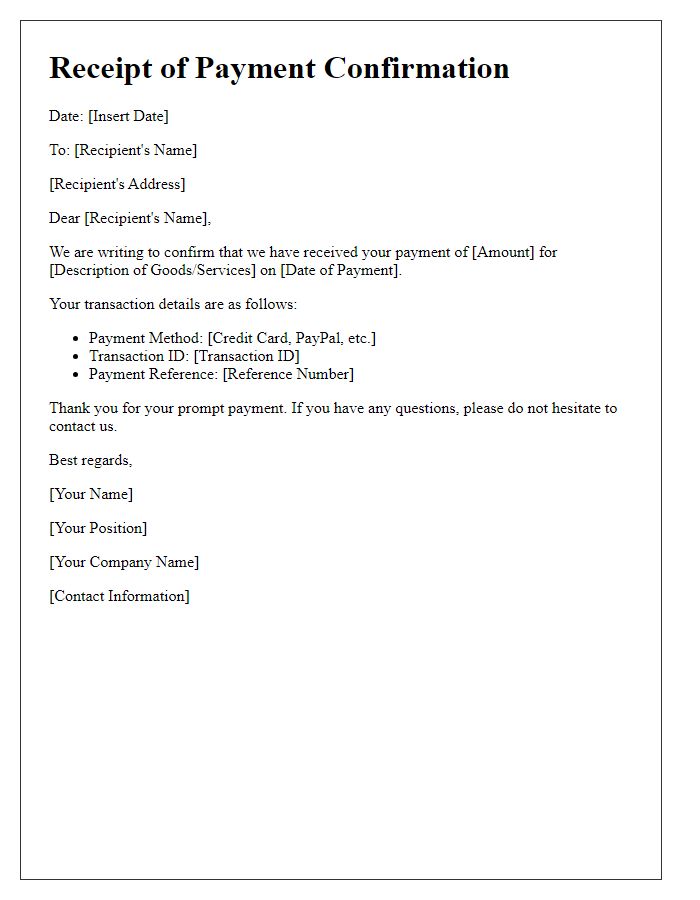

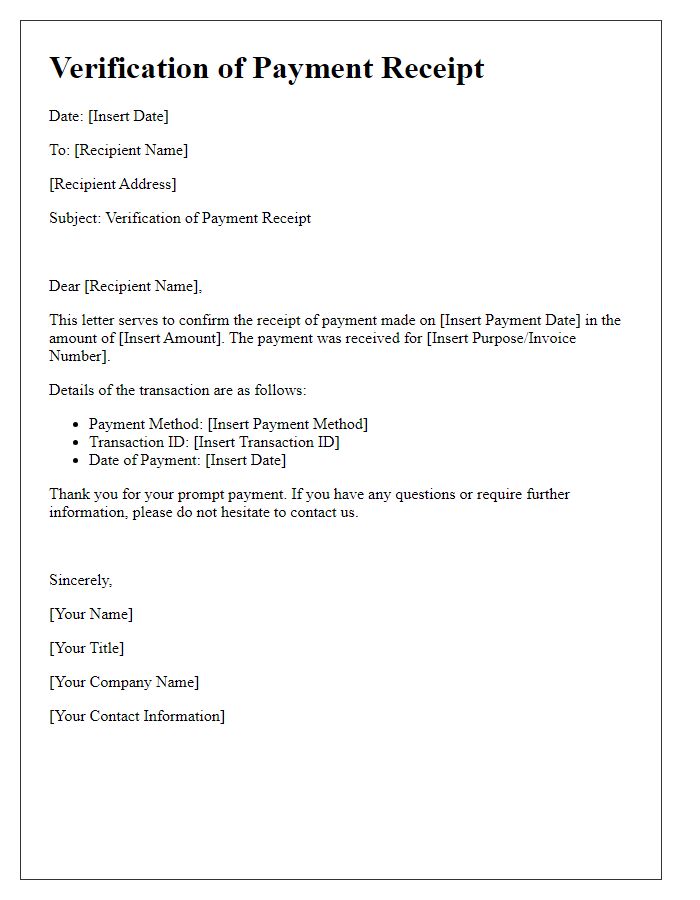

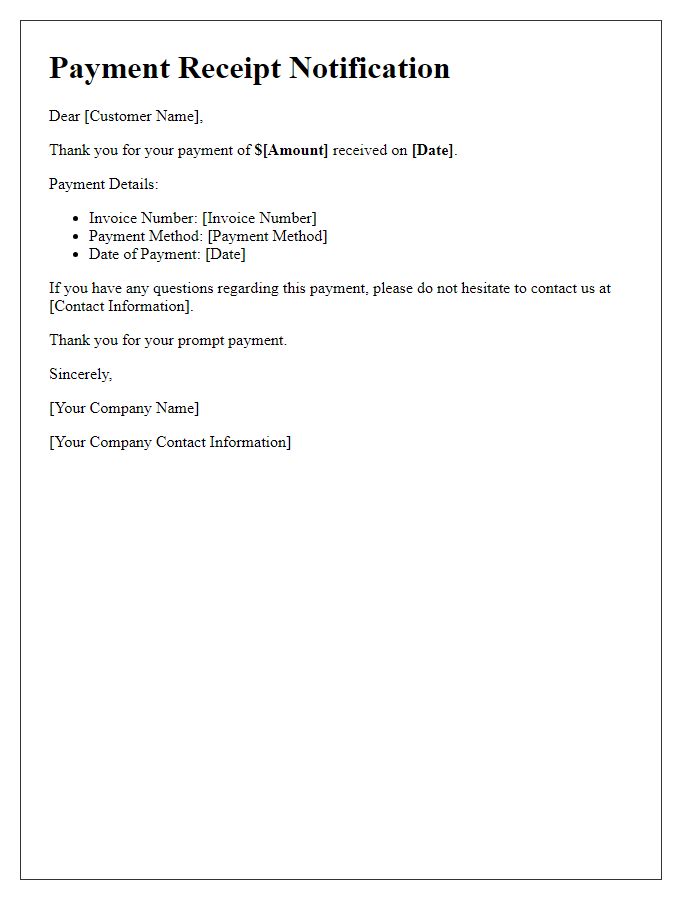

When a payment is received, a confirmation receipt typically includes crucial details such as the sender's name and address, email, and phone number. This information ensures that the recipient can easily identify the sender and reach out if needed. Including transaction specifics like the date of payment (often within the last few days), amount (in specific currency, e.g., USD), and payment method (like credit card or bank transfer) enhances the clarity of the document. Including a unique invoice number or reference number connects the payment to a specific order or service, providing an organized record for future reference.

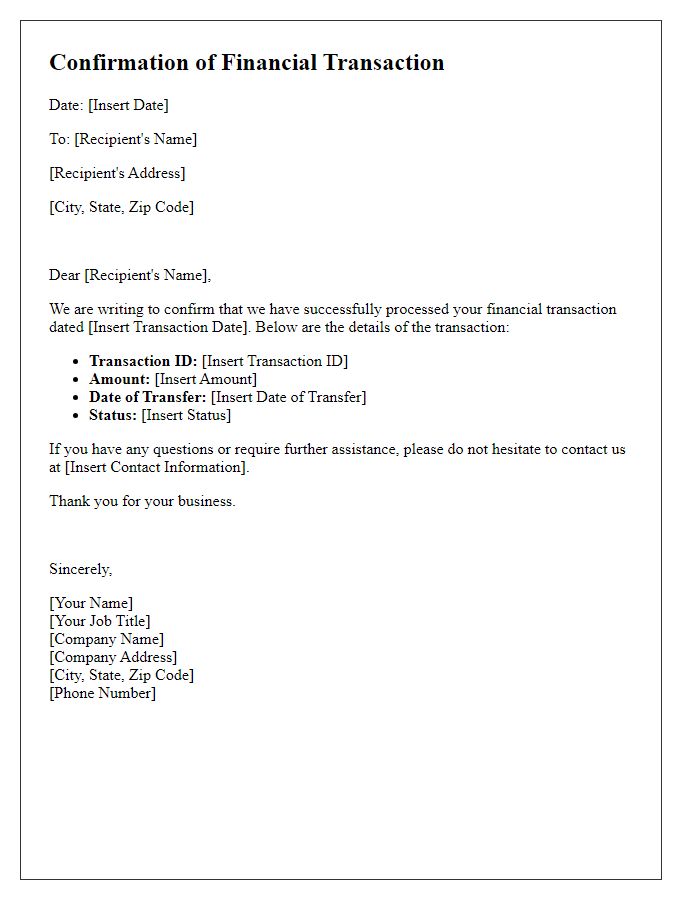

Recipient's contact information

Confirmation of payment receipt serves as a crucial document in financial transactions, ensuring both parties acknowledge the transfer of funds. The recipient's contact information, including full name, physical address, email address, and phone number, plays a pivotal role in establishing clear communication channels. It is essential to note that accuracy in details enhances trust and professionalism. For organizations, including the business name and tax identification number can add an extra layer of legitimacy to the confirmation. Such documentation is often necessary for record-keeping purposes and can serve as proof in case of disputes or inquiries regarding the transaction.

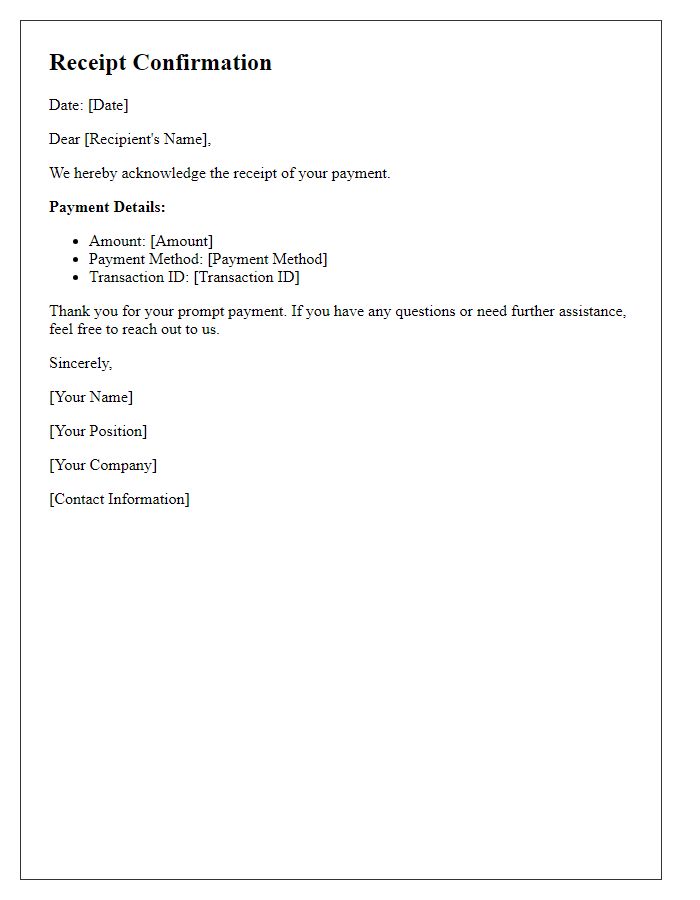

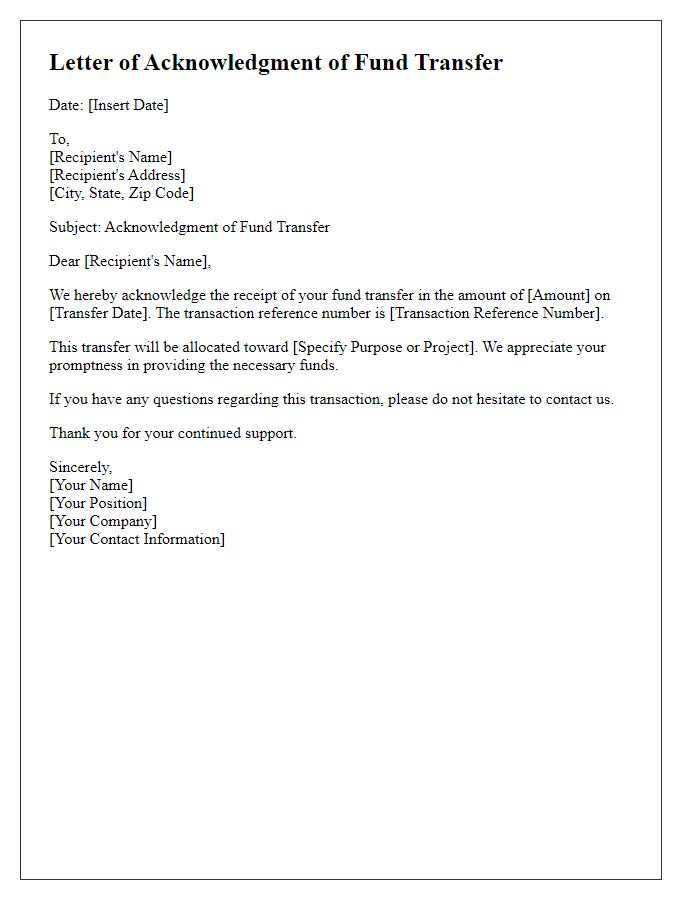

Acknowledgment of payment receipt

Acknowledgment of payment receipts is essential for maintaining transparent financial transactions. A payment receipt confirms the successful transaction between two parties, often including details such as the payment amount, date of the transaction, and method of payment, which could be credit card, bank transfer, or PayPal. Proper documentation, like a receipt number for reference, enhances clarity, especially for accounting purposes. For businesses and clients, maintaining thorough records of acknowledged payments ensures a clear history of financial commitments and can aid in dispute resolution if discrepancies arise in future transactions. Regular confirmations of payment receipt reinforce trust and professionalism in business relationships.

Payment details (amount, date, reference number)

Receipt of payment confirmed for an amount of $500, received on August 15, 2023. The unique reference number associated with this transaction is 123456ABC. This payment pertains to Invoice #7890, issued by XYZ Services, located at 456 Commerce Street, Business City. All transactions are processed securely to ensure customer privacy and accuracy. Thank you for your prompt payment.

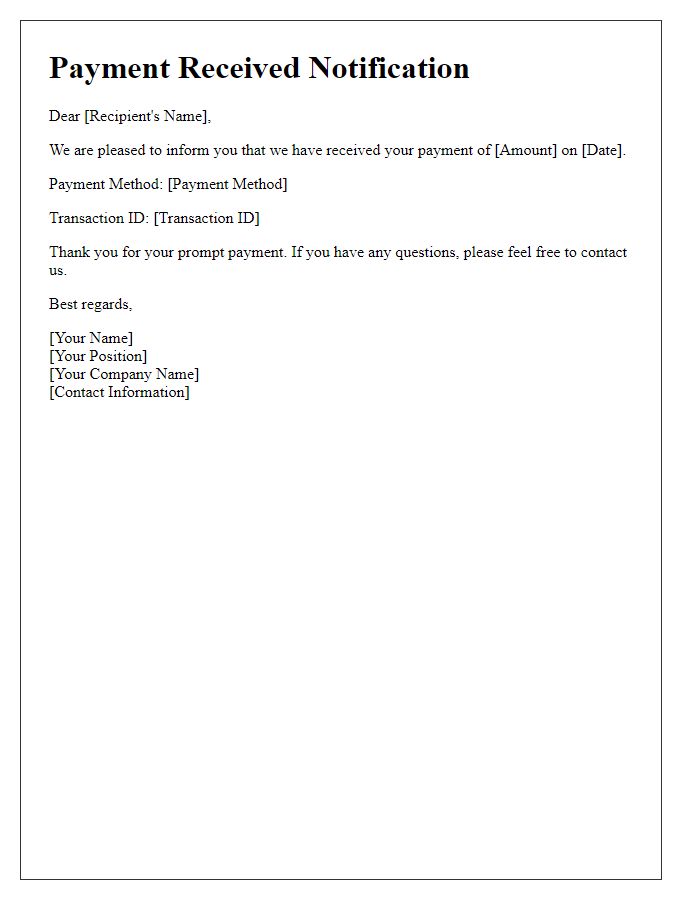

Gratitude and future instructions

Confirmation of payment receipt indicates successful transactions in various financial contexts. Businesses, such as e-commerce platforms, often send these confirmations to ensure transparency. An acknowledgment typically includes details, such as the payment amount, transaction ID, and date, providing clarity to the customer. This communication fosters trust and enhances customer relations. Additionally, instructions for future actions, such as shipping details, account access, or next steps in the purchase, are critical for guiding customers effectively. Engaging language expressing gratitude for the transaction can promote a positive experience, encouraging future interactions and reinforcing brand loyalty.

Comments