Have you ever found an unexpected charge on your bank statement that left you feeling puzzled and a bit uneasy? Well, you're not alone; unauthorized transactions can happen to anyone, and knowing how to address them is crucial for safeguarding your finances. In this article, we'll explore a simple yet effective letter template that will help you communicate with your bank or financial institution about any unapproved charges. So, let's dive in and empower you to take control of your money â read on to find out more!

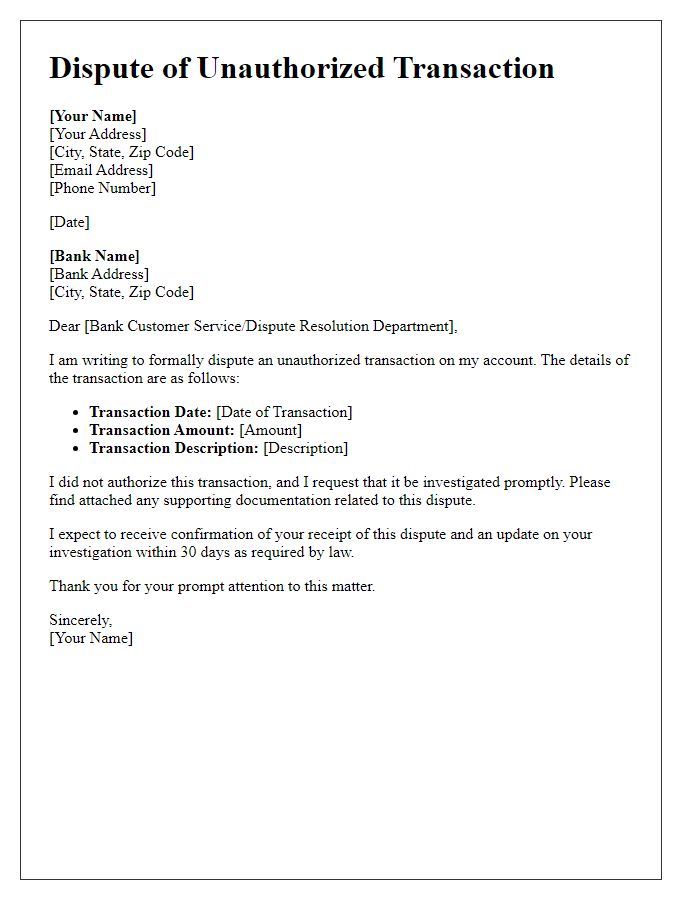

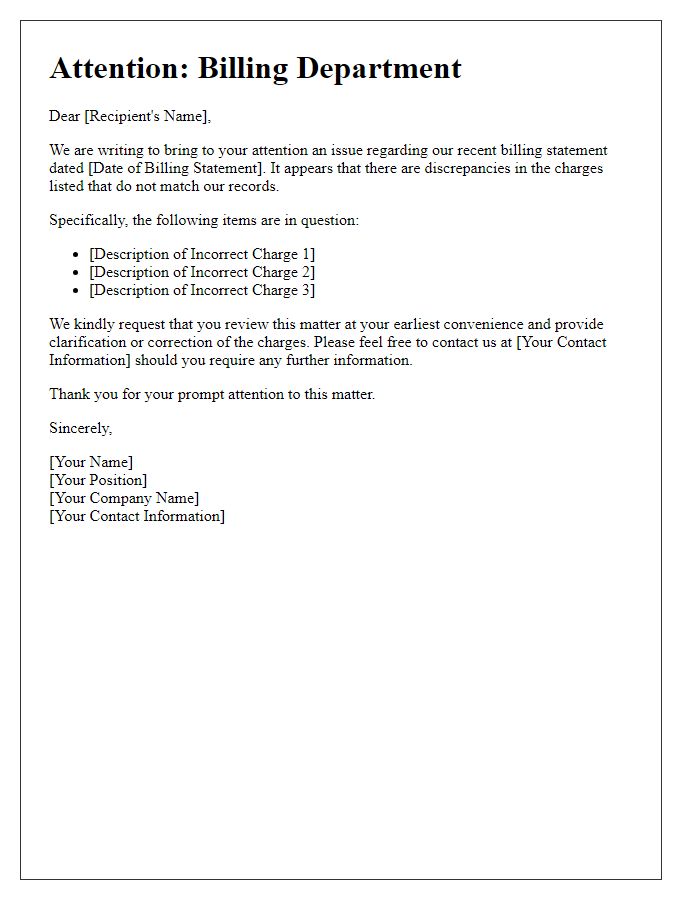

Account Information

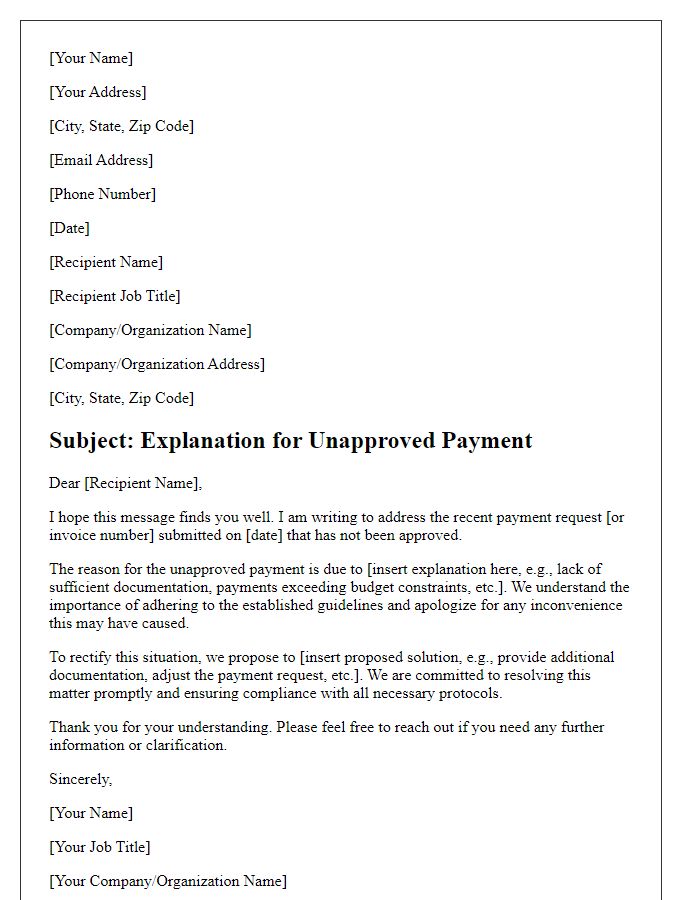

Unauthorized transactions can cause significant concerns for account holders. Individuals noticing an unauthorized transaction (a financial activity that was not permitted or recognized) on their financial accounts, usually linked to banks or credit card companies, should act promptly. Contact the financial institution's customer service (available on their official website) to report the issue. Prepare to provide account details, highlighting any suspicious charges noted on statements (often occurring in varying amounts or unfamiliar merchant names). Documentation such as transaction dates or receipts (if applicable) can help substantiate claims. Many institutions follow procedures under regulations like the Fair Credit Billing Act (FCBA) to protect consumers, ensuring reimbursement for unauthorized transactions if reported in a timely manner.

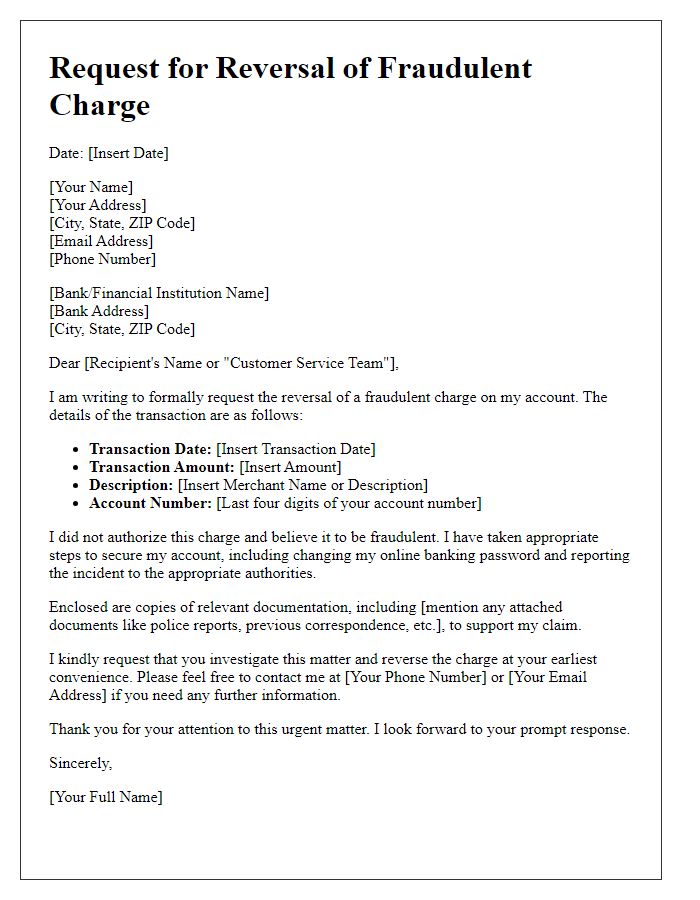

Transaction Details

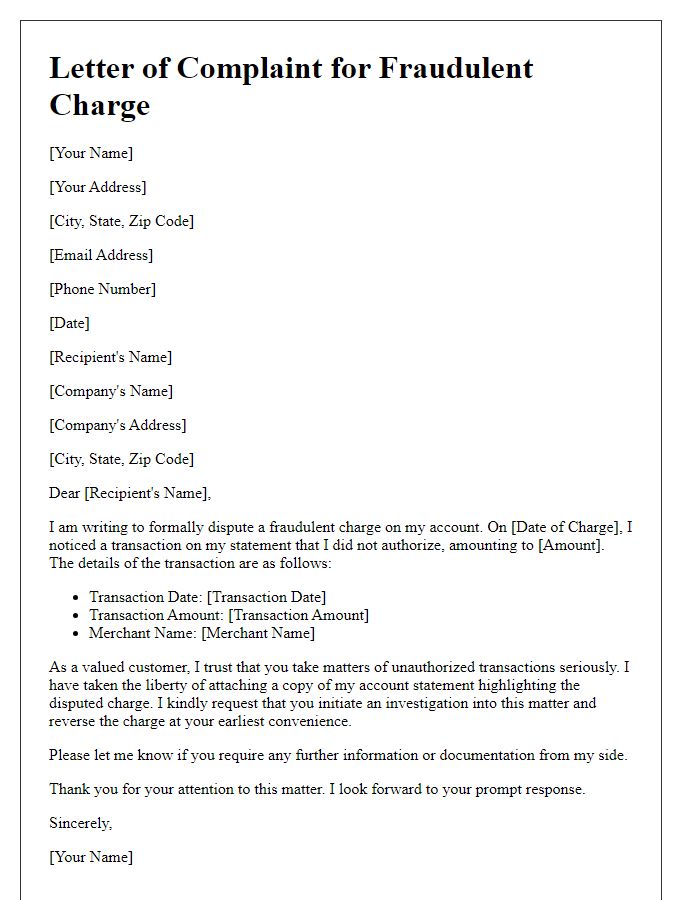

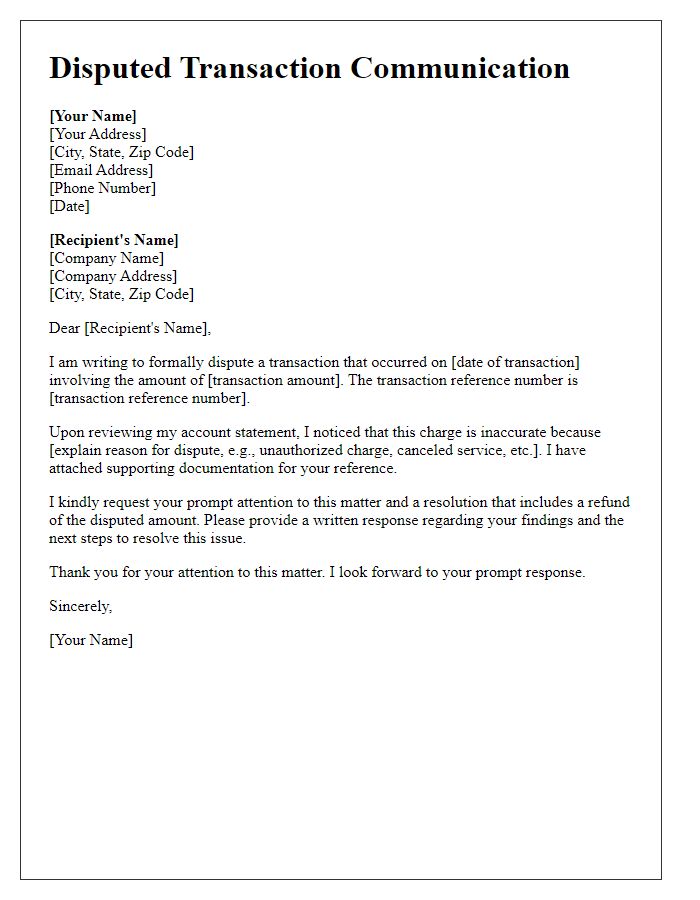

Unauthorized transactions can occur when sensitive financial information, such as credit card numbers, is compromised. For instance, in a common scenario, a user might find a charge of $150 on their Visa card for an online purchase at an unfamiliar site like "ElectroGoods.com." This transaction could indicate potential fraud, especially if the cardholder has not shopped at this retailer. Furthermore, if the transaction occurred on a date when the cardholder was overseas, it reinforces concerns about unauthorized access. Immediate reporting to financial institutions, such as American Express or Chase Bank, along with documentation of the transaction, is crucial for resolution and reimbursement. Consumer protections under regulations like the Fair Credit Billing Act mandate swift investigations into such claims, often requiring the institution to resolve disputes within 30 days.

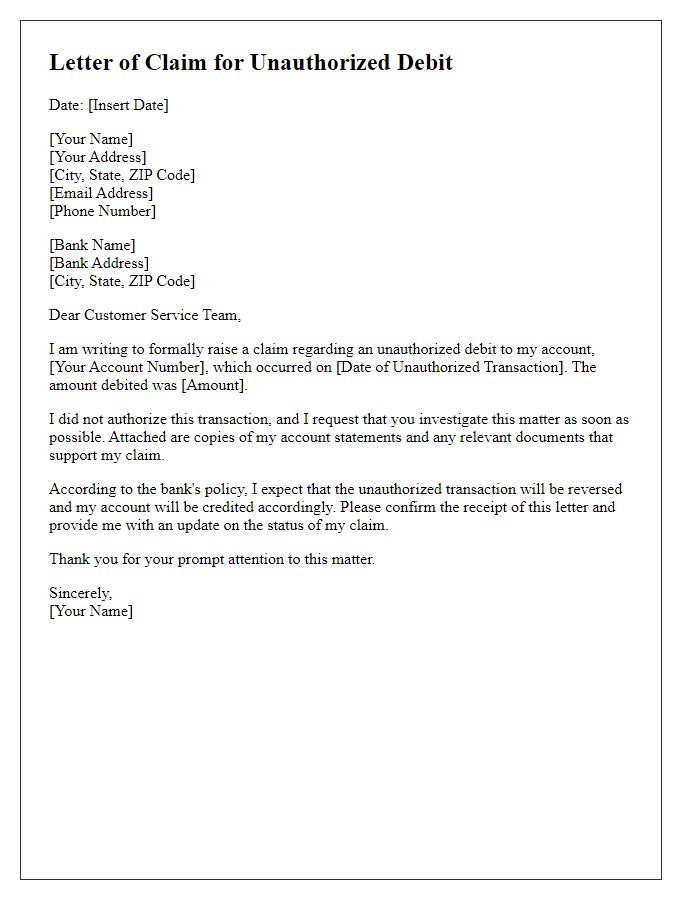

Claim of Unauthorized Activity

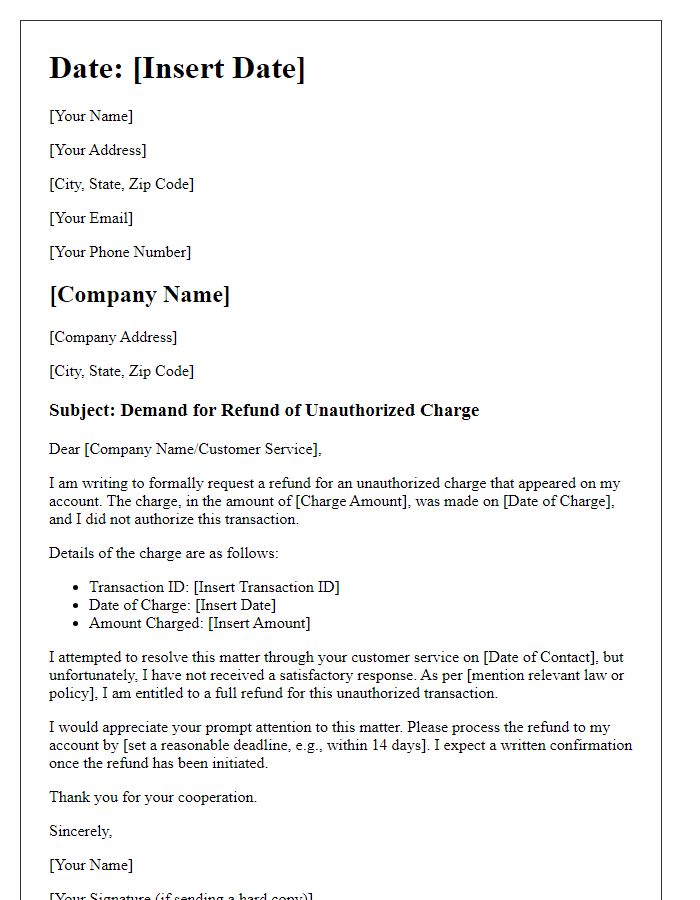

Unauthorized transactions on financial accounts can lead to significant worries for consumers. Such incidents, especially those involving credit cards and bank accounts, require immediate attention and resolution. Typically, these transactions occur when personal information is compromised, with hackers exploiting vulnerabilities, often resulting in monetary losses. Notably, consumers should report unauthorized charges typically within 60 days of the transaction posting date to comply with federal regulations such as the Fair Credit Billing Act. Financial institutions, like Chase Bank or Bank of America, have specific protocols in place for investigating these claims, which might involve account freezes and enhanced security measures. To follow up, submitting a formal written notice detailing the unauthorized activity, including transaction dates, amounts, and associated merchant information, is crucial for a swift resolution.

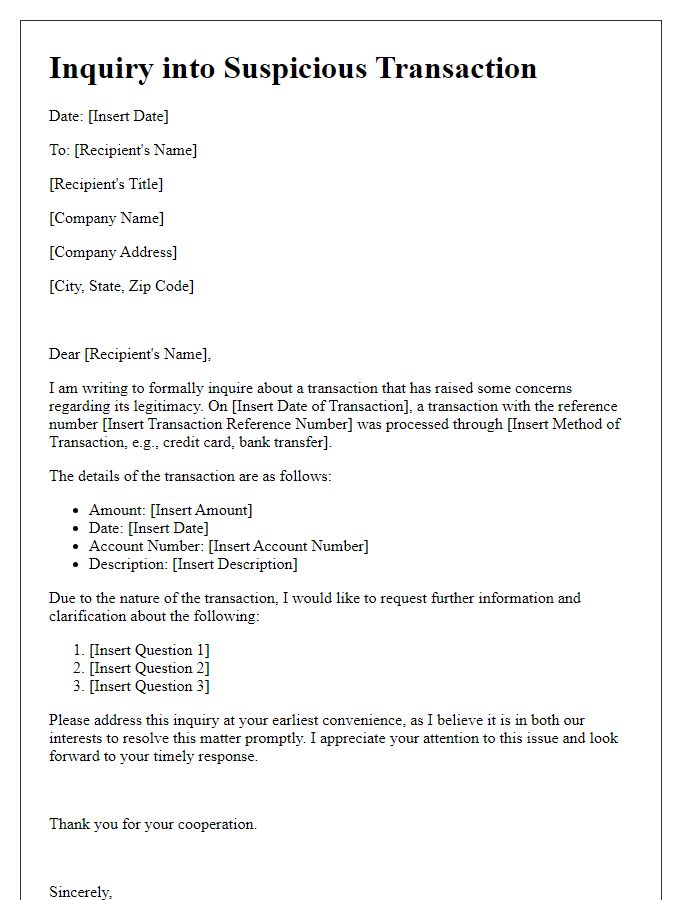

Request for Investigation

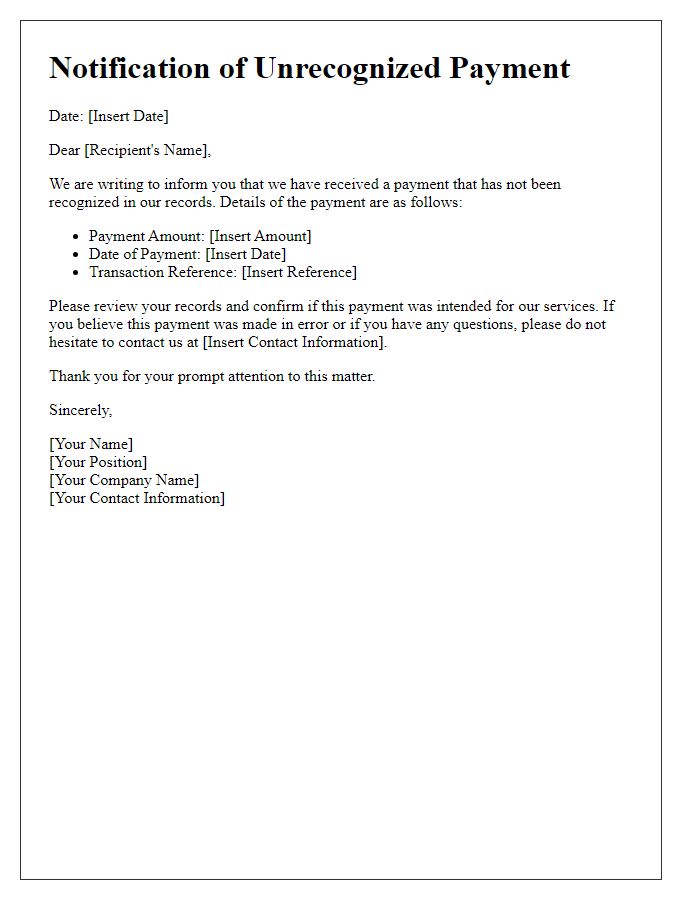

Unauthorized transactions can lead to significant financial loss and distress for consumers. In cases of potential fraud, such as unexpected withdrawals or charges on banking statements, immediate action is necessary. Victims of such incidents often contact their financial institutions or credit card companies for resolution, seeking a thorough investigation into the matter. Providing detailed information, including transaction dates, amounts, and merchant names, enhances the investigation process. Institutions typically follow protocols to secure accounts and refund unauthorized charges after confirming fraudulent activity. Prompt reporting is crucial as many banks have time limits for disputing charges, often within 30 to 60 days of the transaction date.

Contact Information

Unauthorized transactions can lead to significant financial distress and anxiety for affected consumers. It is vital to address such issues promptly by reaching out to the financial institution, such as a bank or credit card company, which can investigate discrepancies. Collect relevant information including transaction dates, amounts, and vendors involved; these details are essential for the dispute process. Reporting requirements may vary by institution, so ensuring correct contact numbers, such as customer service hotlines operating 24/7, and email addresses is crucial. Additionally, documenting communication, including dates and representatives spoken to, strengthens the case and ensures proper follow-up.

Comments