When it comes to giving back, charity donations play a crucial role in supporting causes we care about. Crafting a well-structured letter to confirm these donations not only acknowledges the generosity of the donor but also reinforces their connection to the mission at hand. In this article, we'll explore essential elements to include in your confirmation letters, ensuring they are heartfelt and professional. Join us as we dive deeper into writing effective charity donation confirmation letters that leave a lasting impression!

Donor's name and contact information

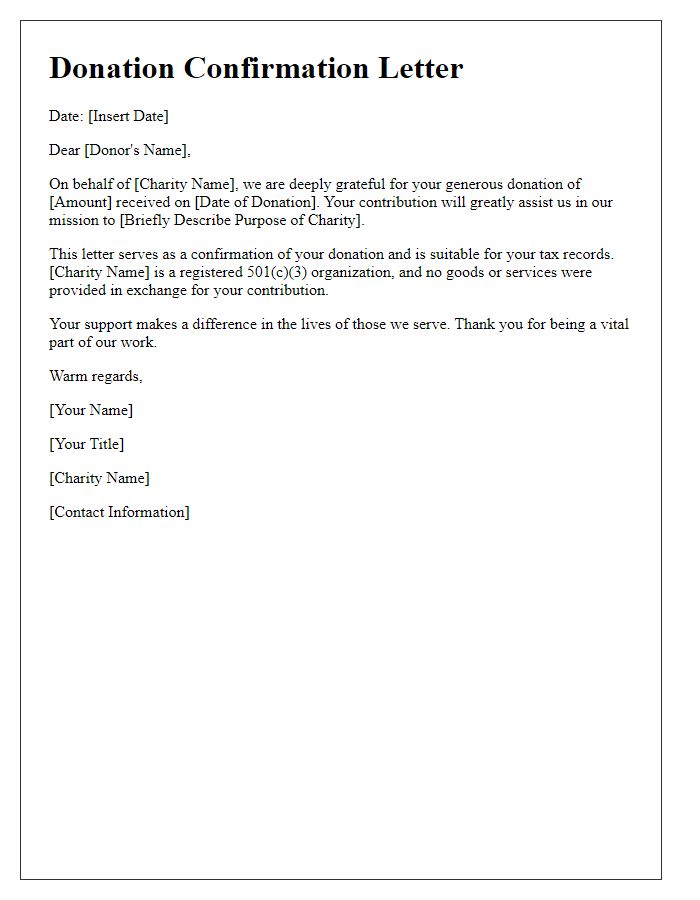

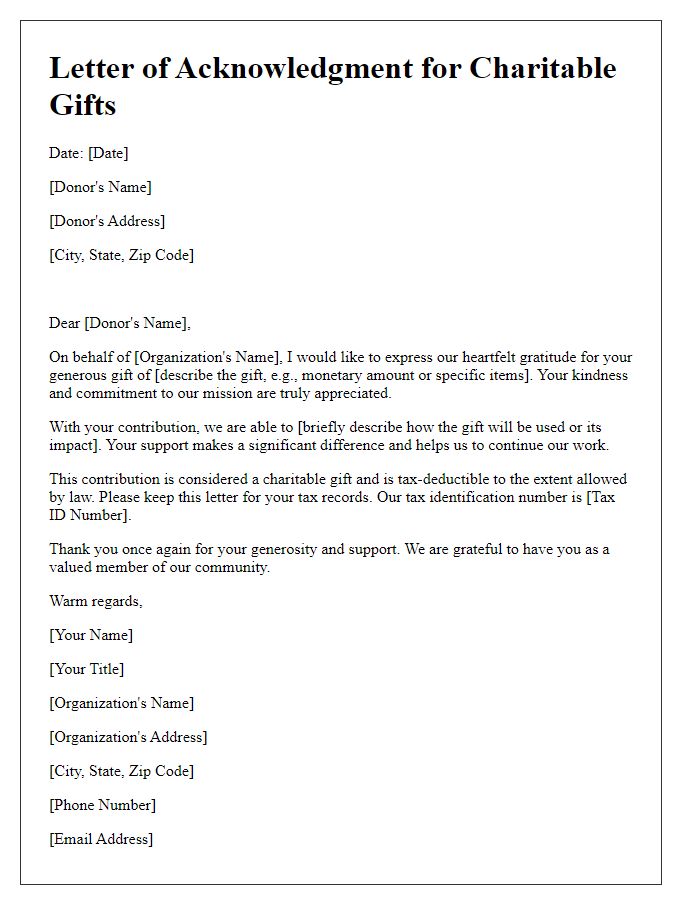

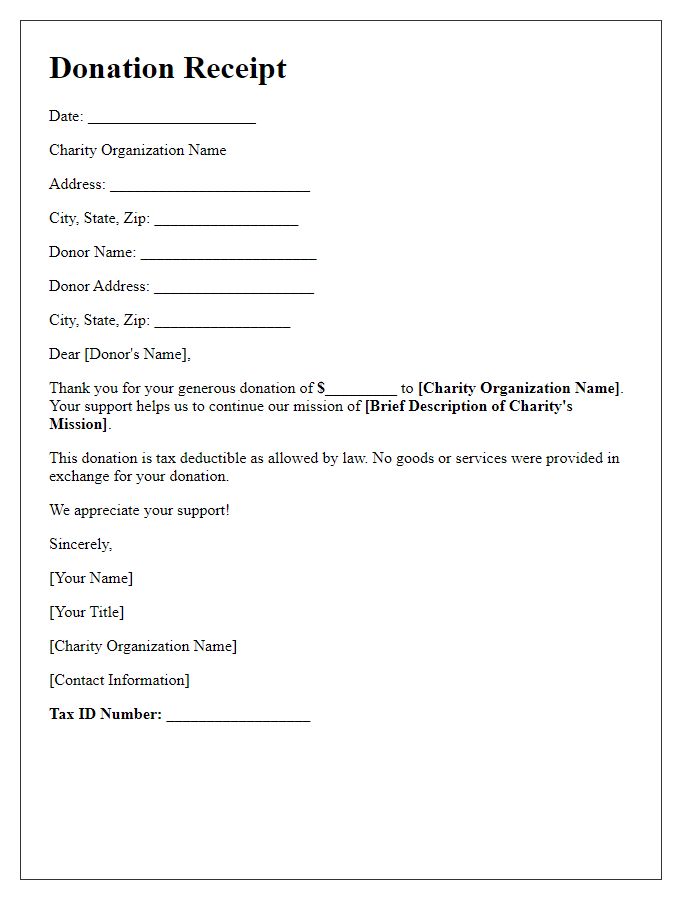

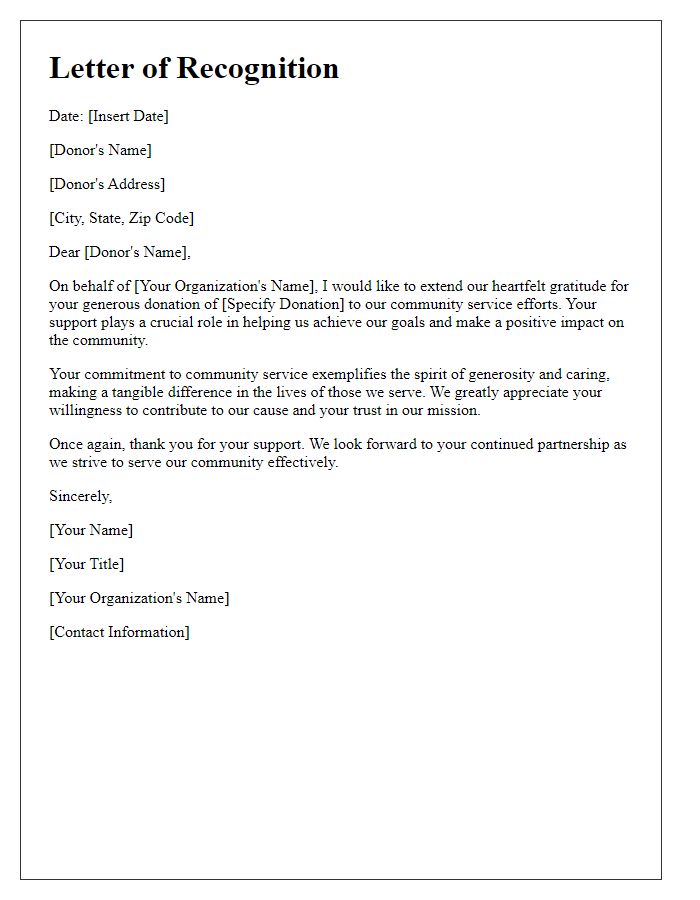

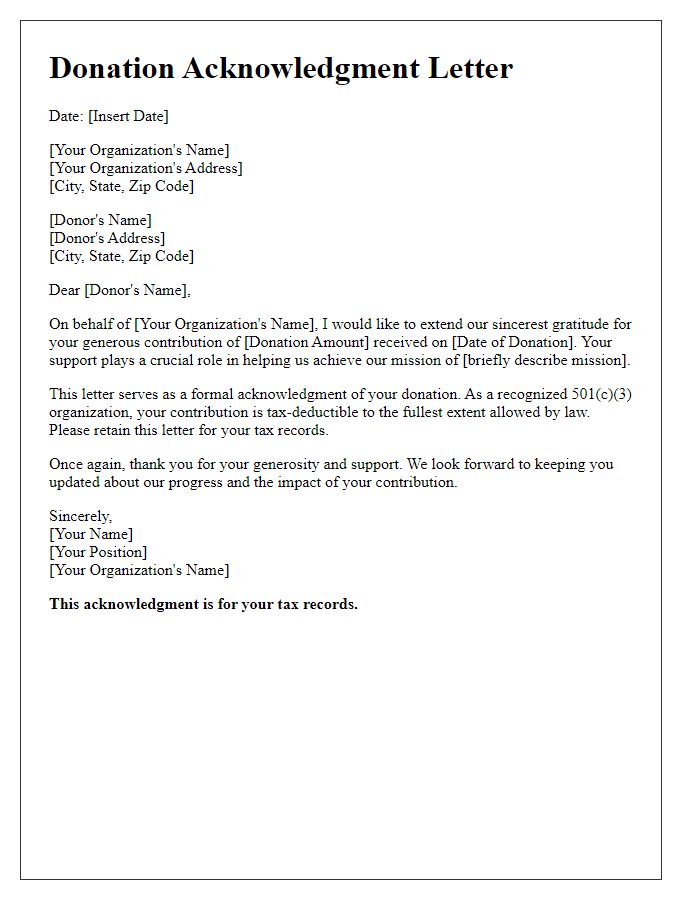

Charity organizations often provide written confirmations for community contributions received from generous donors. These confirmations typically include essential details, such as the donor's full name, contact information (including mail address and email), and the date of donation. The document may specify the amount donated, which in some cases could be substantial figures, like $500 or more, and highlight the specific program or initiative supported by the donation, such as food assistance programs or medical outreach services. Furthermore, the confirmation often includes the charity's tax identification number, which donors can use for tax deduction purposes, reinforcing the significance of their contributions in supporting charitable missions. Such records ensure transparency and accountability in financial transactions within non-profit sectors.

Charity organization's details

The confirmation of donated funds plays a vital role in maintaining transparent communication between charitable organizations and generous contributors. The charity organization, "Hope for Change," located at 123 Philanthropy Lane, Nonprofit City, State, ZIP, proudly registered as a 501(c)(3) entity since 2010, seeks to empower underprivileged communities. On October 10, 2023, a notable contribution of $500 from John Smith was recorded, aimed to support education initiatives. This donation will aid in providing educational materials and scholarships to 50 students from low-income families in the region. Donors receive acknowledgment for tax purposes, reinforcing their positive impact on society. Detailed narration of contributions leads to enhanced donor relations, ensuring ongoing support for future charitable endeavors.

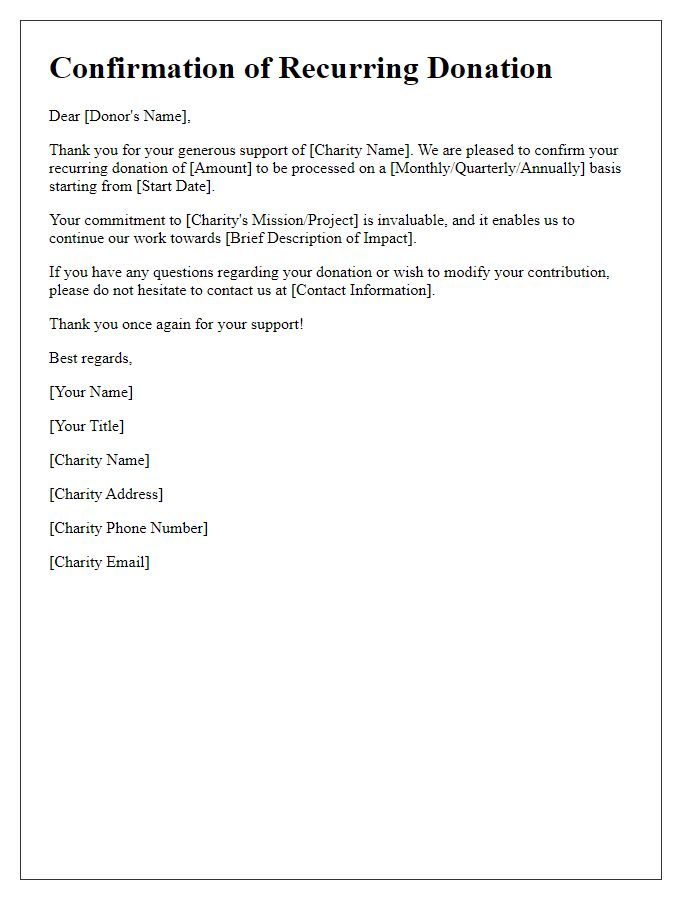

Amount and type of donation

Charitable donations play a crucial role in supporting nonprofit organizations and community initiatives. Monetary contributions (such as $100 donations) provide essential funding for programs that directly aid individuals in need. In-kind donations, like food or clothing, offer immediate relief to those facing hardship. Organizations such as local food banks or shelters rely on these generous gifts to sustain their operations and expand outreach efforts. Documenting the specifics of each donation, including amounts, types, and dates, ensures accurate record-keeping for both donors and charities, fostering transparency and trust in philanthropy.

Date of donation

Charity donations play a crucial role in supporting essential causes and initiatives. On March 15, 2023, the generous contribution of $250 to the Community Health Foundation (established in 2005) aids in providing medical care to underserved populations. This donation will directly fund health clinics in rural areas of Michigan, emphasizing essential services such as maternal health and pediatric care. Supporting organizations like the Community Health Foundation ensures that families receive vital assistance, improving overall well-being and access to healthcare resources.

Tax deduction information (if applicable)

Charitable donations play a crucial role in supporting nonprofit organizations, enabling them to serve communities and fulfill their missions. Donations made to qualified charities, such as 501(c)(3) organizations in the United States, can often be deducted, providing financial relief to donors. For instance, cash contributions may allow donors to receive tax deduction receipts for amounts over $250, whereas non-cash donations need to be valued to assess the deduction eligibility. These contributions not only facilitate charitable activities but also impact overall tax liability, making it essential for donors to keep accurate records. Acknowledgements of these donations typically include the charity's name, the date of the contribution, and the amount donated to ensure compliance with IRS regulations and provide donors with the necessary documentation for tax filing purposes.

Comments