Are you planning a charitable event that requires travel, but unsure how to manage the expenses? Navigating the financial aspects can often feel overwhelming, especially when you're focused on making a positive impact. That's why having an effective letter template for charity travel expenses can simplify the process, allowing you to concentrate on what truly mattersâhelping those in need. Dive into the details and discover how to craft a compelling request for support to cover your travel costs!

Purpose and Mission Alignment

Charity organizations often require travel for community engagement, development projects, or fundraising events. Aligning travel expenses with the charity's purpose ensures responsible use of funds. For instance, a nonprofit focused on childhood education might justify travel expenses incurred while visiting underserved schools in rural Africa (especially if residing in areas lacking resources). Each trip can foster partnerships and create impact, justifying costs associated with transportation, accommodation, and meals. It is essential these expenses be documented to illustrate commitment to the mission and demonstrate accountability to donors and stakeholders. By highlighting the specific outcomes achieved through travel, charities can effectively communicate alignment between expenditures and their overarching goals.

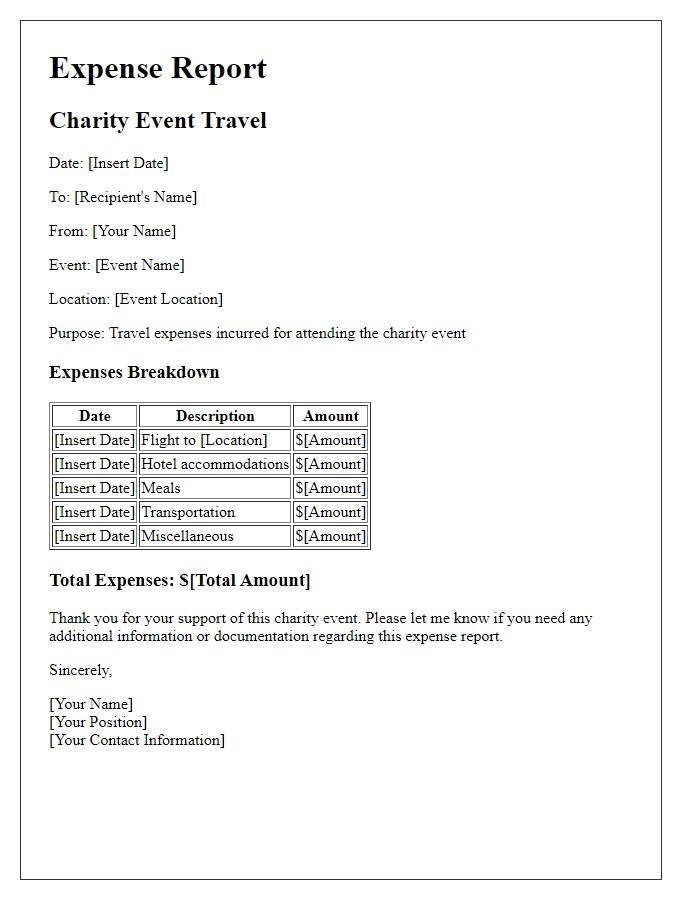

Detailed Budget Breakdown

A charitable initiative requires a meticulous budget breakdown to ensure transparency and accountability in financial management. Travel expenses, which may encompass transportation, accommodation, meals, and contingency funds, should be clearly categorized. For transportation, costs might include round-trip flights (e.g., $300 per person), mileage reimbursement for personal vehicles (e.g., $0.56 per mile as per IRS guidelines), and public transit fares (average $15 per day). Accommodation typically reflects nightly rates at local hotels or hostels (average $100 per night), multiplied by the number of nights required for the project. Meal expenses might average $30 per day per participant, subject to local pricing variations. Including a contingency fund of approximately 10% of total expenses allows for unexpected costs. This breakdown provides donors with a comprehensive understanding of how funds will be allocated, fostering trust and encouraging support for the charitable cause.

Impact and Outcome Goals

Charity travel expenses significantly contribute to the overall success of nonprofit initiatives, facilitating critical outreach programs and community support activities. In 2023, organizations budgeted approximately $15,000 for trips to underserved areas, targeting locations such as rural Appalachian regions known for limited access to healthcare. These journeys allow volunteers to conduct workshops, distribute essential supplies, and promote awareness of vital services. The anticipated outcome includes an increase in engagement from local populations, potentially reaching over 1,500 individuals, and a measurable improvement in community resources. Tracking these expenses directly correlates with enhanced program effectiveness, ensuring funds are optimized for maximum impact.

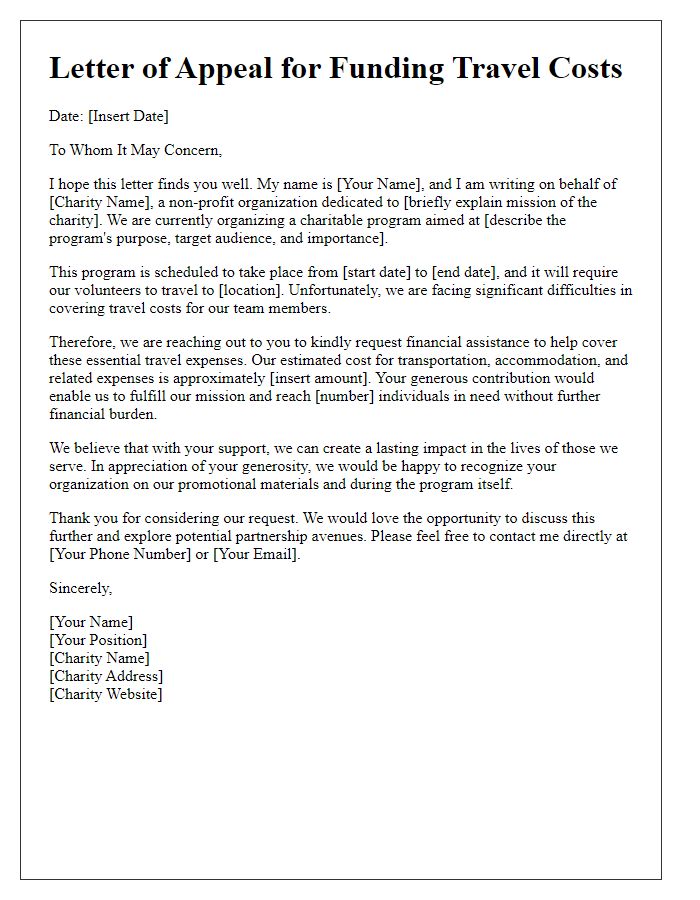

Donor Acknowledgment and Benefits

Charitable travel expenses can significantly enhance engagement for organizations like the American Red Cross, providing outreach to those in need. Donations can cover transportation costs, such as airfare (averaging $300 for domestic flights), hotel accommodations (about $150 per night), and meal expenses (approximately $50 daily per person). Donors often receive acknowledgments on websites or newsletters, enhancing visibility and promoting a culture of giving. Tax deductions may apply to travel expenses incurred while volunteering, depending on IRS regulations. Specifically, mileage incurred while traveling (currently set at $0.14 per mile for charitable purposes) can contribute to potential tax benefits, encouraging more supporters to contribute to travel initiatives.

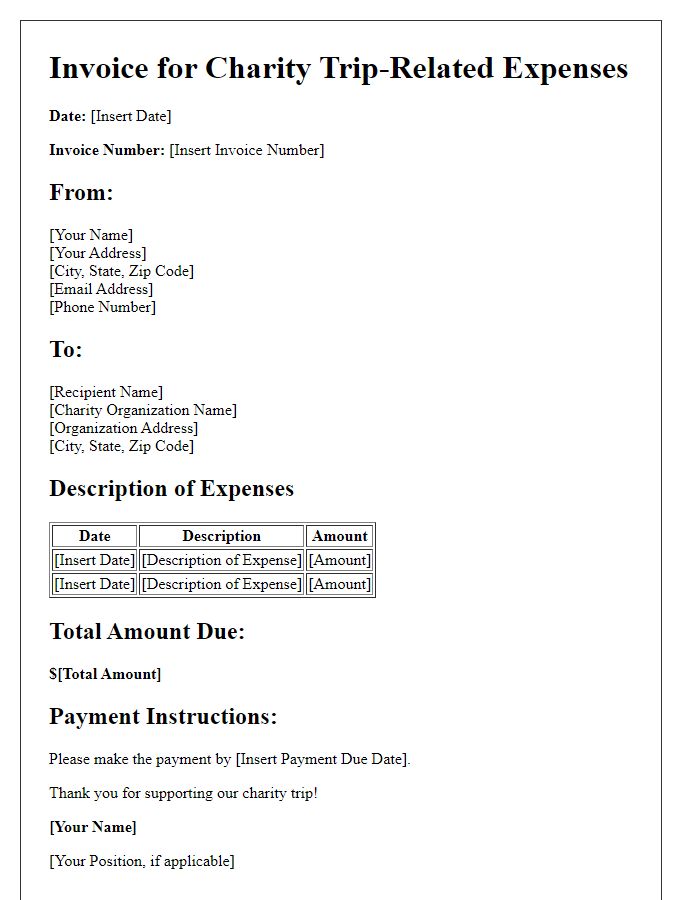

Compliance and Documentation Requirements

Charity travel expenses for nonprofit organizations must adhere to strict compliance and documentation requirements to ensure transparency and accountability in fund utilization. Each travel expense must be supported by detailed receipts, clearly showing the date, amount, and purpose of the expenditure. Comprehensive travel itineraries should be included, outlining destinations such as the specific cities or events attended to demonstrate relevance to the charity's mission. Volunteer or employee timesheets should accompany travel claims, recording hours dedicated to charity work during the trip, providing an accurate account of service activities. In addition, adherence to the IRS guidelines for expense reimbursement is critical, stipulating mileage rates and allowable transportation methods, further ensuring compliance with regulatory standards. Regular audits by organizations such as the Better Business Bureau or Charity Navigator can help validate these practices, fostering trust with donors and stakeholders in the charity's financial integrity.

Letter Template For Charity Travel Expenses Samples

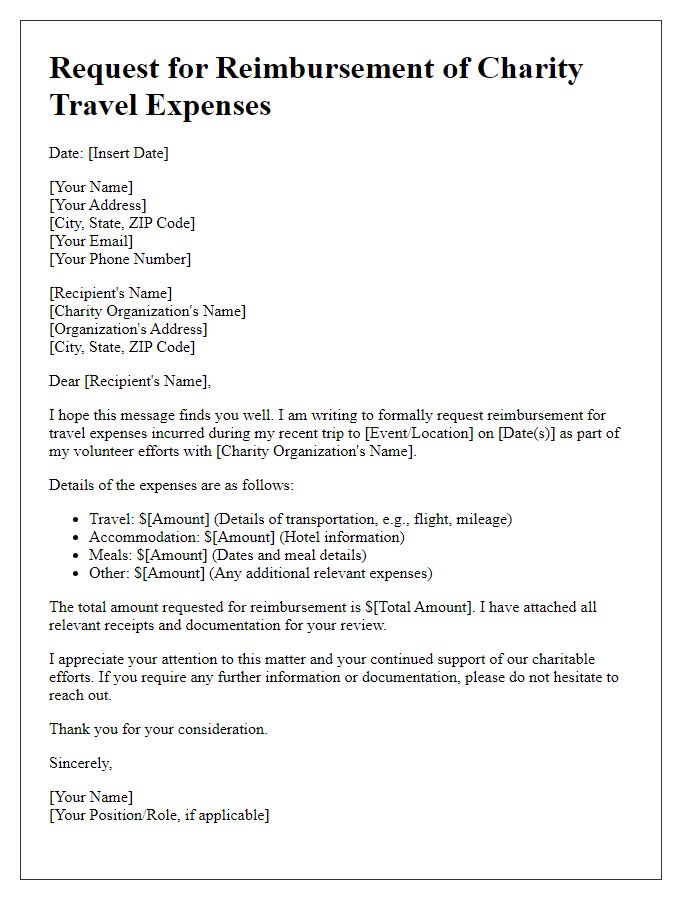

Letter template of request for reimbursement of charity travel expenses.

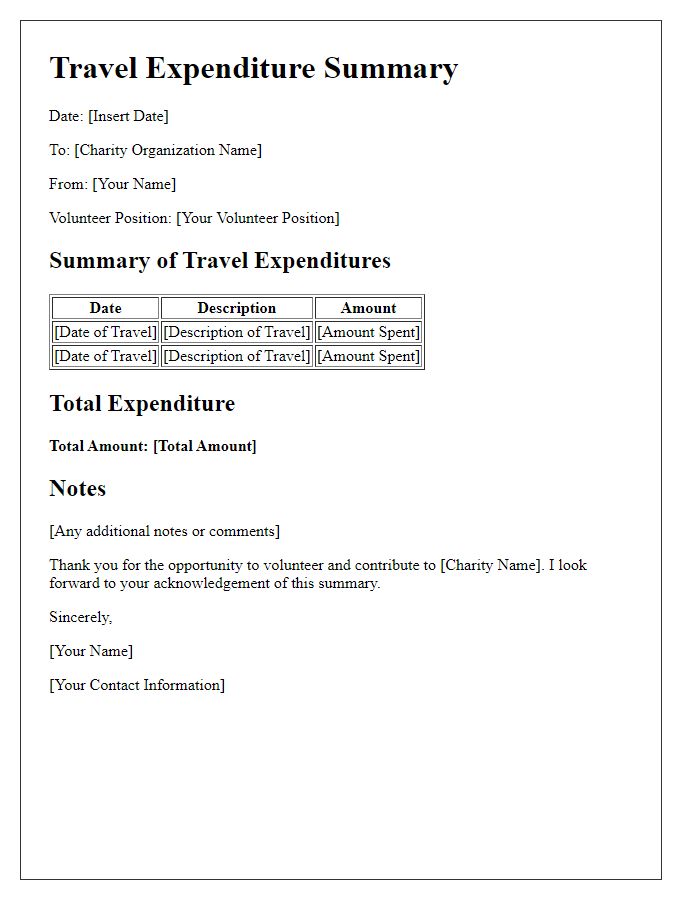

Letter template of travel expenditure summary for charity volunteer work.

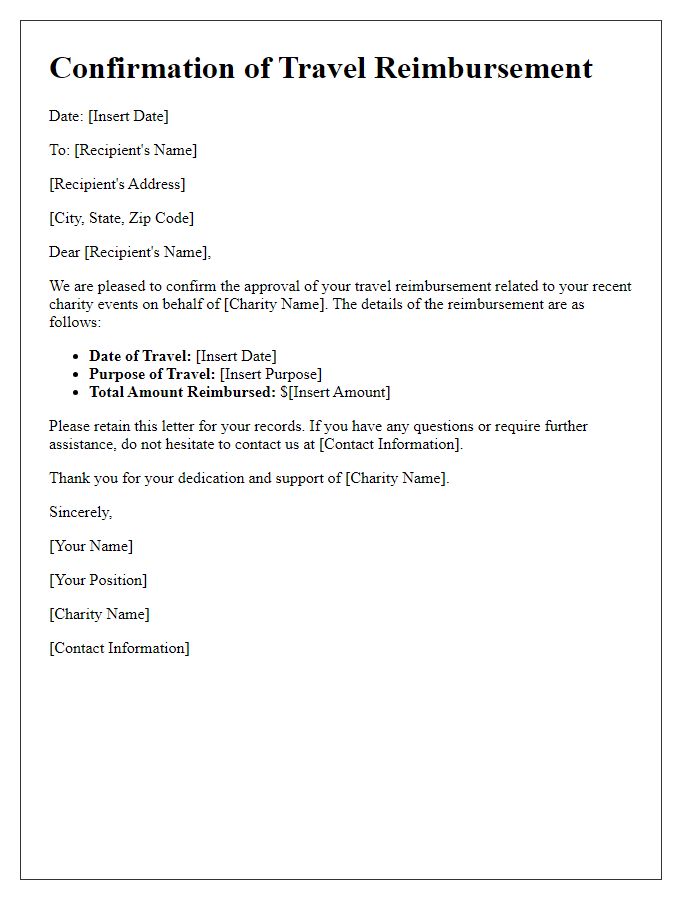

Letter template of confirmation for charity-related travel reimbursements.

Letter template of expense claim for participation in charity initiatives.

Letter template of travel costs justification for charity outreach activities.

Letter template of request for financial support for charity travel needs.

Comments