Hey there! If you've ever found yourself in a situation where you need to request a refund for a charity donation, you're not alone. Sometimes, circumstances change, or perhaps you meant to donate to a different cause, and navigating the refund process can feel a bit daunting. But don't worry, we've crafted a simple letter template to guide you through it. Stick around as we dive deeper into the details and help you with your refund request!

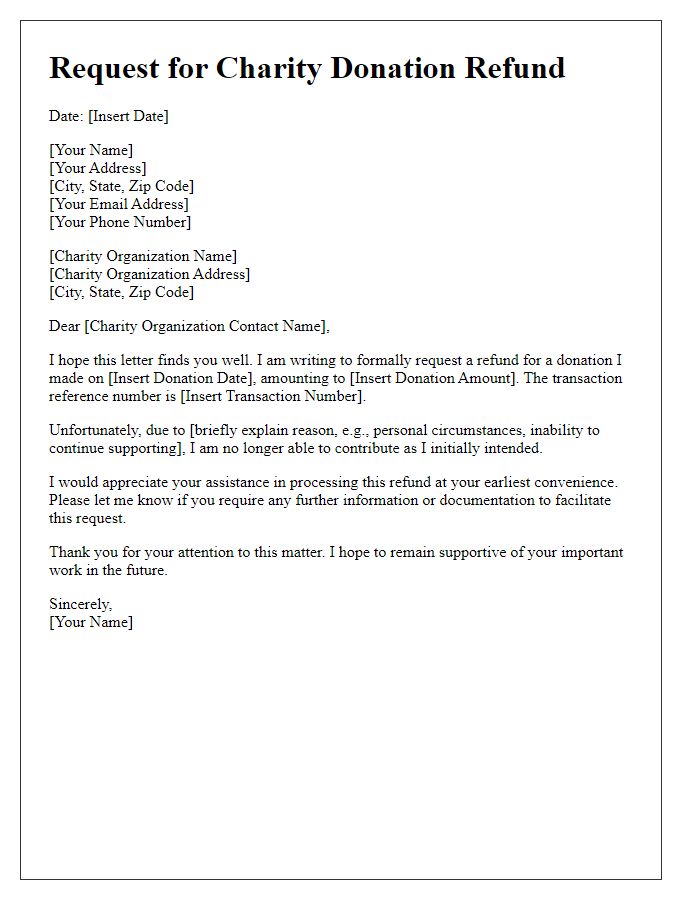

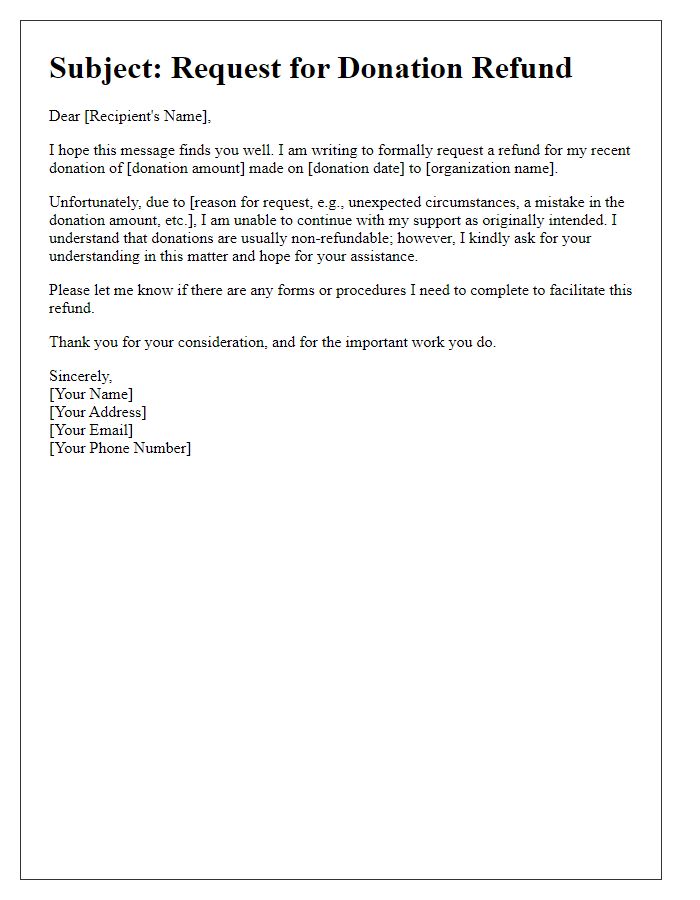

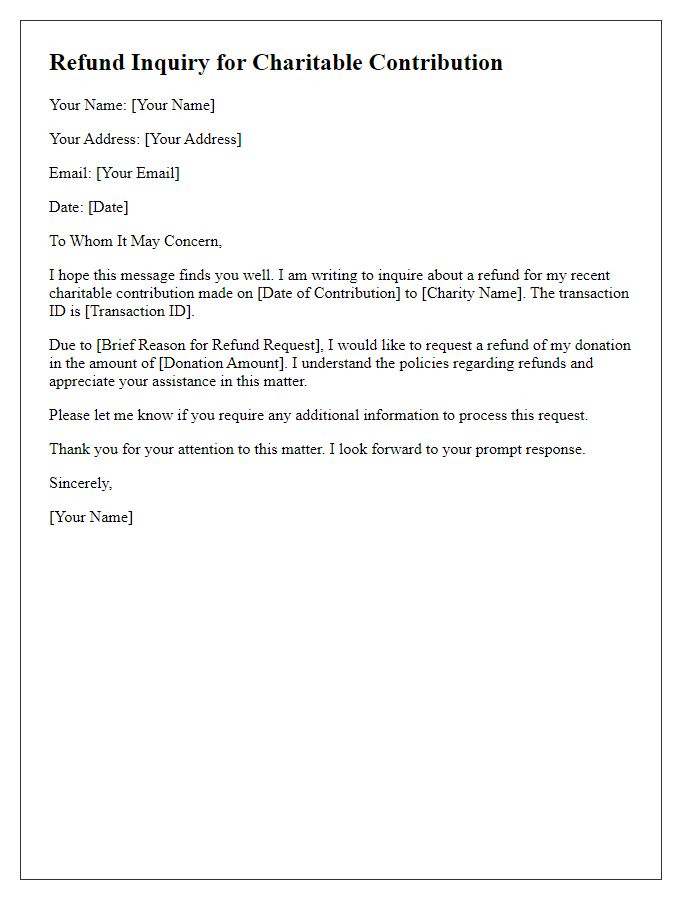

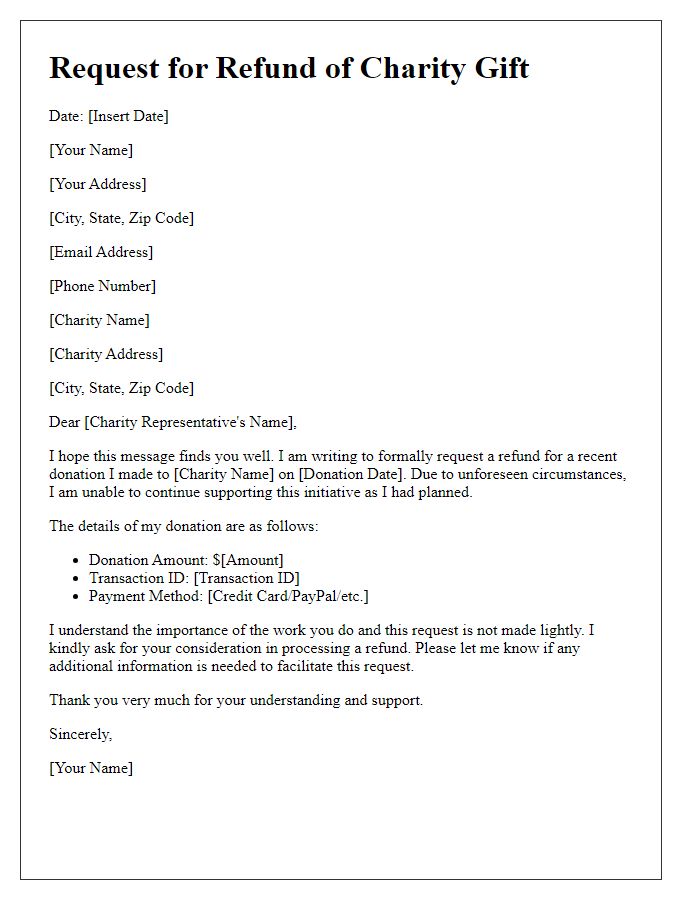

Donor's Full Name and Contact Information

The charitable organization often experiences fluctuations in funding due to varying donor support, which can influence program effectiveness. A donor's full name, including a first name and surname, along with complete contact information, such as an email address (commonly formatted as username@domain.com) and a telephone number (typically in the format of (XXX) XXX-XXXX), is essential for accurately processing refund requests. Additionally, the organization may require details regarding the donation, such as the transaction date (for example, specific month, day, and year) and the amount donated, which helps in verifying and expediting the refund process. It is crucial to ensure all provided information aligns with the records maintained by the organization to facilitate seamless communication and resolution.

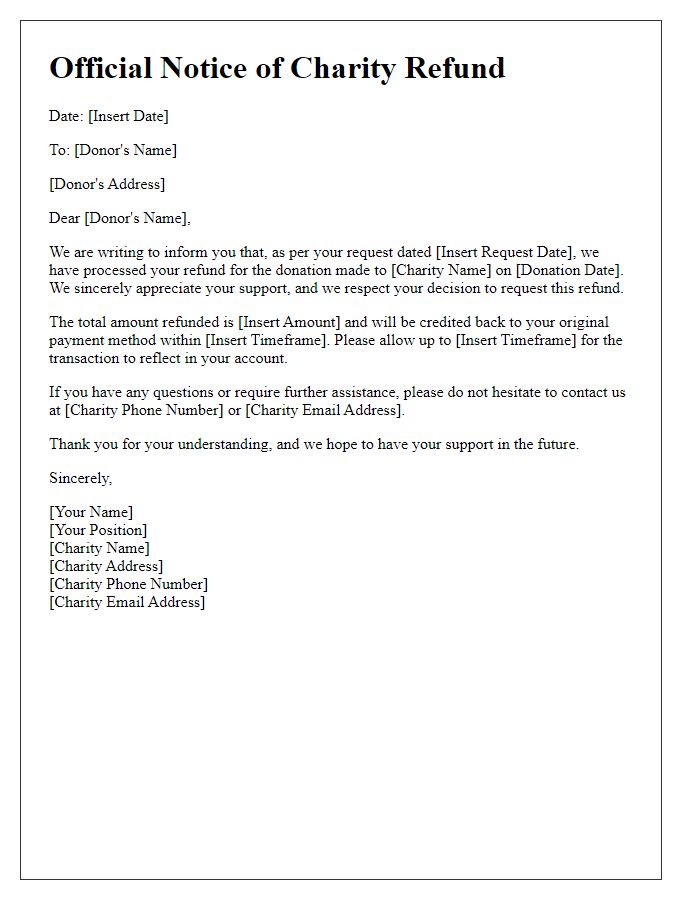

Charity Organization's Details

To receive a refund for a charitable donation, individuals must contact the specific charity organization directly. Compliance with guidelines or policies set by organizations, such as the American Red Cross or UNICEF, is essential. In some cases, refund requests may require specific documentation, including the transaction receipt that demonstrates the donation amount, such as $50 or $100. The organization may have a designated customer service team or an online portal to handle such requests efficiently. Timely submission of refund requests within a defined period after the donation, often within 30 or 60 days, significantly increases the likelihood of approval.

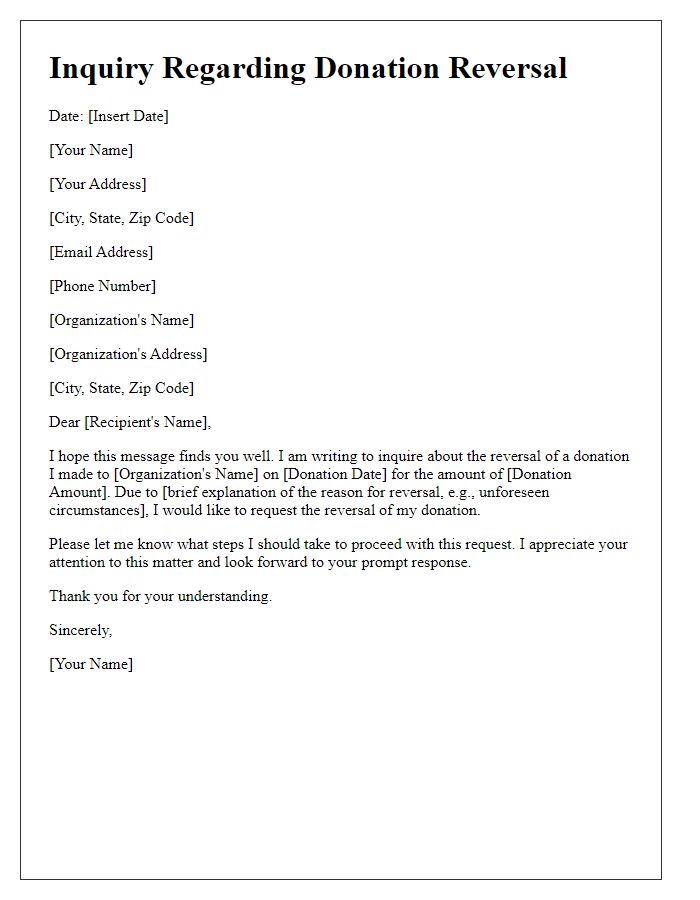

Donation Reference Number

A refund request for charity donations can arise from various situations, such as a mistaken transaction or a change in financial circumstances. A charity organization may have specific policies regarding refunds. It is essential to provide the Donation Reference Number to help identify the transaction, facilitate processing, and expedite communication. Charitable organizations typically have guidelines addressing eligible refund requests and possible timelines for resolution. In many cases, donations made through online platforms may require separate steps for initiating a refund. Always review the charity's website or contact customer service for detailed instructions to ensure a smooth refund process.

Reason for Refund

Charity donation errors can arise from accidental duplicate payments (multiple contributions made within the same month), incorrect amounts (overestimating contributions beyond budget), or unintentional donations without proper authorization (such as transactions initiated by third parties). Such circumstances often necessitate a refund process to rectify the financial discrepancies. Various charities, including prominent organizations like the American Red Cross and WWF, typically provide established procedures for addressing these issues, ensuring that donors can request refunds and clarify their intentions without bureaucratic obstacles. Donors must gather any supporting documentation (such as bank statements or transaction receipts) and contact the charity's financial department promptly to expedite the resolution.

Donation Date and Amount

Charity donations exceeding $250 can typically receive a refund upon request, depending on the organization's policy. The donation date plays a crucial role, specifically if the donation was made close to a fiscal cutoff or financial quarter. The total amount donated, for instance, $500 made to a recognized charity like the American Red Cross in a specific tax year, may be subject to a refund if requested within a certain timeframe. Documentation, such as receipts or acknowledgment letters, will be necessary to process the refund request, ensuring compliance with IRS regulations and maintaining transparency within charitable accounts.

Comments