Are you looking for the perfect way to draft compliance notices for your charitable organization? Writing effective letters can be a game-changer in ensuring transparency and maintaining trust with your donors and community. In this article, we'll explore a variety of sample templates that not only comply with legal requirements but also reflect your charity's mission and values. So grab a cup of coffee and let's dive in for some valuable insights!

Organization Information

Charity compliance notices are essential for maintaining transparency and accountability in nonprofit organizations. Such notices typically encompass key elements like the organization's name, recognized tax-exempt status (like 501(c)(3) in the United States), and registration numbers. They should also include the physical address where the organization operates, ensuring it aligns with the jurisdiction's legal requirements, such as state charity registration or fund-raising licenses. Timely updates on financial reports (Annual Form 990) are critical, as they provide insights into revenues, expenditures, and program impacts, which are crucial for donor confidence. Furthermore, organizations must highlight their mission statement, describing the purpose of their charitable activities, as this informs stakeholders of their objectives and aligns their efforts with community needs.

Compliance Requirements

Charity organizations, such as 501(c)(3) nonprofits in the United States, are required to adhere to specific compliance requirements set forth by the Internal Revenue Service (IRS). Annual filings, including Form 990, must be submitted to maintain tax-exempt status, providing transparency regarding financial activities and fund allocation. In addition, charities must keep accurate and detailed records of donations and expenditures, ensuring that at least 75% of funds raised directly support charitable programs, in accordance with state regulations. Compliance with local fundraising laws, which may vary significantly across states such as California and New York, is essential to avoid penalties. Additionally, charities are encouraged to establish a governing board to oversee operations, uphold ethical standards, and ensure accountability. Failure to comply with these regulations can result in loss of tax-exempt status, fines, and further legal implications. Regular audits and reviews can assist organizations in adhering to these vital requirements.

Deadlines and Timelines

Nonprofit organizations must adhere to strict deadlines and timelines for compliance with charity regulations, ensuring transparency and accountability. Specific dates, such as annual filing deadlines (typically April 15 for 501(c)(3) organizations in the United States), require meticulous preparation of financial statements and tax forms like the Form 990. Timely submission of required documentation (including governance policies and conflict of interest statements) is essential to maintain tax-exempt status. Regulatory bodies, such as the Internal Revenue Service (IRS) and state charities regulators, impose penalties for late filings, which can result in fines and loss of nonprofit status. Establishing a compliance calendar can help organizations track important dates related to fundraising events, renewal of licenses, and reporting obligations to keep operations within legal frameworks.

Contact Information

Charity compliance notices often require precise contact information to ensure effective communication. Essential elements include the charity's full legal name, registered address, and designated contact person's name, such as a Director or Compliance Officer. Further details may encompass phone numbers, email addresses, and website URLs for additional inquiries or public outreach. Accurate contact information aids regulatory bodies, such as the Charity Commission in the United Kingdom, in verifying compliance and streamlining correspondence. Timely and clear communication is crucial for maintaining transparency and fostering trust among donors and stakeholders in the charitable sector.

Documentation Checklist

Charity compliance notices require meticulous attention to detail to ensure adherence to regulations. A comprehensive documentation checklist may include essential categories such as financial records which encompass annual income statements and balance sheets from the previous fiscal year, tax-exempt status verification from the Internal Revenue Service (IRS) or relevant authority, and a list of board members indicating their roles and responsibilities within the organization. Additionally, documentation of fundraising activities including event descriptions, dates, expected outcomes, and expenditure reports is crucial, along with donor acknowledgment letters confirming contributions, which are vital for transparency. Other necessary documents could be minutes from board meetings to demonstrate governance practices and any relevant legal agreements or policies addressing conflict of interest and whistleblower protections. Compliance with regulations in the non-profit sector, such as those outlined by the Charity Navigator or the National Council of Nonprofits, is essential for maintaining public trust and operational legitimacy.

Letter Template For Charity Compliance Notices Samples

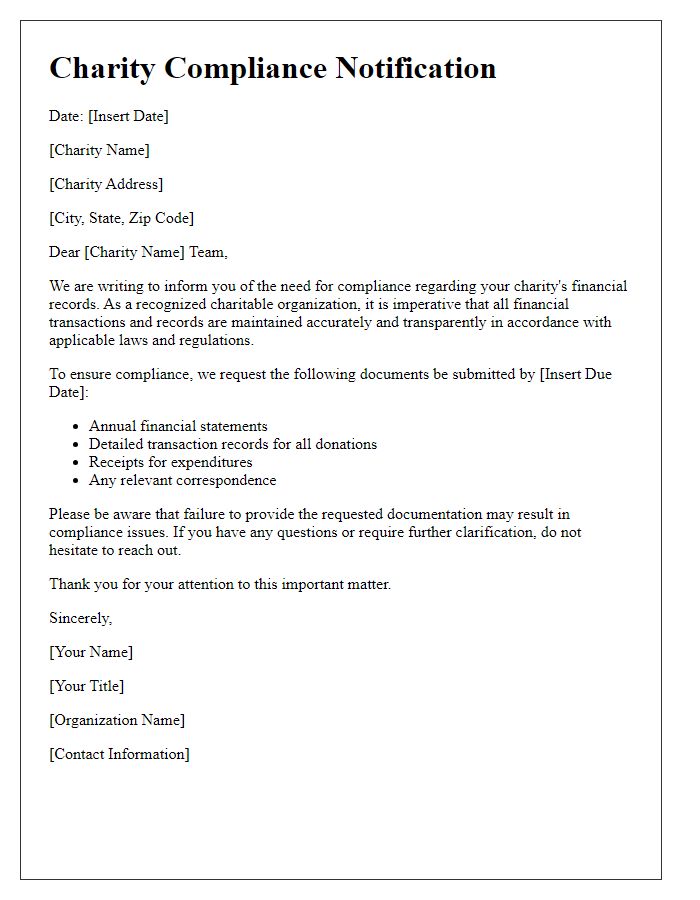

Letter template of charity compliance notification for financial records.

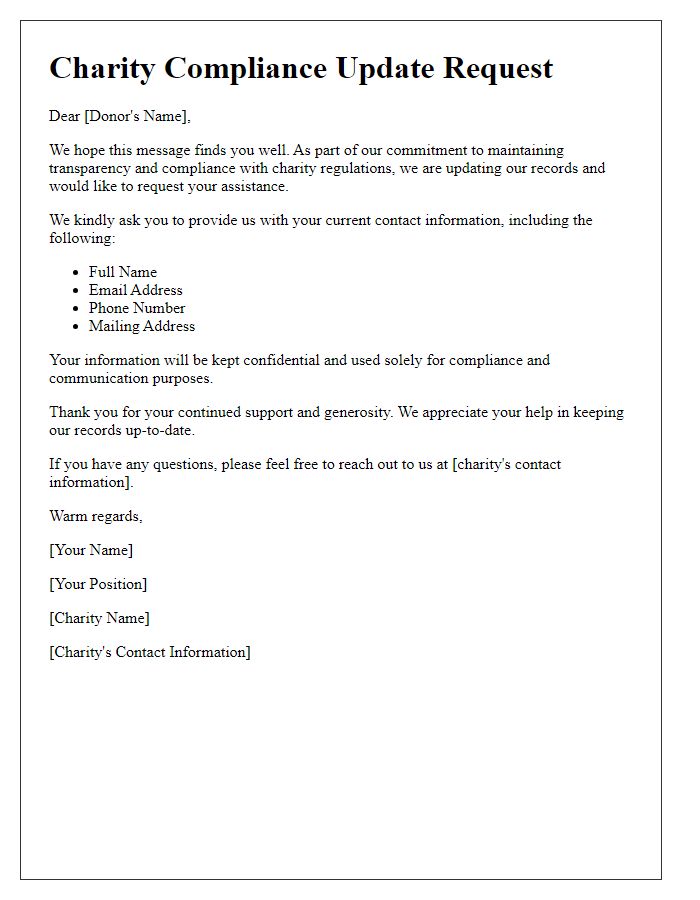

Letter template of charity compliance update request for donor information.

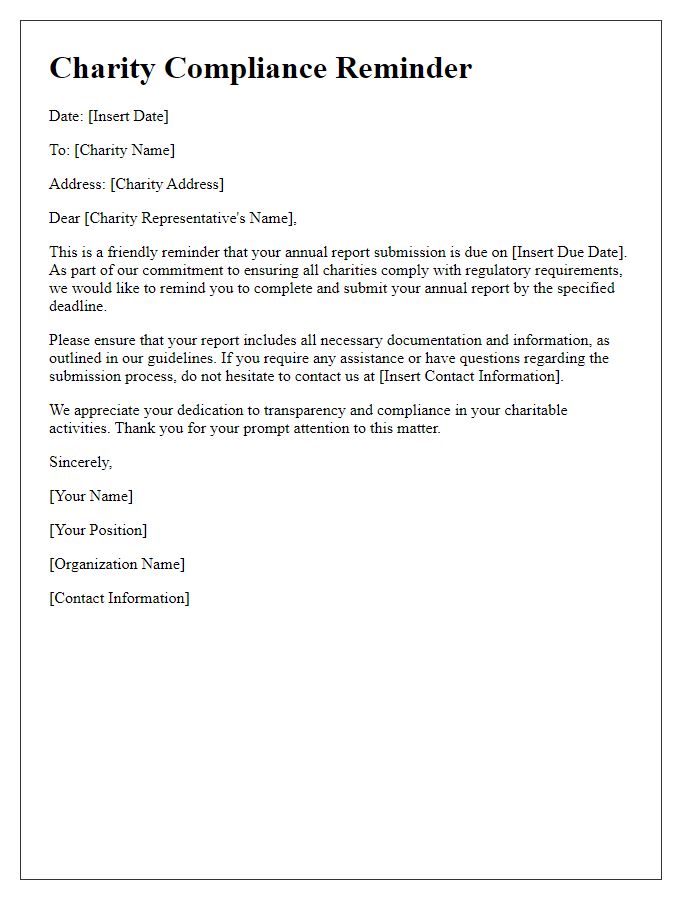

Letter template of charity compliance reminder for annual report submission.

Letter template of charity compliance inquiry regarding governance practices.

Letter template of charity compliance follow-up on previous correspondence.

Letter template of charity compliance acknowledgment of received documents.

Letter template of charity compliance clarification regarding audit process.

Comments