Are you feeling overwhelmed by your student loan payments and considering a deferment plan? You're not alone; many students and graduates find themselves in a similar situation. Navigating the process can be tricky, but understanding your options is crucial for easing your financial burden. In this article, we'll guide you through the steps to request a student loan deferment plan, so keep reading to learn how you can take control of your finances!

Borrower's personal and contact information

When submitting a request for a student loan deferment plan, it's essential to include specific personal and contact information for clarity and processing efficiency. Full name, such as Johnathan Michael Smith, is critical, alongside the unique student loan account number which identifies the loan within the servicing system. Current physical address, for instance, 123 Maple Street, Springfield, IL 62701, ensures that all communications reach the borrower promptly. Additionally, a valid email address, like john.smith@email.com, serves for quick digital correspondence. Finally, a daytime phone number, perhaps (555) 123-4567, enables the loan servicer to contact the borrower for any necessary follow-up regarding the deferment request. Properly organizing this information simplifies the loan deferment process, fostering clear communication between the borrower and the financial institution.

Loan account details

Student loan deferment options provide essential relief for borrowers facing financial difficulties. A deferment application, referencing specific loan account details, enables temporary suspension of loan payments for eligible federal student loans, such as Perkins and Stafford loans. Interest rates, typically fixed around 4.5% to 6.8%, may not accrue during certain types of deferments, like in-school status or economic hardship. Borrowers must submit documentation, such as a signed deferment request form and proof of unemployment or participation in an approved program, to the loan servicer (like FedLoan or Navient) to initiate the process. Each deferment type has distinct eligibility criteria, duration limits (usually up to three years), and implications for credit scores, necessitating a careful review of loan agreements to avoid negative impacts on financial stability.

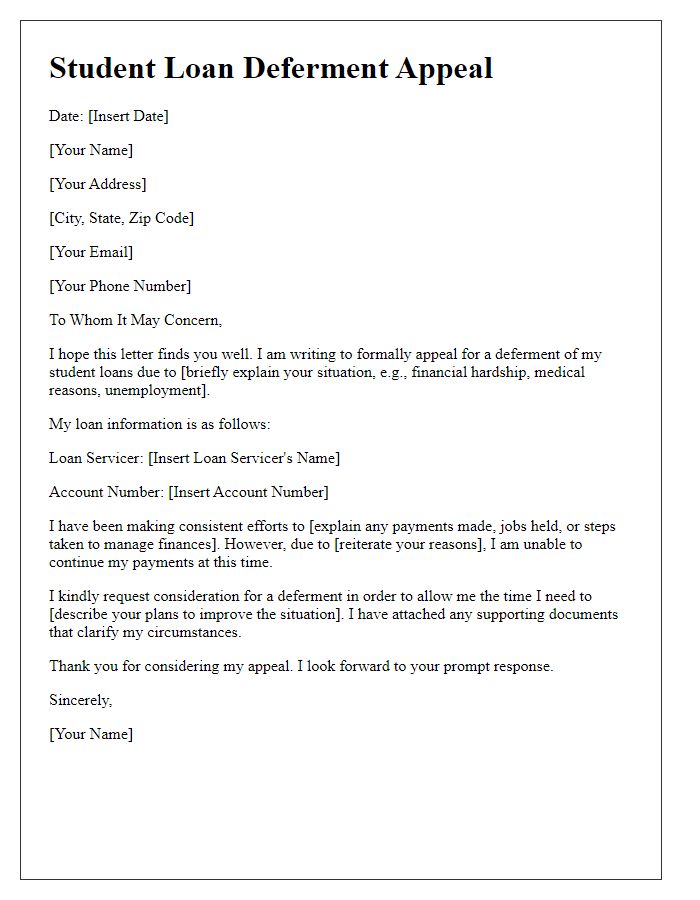

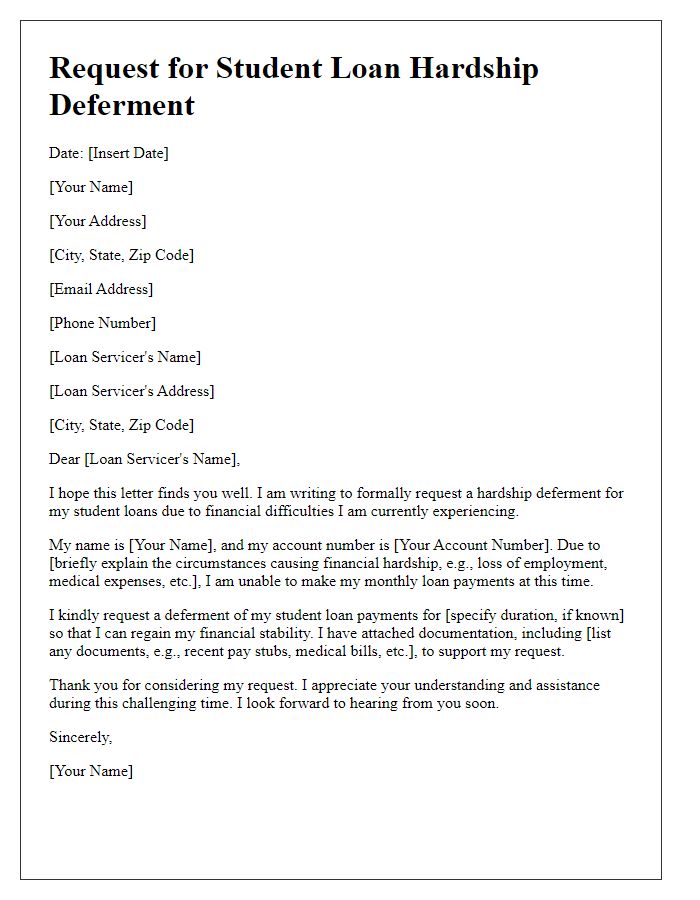

Reason for deferment request

A student loan deferment request often stems from financial hardships such as job loss or medical expenses. Many borrowers face situations beyond their control, resulting in the need to pause loan obligations. The process typically requires submitting documentation supporting the claim, which may include termination letters from employers or medical bills highlighting unanticipated expenses. Additionally, individuals may seek deferment during periods of ongoing education, as enrolling in further academic programs allows for temporary relief from repayment responsibilities. Understanding deferment terms is essential; eligibility can vary based on loan types and specific circumstances. Engaging with loan servicers promptly ensures compliance and prevents potential repercussions on credit scores.

Supporting documentation for deferment eligibility

Requesting a student loan deferment plan requires detailed documentation to establish eligibility. Supporting documentation typically includes the following: proof of enrollment (such as a current class schedule or enrollment verification from a registered academic institution), evidence of financial hardship (like recent pay stubs, tax returns, or unemployment benefits statements), and any other relevant paperwork (such as medical bills or a divorce decree) that may impact financial stability. These documents aim to demonstrate the current inability to make loan payments due to extenuating circumstances. Including clear, organized copies of all materials is essential for an efficient review process by the loan servicer or financial institution.

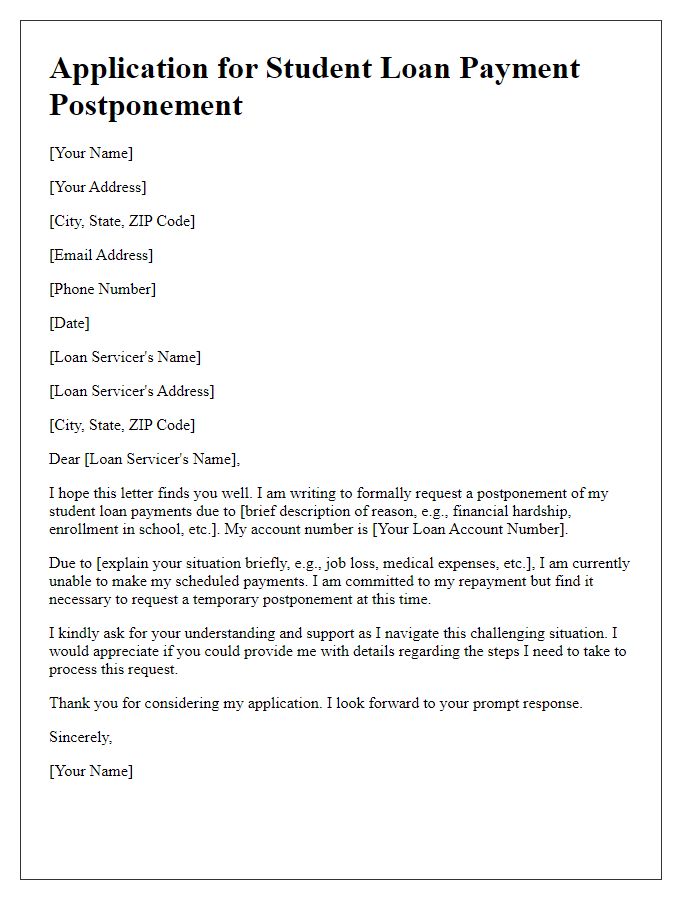

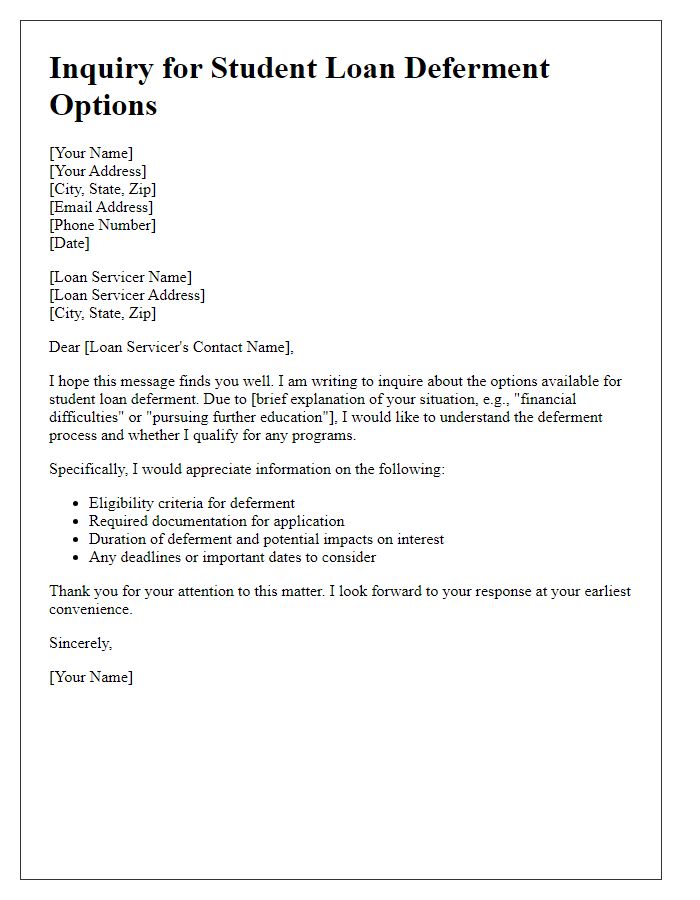

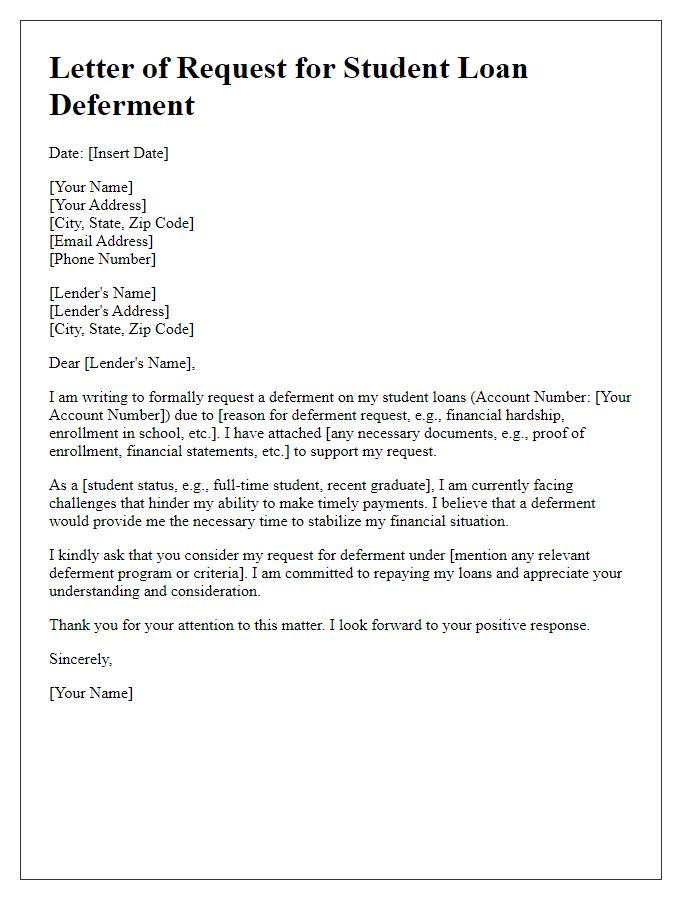

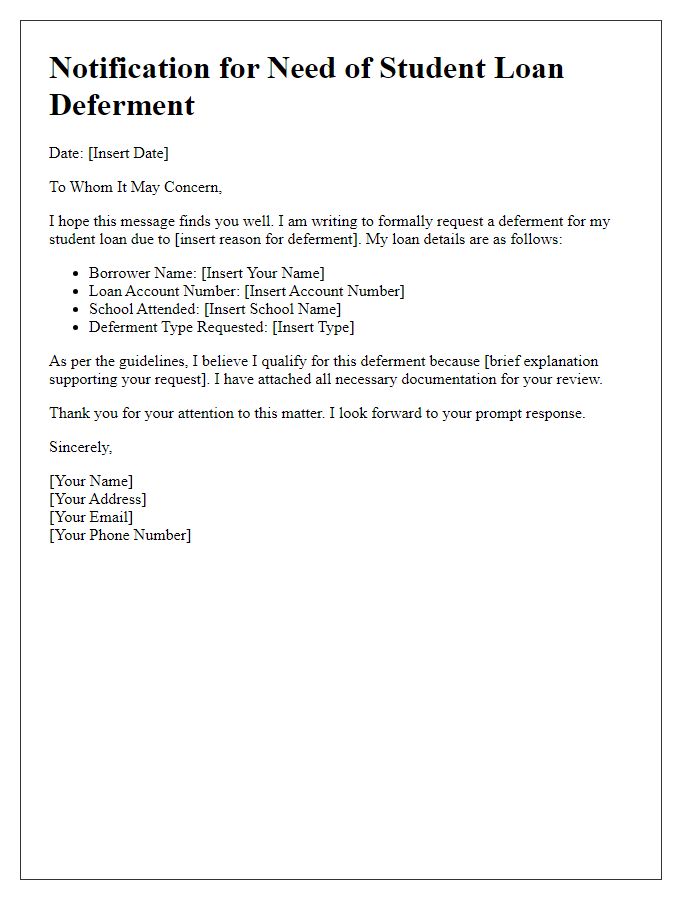

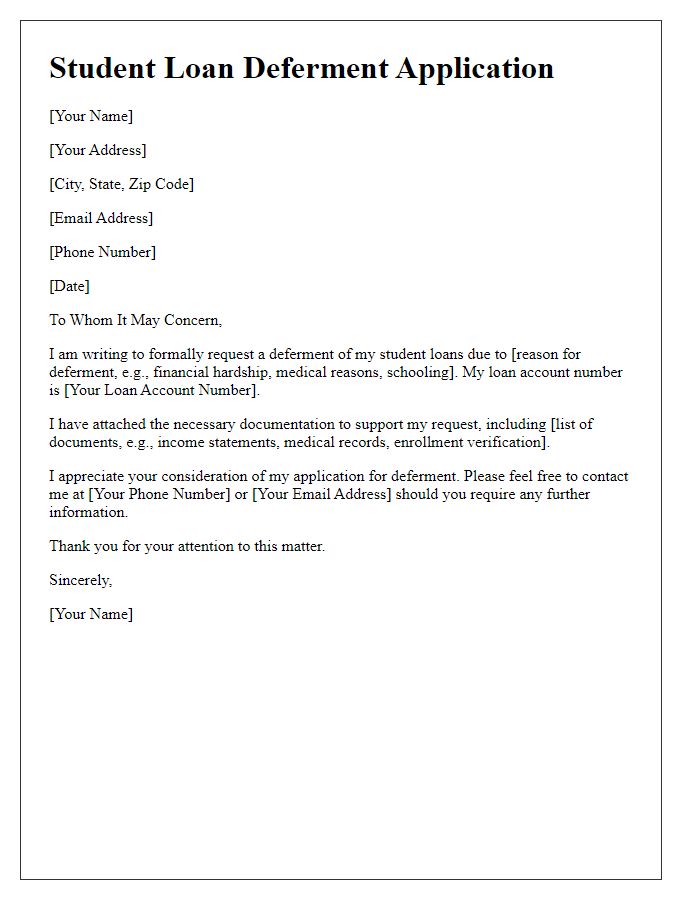

Clear and formal request statement

A student loan deferment plan provides temporary relief for borrowers, allowing them to pause payments without negative consequences on credit history. It is essential for students who face financial hardships or return to higher education. To formally request this plan, detail the reasons for the deferment, such as unemployment, health issues, or academic commitments, and include relevant supporting documentation. Clearly express intentions regarding the timeline for repayment resumption. Address the request to the loan servicer, ensuring all communication is professional and concise, while maintaining a respectful tone throughout.

Letter Template For Requesting Student Loan Deferment Plan Samples

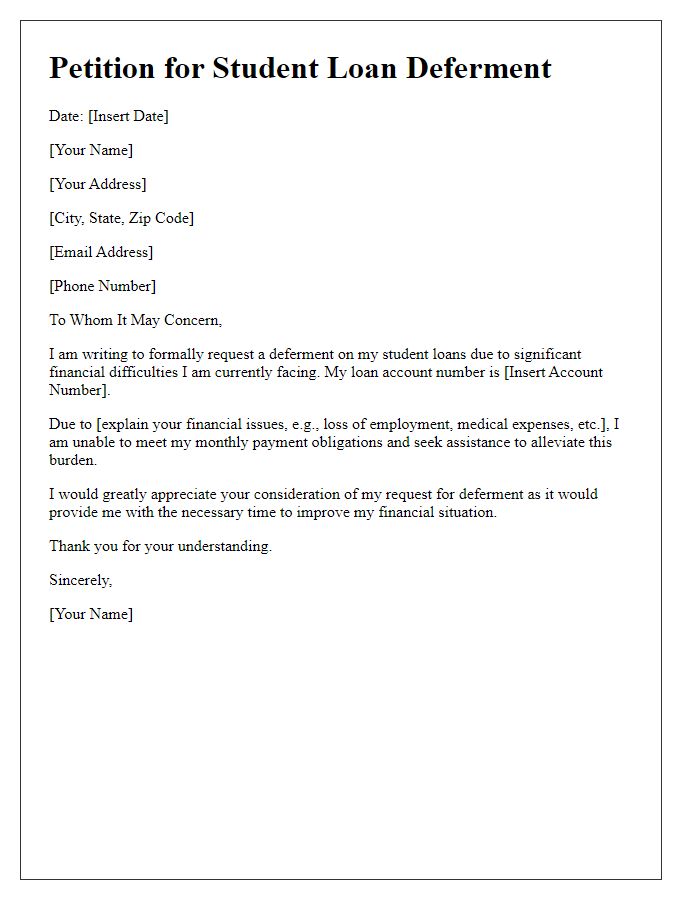

Letter template of petition for student loan deferment due to financial issues

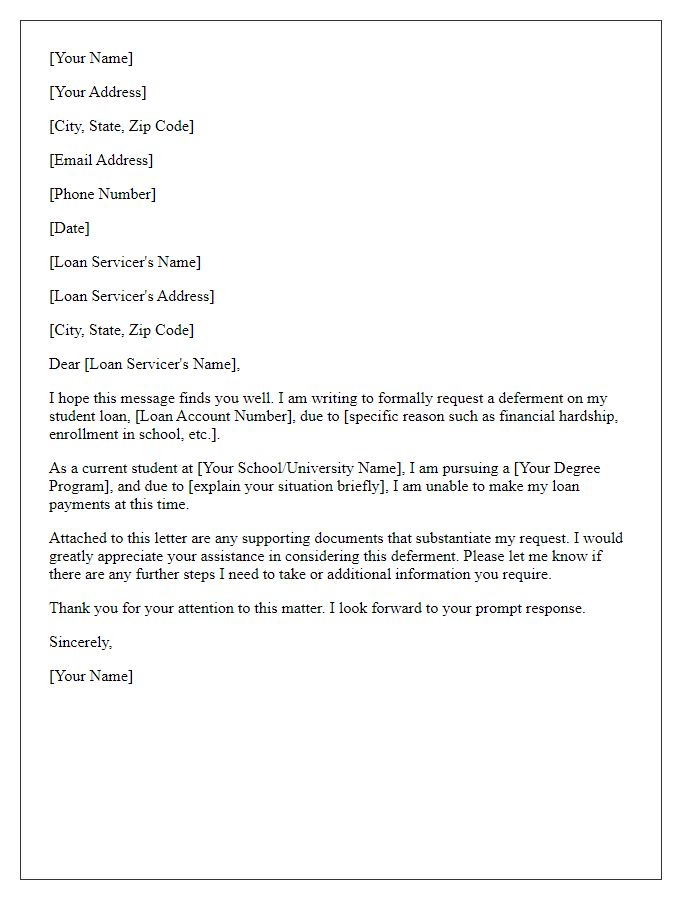

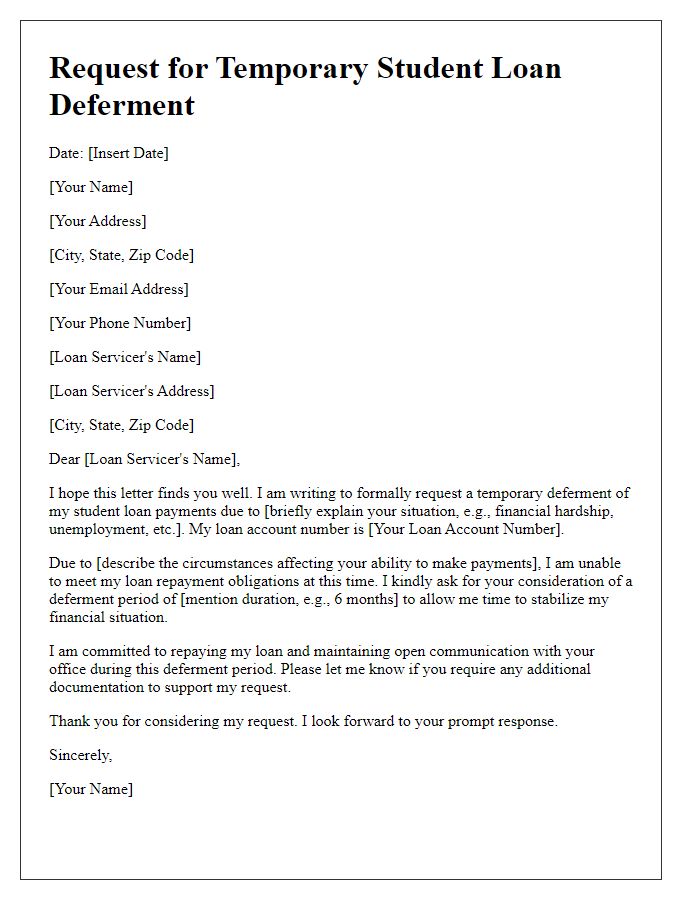

Letter template of correspondence for requesting a student loan deferment

Comments