Are you considering canceling your life insurance policy? It's a decision that many people contemplate for various reasons, from financial considerations to changes in personal circumstances. Understanding the best way to approach this process can help ensure everything goes smoothly. Discover the steps you need to take and important tips for a hassle-free cancellation process in the rest of the article!

Policy Information

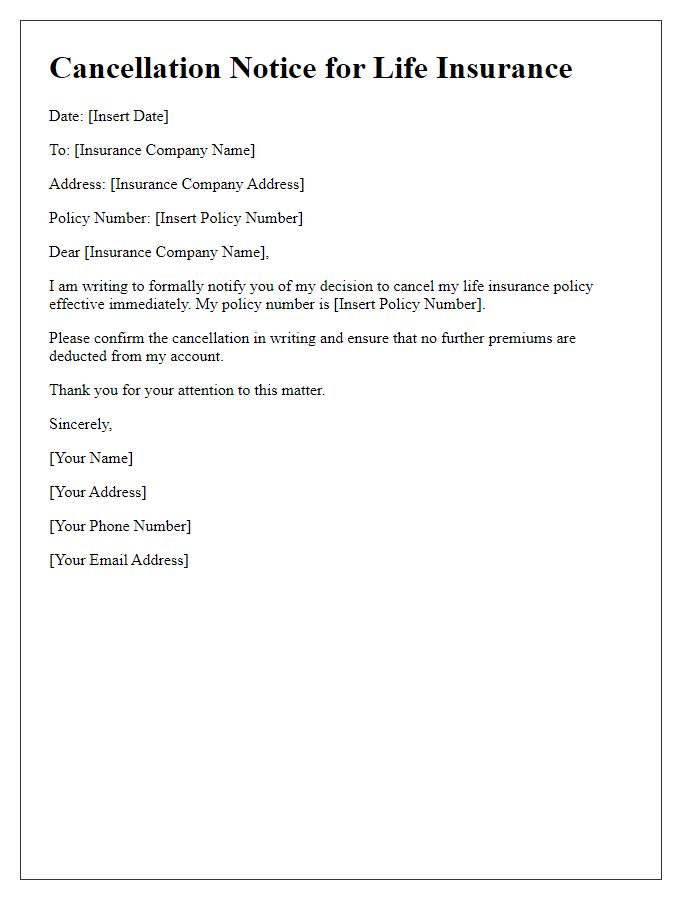

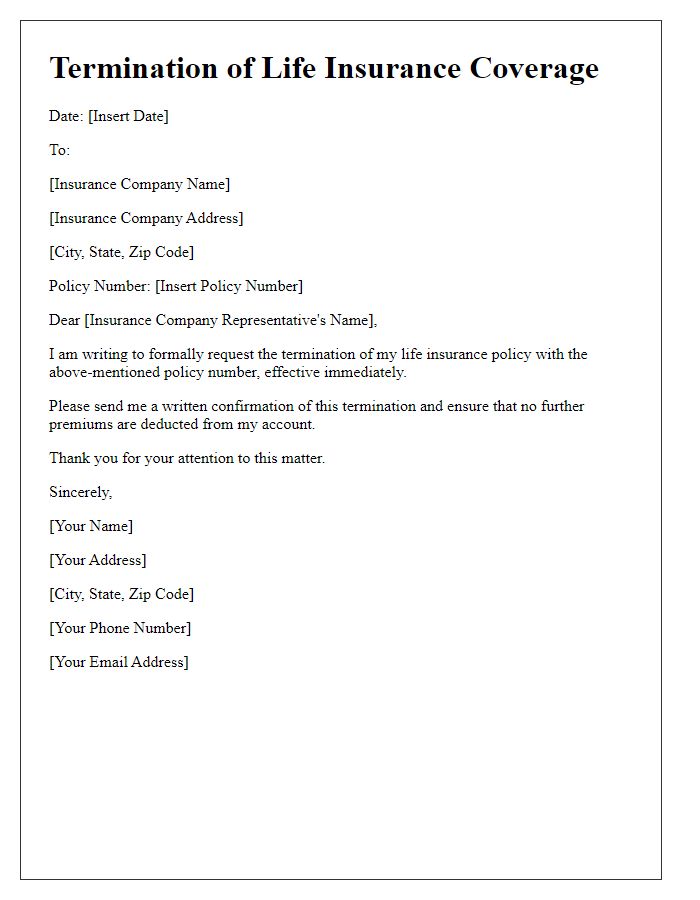

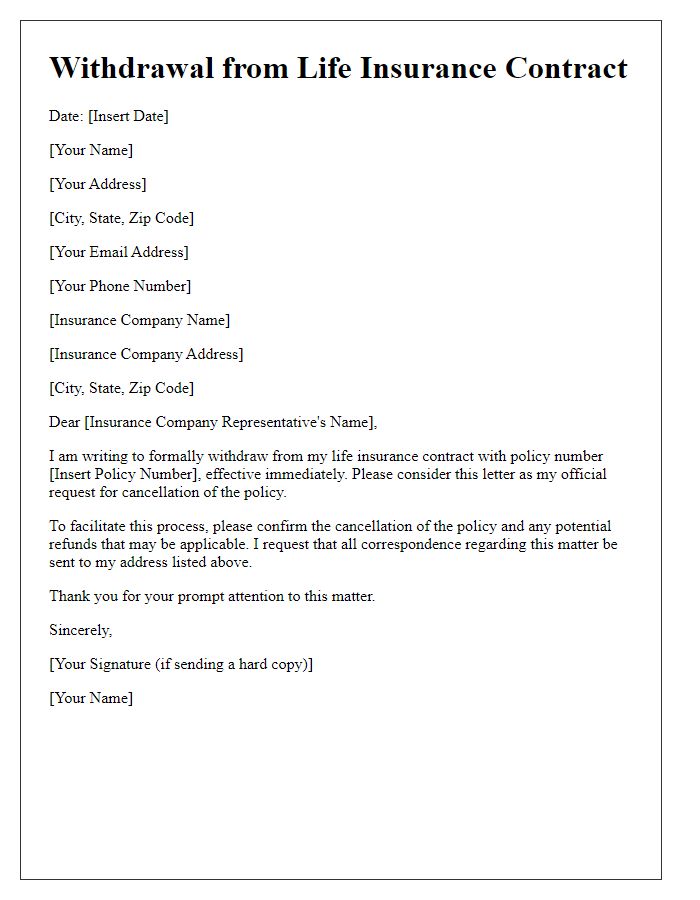

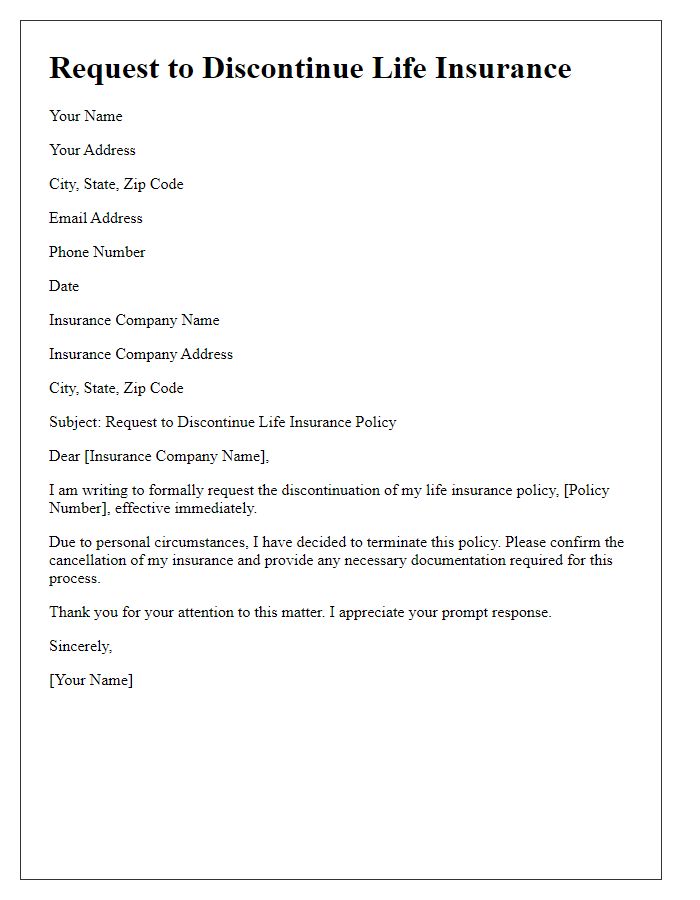

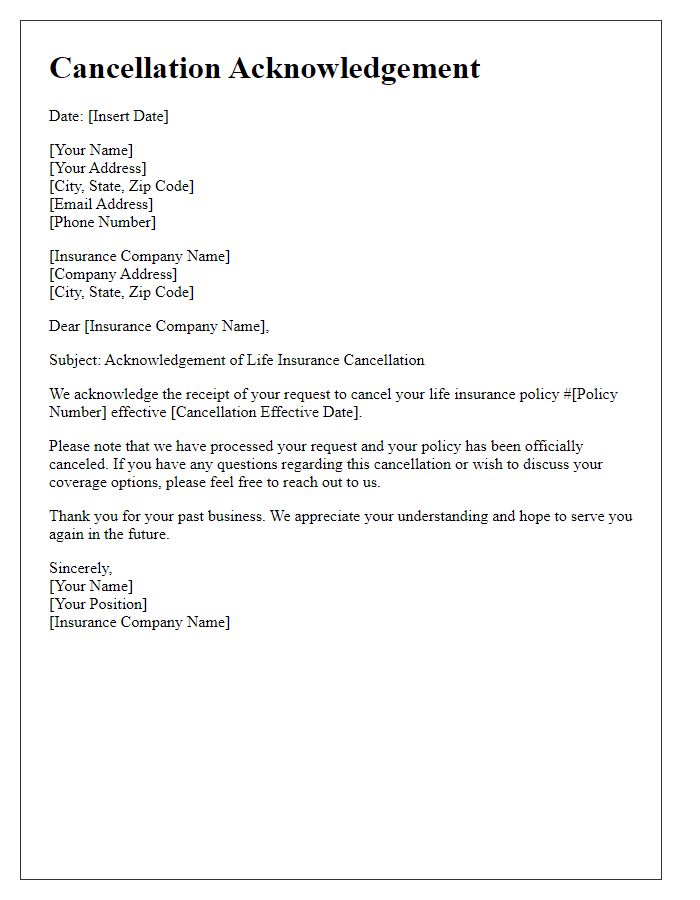

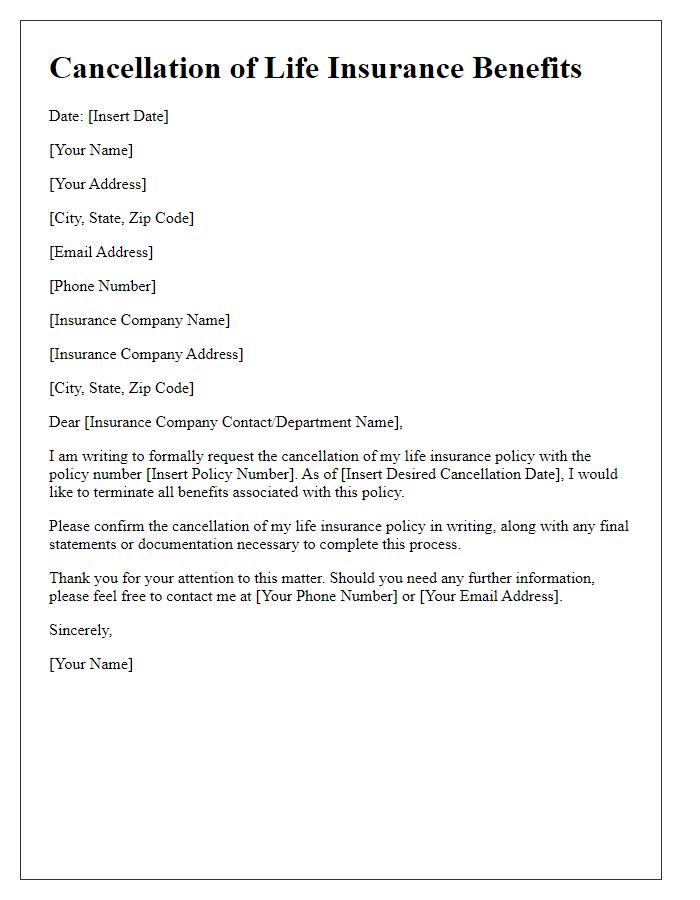

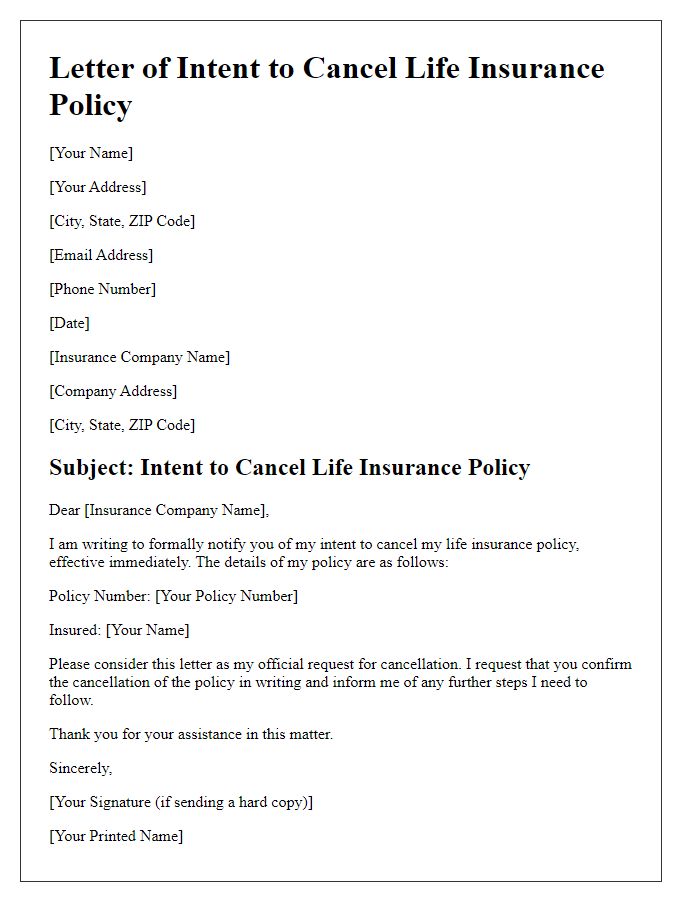

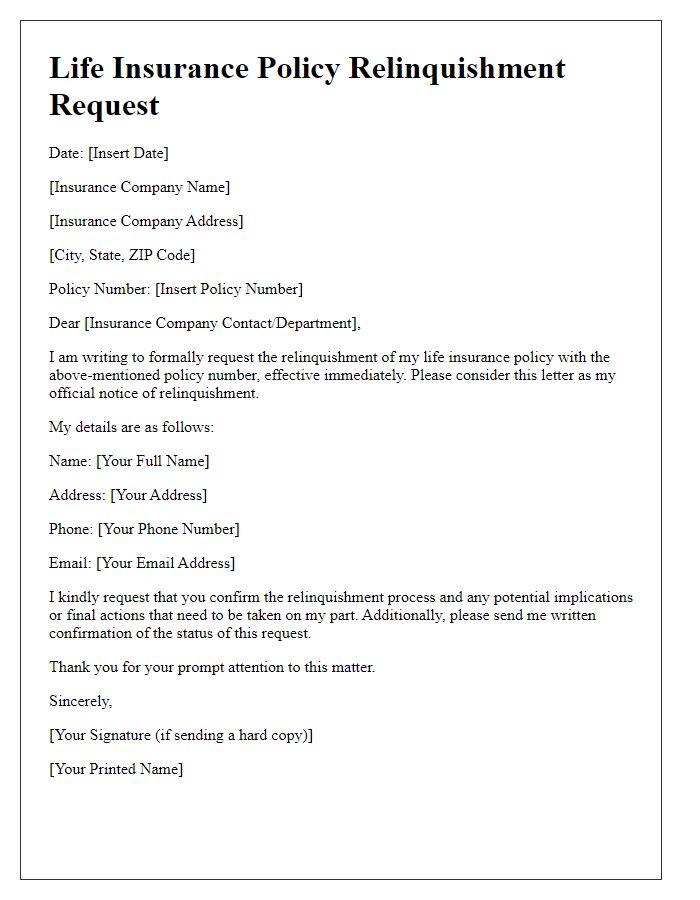

Life insurance cancellation can be a significant decision impacting the financial security of beneficiaries. Policyholders often confront various reasons for cancellation, including changing financial priorities, switching to more affordable options, or finding better coverage elsewhere. It is essential for policyholders to review policy information carefully, such as premium amounts, coverage limits, and specific terms associated with the policy, including surrender charges or grace periods. Additionally, knowing the implications of cancellation, including potential loss of coverage and benefits, can provide critical insights for informed decision-making. Proper documentation submitted to the life insurance company, along with reference to the policy number and relevant identifiers, can ensure the cancellation process is executed smoothly and without unexpected complications.

Effective Cancellation Date

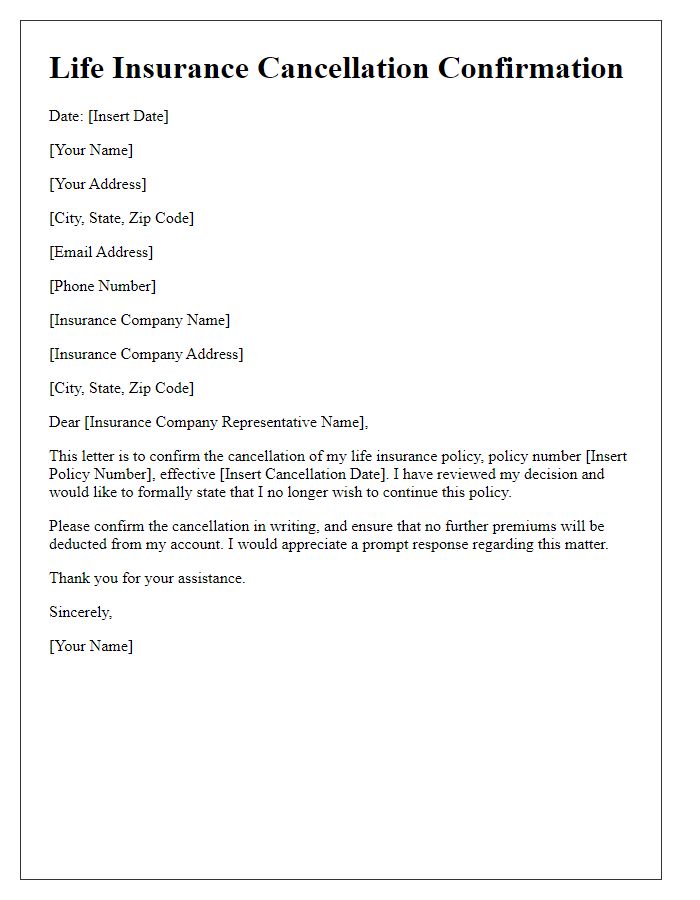

A life insurance policy cancellation involves notifying the insurance provider of the intention to terminate a policy, often due to changing financial conditions or personal circumstances. The effective cancellation date marks the official end of the coverage, which must be clearly stated in communication. Insurers frequently require a written request to process cancellations, adhering to the company's specific procedures. The policyholder should reference their unique policy number to ensure proper identification and streamline the cancellation process. Additionally, any accrued benefits or potential refunds might need consideration, impacting the overall financial decision. It is crucial to retain confirmation of cancellation to avoid unexpected liabilities.

Policyholder Details

The process of canceling a life insurance policy requires careful attention to the details provided by the policyholder. Personal information such as the policyholder's full name, date of birth, and contact address, including city and zip code, plays an essential role in identifying the correct policy within the insurance company's records. The policy number, which is a unique identifier assigned by the insurer, must also be included to ensure the proper cancellation of the specific contract. If applicable, mention of any beneficiaries tied to the policy can also provide clarity on the policy's history and implications post-cancellation. Additionally, including a date for the cancellation request, along with a preferred mode of communication for any future correspondence, can facilitate a smoother process for both parties involved.

Reason for Cancellation

Life insurance policies, such as whole life or term life insurance, may be canceled for various reasons, including financial difficulties or changes in personal circumstances. Common reasons include rising premiums that become unaffordable, failure to pay premiums on time leading to policy lapse, or the policyholder's decision to purchase a different insurance product that better suits their current needs. It's crucial for policyholders to review the terms of cancellation, including any potential penalties or fees, before proceeding with the cancellation process. Understanding the implications can help avoid unintended consequences, such as loss of coverage or decreased benefits upon policy termination.

Contact Information for Confirmation

Life insurance policies provide financial security, yet policy cancellations require careful communication. When initiating cancellation, individuals should include confirmation details encompassing full name, policy number, and contact information. These should be submitted to the insurance company's customer service department. Essential documentation typically includes the original policy document, a cancellation form (if applicable), and a written request stating the desire to cancel. Policyholders should retain copies of all correspondence for future reference. Additionally, review individual state regulations regarding cancellation processes, as guidelines may vary significantly.

Comments