Hey there! We understand how important it is to keep your account information secure and up-to-date, which is why we've created this straightforward letter template for client verification. This handy guide will help you easily communicate with clients about the necessary details needed to confirm their accounts. With clear instructions and a friendly tone, you'll ensure a smooth verification process. Ready to dive into the essentials? Let's explore this topic together!

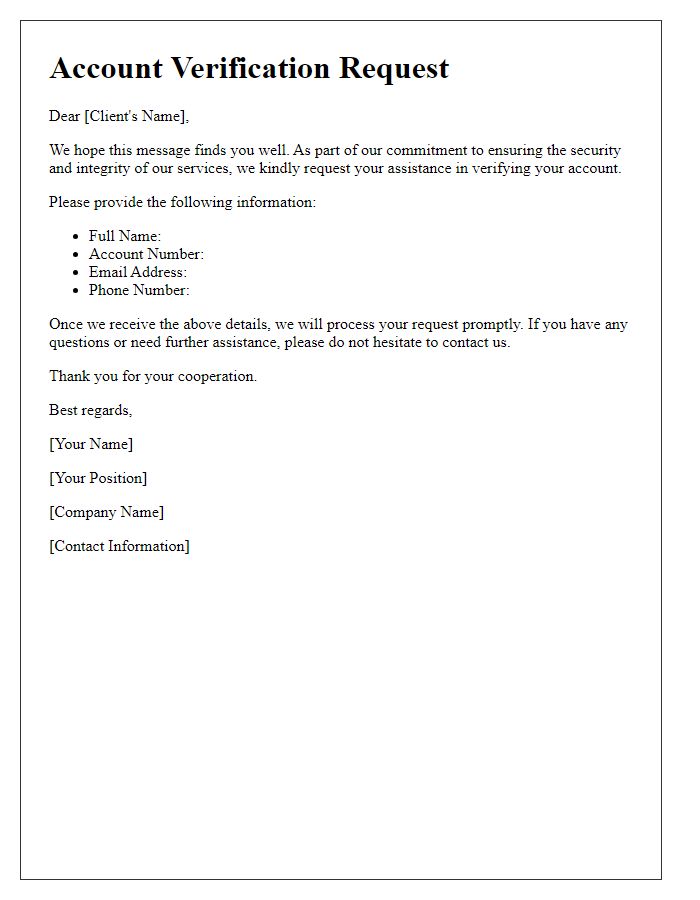

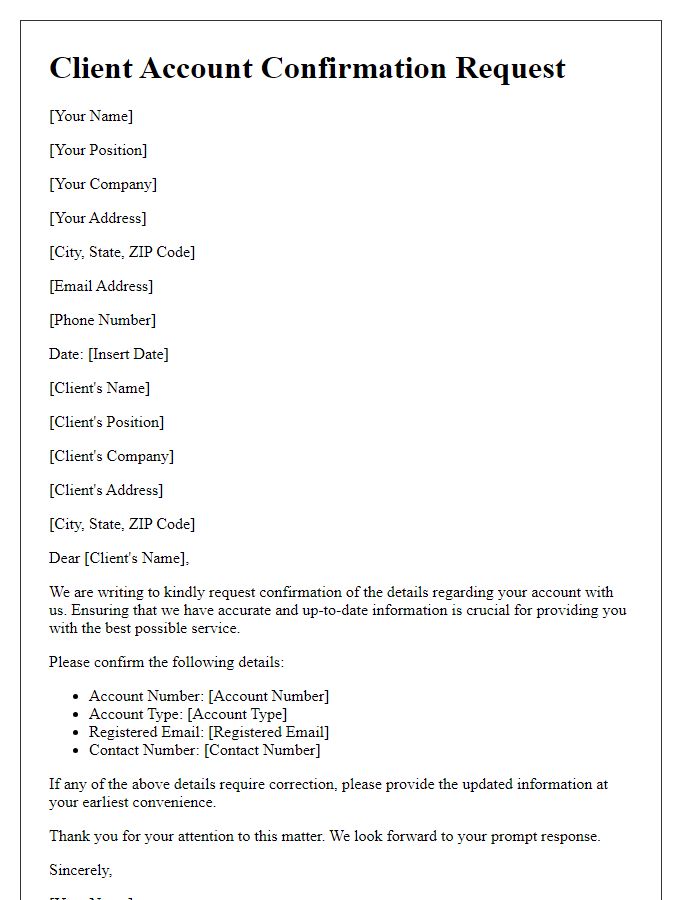

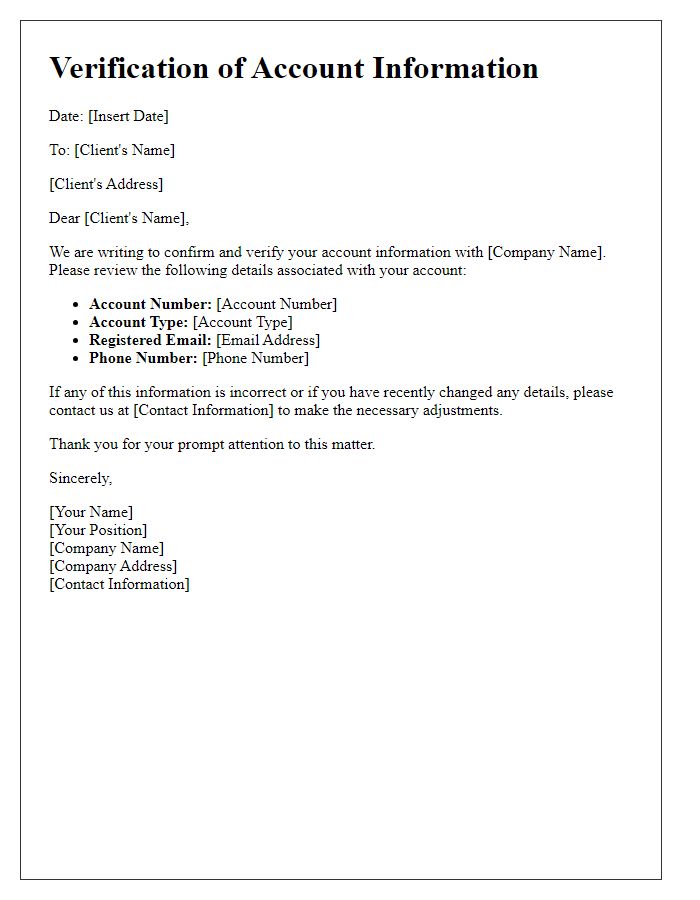

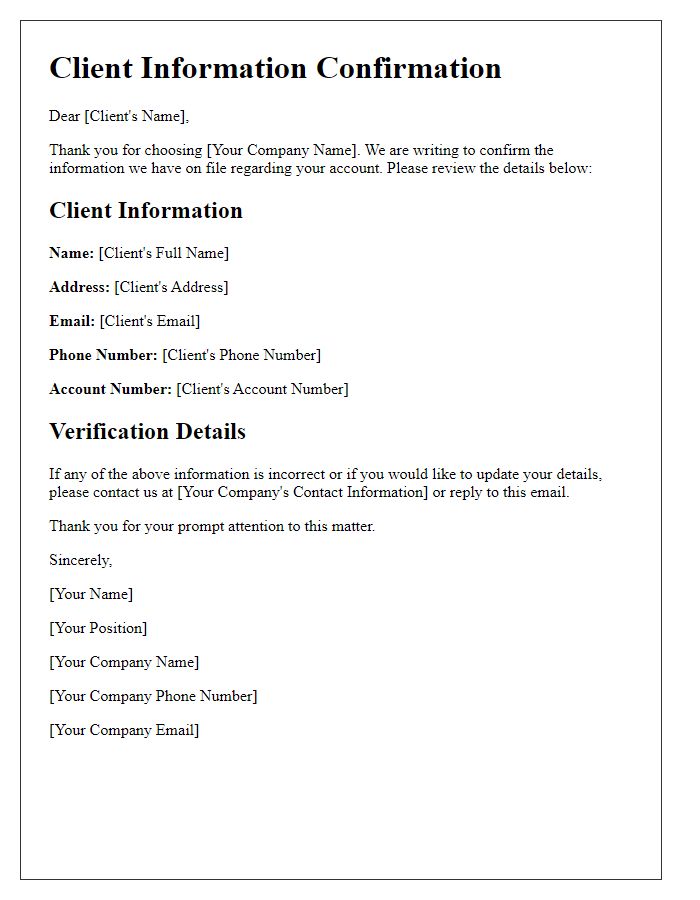

Client's Name and Address

Client verification of account details is essential in financial institutions to prevent fraud and ensure the accuracy of information. Personal identification (e.g., driver's license or passport) alongside current residential addresses are often required. Verification documents typically include utility bills or bank statements dated within the last three months. The process may vary based on regulatory requirements in specific regions, such as the USA's Know Your Customer (KYC) guidelines. Proper verification safeguards against identity theft and maintains the integrity of client accounts, contributing to overall trust in banking relationships.

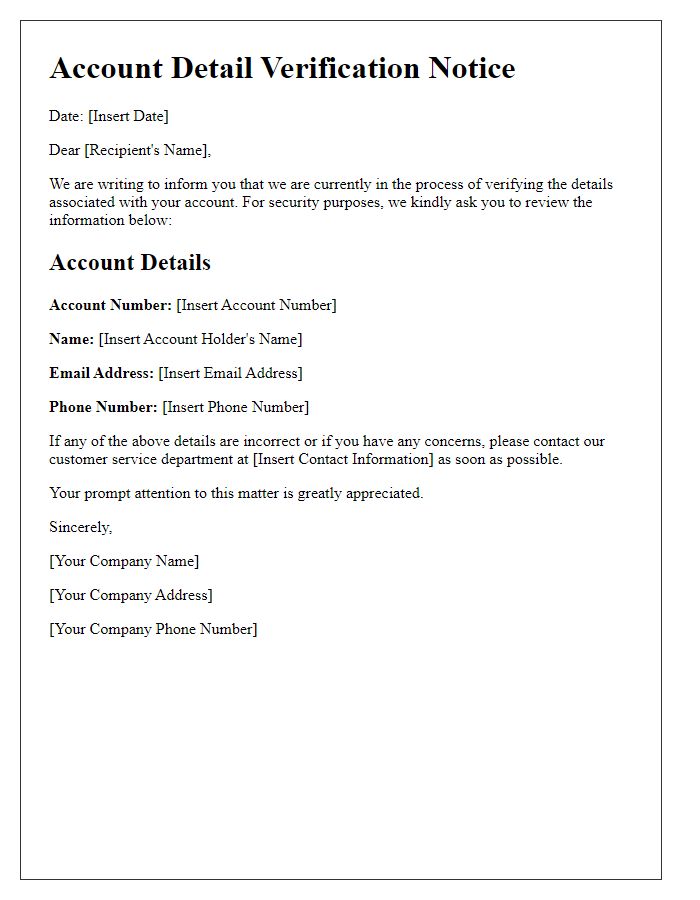

Account Details Verification Section

Account details verification is crucial for maintaining security and integrity in financial transactions. Personal information, such as account numbers (typically 12-16 digits), should be meticulously confirmed to prevent identity theft or fraud. Bank names, along with their corresponding branch locations (often specified as city and branch code), play an essential role in accurate verification. Regulatory bodies, like the Financial Industry Regulatory Authority (FINRA), mandate that institutions uphold strict verification processes to ensure compliance with legal standards. Furthermore, verification methods may include requesting documented identification, such as government-issued IDs or utility bills, to validate client addresses and further authenticate account ownership.

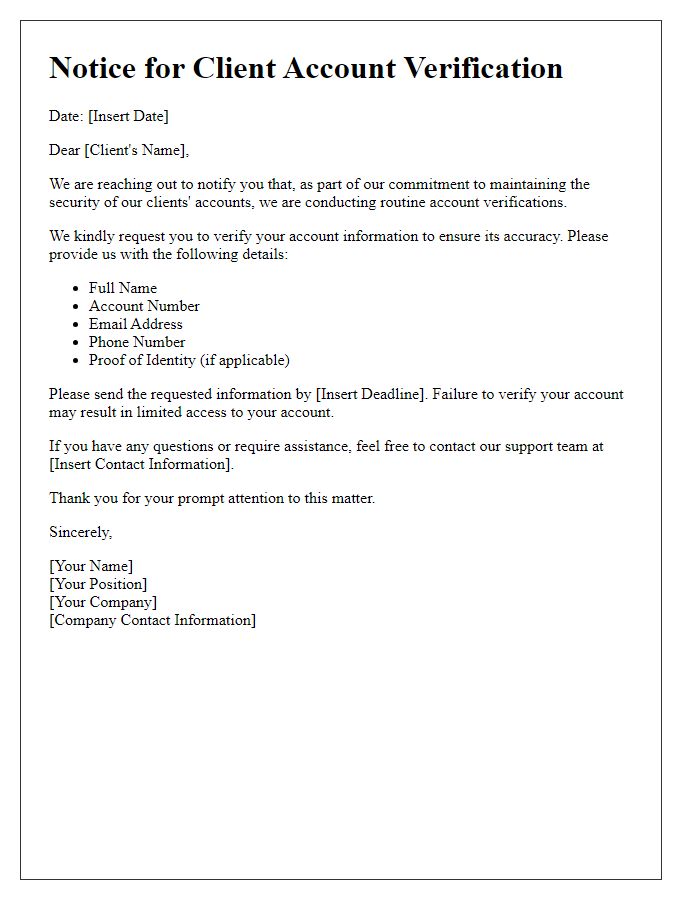

Contact Information for Queries

Client verification of account details is essential for ensuring security and accuracy. Clients are encouraged to provide updated personal information, including phone numbers and email addresses, for seamless communication. For inquiries regarding account status or discrepancies, dedicated contact channels should be available. Clients need to utilize official support lines, such as 1-800-555-0199, during business hours to connect with customer service representatives. Moreover, verification procedures may require clients to present identification documents, such as a government-issued ID or utility bills, confirming their address and identity. Maintaining current contact information helps prevent unauthorized access to accounts and enhances the overall security framework.

Confirmation and Signature Line

Client verification of account details ensures accuracy and security during transactions. Verification involves confirming personal details, such as the client's full name, account number, and contact information, typically associated with banking institutions like Wells Fargo or Chase. This process also includes confirming the address and any associated email for communication. A signature line is essential, providing the client a place to authorize the verification process, validating that the information provided is correct as of the current date. This step protects both the client and the institution from any fraudulent activities, maintaining trust and integrity within financial transactions.

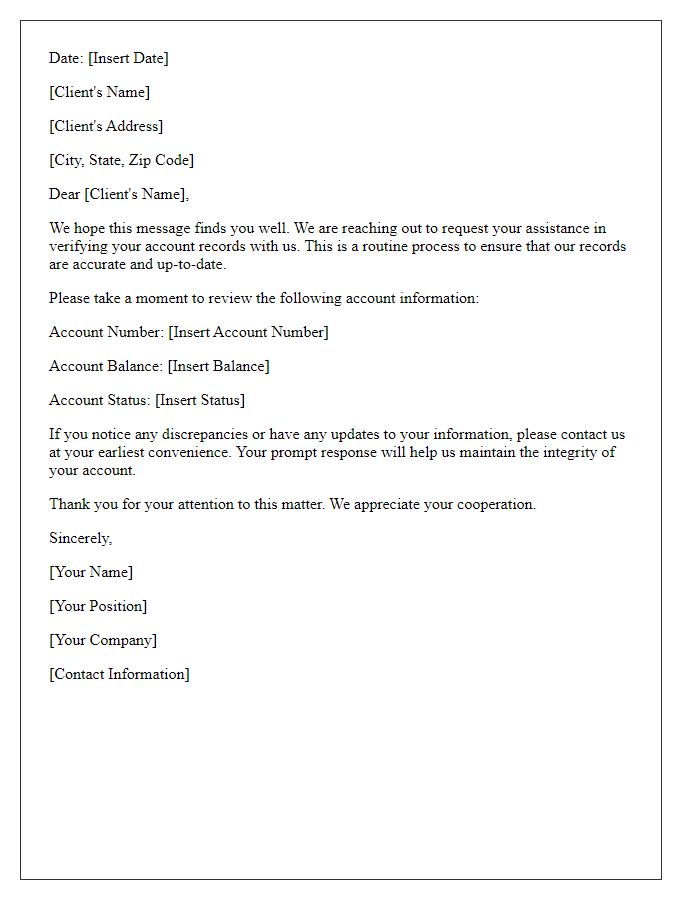

Privacy and Data Protection Disclaimer

Client verification of account details is critical for maintaining security and preventing fraudulent activities. Organizations must ensure that sensitive information such as personal identification numbers and account credentials are handled with utmost care. In accordance with data protection laws like the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States, companies are required to obtain explicit consent from clients when processing their relevant information. Clear guidelines on how this data will be stored, used, and protected from unauthorized access must be communicated effectively. Clients should also be informed of their rights regarding data access and rectification, assuring them that their privacy is a top priority.

Comments