In today's fast-paced world, business transactions can sometimes lead to misunderstandings and unauthorized activities that need immediate attention. If you've ever found yourself in a situation where charges or actions were taken without your approval, you know how crucial it is to address these matters promptly and effectively. Crafting a clear and concise letter to address unauthorized transactions can help clarify the situation and set the record straight. Let's dive into how you can navigate this process and protect your rightsâread on to discover essential tips and a practical template!

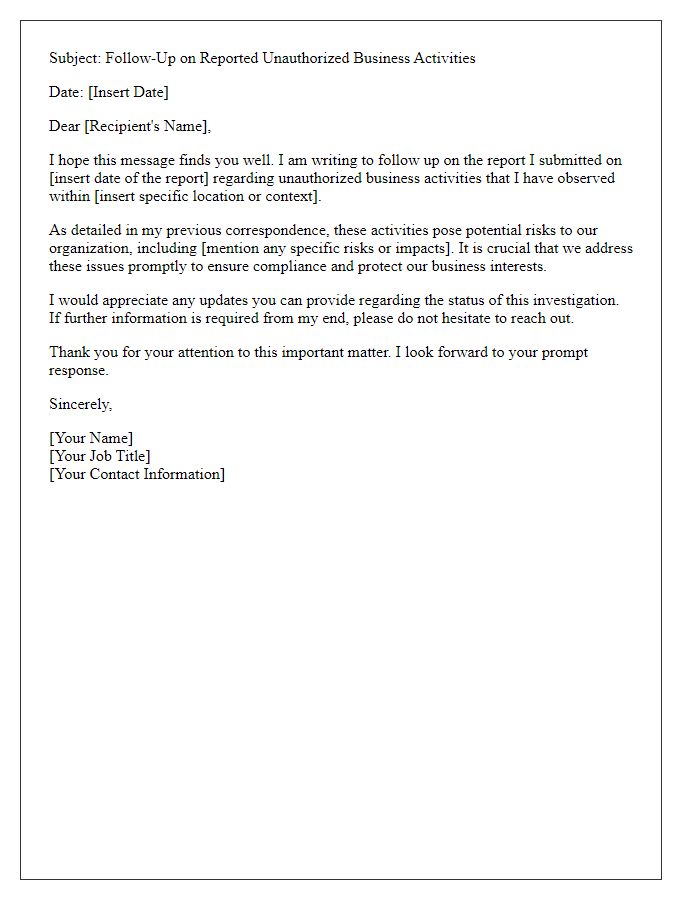

Introduction and Subject Line

Unauthorized business transactions can lead to significant financial discrepancies and reputational damage for companies involved. Identifying the reasons behind these transactions is crucial, as they often arise from compromised accounts or fraudulent activities. In 2022, businesses in the United States reported losses exceeding $25 billion due to payment fraud, underscoring the need for vigilant monitoring and robust security measures. Properly addressing these incidents involves meticulously documenting transaction details, including transaction IDs, amounts, and dates, as well as reporting them to financial institutions. Furthermore, informing affected parties, such as customers and stakeholders, is essential to maintaining trust and transparency within the business framework. Regular audits and employee training can also mitigate future risks associated with unauthorized transactions.

Explanation of Discrepancy

Unauthorized business transactions can significantly impact financial records and stakeholder trust. Discrepancies may arise from various issues such as identity theft, where individuals or organizations unknowingly allow their information to be used for fraudulent activities. Common examples include transactions recorded on payment platforms like PayPal or credit card statements that do not match authorized invoices. Reviewing transaction histories, especially in high-traffic businesses like e-commerce, can uncover unauthorized charges that damage financial integrity. It is essential for businesses to regularly monitor their accounts and implement security measures, such as multi-factor authentication, to prevent unauthorized access and mitigate potential losses.

Detailed Transaction Information

Unauthorized business transactions can lead to significant financial repercussions for both individuals and companies involved. Transaction records such as date (e.g., January 15, 2023), time (e.g., 3:45 PM), and transaction ID (e.g., TX123456789) play a crucial role in tracing fraudulent activities. The involved amount (e.g., $2,500) and merchant name (e.g., ABC Electronics) must be clearly documented for effective resolution. Additionally, the payment method utilized (e.g., credit card ending in 1234) should be noted to assist financial institutions in their investigation. Key stakeholders, such as customer service representatives or fraud investigators, may require specific account details (e.g., account number or email address linked to the transaction) to address the issue promptly. Timely reporting of such anomalies can prevent further unauthorized transactions and minimize loss.

Request for Immediate Action

Unauthorized business transactions present a significant risk to financial security. Instances of fraudulent credit card charges, unauthorized drafts from operational accounts, or identity theft can emerge from inadequate data protection measures or system vulnerabilities. In October 2022, an estimated 22 million Americans experienced identity theft, leading to financial losses totaling around $52 billion. Businesses, particularly small enterprises with limited security resources, must address such incidents swiftly to prevent further losses. Regulatory frameworks, such as the Payment Card Industry Data Security Standard (PCI DSS), outline necessary steps to mitigate these risks. Immediate action is crucial, including notifying affected parties, conducting thorough audits, and implementing enhanced security protocols to protect sensitive information against future breaches.

Closing with Contact Information

Unauthorized business transactions can lead to significant financial losses and legal complications. Individuals may discover unrecognized charges on their bank statements or credit accounts, often associated with identity theft or fraudulent activity. It's crucial to immediately report such transactions to financial institutions, such as Bank of America or Chase, within 30 days to comply with federal regulations. Taking steps to contact the local authorities or filing a report with the Federal Trade Commission (FTC) can provide additional protection. Keeping a record of communication regarding the fraudulent transactions with relevant details like transaction dates, amounts, and locations can assist in the investigation process. Including personal contact information, such as phone numbers and email addresses, ensures that follow-up discussions and resolutions can proceed efficiently.

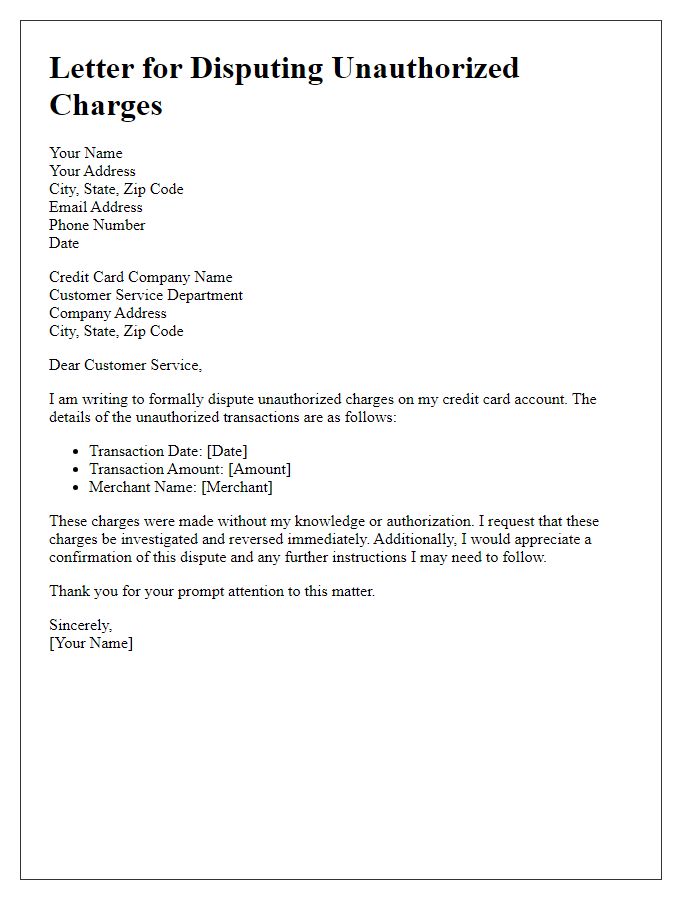

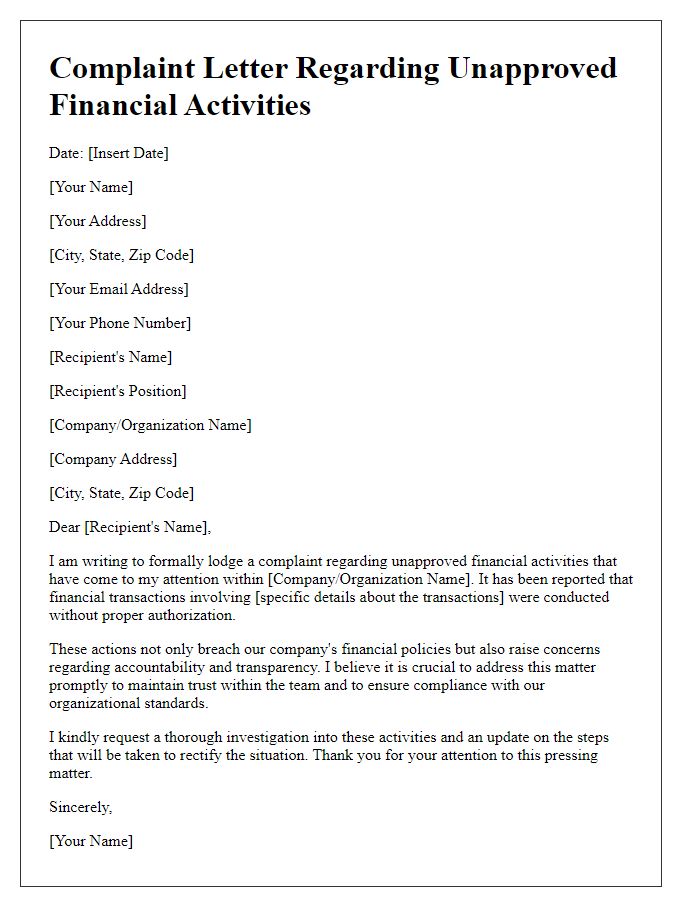

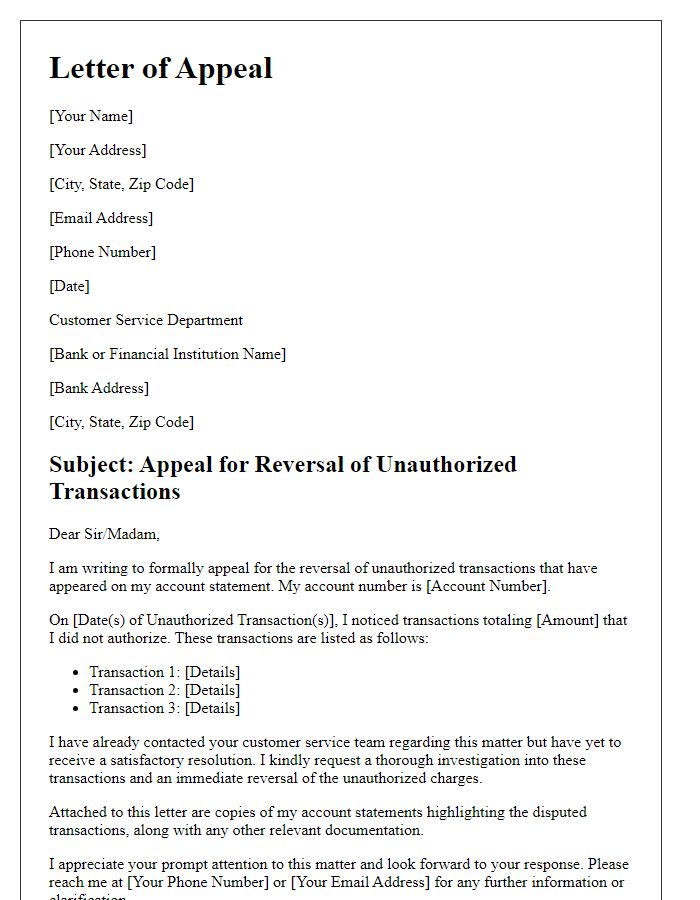

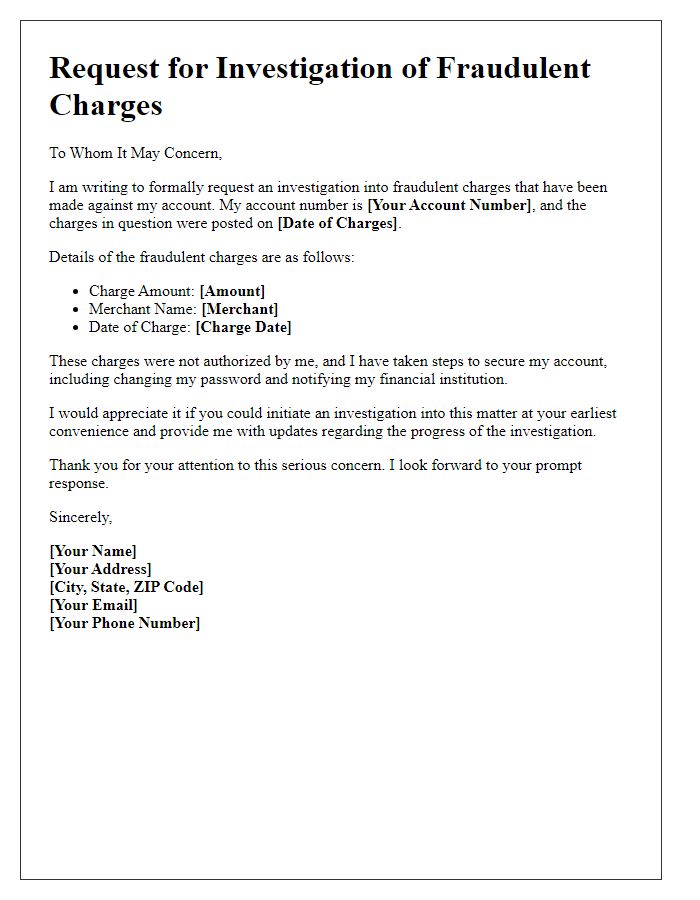

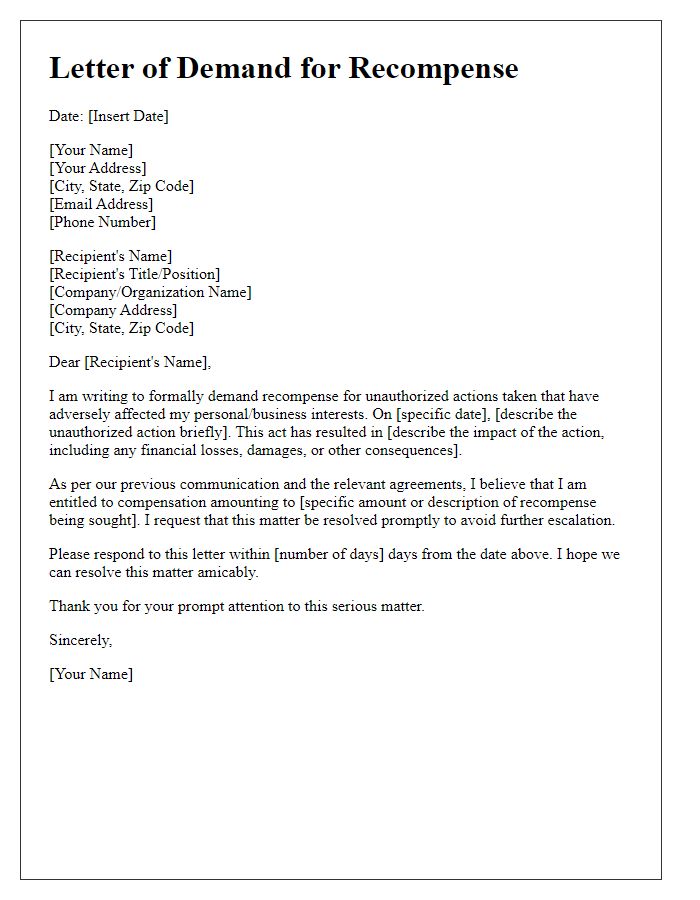

Letter Template For Addressing Unauthorized Business Transactions Samples

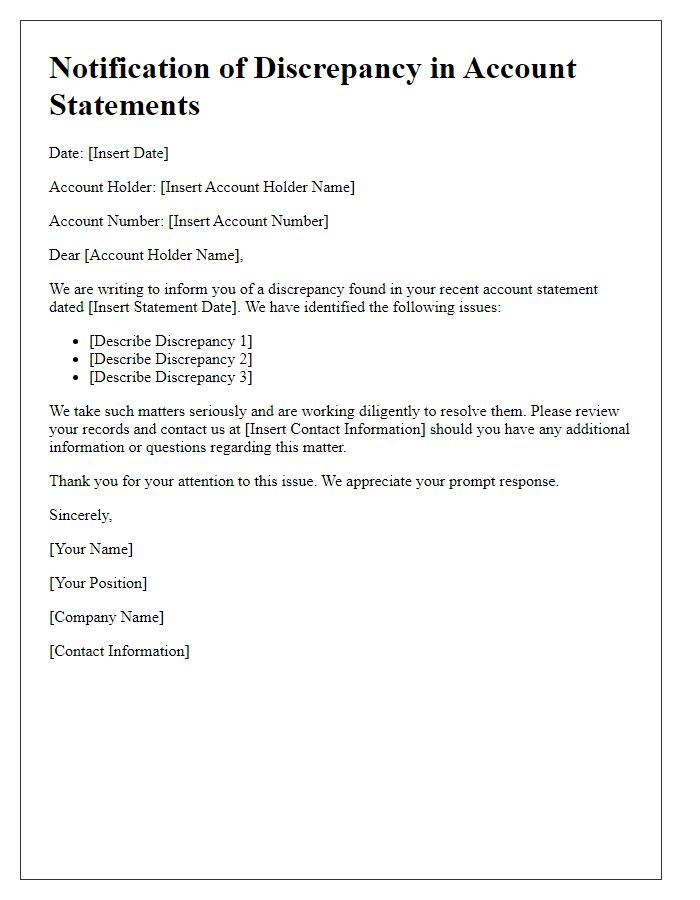

Letter template of notification for discrepancies in account statements.

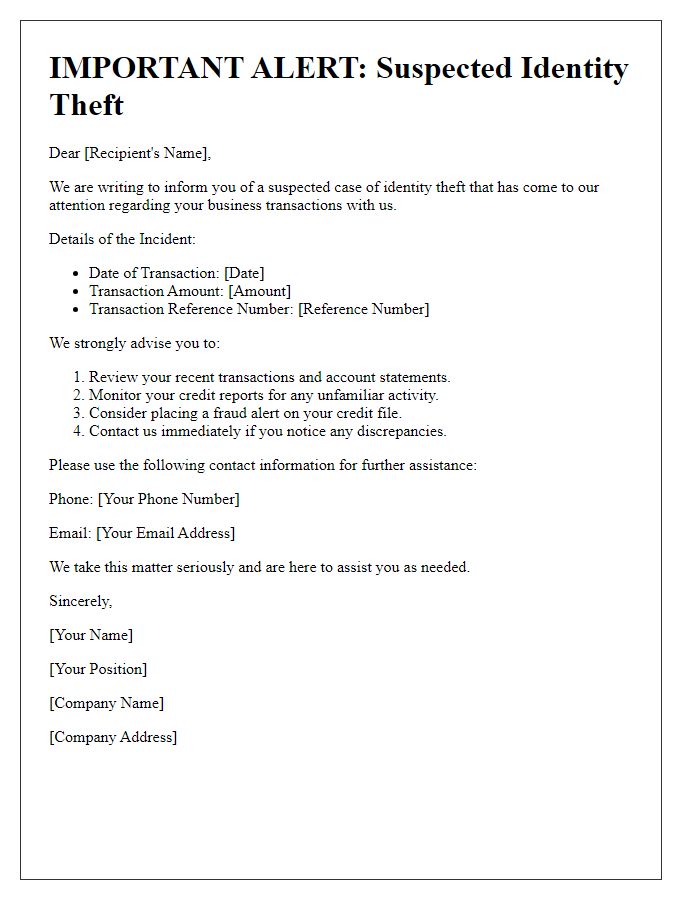

Letter template of alert for suspected identity theft in business transactions.

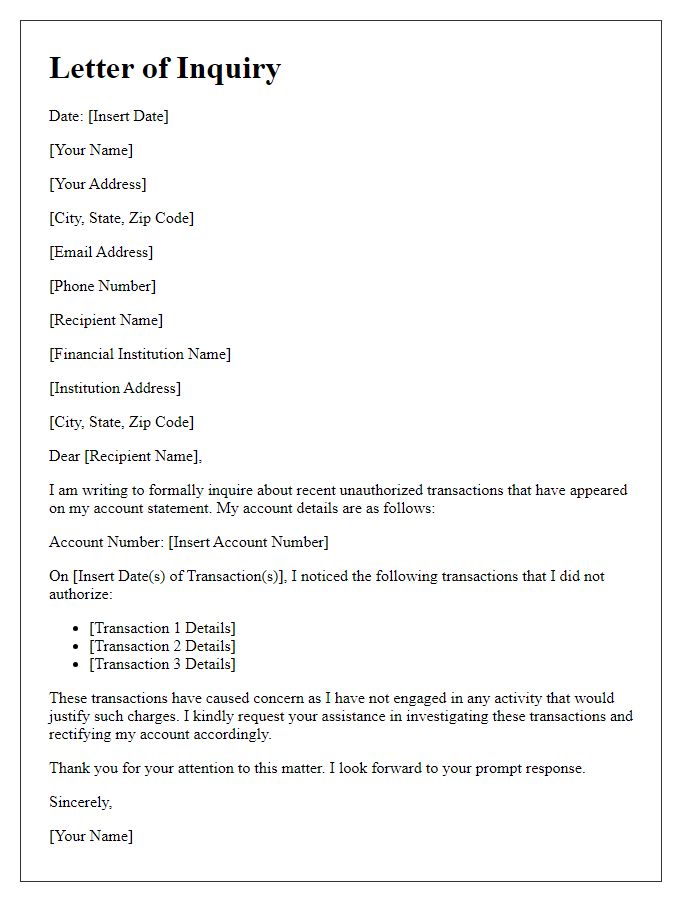

Letter template of documentation request for unauthorized transaction details.

Comments