When the tax season rolls around, the pressure can feel overwhelming, especially for business owners who juggle multiple responsibilities. If you find yourself in a situation where more time is needed to prepare your tax filings, requesting an extension can provide much-needed relief. A well-crafted letter can streamline this process, ensuring that you maintain compliance without the added stress of a looming deadline. Curious to learn how to structure your extension request effectively? Read on for a detailed guide!

Company Information

When preparing a business tax filing extension request, include essential details such as the company's legal name (for example, ABC Tech Solutions), Employer Identification Number (EIN), and the current business address (such as 123 Innovation Drive, Suite 100, San Francisco, CA, 94107). Specify the tax year for which the extension is requested, indicating the original filing deadline (typically April 15th for calendar-year filers). Additionally, mention the specific tax form involved, such as Form 1120 for corporations or Form 1065 for partnerships. Providing a brief explanation for the extension request--like ongoing bookkeeping reconciliations or pending documentation--helps clarify the situation. Finally, include contact information, including a phone number and email address for any follow-up communications by the Internal Revenue Service (IRS).

Reason for Extension

Businesses may require a tax filing extension due to various factors, such as unforeseen events (natural disasters, sudden regulatory changes), accounting complexities (new accounting software implementation, difficulties in gathering financial records), or staffing issues (unexpected employee turnover or illness affecting financial reporting). The IRS allows for a six-month extension for C corporations and partnerships, which can provide additional time to ensure accurate tax returns. It's crucial to submit the extension request before the original due date, along with the estimated tax payment to avoid penalties, enhancing compliance with federal tax regulations.

Specific Tax Year

Business owners seeking an extension for tax filing must ensure they adhere to the regulations set forth by the Internal Revenue Service (IRS). The tax year typically runs from January 1 to December 31, impacting a business's fiscal responsibilities. Extensions, commonly referred to as Form 7004, allow an additional six months for filing corporate taxes. This extension does not alleviate tax payment obligations, which generally remain due on April 15 for most corporate entities. Businesses must provide specific identifying information, including Employer Identification Number (EIN) and the tax year in question, ensuring proper documentation and accuracy. Adhering to deadlines and regulations is crucial for avoiding penalties that can arise from late filings.

Requested Extension Period

A business tax filing extension request typically involves formal communication to the IRS. Taxpayers commonly request an extension for a six-month period, allowing additional time for preparing accurate financial documentation. The extension request may encompass various types of taxes, including corporate income taxes (form 1120) or partnerships (form 1065), depending on the business structure. Businesses intending to submit this request must accurately calculate any potential tax liabilities to avoid penalties and interest. Additionally, providing a valid reason for the extension, such as unexpected financial delays or incomplete documentation, can strengthen the request. Form 4868 serves as the official document for individual filers, while corporate businesses may need to use different forms, such as timely filing Form 7004 to secure the extension.

Contact Information

A business tax filing extension request should include essential contact information to ensure clear communication. Key details such as the business's legal name (e.g., Smith & Co. LLC), Employer Identification Number (EIN, for instance, 12-3456789), primary business address (e.g., 123 Main St, Springfield, IL, 62701), and the contact person's name (e.g., John Smith, Tax Manager) along with their direct phone number (e.g., (555) 123-4567) and email address (e.g., john.smith@smithco.com) are crucial. This information facilitates timely processing and addresses any inquiries the IRS may have regarding the extension request. Additionally, noting the tax period for which the extension is desired (e.g., for the fiscal year ending December 31, 2023) adds clarity.

Letter Template For Business Tax Filing Extension Request Samples

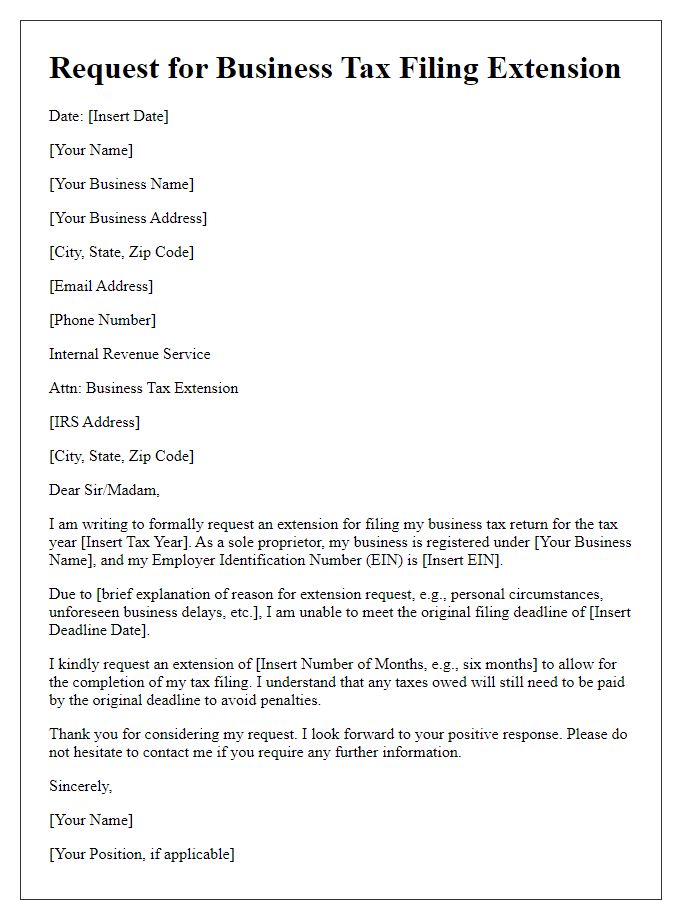

Letter template of business tax filing extension request for sole proprietors.

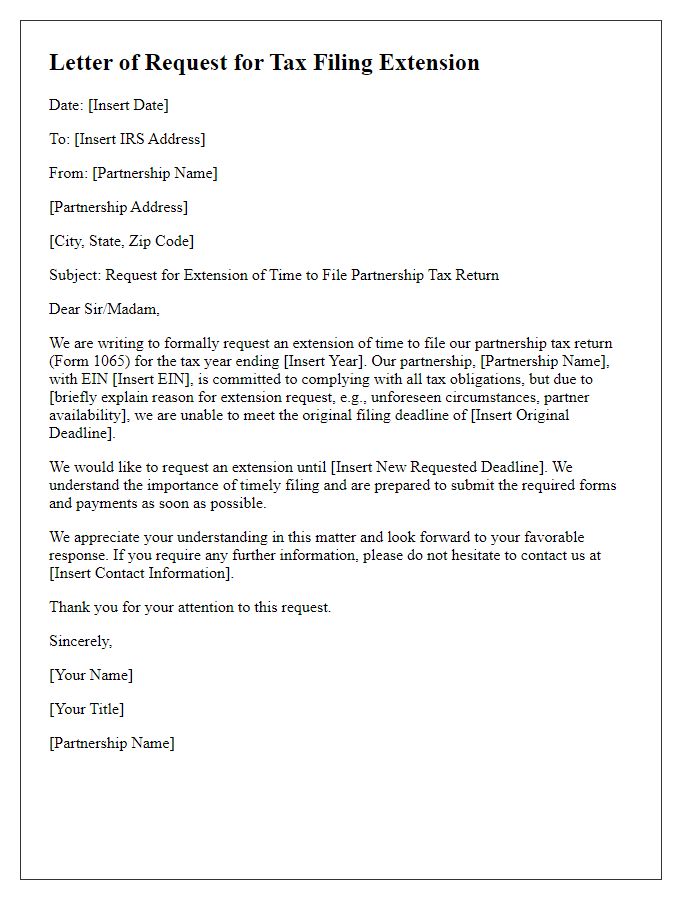

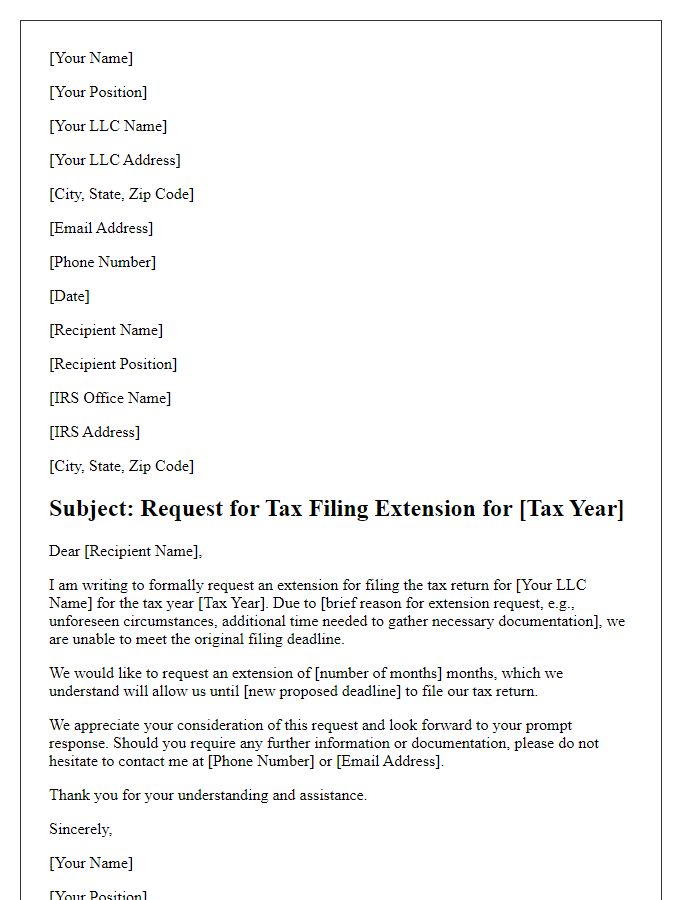

Letter template of business tax filing extension request for partnerships.

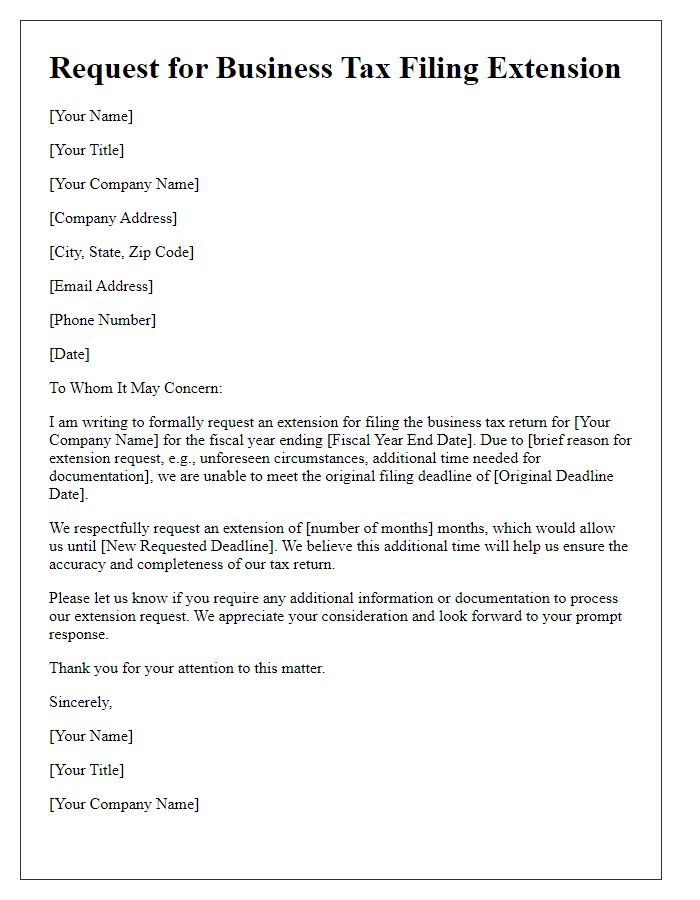

Letter template of business tax filing extension request for corporations.

Letter template of business tax filing extension request for nonprofit organizations.

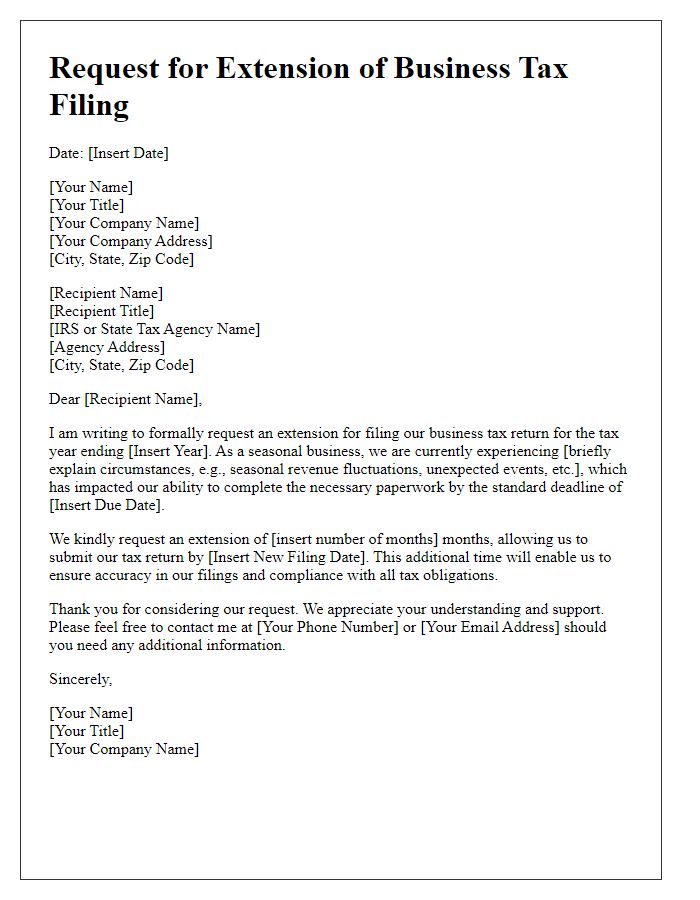

Letter template of business tax filing extension request due to unforeseen circumstances.

Letter template of business tax filing extension request for new businesses.

Letter template of business tax filing extension request for companies undergoing audits.

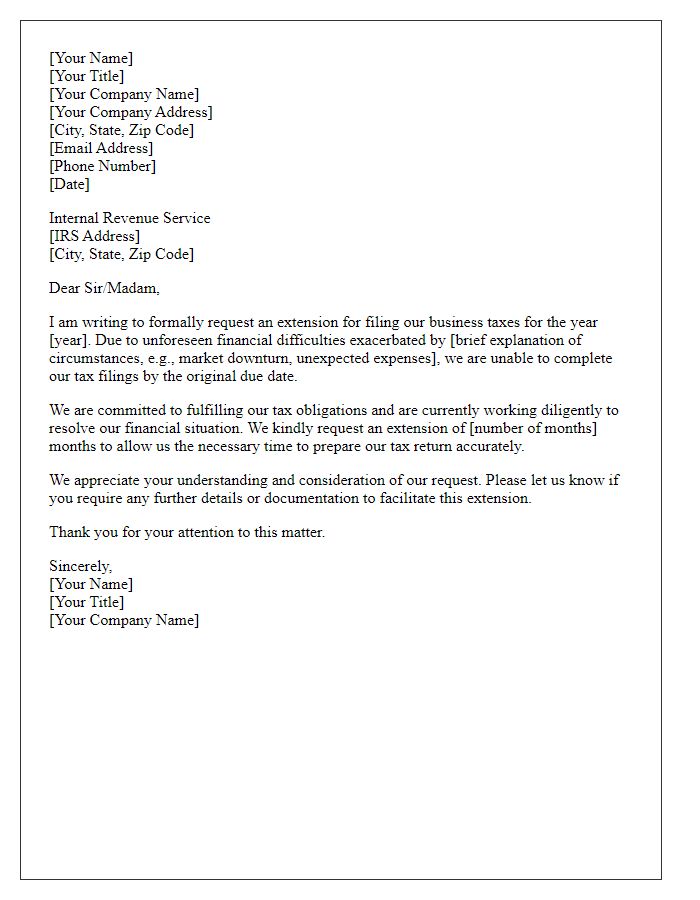

Letter template of business tax filing extension request citing financial difficulties.

Comments