Are you looking to elevate your business's financial management? In today's competitive landscape, having a reliable accounting partner can make all the difference. We understand that every organization has unique needs, and we are here to offer tailored solutions that not only streamline your accounting processes but also enhance your overall financial health. Ready to discover how our accounting services can benefit you? Let's dive into the details!

Professional Tone and Branding

The accounting services industry in the United States is highly competitive, with over 1.3 million professionals serving businesses. International Financial Reporting Standards (IFRS) form a critical framework for transparency and consistency across financial statements, impacting clients' decision-making processes. A strong branding strategy is essential for distinguishing services in this sector. Targeted messaging can address specific clientele needs, such as tax preparation, auditing, and financial consulting, that vary across industries like healthcare, construction, and technology. Utilizing a professional tone in proposals can reinforce credibility and trust, while a consistent brand identity enhances recognition and fosters client relationships. Deploying advanced technology, such as cloud accounting platforms, can streamline services, enabling real-time financial monitoring and collaboration with clients.

Clear Service Descriptions

Comprehensive accounting services encompass a wide array of financial solutions tailored for small to medium-sized businesses. Tax preparation involves thorough preparation of federal and state tax returns, ensuring compliance with IRS regulations while maximizing deductions. Bookkeeping services maintain accurate financial records, including tracking income, expenses, and bank reconciliations, vital for informed decision-making. Financial reporting provides periodic updates on a business's financial health through profit and loss statements, balance sheets, and cash flow analyses, essential for strategic planning. Payroll processing manages employee compensation, tax withholdings, and compliance with labor laws, streamlining operations. Consulting services offer strategic advice on budgeting, cash flow management, and financial forecasting to enhance profitability and growth. Each service aims to improve financial clarity and support business sustainability.

Client Benefits and Value Proposition

Comprehensive accounting services provide clients with financial clarity, efficiency, and strategic insights. Utilizing advanced software systems like QuickBooks and Xero enhances accuracy in financial reporting, ensuring timely and compliant submissions for tax obligations. Expertise in tax planning allows businesses to minimize liabilities, maximizing cash flow for reinvestment or operational needs. Regular financial health assessments, conducted on a quarterly basis, help identify trends affecting profitability, enabling proactive adjustments. Additionally, personalized consultations provide tailored advice based on industry benchmarks, fostering informed decision-making. By streamlining processes and offering clear visibility into financial performance, clients experience peace of mind, allowing them to focus on core business activities.

Credentials and Experience

In the competitive accounting services landscape, credentials such as Certified Public Accountant (CPA) designation underscore professionalism and expertise. With over ten years of experience in various sectors, our team has successfully managed financial strategies for small businesses and Fortune 500 companies alike. Notable past projects include the implementation of a comprehensive auditing system for a prominent retail chain in California in 2022, resulting in a 15% increase in operational efficiency. Our experience extending from tax planning to financial consulting equips us to address diverse client needs effectively. Furthermore, we are committed to continuous professional development, ensuring our knowledge remains current with evolving accounting standards, such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

Call to Action and Contact Information

A well-structured accounting services business proposal emphasizes the significance of these services in managing finances, ensuring compliance, and optimizing operations. Professional accounting services, such as tax preparation, auditing, and financial consulting, can greatly influence business growth. Businesses facing challenges in financial reporting or cash flow management may benefit from expert assistance to streamline processes and enhance accuracy. Contact details should be prominently displayed, including phone number, email address, and website, inviting potential clients to reach out for tailored solutions that align with their unique financial needs. Call to action may encourage immediate consultation or a no-obligation meeting to discuss specific requirements and potential benefits of professional accounting services.

Letter Template For Accounting Services Business Proposal Samples

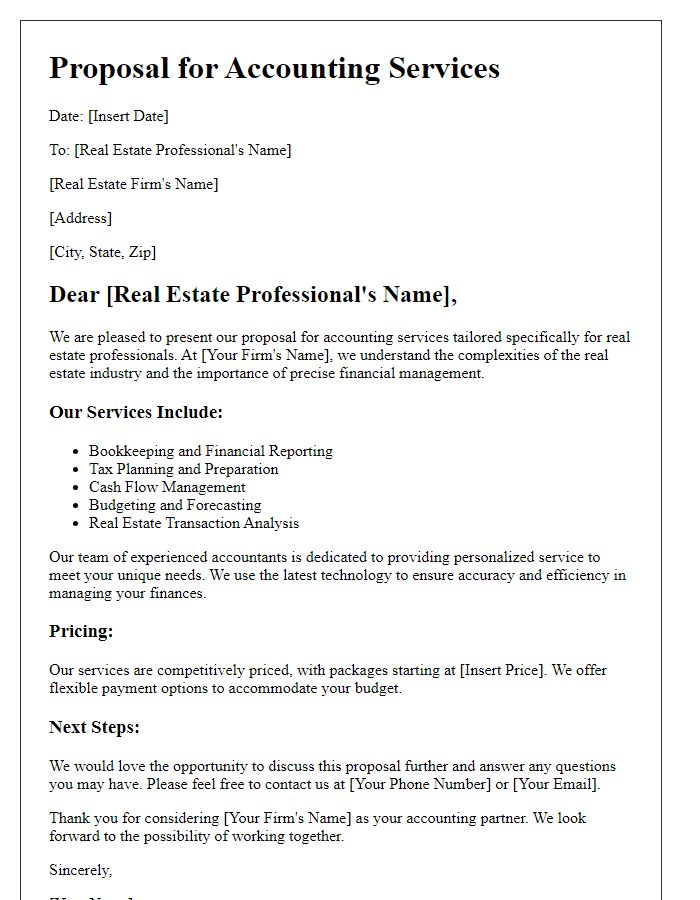

Letter template of accounting services proposal for real estate professionals

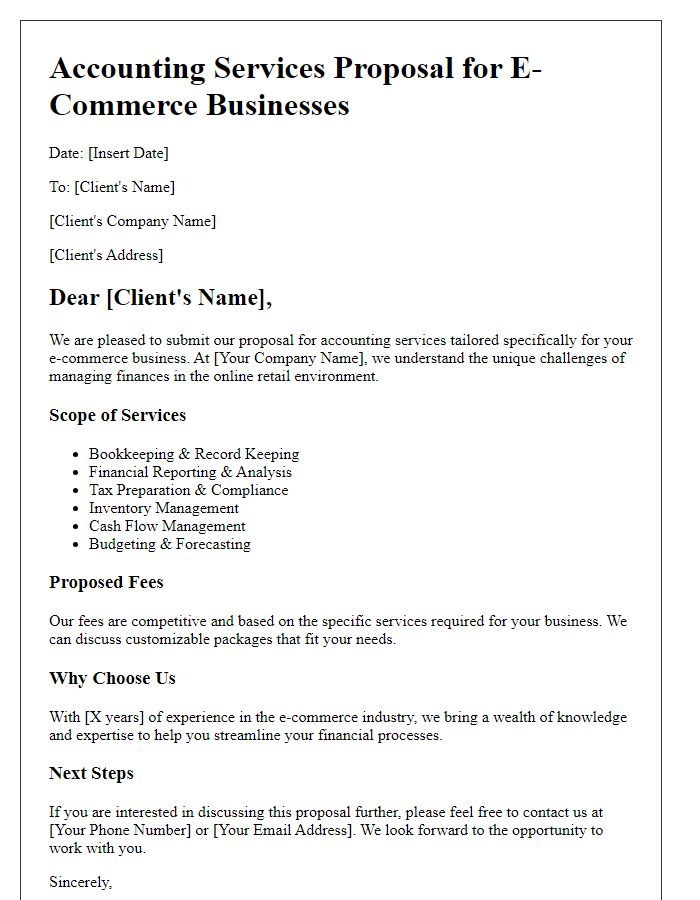

Letter template of accounting services proposal for e-commerce businesses

Comments