Hello there! We all know that giving back can be one of the most rewarding actions we can take. Whether you're supporting a cause close to your heart or helping others in need, every contribution makes a difference. In this article, we'll explore how to create a meaningful donation acknowledgment letter that expresses gratitude and strengthens connections with your supporters. So, let's dive in and discover how to craft the perfect message to show appreciation!

Donor's Full Name and Address

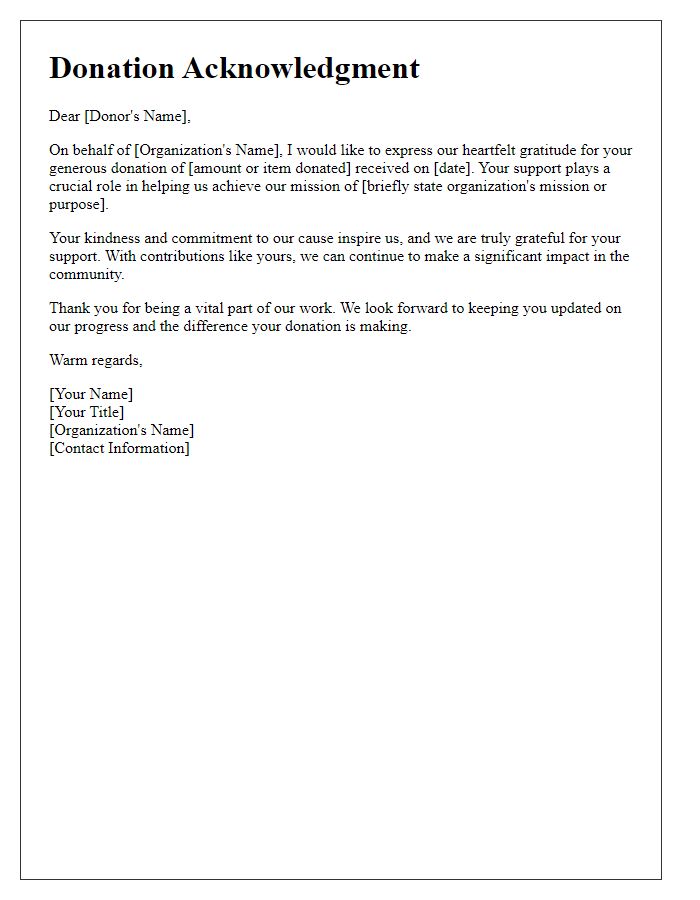

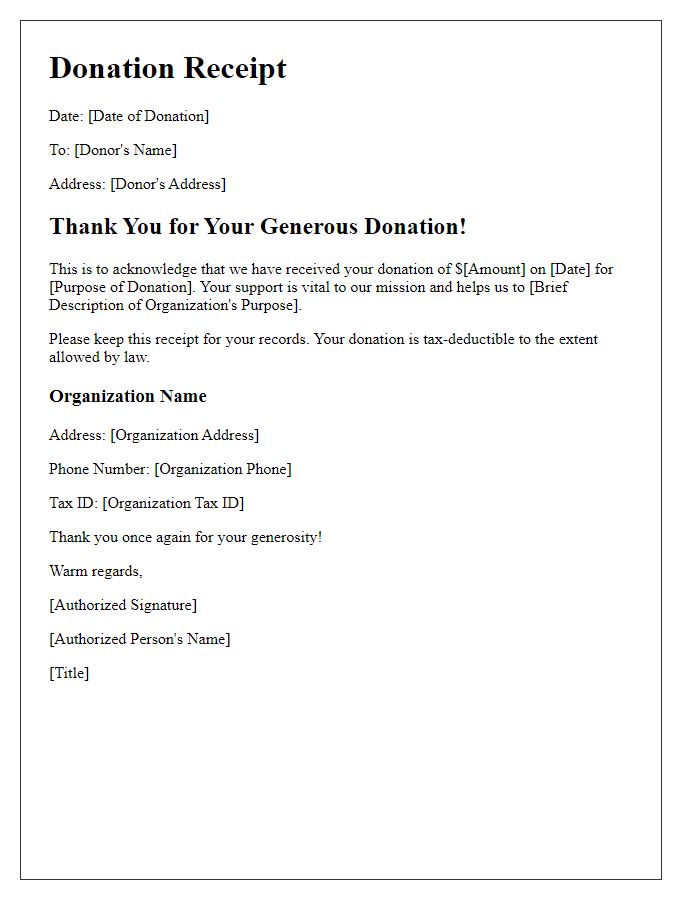

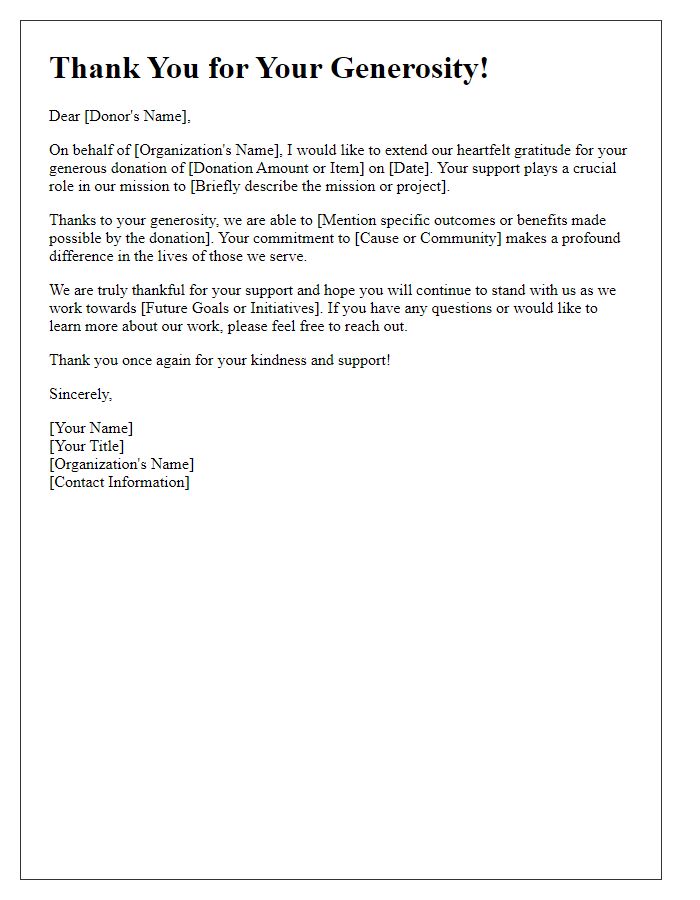

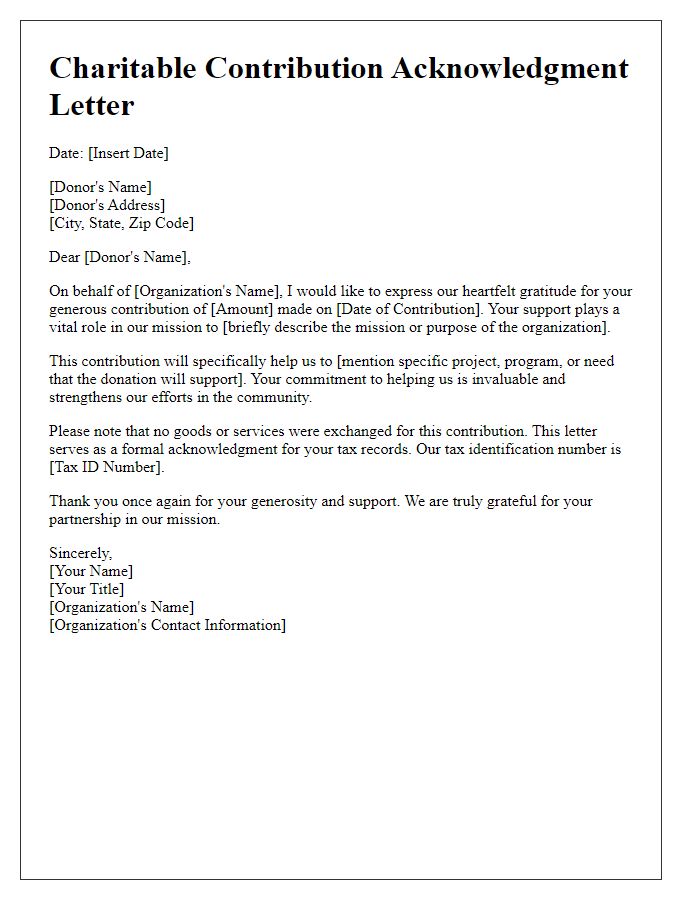

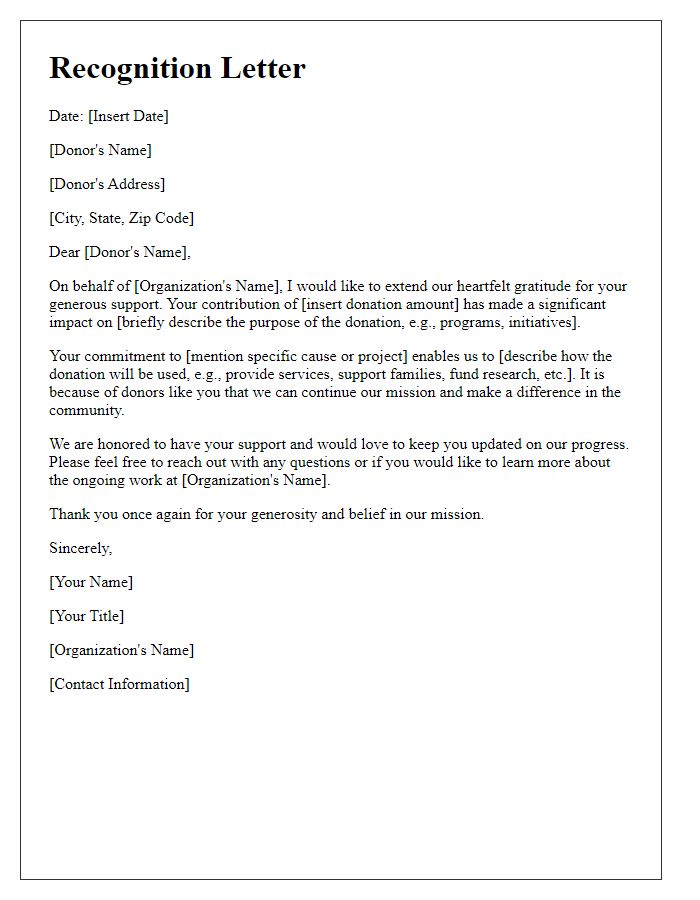

The donation acknowledgment letter serves as a vital communication tool for non-profit organizations (NPOs) to express gratitude to individuals who contribute funds or resources. Each letter should clearly state the donor's full name and address at the top, ensuring personalization and proper record-keeping. NPOs may include specific details about the donation received, such as the amount donated, the purpose of the donation--such as supporting educational programs or funding community projects--and the date of the contribution. These elements not only enhance the sincerity of the acknowledgment but also serve as an important tax-deduction record for the donor, especially for contributions exceeding $250 (as per IRS regulations). Additionally, the letter often concludes with information on how the donation will impact the organization's mission, fostering a deeper connection between the donor and the cause.

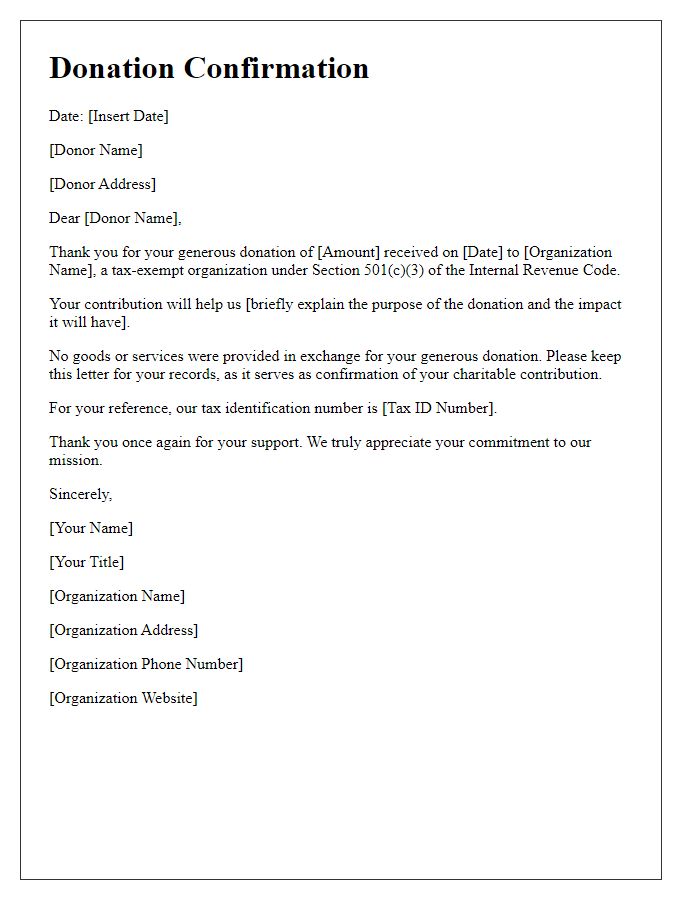

Organization's Name and Contact Information

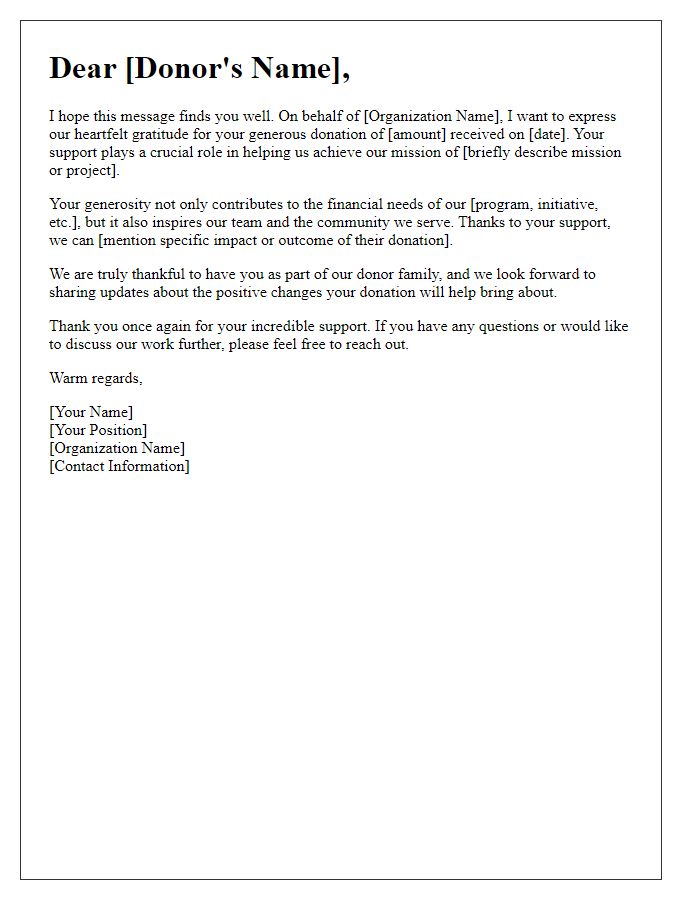

Nonprofit organizations often rely on the generosity of donors to sustain their missions. When a donation is made, acknowledging the contribution plays a significant role in maintaining positive relationships. An effective donation acknowledgment includes vital information such as the organization's name, which identifies the charity, and its contact information, providing a clear means for donors to reach out for any inquiries or further engagement opportunities. This acknowledgment typically features a warm expression of gratitude, detailing the specific donation amount, its intended use, and the impact it will have on the community or cause served, reinforcing the connection between the donor and the organization while encouraging future support.

Specific Donation Details (amount, date, etc.)

Generous donations, such as $500 received on April 12, 2023, significantly support community initiatives, including local food banks and educational programs. These contributions directly impact the lives of families in need and help sustain vital resources. Recognizing donors fosters lasting relationships, as transparency about how funds will be utilized builds trust and encourages ongoing support. The acknowledgment process involves sending personalized letters that highlight specific donation details, reinforcing gratitude and showcasing tangible benefits achieved with the donated amount.

Personalized Appreciation Message

A heartfelt donation acknowledgment letter expresses gratitude to donors for their generous contributions to charitable causes. Personalization enhances connection; addressing the donor by name emphasizes recognition. Including specific details, like the amount donated, showcases the impact of their support. Mention particular projects or goals funded by their generosity (e.g., community outreach initiatives, educational programs). A timely response, ideally within two weeks of receiving the donation, reinforces appreciation. Making the letter visually appealing with branded stationery can enhance professionalism. Inviting donors to future events or providing updates on project progress can foster ongoing relationships. A strong closing remark reiterates the organization's gratitude while keeping the door open for future engagements.

Tax Deductibility Statement and Legal Information

Tax-deductible donations play a critical role in supporting non-profit organizations' missions, such as food banks or educational funds. For instance, a donation made to a qualified 501(c)(3) organization can provide the donor with potential tax benefits under the Internal Revenue Code guidelines, allowing for deductions on federal income taxes. To ensure compliance, acknowledgment letters must include specific legal information, such as the organization's name, address, and tax identification number. Additionally, any goods or services provided in exchange for the donation must be stated, ensuring clarity for the donor's records. This helps maintain transparency and fosters trust, encouraging continued support.

Comments