Welcome to our guide on strategic board planning! Here, we'll explore the crucial elements that make up an effective strategy for your board, ensuring that it aligns with your organization's goals and values. Whether you're looking to refine existing plans or develop new initiatives, we'll provide you with key insights and practical tips. So, grab a cup of coffee and dive into our article to discover how to elevate your board's strategic planning process!

Objective Alignment

Strategic board planning involves aligning objectives that drive organizational success. Stakeholders from various departments need to identify key performance indicators (KPIs) that reflect both short-term and long-term goals. Regular assessment of past performance, including revenue growth percentages and market share fluctuations, is essential for refining strategies. Also, annual review meetings, typically held in the fourth quarter at headquarters, facilitate discussions on emerging trends, competitive positioning, and resource allocation. By setting clear objectives, such as increasing customer retention rates by 15% over the next fiscal year, and aligning them with actionable plans, boards can ensure cohesive efforts across teams, fostering accountability and enhanced collaboration.

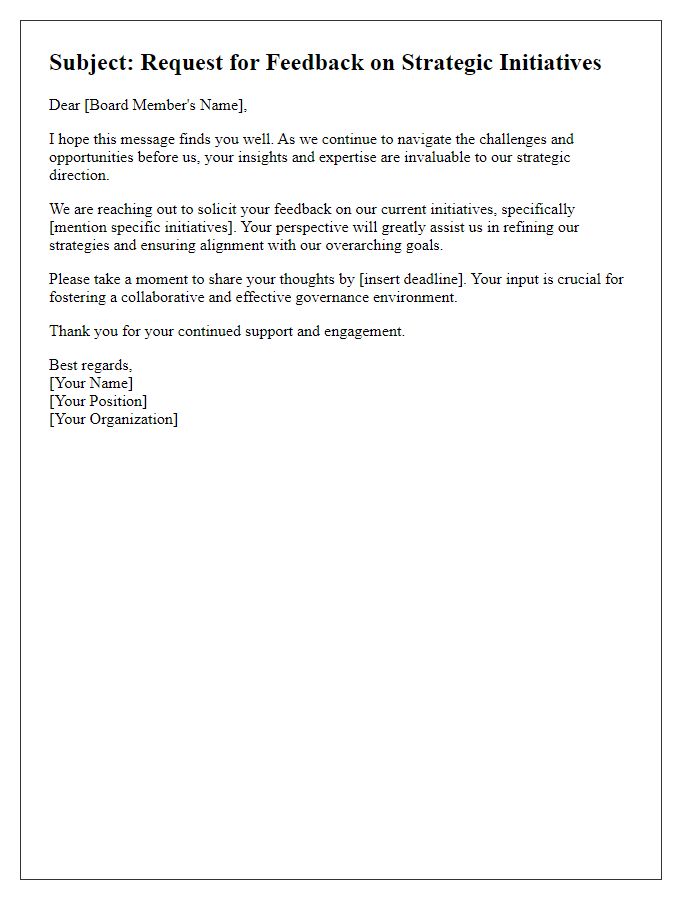

Stakeholder Engagement

Stakeholder engagement is a crucial element in strategic board planning, ensuring that diverse perspectives are considered in decision-making processes. Identifying key stakeholders such as investors, employees, customers, and community members facilitates collaborative dialogue. Engaging these parties through surveys, focus groups, and consultations allows boards to gather insights and prioritize initiatives. Successful stakeholder engagement fosters transparency and enhances trust, leading to stronger organizational alignment and buy-in for strategic goals. For instance, a 2021 survey from the Harvard Business Review indicated that companies with proactive stakeholder engagement practices could improve shareholder value by up to 30% over three years.

Risk Assessment

Risk assessment is a critical component of strategic board planning, ensuring proactive identification and management of potential threats that may affect organizational objectives. Various types of risks, including operational, financial, compliance, and reputational, must be evaluated meticulously. Internal audits, conducted quarterly, can highlight weaknesses in processes or systems, while external audits, usually performed annually by independent firms, assess compliance with industry regulations. Furthermore, emerging risks, such as cybersecurity threats targeting sensitive data, emphasize the need for continuous monitoring and adaptation. The board must consider historical data, such as previous incidents or market fluctuations, to develop robust mitigation strategies. Engaging stakeholders, including department heads and external consultants, can enhance the depth of the assessment, providing diverse perspectives and expert insights. Regular reviews, ideally every six months, will ensure the risk management frameworks remain relevant and effective in a rapidly evolving landscape.

Resource Allocation

Strategic board planning requires careful consideration of resource allocation, particularly in organizations such as Fortune 500 companies. Effective resource allocation directs capital (financial resources), human resources (staffing and expertise), and technological resources (software and hardware) towards achieving specific goals. Determining the allocation percentage (e.g., 30% for R&D initiatives, 20% for marketing campaigns) plays a crucial role in optimizing productivity and enhancing competitive advantages. Geographic locations (like Silicon Valley for tech startups or Wall Street for finance firms) also significantly influence resource distribution due to market opportunities and talent availability. Additionally, recent trends highlight the importance of agile resource allocation, with companies reported to experience a 15% increase in efficiency when adjusting resources dynamically in response to market changes.

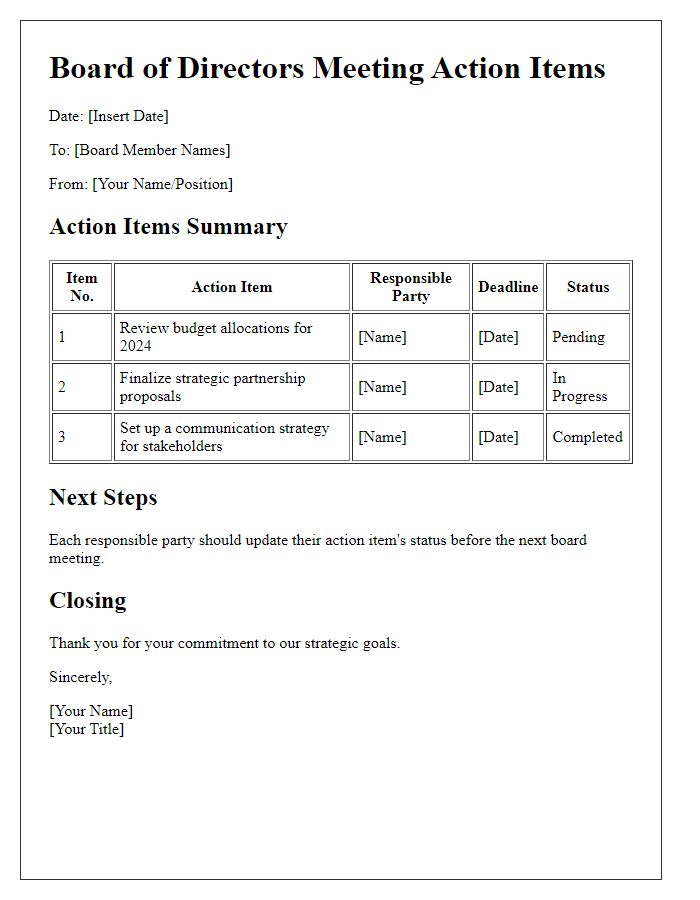

Performance Metrics

Performance metrics are essential for evaluating organizational efficiency and effectiveness, utilizing quantifiable data to guide decision-making. Key performance indicators (KPIs) such as revenue growth rate, customer satisfaction score, and employee turnover rate provide insights into operational performance across various departments. For instance, an increase in revenue growth rate, averaging 15% year-over-year in the technology sector, indicates successful product launches and marketing strategies. Customer satisfaction scores, often measured on a scale of 1 to 10, directly correlate with repeat business, which can reach upwards of 70% in high-performing companies. Additionally, understanding employee turnover rates, which can average 12-15% in the retail industry, aids in workforce planning and development. Analyzing these metrics holistically is crucial for shaping strategic initiatives during board planning sessions.

Comments