In today's ever-evolving financial landscape, making strategic investment decisions is crucial for any board director. It's important to balance potential risks with promising opportunities, all while aligning with the organization's long-term goals. With an array of factors to considerâfrom market trends to shareholder expectationsâeffective communication and collaboration are essential. So, let's dive deeper into the best practices for navigating this complex decision-making process!

Purpose and Objectives

The purpose of board director investment decisions revolves around strategic financial planning and long-term growth for the organization. Objectives include maximizing shareholder value, identifying high-potential investment opportunities within emerging markets, and diversifying the organization's investment portfolio to mitigate risk. Thorough analysis of potential investments, including industry trends, market competition, and financial health of target companies, is essential. Additionally, aligning investments with the organization's core mission and values enhances overall effectiveness. Evaluating potential returns, both short-term and long-term, supports informed decision-making and strengthens the organization's position within the marketplace.

Investment Evaluation and Analysis

Investment evaluation involves a comprehensive assessment of potential opportunities to ensure alignment with strategic financial goals. Factors such as return on investment (ROI) percentages and risk assessments are essential during this process. The analysis includes market research data (including industry trends from sources like Statista) and financial projections that indicate projected revenue growth (such as a 15% yearly increase). Locations with significant potential for expansion, like the emerging markets in Southeast Asia (particularly Vietnam and Indonesia), may also be considered. Feasibility studies often incorporate internal metrics (like net present value calculations) alongside external economic indicators (such as inflation rates and currency fluctuations) to inform board directors' decisions. Additionally, understanding the competitive landscape and identifying key players within the sector can provide insights for positioning and strategic investment allocations.

Risk Assessment and Mitigation Strategies

The investment decision process requires a thorough risk assessment to identify potential challenges associated with the proposed project. Key risks include market volatility, which can affect stock prices and overall investment returns in sectors like technology or real estate. Regulatory risks, particularly in heavily monitored industries such as pharmaceuticals, require careful consideration of compliance measures and potential legal implications. Financial stability of target companies is pivotal, with credit ratings influencing funding costs and investment viability. Additionally, operational risks, including supply chain disruptions or management inefficiencies, must be analyzed for their potential impact on performance. Developing robust mitigation strategies involves diversifying the investment portfolio to spread risk, conducting due diligence to assess the financial health of target investments, and staying informed about industry trends and regulatory changes. Furthermore, implementing contingency plans can address unforeseen circumstances, thereby safeguarding the investment's profitability.

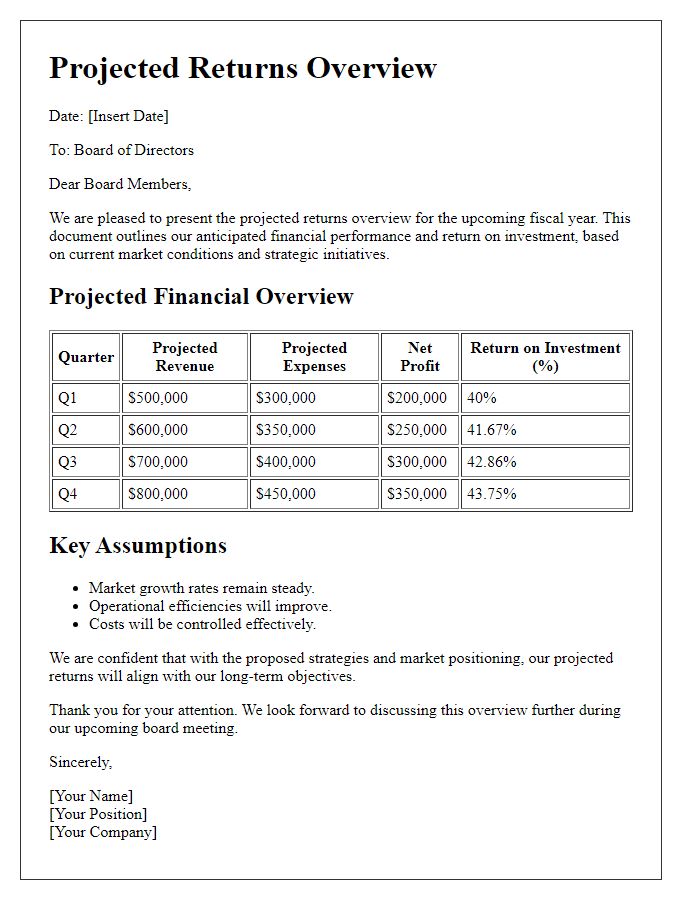

Financial Projections and Returns

Financial projections play a crucial role in evaluating potential investment decisions for board directors. Accurate forecasting models, utilizing historical data and market analysis, can offer insights into revenue expectations and cost management. For instance, a projected annual growth rate of 15% for the next five years, based on industry trends, can significantly impact return on investment metrics. Key performance indicators, such as net present value (NPV) and internal rate of return (IRR), help quantify the potential financial returns, enabling directors to make informed strategic choices. Additionally, understanding risk factors, including market volatility and competitive landscape, is essential for assessing the investment's overall reliability and profitability. The location of operations, such as emerging markets with favorable regulatory environments, may further enhance potential returns, influencing the final investment decision.

Strategic Alignment and Potential Impact

The board of directors evaluates investment opportunities based on strategic alignment and potential impact. Strategic alignment refers to how well an investment aligns with the company's long-term goals, such as market expansion or innovation. For instance, investing in renewable energy technologies could align with sustainability initiatives aimed at reducing carbon footprints in urban areas. Potential impact assesses the expected return on investment (ROI) in measurable terms, considering market trends that suggest a flourishing demand for eco-friendly products, with projected market growth rates of over 20% in the next five years. Understanding risk factors is essential; volatility in the energy sector can influence outcomes. Ultimately, thorough analysis of both strategic alignment and potential impact enables informed decisions that drive company growth and shareholder value.

Letter Template For Board Director Investment Decision Samples

Letter template of strategic investment recommendation for board members

Comments