Are you looking for a simple way to create a letter template for a beneficiary distribution hold agreement? This agreement can help clarify the terms under which beneficiaries will receive their distributions, ensuring that everyone is on the same page. With a clear and concise letter, you can set the stage for a smooth distribution process while safeguarding the interests of all parties involved. Stay tuned as we delve into the details and provide you with a comprehensive template that you can easily adapt to your needs!

Headings and Titles

The Beneficiary Distribution Hold Agreement outlines critical aspects related to the distribution of assets among beneficiaries. Key headings include: **I. Introduction** - Overview of the Hold Agreement purpose and significance. **II. Definitions** - Clarification of terms such as "Beneficiary," "Trust," and "Distribution." **III. Parties Involved** - Identification of all parties, including the Trust's Settlor and Beneficiaries. **IV. Hold Period** - Specification of the duration for which the distribution is held, including start and end dates. **V. Conditions for Release** - Detailed criteria required for asset distribution to occur, such as legal obligations or specific events. **VI. Responsibilities of the Parties** - Outline of duties and obligations for all involved parties during the hold period. **VII. Governing Law** - Indication of the jurisdiction under which the agreement is enforced. **VIII. Signatures** - Space for all parties to sign, confirming agreement and compliance. This structured format helps ensure clarity and prevents misunderstandings regarding asset distributions.

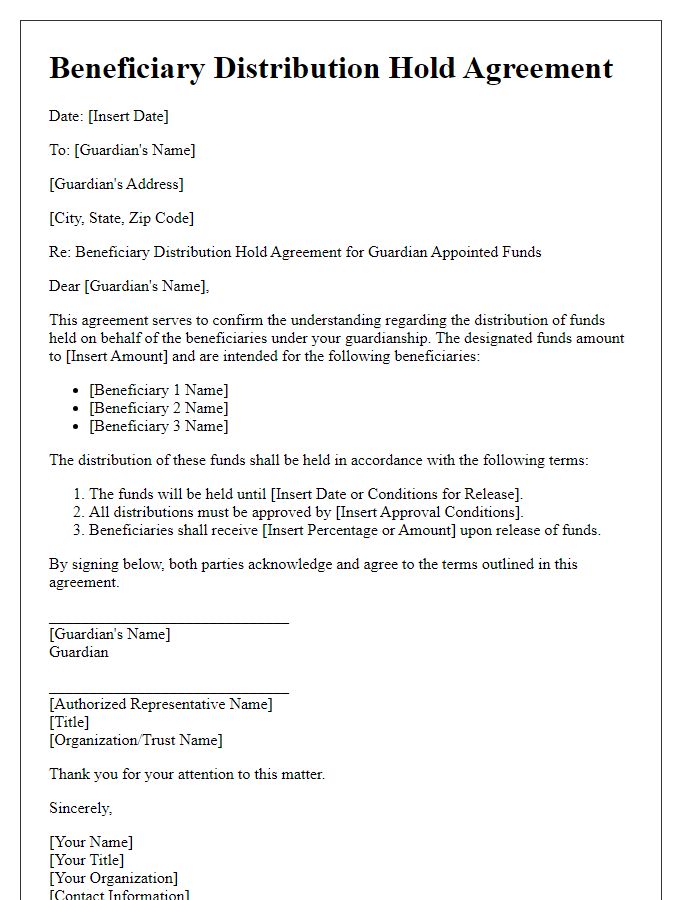

Clear Beneficiary Identification

The Clear Beneficiary Identification process ensures transparent distribution of assets to designated recipients. Vital documents like the Beneficiary Designation Form outline families, individuals, or organizations entitled to benefits, ensuring accurate identification. Unique identifiers, including Social Security Numbers, prepare for appropriate legal distributions of pensions, insurance proceeds, or estate assets. Involving legal counsel enhances clarity, reducing conflicts over inheritance. Effective communication with all beneficiaries about their entitlements promotes trust within families, particularly during sensitive times of loss. Regular updates to designation forms can adapt to life events like marriages or births, preserving accurate records for future distribution activities.

Specific Distribution Terms

Beneficiary distribution agreements outline the terms related to the allocation of assets to heirs or beneficiaries, often influenced by legal stipulations or individual wishes. Specific distribution terms establish conditions under which the distribution occurs, including stipulations for asset division based on percentage shares, timing of distributions, or contingencies based on life events. Clarifications regarding the roles of fiduciaries, like executors or trustees, are essential, as they ensure compliance with state laws or the terms of a will. Documentation typically includes identification details of all beneficiaries involved, such as full names, relationships, and contact information. Financial aspects can also be addressed, highlighting potential tax implications or costs associated with managing the estate during the distribution process, which are crucial for transparency and equitable treatment.

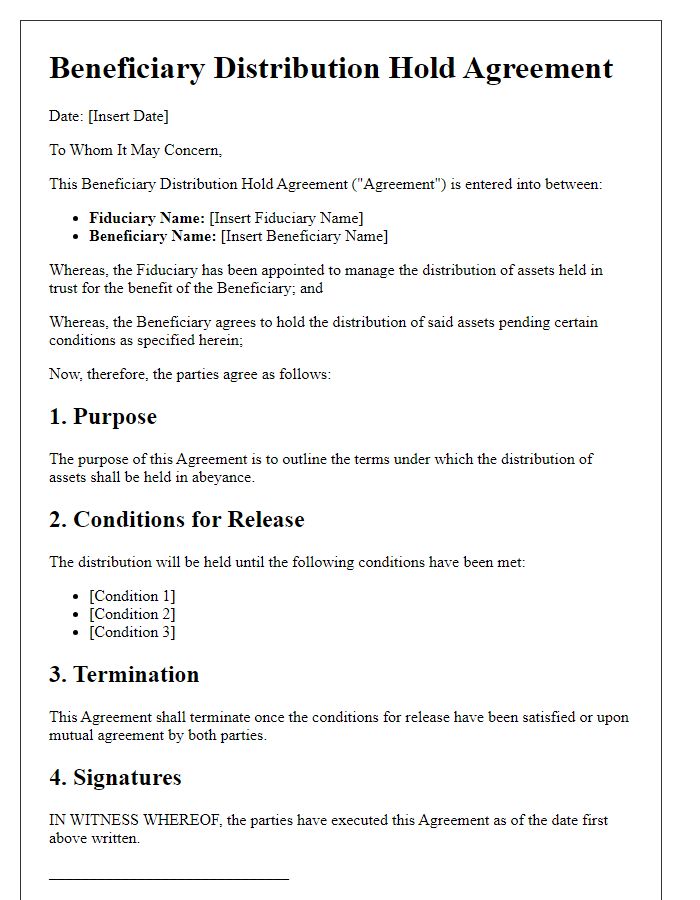

Conditions for Holding Distribution

Beneficiary distribution hold agreements serve to outline specific conditions under which the distribution of assets or benefits to designated beneficiaries is temporarily suspended. These agreements typically arise in estate management scenarios, such as after the death of an individual who left behind a will that designates multiple beneficiaries. Conditions for holding distribution may include pending litigation concerning the estate, unresolved tax liabilities, or the necessity for asset evaluation prior to distribution. In these cases, the fiduciary responsible for the estate, such as an executor or trustee, is required to ensure equitable treatment of all beneficiaries while maintaining compliance with applicable laws and regulations governing the administration of the estate. The agreement clearly specifies the time frame for the hold, stipulates conditions for potential release, and outlines the communication process with beneficiaries to keep them informed about the status of their anticipated distributions.

Signatures and Date

The Beneficiary Distribution Hold Agreement serves as a legal document establishing the conditions under which the distribution of assets (such as funds or property) to beneficiaries (individuals entitled to receive assets) will be temporarily withheld (typically pending further instructions or legal requirements). Signatures (the names written by hand) of all involved parties finalize the agreement, ensuring that every beneficiary acknowledges and agrees to the terms set forth. Dates (the specific days of signing) are essential for documenting the timeline of the agreement, providing clarity on when the hold on distribution begins and potential conditions under which it may be lifted. Proper execution entails that all signatures are collected before any actions regarding asset distribution can proceed.

Letter Template For Beneficiary Distribution Hold Agreement Samples

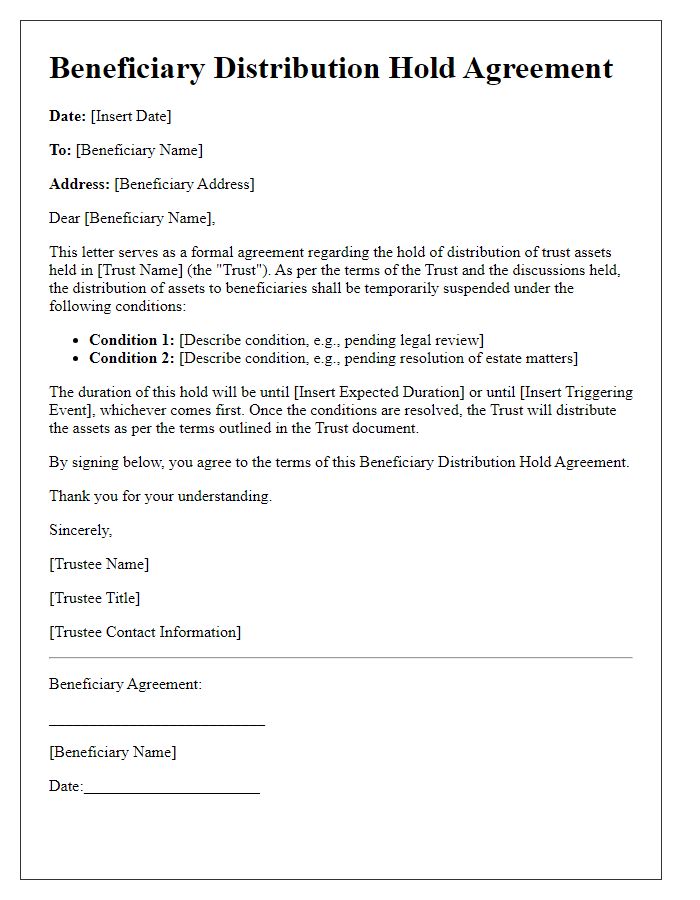

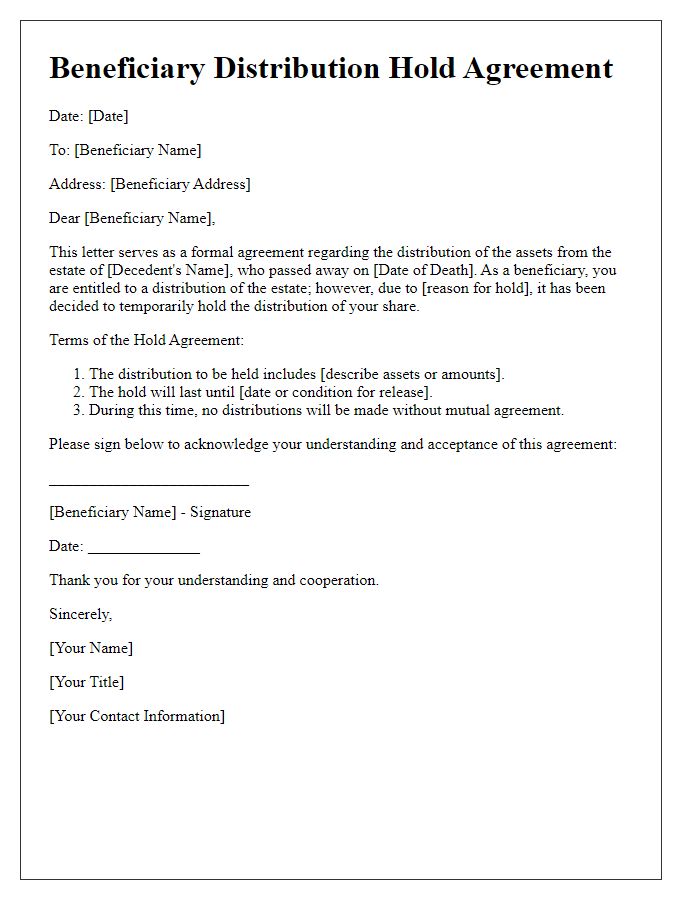

Letter template of beneficiary distribution hold agreement for trust assets

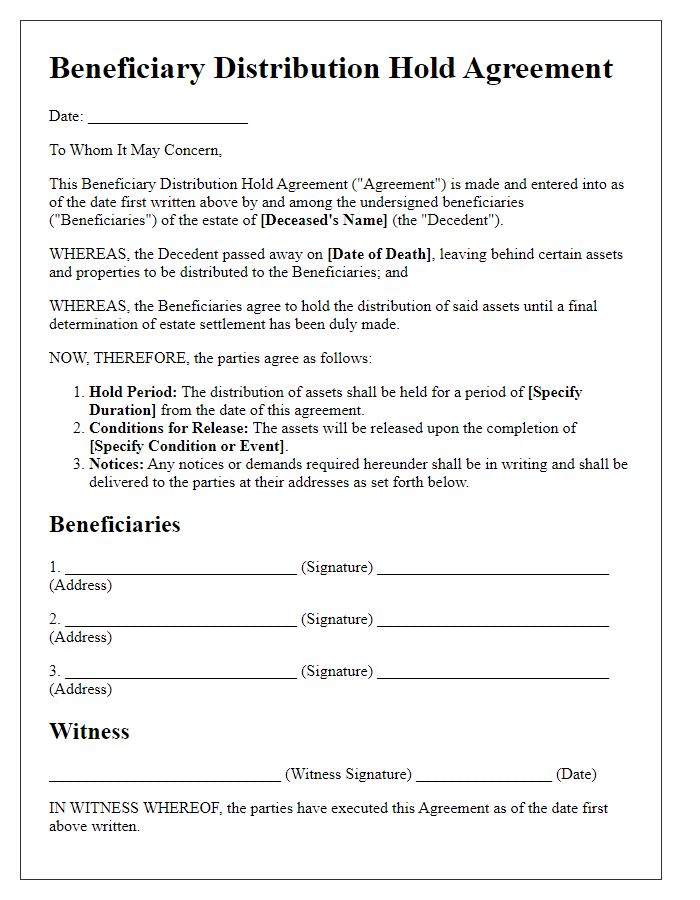

Letter template of beneficiary distribution hold agreement for estate settlement

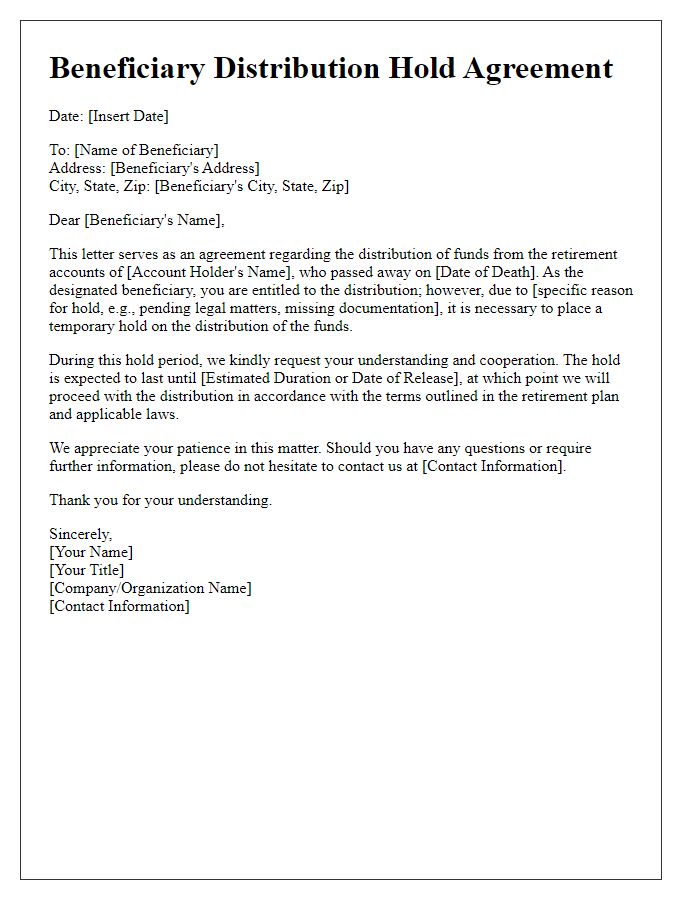

Letter template of beneficiary distribution hold agreement for retirement accounts

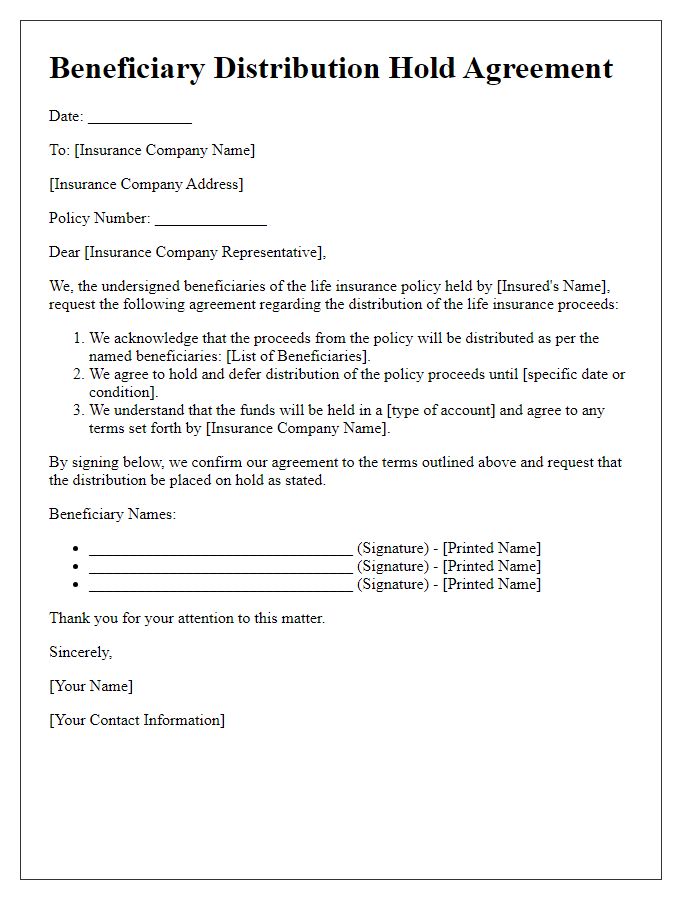

Letter template of beneficiary distribution hold agreement for life insurance proceeds

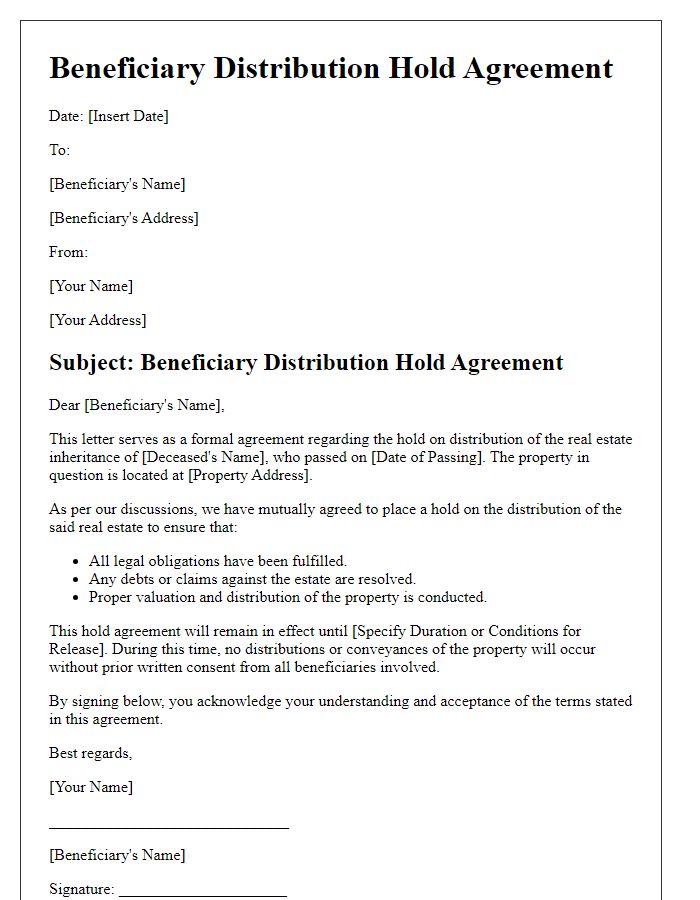

Letter template of beneficiary distribution hold agreement for real estate inheritance

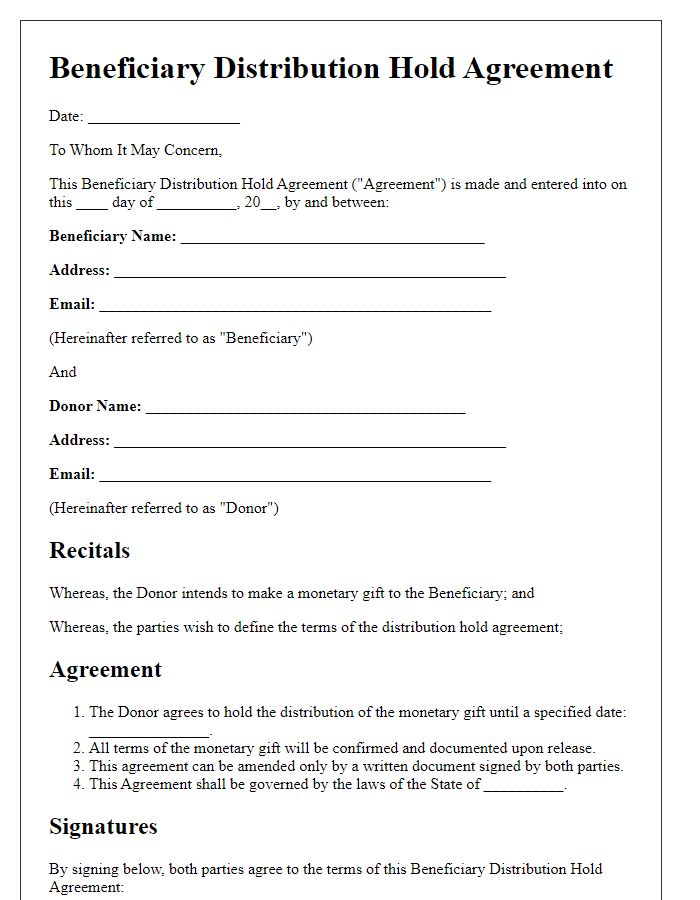

Letter template of beneficiary distribution hold agreement for monetary gifts

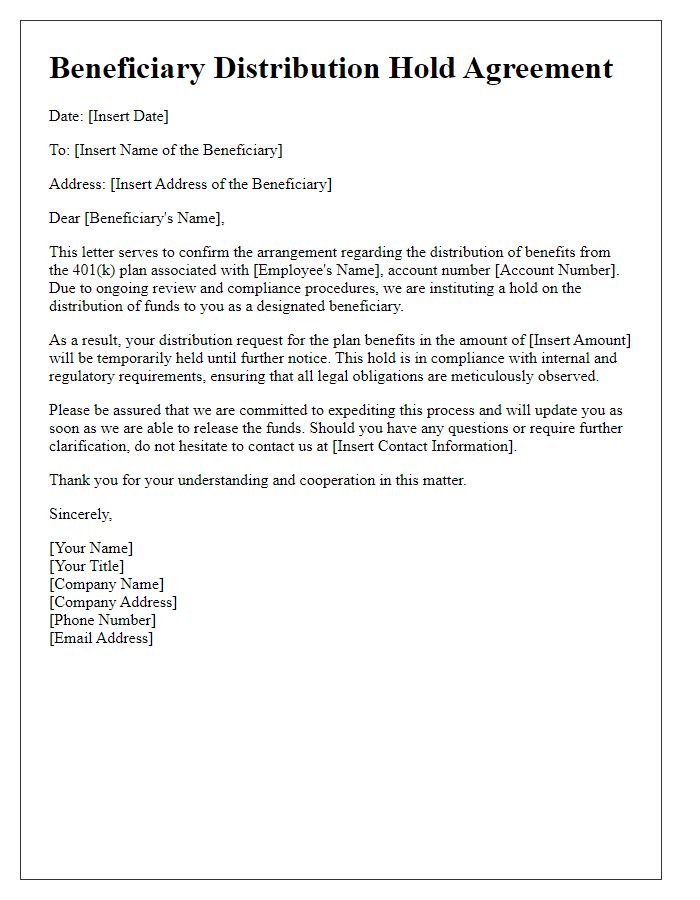

Letter template of beneficiary distribution hold agreement for 401(k) plans

Letter template of beneficiary distribution hold agreement for wills and estates

Letter template of beneficiary distribution hold agreement for fiduciary responsibilities

Comments