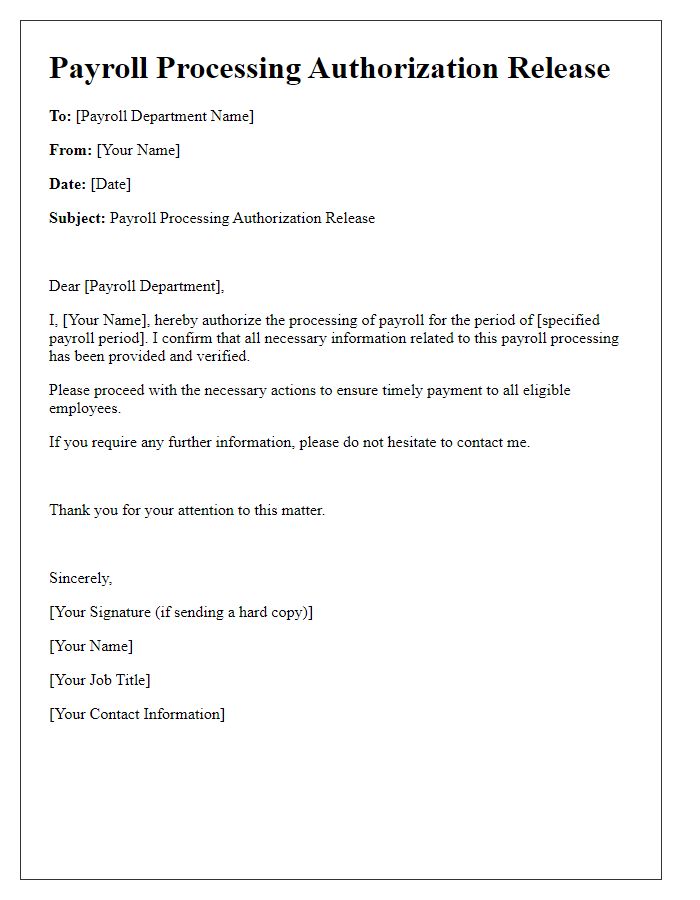

Are you wondering how to streamline your payroll processing? A well-crafted payroll processing authorization letter can be your secret weapon in ensuring accuracy and efficiency. This simple yet powerful document not only outlines the responsibilities of parties involved but also enhances transparency between employers and employees regarding payroll decisions. Ready to learn more about crafting the perfect authorization letter? Let's dive in!

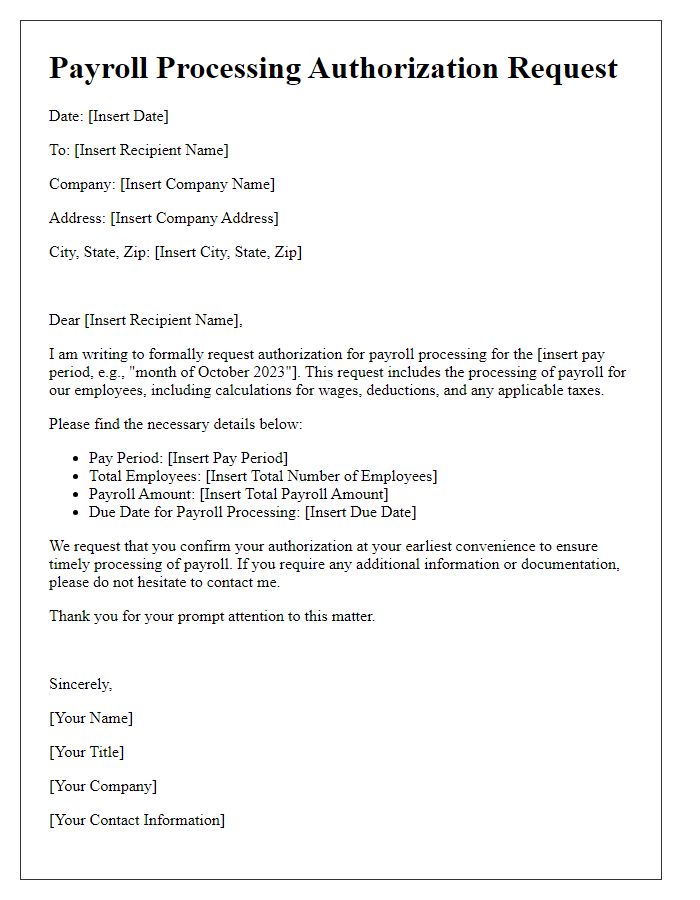

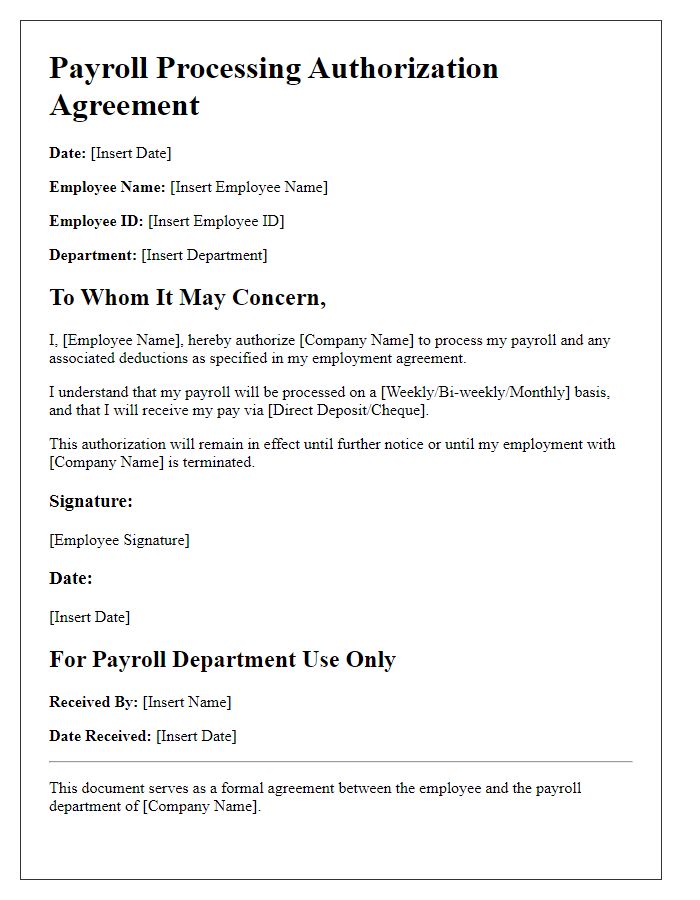

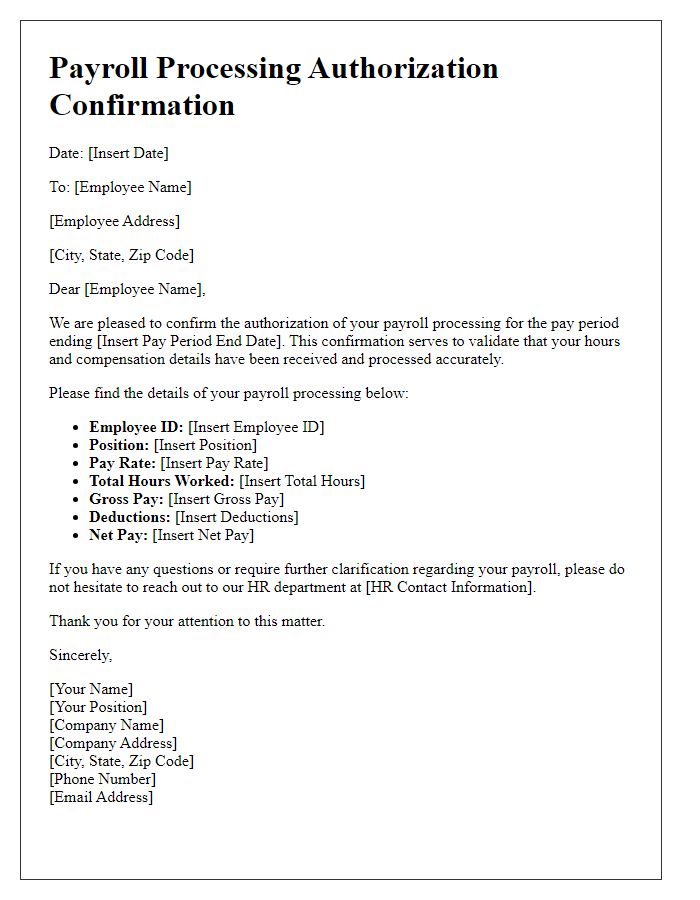

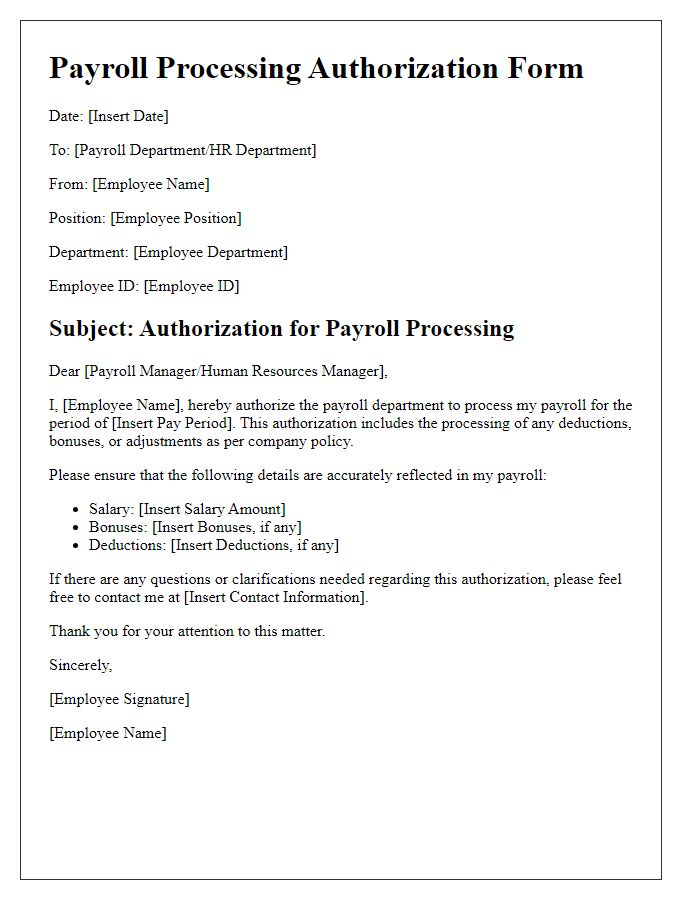

Employee and employer details

Payroll processing authorization is essential for managing employee compensation efficiently in organizations. Employee details include full name, identification number, position, and department. Employer details encompass company name, registered address, and tax identification number. Timely submission of this information ensures compliance with labor laws and payroll regulations. Proper authorization facilitates accurate payment processing, benefits allocation, and deduction management. This process requires stringent data security measures to protect sensitive financial information, minimizing risks of identity theft or fraud. Regular audits should be conducted to ensure adherence to regulations and internal policies.

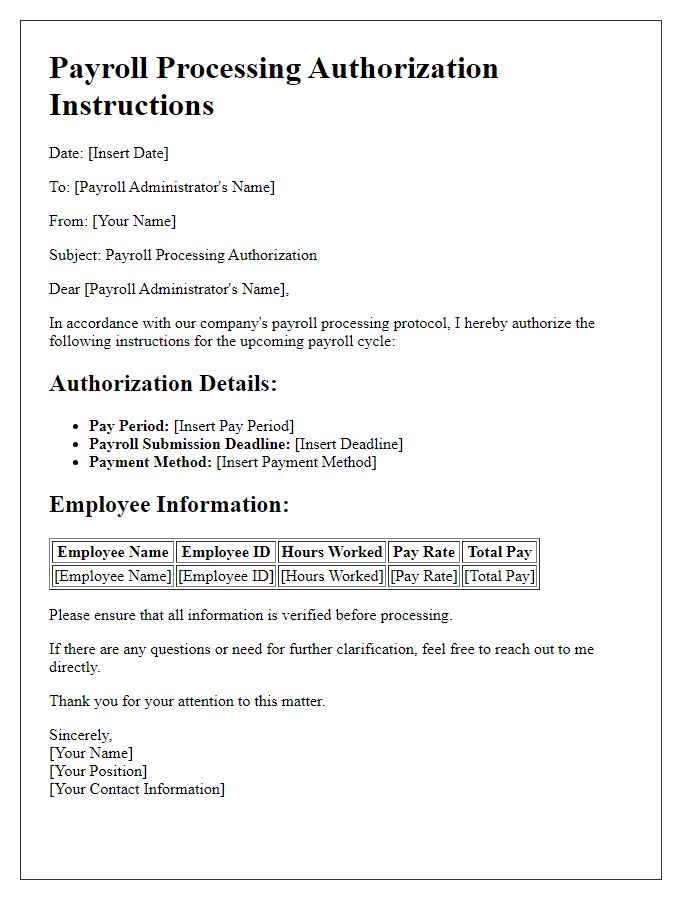

Authorization specifics

Payroll processing authorization ensures accurate and timely employee compensation. Company policies dictate specific details such as employee identification numbers, payment frequency (bi-weekly or monthly), and authorization dates. Essential documentation includes signed forms by responsible personnel (such as HR managers) and appropriate financial authorizations (bank signatures and accountant approvals). Authorization limits may be set for different roles (e.g., department heads authorized up to $10,000), ensuring accountability. Additionally, specific payroll software (like ADP or Paychex) may be utilized to streamline processing, integrating with accounting systems for compliance with federal regulations. Documentation retention should comply with state laws for audit purposes, typically for at least three years.

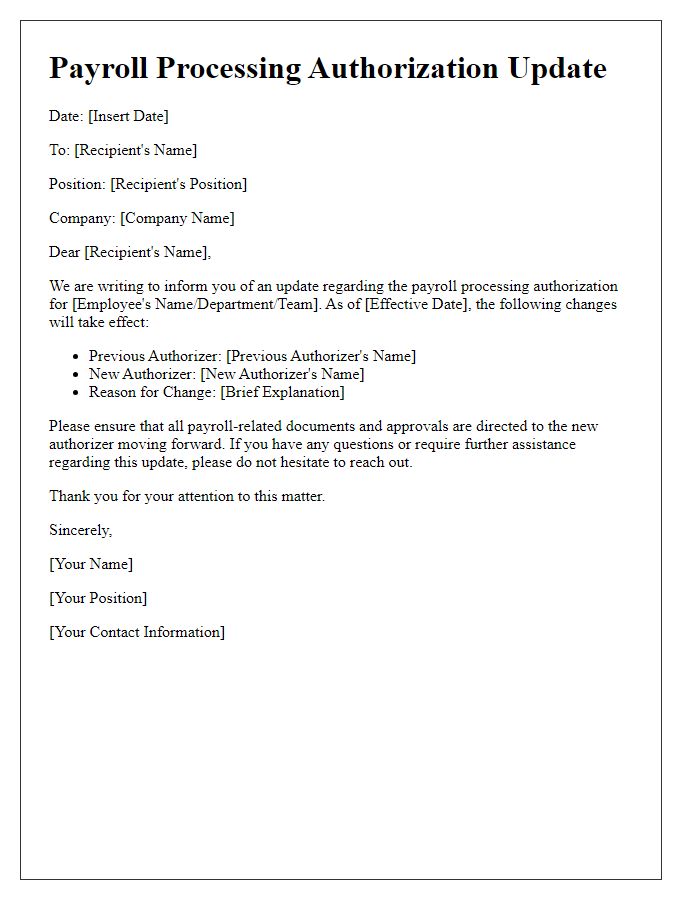

Effective date and duration

Payroll processing authorization is a critical aspect of human resource management within organizations. This authorization typically includes key details such as the effective date, which signifies the starting point for processing payroll changes or adjustments, and the duration, which indicates how long the authorization remains valid. For example, an effective date of January 1, 2024, may correlate with the beginning of a new fiscal quarter, while a duration set for one year allows for continuous payroll processing without the need for frequent renewals. Accurate payroll processing ensures timely and precise salary disbursements, compliance with labor laws, and maintenance of employee records, significantly impacting overall employee satisfaction and corporate financial health.

Method of payment

Payroll processing authorization requires specific details regarding the method of payment. Direct deposit, prevalent in many organizations, allows employees to receive payments electronically into designated bank accounts, ensuring timely transfers, often on a bi-weekly schedule. Paper checks, although less common, may still be used for manual payment, often issued bi-monthly at designated payroll offices. These methods are compliance-sensitive, adhering to IRS regulations governing taxes and reporting, which mandate accurate employee information such as Social Security Numbers and tax withholding forms (W-4). Ensuring transparency and security in payroll processing is essential to maintain trust in employer-employee relationships and uphold labor laws.

Legal compliance and confidentiality terms

The payroll processing authorization aligns with legal compliance standards, ensuring adherence to regulations such as the Fair Labor Standards Act (FLSA) and the Health Insurance Portability and Accountability Act (HIPAA). Confidentiality terms safeguard sensitive employee information, including Social Security numbers, bank account details, and salary figures, which should only be accessible to authorized personnel. These measures protect against unauthorized access and potential data breaches, maintaining trust and security in the payroll system. Regular audits and compliance checks are essential to uphold these legal obligations and confidentiality protocols.

Comments