Are you feeling overwhelmed by the process of filing an insurance claim? The good news is that crafting an effective authorization letter can simplify your journey and ensure that your claim is processed smoothly. In this article, we'll provide a handy template and useful tips to guide you through writing a compelling letter that meets your insurer's requirements. Stick around to discover how you can easily navigate the claims process and protect your interests!

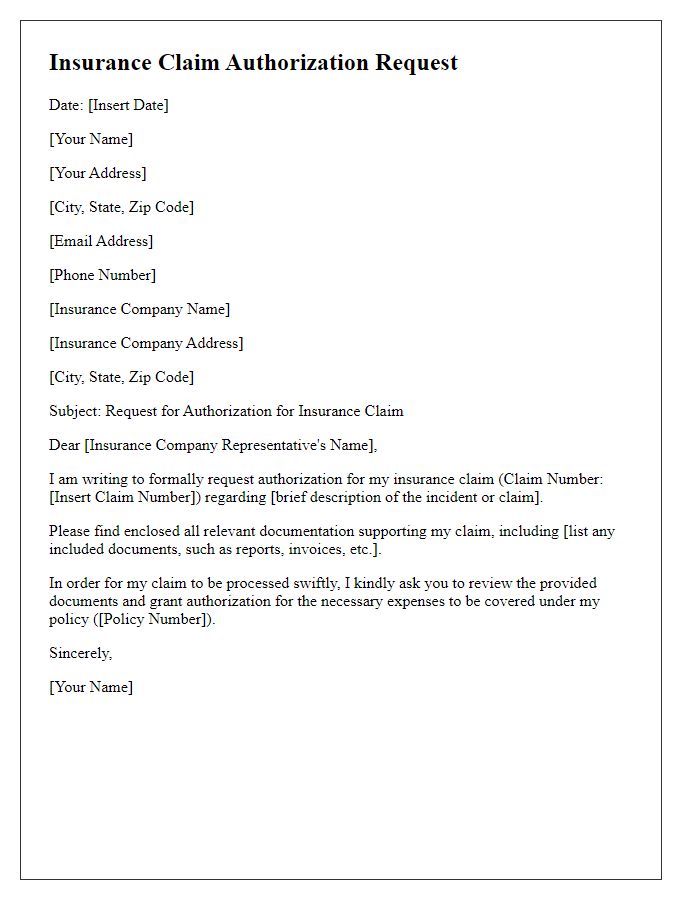

Policyholder Information

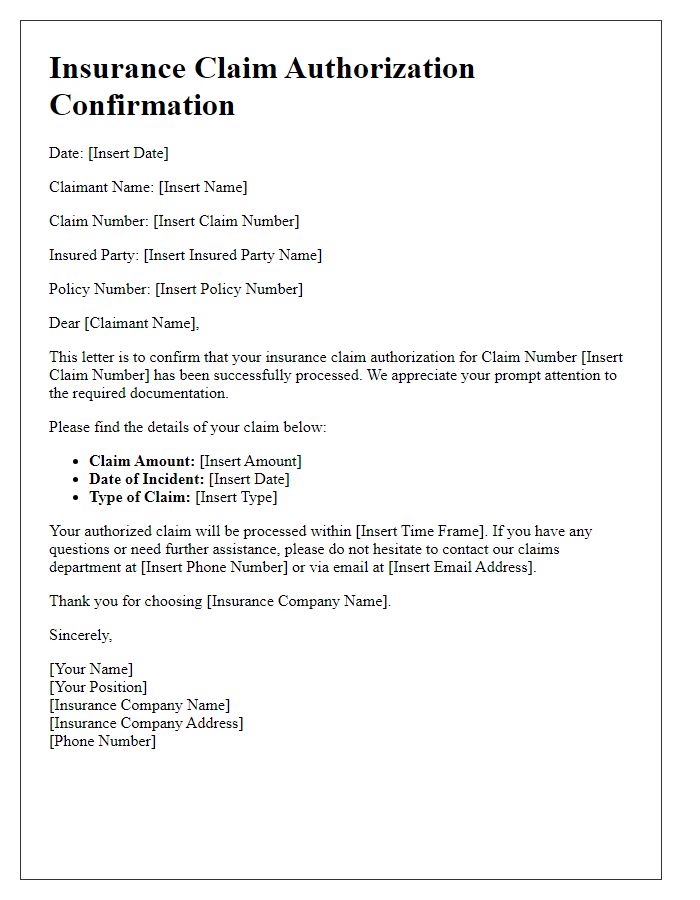

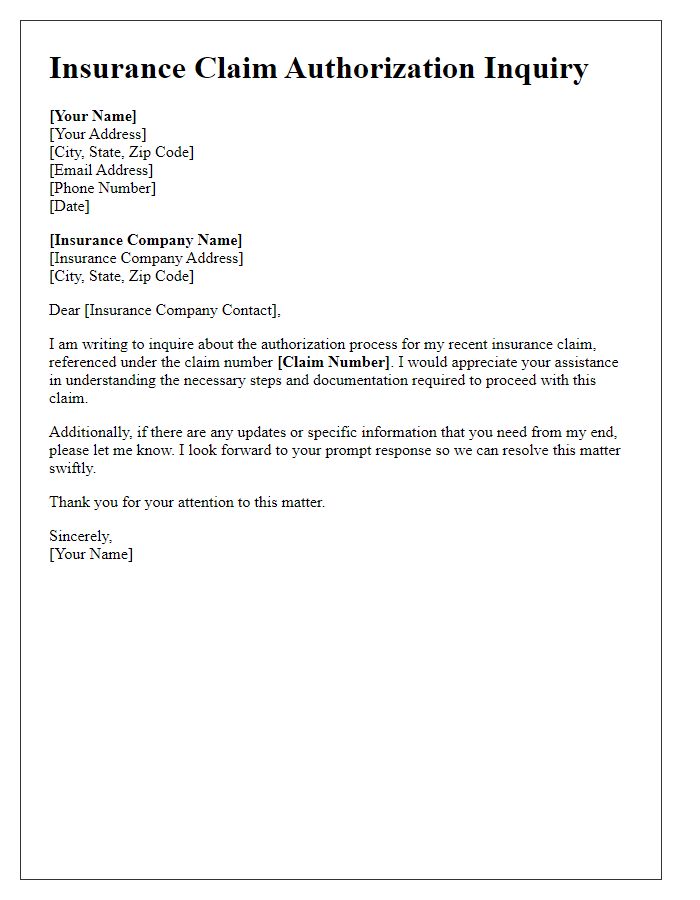

Policyholder information plays a crucial role in facilitating insurance claim authorization. Essential details include the policyholder's full name, a unique policy number that identifies the coverage, address including city and state for verification purposes, and contact information such as a phone number and email address for follow-up communication. Additionally, the type of insurance policy--be it health, property, or auto--must be clearly specified. Submission dates of claims along with any relevant incident or reference numbers related to the claim are significant for tracking progress. Accurate and comprehensive information streamlines the authorization process and ensures timely approval, minimizing delays in receiving benefits.

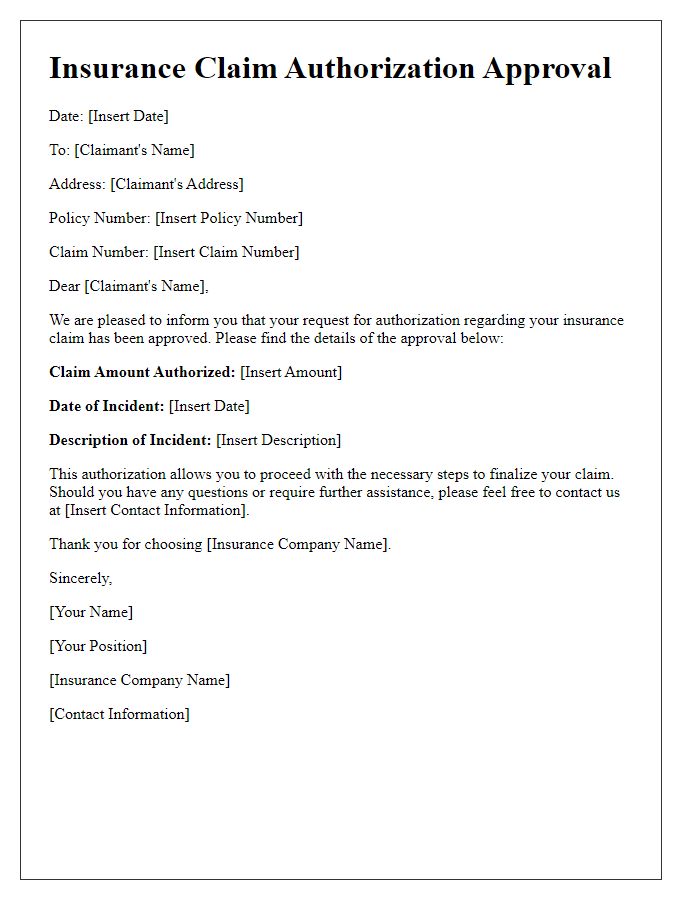

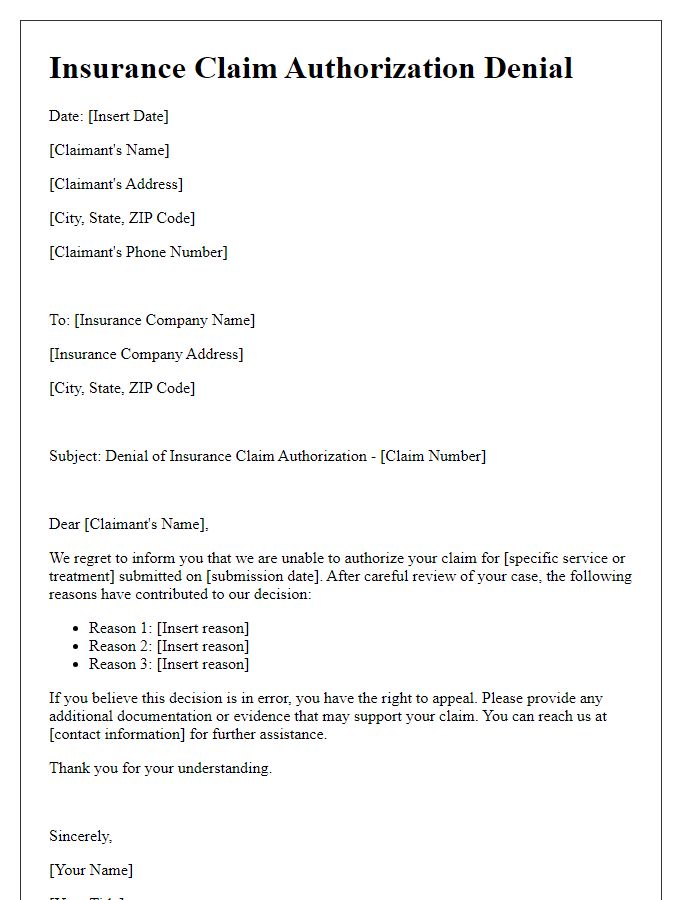

Claim Details

Insurance claims often entail detailed documentation regarding events leading to the claim, including policy numbers, dates, and nature of incidents. A typical claim might include specifics such as a car accident occurring on September 15, 2023, involving a 2019 Honda Accord at the intersection of Fifth Avenue and Main Street. Supporting documents could encompass police reports, photographs of vehicle damage, and medical receipts from urgent care visits. These elements together form a comprehensive claim package, ensuring that insurance adjusters have the necessary information to evaluate and expedite the process effectively.

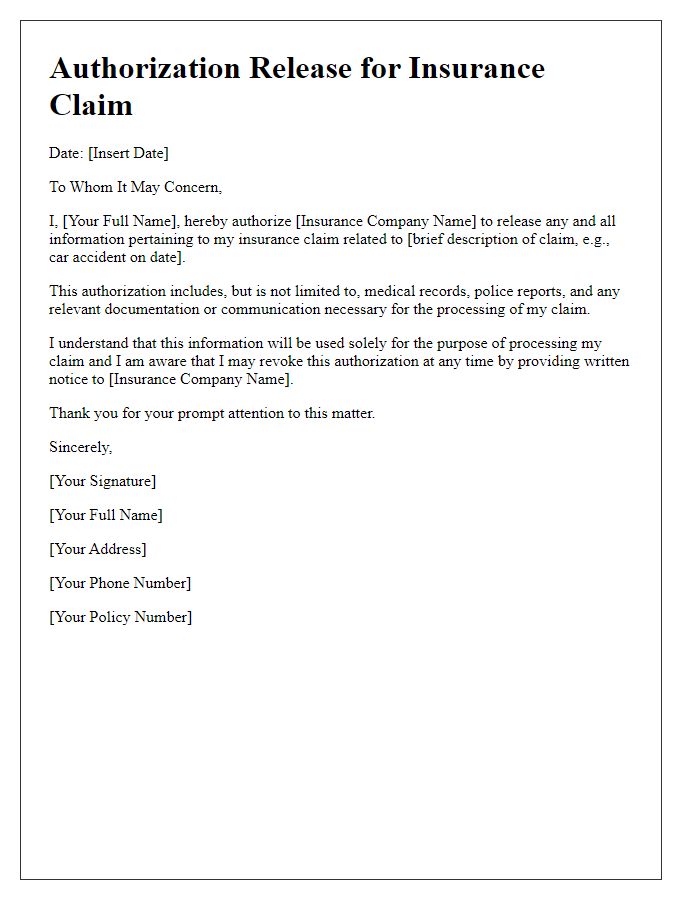

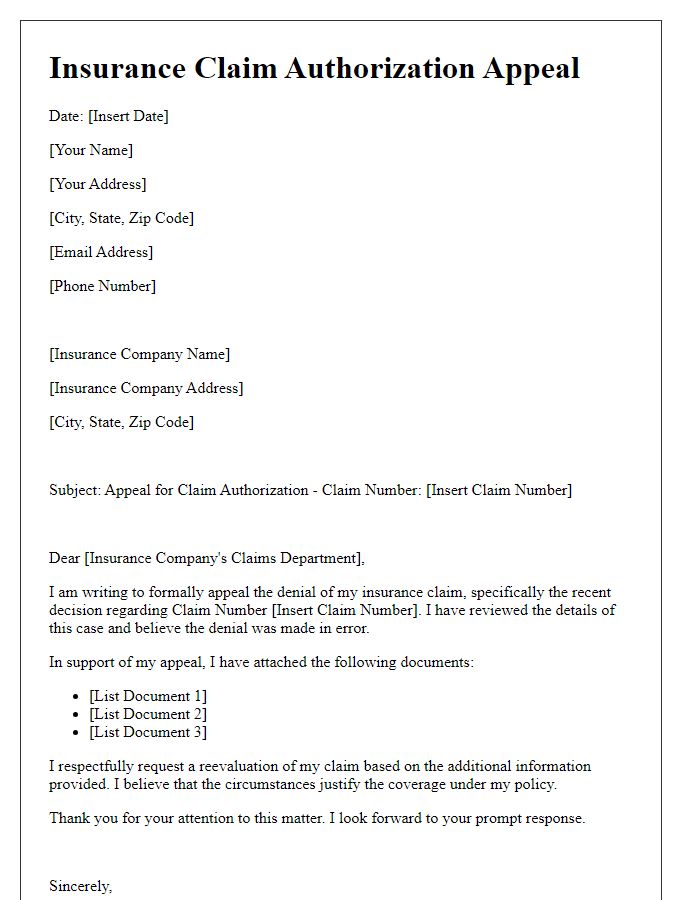

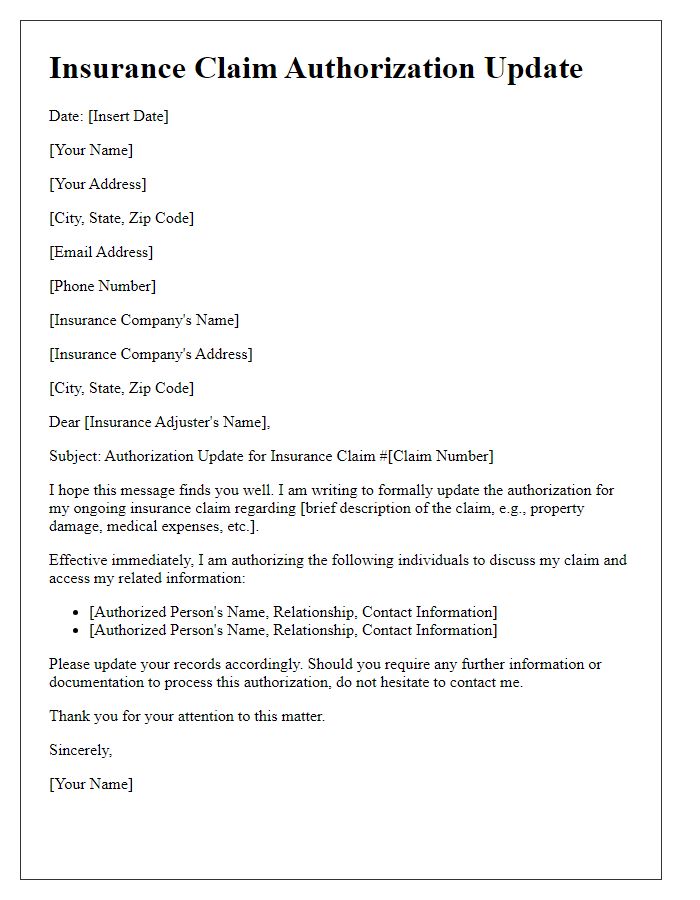

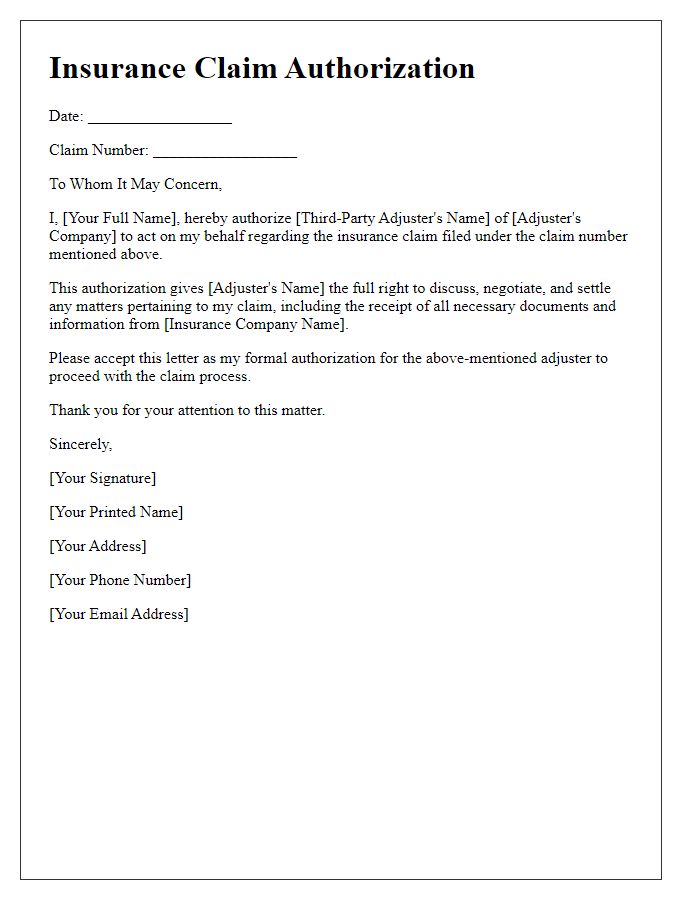

Authorization Consent

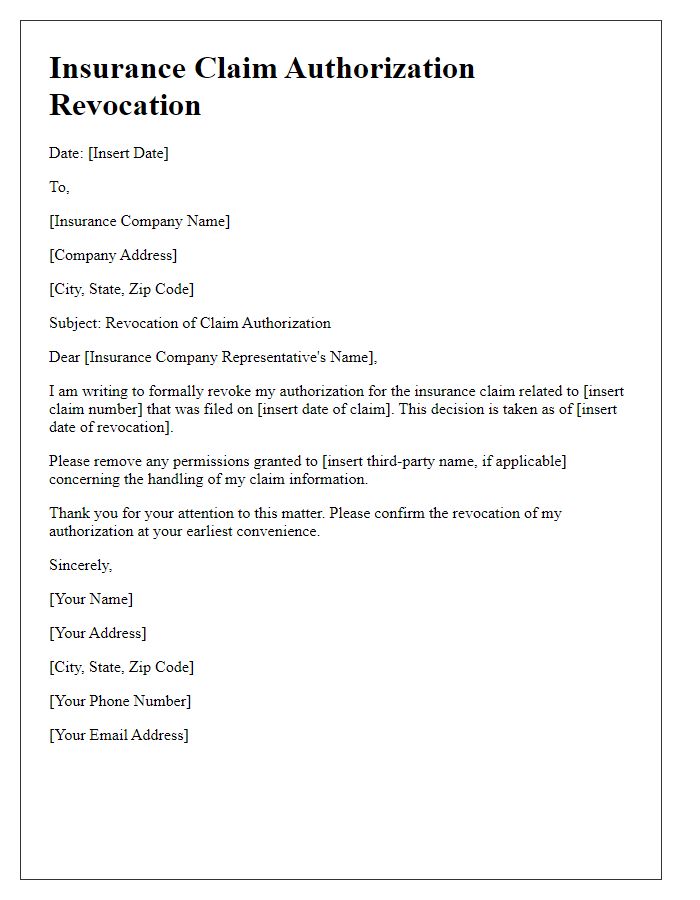

Insurance claims often require authorization consent for the processing of sensitive information. An authorization consent form grants the insurance company permission to access necessary medical records, financial data, or other pertinent information related to the claim process. This form typically includes personal identifiers such as name, policy number, and date of birth, along with a statement outlining the specific types of information authorized for release. Completing this step is crucial for expediting claim assessments and disbursements, ensuring a smoother interaction between the policyholder and the insurance provider. In many instances, the form must be signed and dated to validate consent, adhering to regulatory standards like HIPAA in the United States for the protection of personal health information.

Supporting Documentation

Insurance claim authorization requires comprehensive supporting documentation. Essential documents include copies of the policy, detailing coverage limits and exclusions relevant to the claim. Medical records, if applicable, outlining diagnosis and treatment provided by healthcare professionals, are crucial for validating health-related claims. Incident reports, including police reports for accidents or fire department reports for property damage, are vital to establish the circumstances surrounding the claim. Photographic evidence of the damage, timestamped for credibility, can significantly bolster the claim. Estimates for repair costs from licensed contractors add clarity and substantiate the financial aspect of the claim. Additionally, correspondence with the insurance agent should be included to document communication efforts regarding the claim process. All documents should be organized clearly and submitted promptly to facilitate a smooth authorization process.

Contact Information

Insurance claim authorization requires precise and complete contact information of the policyholder. Including the full name of the insured party, policy number (a unique identifier issued by the insurance company), mailing address (including street name, city, state, and zip code), personal phone number (for direct communication), and email address (for electronic correspondence) is critical. It's advisable to add the insurance company's name, address, and contact details to ensure prompt processing of the claim. Properly documenting this information can streamline the claim process and facilitate quicker approvals.

Comments